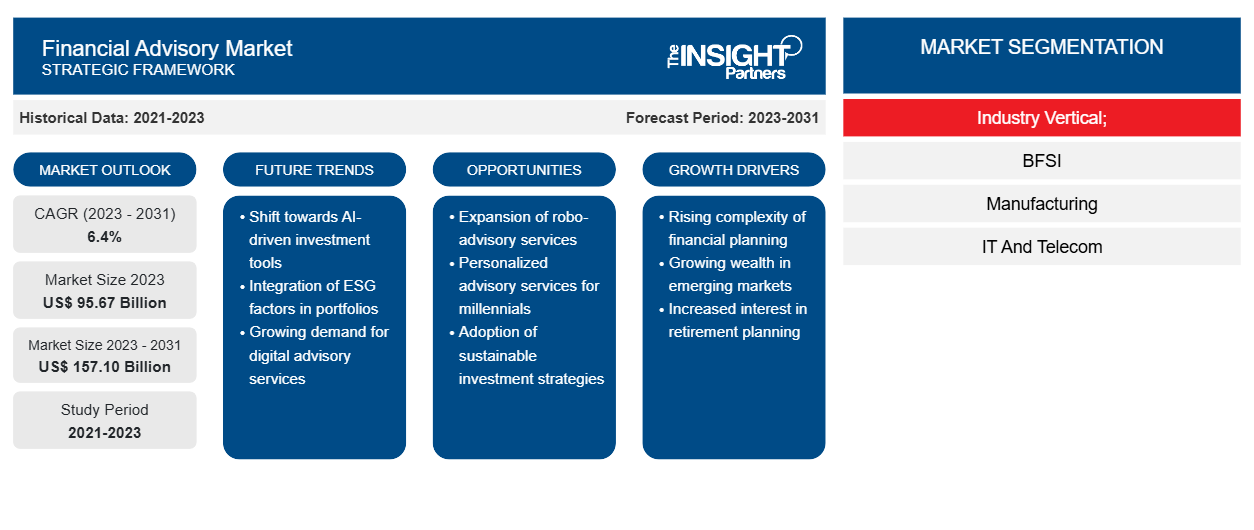

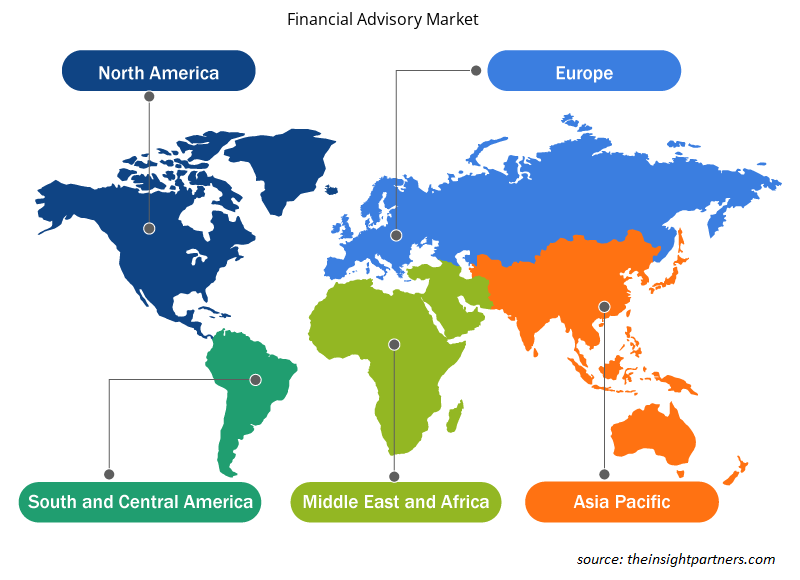

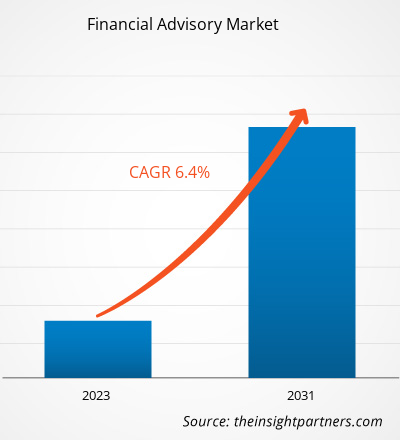

The size is expected to grow from US$ 95.67 billion in 2023 to US$ 157.10 billion by 2031; it is anticipated to expand at a CAGR of 6.4% from 2023 to 2031.

