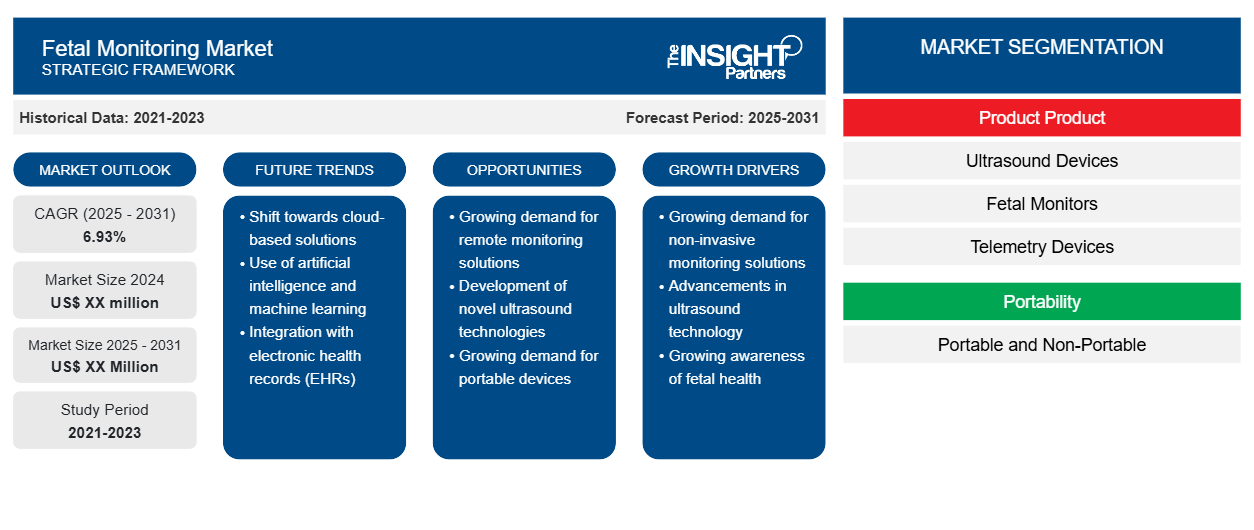

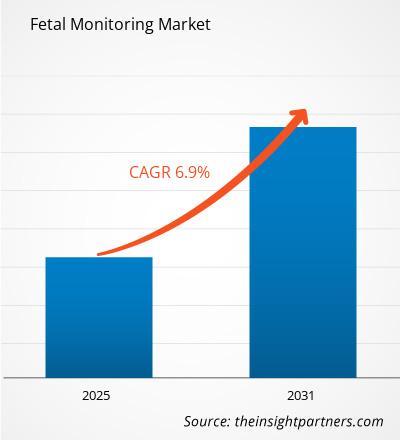

The Fetal Monitoring Market is expected to register a CAGR of 6.93% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Product (Ultrasound Devices, Fetal Monitors, Telemetry Devices, Fetal Electrodes, Others), Portability (Portable and Non-Portable), Method (Invasive and Non-invasive), Application (Antepartum and Intrapartum), and End User (Hospitals, Obstetrics & Gynecology Clinics, and Home Care Settings). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Fetal Monitoring Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Fetal Monitoring Market Segmentation

Product Product

- Ultrasound Devices

- Fetal Monitors

- Telemetry Devices

- Fetal Electrodes

- Others

Portability

- Portable and Non-Portable

End User

- Hospitals

- Obstetrics & Gynecology Clinics

- Home Care Settings

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fetal Monitoring Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Fetal Monitoring Market Growth Drivers

- Growing demand for non-invasive monitoring solutions: The increasing adoption of remote monitoring solutions is driven by the need for more convenient and cost-effective ways to monitor fetal health. With the advancement of technology, remote monitoring solutions are becoming more accessible and user-friendly, making it easier for healthcare providers to monitor fetal health remotely. This is particularly beneficial for expectant mothers who live in rural areas or have limited access to healthcare facilities. Remote monitoring solutions also enable real-time monitoring, which can help identify potential issues early on, allowing for prompt intervention and improved outcomes

- Advancements in ultrasound technology: Advancements in ultrasound technology have significantly improved the accuracy and reliability of fetal monitoring. Modern ultrasound machines are capable of producing high-resolution images that provide detailed information about fetal development and health. This has led to increased adoption of ultrasound-based fetal monitoring solutions, which offer a more comprehensive and accurate view of fetal health. Additionally, advancements in ultrasound technology have enabled the development of portable and handheld ultrasound devices, making it easier for healthcare providers to perform fetal assessments in various settings.

