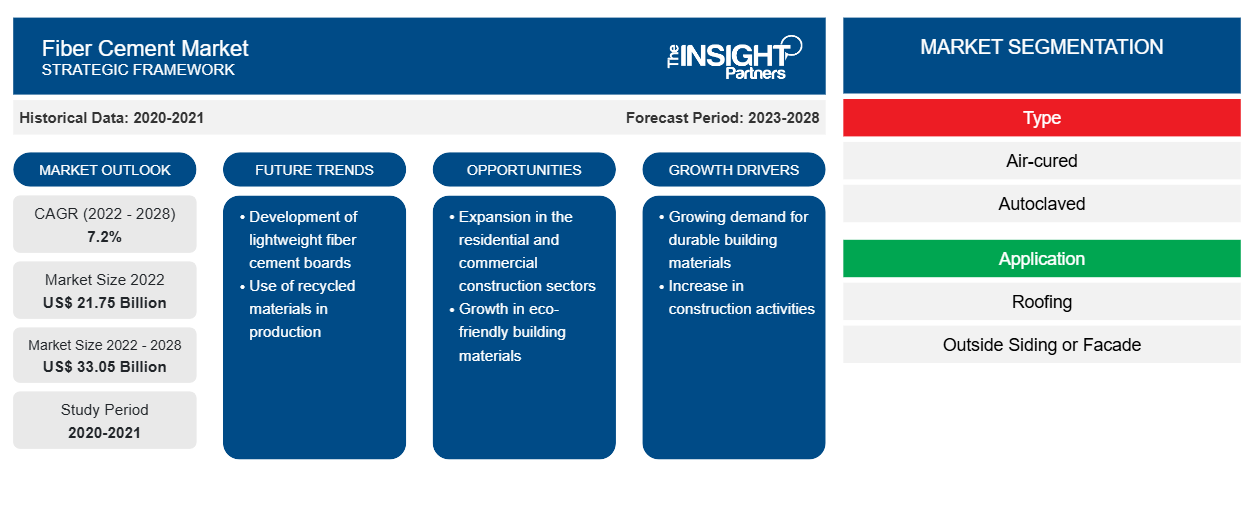

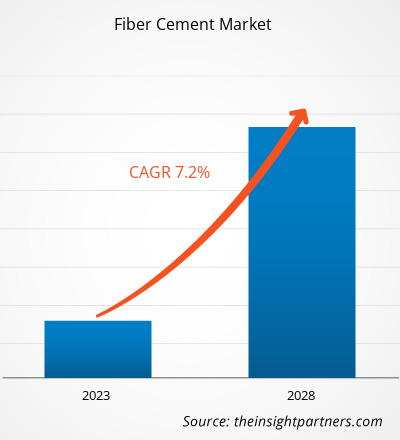

[Research Report] The fiber cement market size is expected to grow from US$ 21,748.45 million in 2022 to US$ 33,052.23 million by 2028; it is estimated to record a CAGR of 7.2% from 2022 to 2028.

Fiber cement is commonly used as an exterior siding material as it offers excellent durability and weather and fire resistance. Additionally, fiber cement is often used as a roofing material due to its ability to withstand harsh weather conditions, such as heavy rain, hail, and wind. Moreover, fiber cement can also be used for trim and fascia work, as it is easy to shape and can be painted or stained to match the building’s exterior. It is also frequently used in commercial buildings, such as hospitals, schools, and office buildings, as it offers a low-maintenance, durable option for their exteriors.