Financial advisory Market Analysis

The financial advisory market forecast is estimated on the basis of various secondary and primary research findings such as key company publications, association data, and databases. Financial advisory services are consulting services that build on a robust financial-analytical fundamental. These service offerings span an extensive variety of topics, such as risk management, transaction services, real estate advisory, tax advisory, compliance, and litigation services, among others. Furthermore, financial advisors provide customers with global advisory services that completely focus on the strategic direction of business development and success.

Financial advisory

Industry Overview

- Financial advisory services consist of fees earned for assisting clients with transactions related to financial restructurings and mergers & acquisitions. Revenue differs depending on the size of the transaction and the scope of services performed and normally depends on the effective completion of the transaction.

- Increasing demand for financial advisory services among small and medium enterprises (SMEs) and continuous growth in global high-net-worth individuals drive the financial advisory services market growth. Additionally, factors such as the mounting demand for alternate investments certainly impact the financial advisory market growth. However, a lack of awareness regarding financial risk advisory services and higher dependency on obsolete methods are anticipated to hinder market growth. On the contrary, increasing innovations in the fintech business and the untouched potential of developing economies are projected to bid lucrative opportunities for expansion of the financial advisory services market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Financial Advisory Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Financial Advisory Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Financial Advisory Market Driver

Growing demand for financial advisory services among SMEs to Drive Financial Advisory Market Growth

- Financial advisory services are the finest technique to offer value for SMEs as they can maximize their pricing by the value they deliver to their small business customers. Furthermore, according to an Accounting Today survey in October 2021, 78.0% of small businesses want a trusted advisor with financial knowledge.

- Additionally, during the COVID-19 pandemic, some major banks collaborated to deliver proper financial advisory services for SMEs. For instance, in August 2021, Gulf Bank collaborated with Balance Business Advisory, a Kuwaiti-based SME, to offer financial advisory services to SMEs and entrepreneurs as part of their continual commitment to their customers in this segment. This collaboration is rooted in the Bank’s strategy toward offering advisory and financial services to the SME’s.

Financial Advisory

Market Report Segmentation Analysis

- Based on type, the financial advisory market is segmented into corporate finance, tax advisory, accounting, advisory, risk management, transaction services, and others. The corporate finance segment held a significant financial advisory market share in 2023.

- The banking, financial services, and insurance (BFSI) segment held the largest financial advisory market share by industry vertical. Increasing demand for financial advisory services from the BFSI sector provides a range of financial products and services. Further, the BFSI industry is set to grow significantly in the coming years worldwide due to increasing awareness among individuals about financial services and products.

