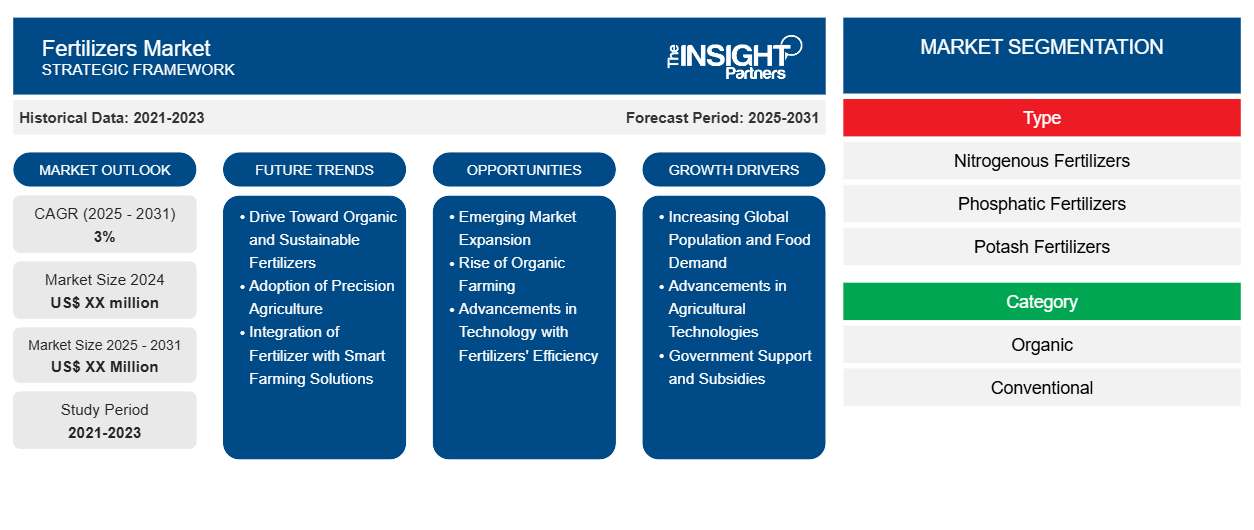

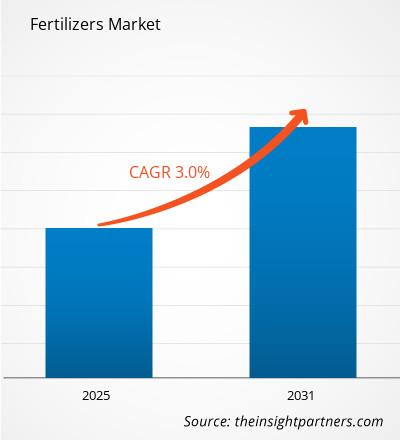

The Fertilizers Market is expected to register a CAGR of 3% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

Fertilizers Market covers analysis By Type (Nitrogenous Fertilizers, Phosphatic Fertilizers, Potash Fertilizers, Micronutrient Fertilizers, and Others), Category (Organic and Conventional), Form (Liquid, Dry, and Granular), Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America). Fertilizers are commonly used by agricultural producers and farmers to boost crop yield and enhance the general health of every crop. They add fertilizers to the soil, which acts as a key source of essential nutrients for plants.

Purpose of the Report

The report Fertilizers Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Fertilizers Market Segmentation

Type

- Nitrogenous Fertilizers

- Phosphatic Fertilizers

- Potash Fertilizers

- Micronutrient Fertilizers

Category

- Organic

- Conventional

Form

- Liquid

- Dry

- Granular

Crop Type

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fertilizers Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Fertilizers Market Growth Drivers

- Increasing Global Population and Food Demand: As the populace of the globe inflates, the need for food production increases. Given these increasing food requirements of the ever-increasing population, the role of fertilizers in enhancing crop yield and, consequently food security in agriculture is well recognized.

- Advancements in Agricultural Technologies: Modern farming technologies like precision agriculture have also stimulated demand for fertilizers. Their maximum utilization, optimization of nutrient delivery, and waste reduction encourage farmers to adopt innovative fertilizers for increased production and sustainability.

- Government Support and Subsidies: Most governments of various countries encourage fertilizer utilization to enhance agricultural development by implementing different subsidies and incentives. These policies would increase crop production, improve food security, and develop the rural economy, thereby uplifting the demand of fertilizers both in developed and developing markets.

Fertilizers Market Future Trends

- Drive Toward Organic and Sustainable Fertilizers: Such increasing awareness about environmental impacts shifts demand for organic fertilizers as farmers are going for greener solutions to minimize chemical use, improve soil health, and they consider the consumer's eating habits in organic produce to support organic fertilizer markets.

- Adoption of Precision Agriculture: The fertilizer market today is defined by precision agriculture. The use of soil sensor, GPS, data analytics, and such really enables more benefit from small amounts of fertilizer by combining them with the ability to better direct injection and even reduce waste and improve productivity. This acts as a driver for new requirements for slow-release fertilizers and customized fertilizers.

- Integration of Fertilizer with Smart Farming Solutions: Fertilizers are increasingly combined with smart farming technologies, such as drone-assisted application and IoT-based monitoring. These enable farmers to optimize fertilizer use according to the real-time data available and improve crop yields with minimum adverse effects on the environment while making fertilizers more effective, ensuring future growth in the market.

Fertilizers Market Opportunities

- Emerging Market Expansion: There is a big space opened for fertilizer manufacture in emerging economies as agriculture transforms to yet another level. These markets, especially those in Asia, Africa, and Latin America, are indeed underwriting great growth opportunity. Farmers would want to adopt those fertilizers to improve crop yield while meeting increasing food demands.

- Rise of Organic Farming: There is a growing chance for organic fertilizers in an increasing demand where organic foods are becoming hot cake in the market. As consumers are gradually becoming more health and environmentally conscious, there is an expanding market for natural fertilizers that may enhance soil fertility along with best practices in organic farming, offering growth potential for manufacturers.

- Advancements in Technology with Fertilizers' Efficiency: Future advanced fertilizers, including slow-release or controlled-release type fertilizers, hold possibilities in precision agriculture. Reduced nutrient wastage, increase in efficiency, and sustain of green farming practices are some of the benefits possible from these products. With the world moving towards better, more efficient and environment-friendly solutions, this appears to be a significant growth opportunity for the industry.

Fertilizers Market Regional Insights

The regional trends and factors influencing the Fertilizers Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Fertilizers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Fertilizers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Fertilizers Market Players Density: Understanding Its Impact on Business Dynamics

The Fertilizers Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Fertilizers Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Fertilizers Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Fertilizers Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Frequently Asked Questions

What are the future trends in the market?

Based on geography, which region is expected to record a highest CAGR in the market.

Which category segment accounted for the highest share in the fertilizers market?

What are the driving factors impacting the fertilizers market?

What are the key players operating in the fertilizers market?

What is the expected CAGR of the Fertilizers Market ?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For