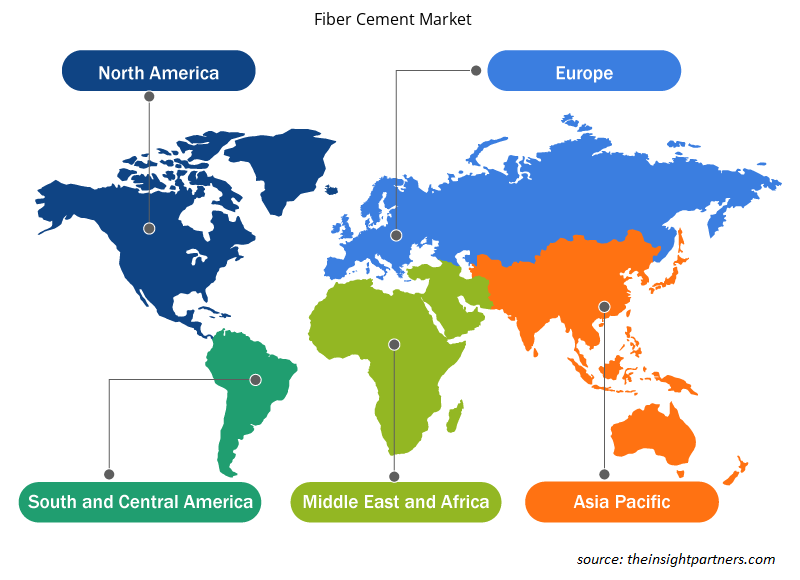

In 2022, Asia Pacific held the largest revenue share of the global fiber cement market. The demand for fiber cement is increasing in Asia Pacific due to the growing awareness regarding the benefits of fiber cement. This region has been noticed as one of the prominent markets for the utilization of fiber cement boards owing to the surge in construction activities. Moreover, government initiatives and policies such as Make-in-India encourage the setup of different manufacturing plants in India. Rising foreign direct investments also lead to economic growth in the region. The growing number of fiber cement board uses in numerous residential and nonresidential sectors is anticipated to increase the fiber cement board demand in Asia Pacific in the coming years. In India, the construction industry is the second largest industry after agriculture, accounting for about 11% of the country's GDP. The building & construction industry is a strong contributor to the market's growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fiber Cement Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fiber Cement Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Fiber Cement Market

The construction sector has been the major contributor to the demand for fiber cement. The COVID-19 pandemic adversely affected the growth of the chemicals & materials sector and fiber cement market. The implementation of measures to combat the spread of SARS-CoV-2 negatively impacted the growth of various industries. Industries such as packaging, consumer goods, automotive & transportation, textiles, and building & construction were adversely affected by the disruptions in operational efficiencies and value chains due to the sudden closure of national and international boundaries. During the COVID-19 pandemic, falling revenue and increasing project delivery challenges led to the sector’s contraction in most markets, with a corresponding negative impact on the labor force. Builders experienced delays and increased costs for imported raw materials and off-site building materials due to many factories being shut down for long periods. The damage to the building & construction industry hampered the demand for fiber cement during the pandemic.

Market Insights

Surging Demand for Energy-Efficient Buildings Bolsters Fiber Cement Market Growth

According to the Energy Sector Management Assistance Program, nearly one-third of global energy is consumed in residential, public, and commercial buildings for space cooling, heating, ventilating, cooking, refrigerating, lighting, water heating, and operating electric and mechanical devices. Modernizing cities in developing countries and increasing per capita income propel energy use in buildings across the world. High energy consumption in public, residential, and commercial buildings create a need for energy savings. According to the International Energy Agency, buildings are expected to account for ∼41% of global energy savings potential by 2035, and the industrial sector and transport sector will hold 24% and 21%, respectively. A layer of fiber cement is applied to the building to reduce heat transfer through the walls, keeping the interior warmer in winter and cooler in summer, which helps reduce energy consumption. According to the ASHRAE Fundamentals Handbook, fiber cement has an R-value of 0.15, which is better than the value of brick and stone.

Type Insights

Based on type, the global fiber cement market is bifurcated into air-cured and autoclaved. The autoclaved segment held a larger market share in 2022. Autoclaved fiber cement is made from a mixture of cement, sand, cellulose fibers, and other additives. The mixture is formed into sheets or boards and then cured in an autoclave, which is a high-pressure vessel that applies heat and steam to the material. The autoclaving process causes a chemical reaction that strengthens the material, making it more durable and resistant to water, fire, and pests. It is generally used in a wide range of applications, including roofing, siding, flooring, and as a backing for ceramic tiles. Moreover, autoclaved fiber cement is also known for its versatility and design flexibility, as it can be made to mimic the appearance of other building materials, such as wood or stone. It is also available in various colors and textures, making it a popular choice for both residential and commercial construction projects.

James Hardie Industries plc, Etex NV, Swisspearl Group AG, CSR Ltd, NICHIHA Corp, Plycem Construsistemas Costa Rica SA, Compagnie de Saint Gobain SA, Century Plyboards Ltd, Everest Industries Ltd, and Isam Khairi Kabbani Group are a few key players operating in the global fiber cement market. Market players focus on providing high-quality products to fulfill customer demand. They are also adopting strategies such as investments in research and development activities and launches of new products. .