- Growing awareness of fetal health: Growing awareness of fetal health is driving the demand for fetal monitoring solutions. Expectant mothers and healthcare providers alike are recognizing the importance of monitoring fetal health to ensure optimal outcomes. This awareness is fueled by increasing knowledge about the risks associated with pregnancy-related complications, such as preeclampsia, gestational diabetes, and premature birth. As a result, expectant mothers are seeking more proactive approaches to managing their health during pregnancy, which includes regular monitoring and screening for potential issues.

Fetal Monitoring Market Future Trends

- Shift towards cloud-based solutions: The shift towards cloud-based solutions is a trend in the fetal monitoring market, driven by the need for more convenient, cost-effective, and scalable solutions. Cloud-based fetal monitoring solutions enable remote monitoring, real-time data transmission, and seamless integration with other healthcare systems. This allows healthcare providers to access fetal monitoring data from anywhere, at any time, and make more informed decisions. Cloud-based solutions also reduce the need for on-site hardware and software maintenance, freeing up resources for more critical tasks.

- Use of artificial intelligence and machine learning: The use of artificial intelligence (AI) and machine learning (ML) is a trend in the fetal monitoring market, enabling the development of advanced analytics and predictive models. AI-powered fetal monitoring systems can analyze large amounts of data, identify patterns, and predict potential issues earlier than human analysts. ML algorithms can be trained on large datasets to improve the accuracy of fetal monitoring and detect subtle changes in fetal heart rate or movement patterns. AI-powered systems can also provide personalized care plans and alerts for healthcare providers, enabling more timely interventions.

- Integration with electronic health records (EHRs): Integration with electronic health records (EHRs) is a trend in the fetal monitoring market, enabling seamless sharing of data between different systems and stakeholders. EHR-integrated fetal monitoring solutions allow healthcare providers to access patient data, track vital signs, and monitor fetal health in real-time. This integrated approach also enables more accurate diagnoses, reduces errors, and streamlines clinical workflows. Integration with EHRs also facilitates data sharing and collaboration between healthcare providers, reducing the risk of miscommunication or lost information.

Fetal Monitoring Market Opportunities

- Growing demand for remote monitoring solutions: The growing demand for remote monitoring solutions is a significant opportunity in the fetal monitoring market. Remote monitoring solutions enable healthcare providers to monitor fetal health remotely, reducing the need for frequent hospital visits and improving patient convenience. This trend is driven by the increasing adoption of telemedicine and the need for more efficient and cost-effective healthcare solutions. As a result, companies that develop remote monitoring solutions can capitalize on this trend by providing healthcare providers with the technology and tools they need to monitor fetal health remotely

- Development of novel ultrasound technologies: The development of novel ultrasound technologies is another opportunity in the fetal monitoring market. Advances in ultrasound technology are enabling the development of more accurate and reliable fetal monitoring devices. For example, the development of 3D and 4D ultrasound technologies is providing healthcare providers with more detailed images of fetal development and health. This is enabling them to detect potential issues earlier and more accurately, leading to improved patient outcomes. Companies that develop novel ultrasound technologies can capitalize on this trend by providing healthcare providers with advanced diagnostic tools.

- Growing demand for portable devices: The growing demand for portable devices is also an opportunity in the fetal monitoring market. Portable devices enable healthcare providers to perform fetal assessments in various settings, including at home or in clinical settings. This is particularly beneficial for expectant mothers who require frequent monitoring but have limited access to healthcare facilities. Companies that develop portable devices can capitalize on this trend by providing healthcare providers with convenient and easy-to-use solutions that can be used in a variety of settings.