Financial Advisory

Market Regional Analysis

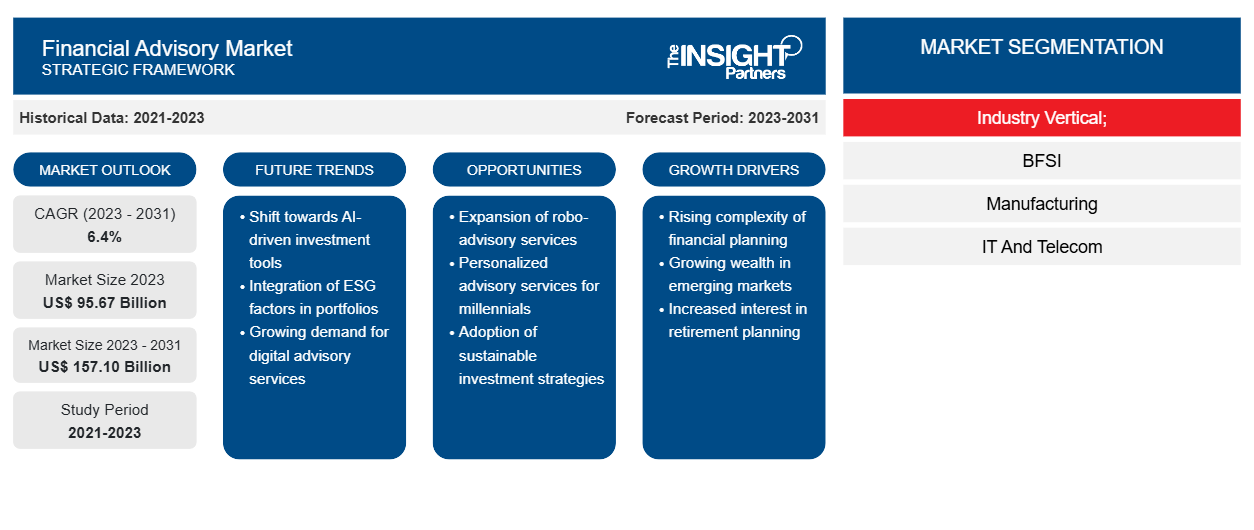

The scope of the financial advisory market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is observing rapid growth and is expected to hold a noteworthy financial advisory market share in 2023 due to rapidly increasing owing to evolving customer segments, rapid technological developments, and fluctuating competitive dynamics. However, Asia-Pacific is projected to observe significant growth during the forecast period, owing to continued growth in regulation, distribution regimes, use of technology, and wealth management products.

Financial Advisory

Financial Advisory Market Regional Insights

The regional trends and factors influencing the Financial Advisory Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Financial Advisory Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Financial Advisory Market

Financial Advisory Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 95.67 Billion |

| Market Size by 2031 | US$ 157.10 Billion |

| Global CAGR (2023 - 2031) | 6.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Industry Vertical;

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

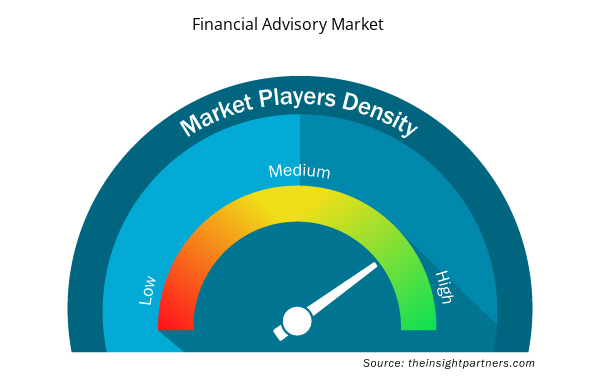

Financial Advisory Market Players Density: Understanding Its Impact on Business Dynamics

The Financial Advisory Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Financial Advisory Market are:

- PWC

- Morgan Stanley

- Goldman Sachs Group Inc.

- Wells Fargo & Co

- Deloitte

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Financial Advisory Market top key players overview

The "Financial Advisory Market Analysis" was carried out based on card type and geography. In terms of type, the market is segmented into corporate finance, accounting advisory, tax advisory, transaction services, risk management, and others. By organization size, the market is segmented into large enterprises and small & medium-sized enterprises. By industry vertical, the market is segmented into manufacturing, BFSI, IT And telecom, retail and e-commerce, public sector, healthcare, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Financial Advisory

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Financial advisory market. A few recent key market developments are listed below:

- February 2023: Morgan Stanley Investment Management announced that it had received approval from the China Securities Regulatory Commission (CSRC) to take a complete supervisory stake in Morgan Stanley Huaxin Funds, marking a significant strategic advancement for the company's comprehensive footprint in China.

(Source: Morgan Stanley Investment Management, Company Website)

Financial Advisory

Market Report Coverage & Deliverables

The market report "Financial Advisory Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Unit Heater Market

- Aircraft Landing Gear Market

- Energy Recovery Ventilator Market

- Greens Powder Market

- Vision Guided Robotics Software Market

- EMC Testing Market

- Industrial Inkjet Printers Market

- Fill Finish Manufacturing Market

- Analog-to-Digital Converter Market

- Authentication and Brand Protection Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Organization Size, Industry Vertical,, Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global financial advisory market are Morgan Stanley, Goldman Sachs Group Inc., Wells Fargo & Co, Deloitte, and Bank of America Corporation.

The global Financial advisory market is expected to reach US$ 157.10 billion by 2031.

The global financial advisory market was estimated to be US$ 95.64 billion in 2023 and is expected to grow at a CAGR of 6.4% during 2023 - 2031.

Digital advancements in the financial advisory market to play a significant role in the global financial advisory market in the coming years.

Increasing demand from the BFSI sector and increasing initiatives by market players are the major factors that propel the global financial advisory market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- PWC

- Morgan Stanley

- Goldman Sachs Group Inc.

- Wells Fargo & Co

- Deloitte

- Bank of America Corporation

- KPMG

- JPMorgan Chase & Co.

- McKinsey & Company

- BCG Group

Get Free Sample For

Get Free Sample For