Report Spotlights

- Progressive industry trends in the fiber cement market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the fiber cement market from 2020 to 2028

- Estimation of global demand for fiber cement

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the fiber cement market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The fiber cement market size at various nodes

- Detailed overview and segmentation of the market, as well as the fiber cement industry dynamics

- The fiber cement market size in various regions with promising growth opportunities

Fiber Cement Market Regional Insights

Fiber Cement Market Regional Insights

The regional trends and factors influencing the Fiber Cement Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Fiber Cement Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fiber Cement Market

Fiber Cement Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 21.75 Billion |

| Market Size by 2028 | US$ 33.05 Billion |

| Global CAGR (2022 - 2028) | 7.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Fiber Cement Market Players Density: Understanding Its Impact on Business Dynamics

The Fiber Cement Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fiber Cement Market are:

- James Hardie Industries plc

- Etex NV

- Swisspearl Group AG

- CSR Ltd

- NICHIHA Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fiber Cement Market top key players overview

Global Fiber Cement Market

Based on fiber type, the global fiber cement market is segmented on the basis of type, application, and end-use. Based on type, the global fiber cement market is segmented into air-cured and autoclaved. Based on application, the fiber cement market is segmented into roofing, outside siding or façade, and others. Based on end-use, the fiber cement market is segmented into residential and non-residential.

Company Profiles

- James Hardie Industries plc

- Etex NV

- Swisspearl Group AG

- CSR Ltd

- NICHIHA Corp

- Plycem Construsistemas Costa Rica SA

- Compagnie de Saint Gobain SA

- Century Plyboards Ltd

- Everest Industries Ltd

- Isam Khairi Kabbani Group

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Fill Finish Manufacturing Market

- Non-Emergency Medical Transportation Market

- Blood Collection Devices Market

- Medical Second Opinion Market

- Glycomics Market

- Small Molecule Drug Discovery Market

- Nurse Call Systems Market

- Hair Extensions Market

- HVAC Sensors Market

- Health Economics and Outcome Research (HEOR) Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application and, End-Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Asia Pacific accounted for the largest share of the global fiber cement market. Asia Pacific is one of the most significant regions for the fiber cement market owing to surging demand for energy-efficient buildings.

Durability is one of the most desirable qualities of fiber cement. Fiber cement siding, boards, and panels typically outlast vinyl siding and other alternative products in lifespan. Within 10 to 15 years, vinyl siding can show signs of aging, whereas fiber cement siding can last up to 30 to 50 years or more. Further, in cement production, carbon dioxide is a byproduct. However, manufacturing vinyl siding containing polyvinyl chloride (PVC) produces more carbon dioxide than cement production. Hence, fiber cement siding is a greener alternative to vinyl siding. Fiber cement products do not require frequent repainting as it holds paint well. Also, they do not dent unlike steel siding. Fiber cement products stand stronger in moisture and leaks than gypsum boards. These products possess excellent moisture-absorbing and drying properties, making them resistant to weather changes.

Based on type, autoclaved segment held the largest revenue share owing to the its durability and resistance to water, fire, and pests.

Based on the application, roofing segment is projected to grow at the fastest CAGR over the forecast period. Fiber cement roofing sheets and tiles are popular for their durability, resistance to weathering, and low maintenance requirements. They are also available in a variety of colors and styles to suit multiple architectural requirements and design preferences.

According to the World Bank, across the world, a large proportion of the population lives in cities. In 2011, 52.0% lived in urban areas. Over the last ten years, owing to urbanization in developing economies in Asia and Oceania, the urbanization rate increased from 43.3% in 2011 to 50.0% in 2021. Africa has seen a 4.6% increase in the same period. Governments of various countries across the world focus on supporting and increasing construction activities. Saudi Arabia launched its Saudi Vision 2030 to diversify its economy, modernize its administration, and introduce bold reforms in many sectors. The country is targeting to increase the contribution of its construction sector to the overall GDP. Due to its Saudi Vision 2030, the country's construction market reports significant growth in residential and nonresidential segments and offers lucrative potential to fiber cement.

The major players operating in the global fiber cement market are James Hardie Industries plc, Etex NV, Swisspearl Group AG, CSR Ltd, NICHIHA Corp, Plycem Construsistemas Costa Rica SA, Compagnie de Saint Gobain SA, Century Plyboards Ltd, Everest Industries Ltd, and Isam Khairi Kabbani Group.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Fiber Cement Market

- James Hardie Industries plc

- Etex NV

- Swisspearl Group AG

- CSR Ltd

- NICHIHA Corp

- Plycem Construsistemas Costa Rica SA

- Compagnie de Saint Gobain SA

- Century Plyboards Ltd

- Everest Industries Ltd

- Isam Khairi Kabbani Group

Get Free Sample For

Get Free Sample For