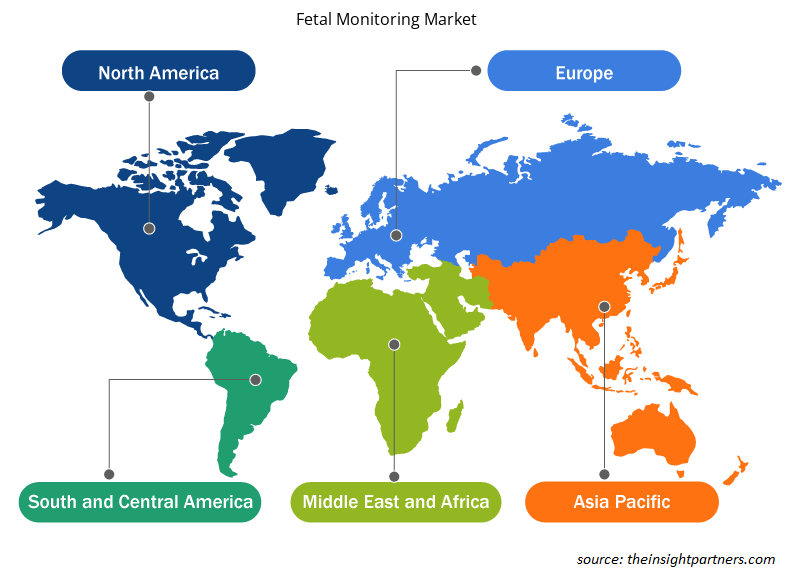

Fetal Monitoring Market Regional Insights

The regional trends and factors influencing the Fetal Monitoring Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Fetal Monitoring Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fetal Monitoring Market

Fetal Monitoring Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 6.93% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

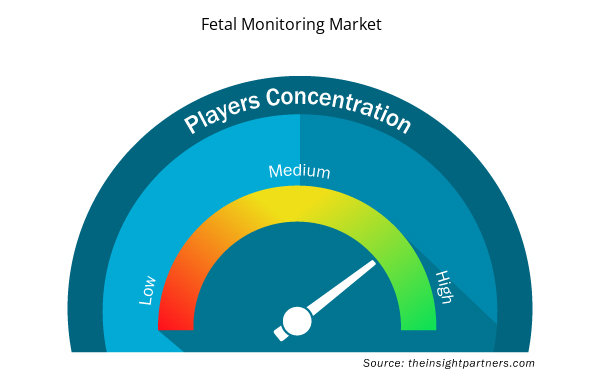

Fetal Monitoring Market Players Density: Understanding Its Impact on Business Dynamics

The Fetal Monitoring Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fetal Monitoring Market are:

- NEOVENTA MEDICAL AB

- NATUS MEDICAL INCORPORATED

- SIEMENS HEALTHCARE

- GENERAL ELECTRIC COMPANY

- ANALOGIC CORPORATION

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fetal Monitoring Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Fetal Monitoring Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Fetal Monitoring Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Portability, Method, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The fetal monitoring market is estimated to grow with a CAGR of 6.9% from 2023 to 2031.

Asia Pacific region is likely to witness fastest growth rate during the forecast period.

The market drivers include growing demand for non-invasive monitoring solutions and advancements in ultrasound technology are driving the fetal monitoring market

The fetal monitoring market majorly consists of the players such as General Electric Company, Cardinal Health Inc., Siemens AG among others.

Use of artificial intelligence and machine learning are likely to remain the key trend during the forecast period

North America dominated the fetal monitoring market in 2023

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. NEOVENTA MEDICAL AB

2. NATUS MEDICAL INCORPORATED

3. SIEMENS HEALTHCARE

4. GENERAL ELECTRIC COMPANY

5. ANALOGIC CORPORATION

6. FUJIFILM SONOSITE

7. PHILIPS HEALTHCARE

8. OSI SYSTEMS, INC

9. MEDTRONIC PLC

10. GETINGE GROUP

Get Free Sample For

Get Free Sample For