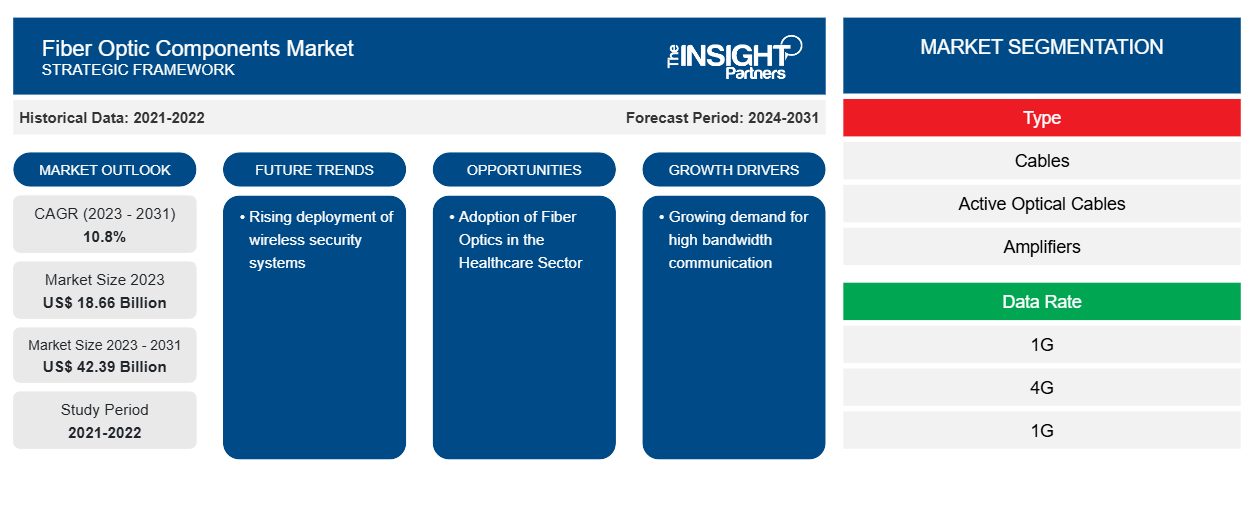

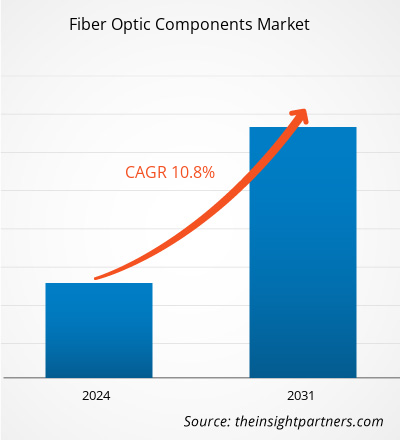

The global fiber optic components market size is expected to grow from US$ 18.66 billion in 2023 to US$ 42.39 billion by 2031; it is anticipated to expand at a CAGR of 10.8% from 2023 to 2031. The rising deployment of wireless security systems is likely to remain key fiber optic components market trends.

Fiber Optic Components Market Analysis

This market's growth is being driven by a number of commercial reasons, including increased data center deployment, expanding internet penetration and data traffic, rising need for bandwidth and dependability, and improvements in the fiber optic components ecosystem.

Fiber Optic Components Market Overview

A typical optical fiber consists of three major components: the core, which transports the light; the cladding, which surrounds the core with a lower refractive index and confines the light; and the coating, which protects the delicate fiber within. The core, which carries the light, is the smallest component of the optical fiber. Optical fiber cores are typically constructed of glass, while some are made of plastic. The cladding surrounds the core and provides a reduced refractive index, allowing the optical fiber to function. When using glass cladding, the cladding and core are made from the same silicon dioxide-based material in a permanently fused condition. The coating is the optical fiber's protective covering. The layer absorbs shocks, nicks, scratches, and even dampness, which may harm the cladding. Without the coating, the optical fiber is extremely brittle.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fiber Optic Components Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fiber Optic Components Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Fiber Optic Components Market Drivers and Opportunities

Growing demand for high bandwidth communication to Favor Market

The need for high-speed wired internet and broadband network infrastructures is expanding, which is driving up the demand for fiber optic cables. Several factors contribute to this need, including the necessity for fast internet connections for specialized programs such as gaming, media, and video streaming. Fiber optic lines have a larger bandwidth capacity and can carry data at quicker speeds than copper wires. Fiber optic cables have lower signal loss and are less susceptible to electromagnetic interference, resulting in more dependable and robust communications.

Adoption of Fiber Optics in the Healthcare Sector

The healthcare business is continually developing and adopting new technology to improve patient care and communication among healthcare staff. Fiber optic networks are critical to this shift because they offer the most dependable and secure connectivity. This thorough guide will look at the benefits of optical fiber networks in healthcare, the cutting-edge technologies they enable, and the industry's digital revolution. The healthcare business is a major adopter of fiber optic internet and networks. Healthcare businesses rely on fast, secure internet connections to guarantee that patient data is delivered swiftly and safely. Fiber networks are also more scalable than traditional internet connections.

Fiber Optic Components Market Report Segmentation Analysis

Key segments that contributed to the derivation of the fiber optic components market analysis type, data rate, and application.

- Based on type, the market is divided into cables, active optical cables (AOC), amplifiers, splitters, connectors, circulators, transceivers, and others. The cables segment held a larger market share in 2023.

- Based on data rate, the market is divided into 10G, 40G, 100G, and above 100G. The 100G segment held a larger market share in 2023.

- Based on application, the market is divided into communications, distributed sensing, analytical and medical equipment, and lighting. The communications segment held a larger market share in 2023.

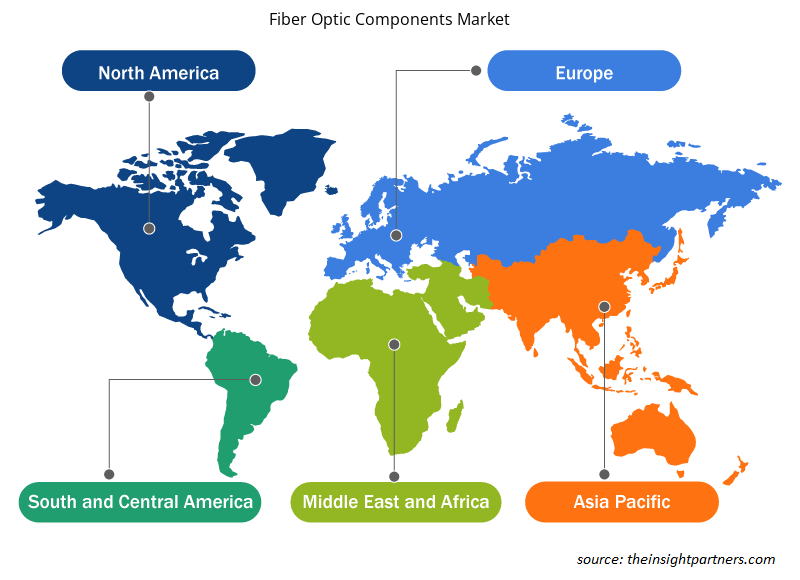

Fiber Optic Components Market Share Analysis by Geography

The geographic scope of the fiber optic components market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. North America dominated the fiber optic components market in 2023. Technological advancements, such as the use of wireless technology, cloud computing platforms, and IoT-based security systems, are propelling the growth of the fiber optic components market. These advancements improve the efficiency, convenience, and effectiveness of wireless communication systems.

Fiber Optic Components Market Regional Insights

The regional trends and factors influencing the Fiber Optic Components Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Fiber Optic Components Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fiber Optic Components Market

Fiber Optic Components Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 18.66 Billion |

| Market Size by 2031 | US$ 42.39 Billion |

| Global CAGR (2023 - 2031) | 10.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

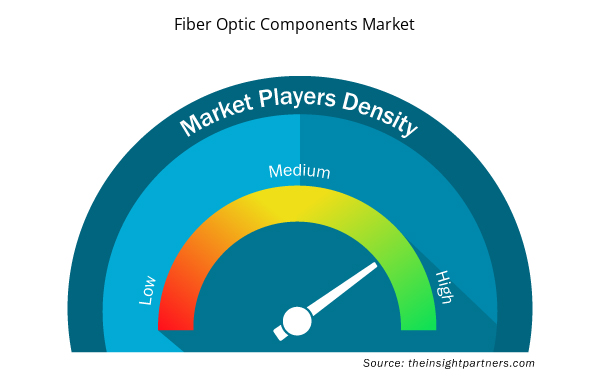

Fiber Optic Components Market Players Density: Understanding Its Impact on Business Dynamics

The Fiber Optic Components Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fiber Optic Components Market are:

- Accelink Technology Co. Ltd.

- Broadcom, Inc.

- EMCORE Corporation

- Fujitsu Limited

- Furukawa Electric Co. Ltd.

- Coherent

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fiber Optic Components Market top key players overview

Fiber Optic Components Market News and Recent Developments

The fiber optic components market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In September 2023, Fujitsu developed an optical transmission technology that can deliver data at a rate of up to 1.2 Tbps per optical wave. This is equivalent to transferring the data from six Blu-ray discs (each with a capacity of 25 GB) in just one second.

(Source: Fujitsu, Press Release, 2023)

Fiber Optic Components Market Report Coverage and Deliverables

The "Fiber Optic Components Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Ketogenic Diet Market

- Batter and Breader Premixes Market

- Medical Audiometer Devices Market

- Helicopters Market

- Public Key Infrastructure Market

- Industrial Valves Market

- Fish Protein Hydrolysate Market

- Bioremediation Technology and Services Market

- Human Microbiome Market

- Health Economics and Outcome Research (HEOR) Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; Data Rate ; Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global fiber optic components market is expected to reach US$ 42.39 billion by 2031.

The key players holding the majority of shares in the global fiber optic components are Accelink Technology Co. Ltd., Broadcom, Inc., EMCORE Corporation, Fujitsu Limited, and Furukawa Electric Co. Ltd.

The rising deployment of wireless security systems is likely to remain key fiber optic components market trends.

The increasing deployment of data centers, growing internet penetration and data traffic, rising demand for bandwidth and reliability, and developments in the fiber optic components ecosystem are driving the market for fiber optic components.

The fiber optic components market size is expected to grow from US$ 18.66 billion in 2023 to US$ 42.39 billion by 2031; it is anticipated to expand at a CAGR of 10.8% from 2024 to 031.

Get Free Sample For

Get Free Sample For