MARKET INTRODUCTION

Financial services application is a software program that facilitates the management of money related processes. Globalization and digitization of financial institutions and infrastructure have cultivated the need for risk-free financial services. Rise of big data analytics and business intelligence solutions are revolutionizing the fintech industry. Financial institutions are increasingly incorporating AI to improve customer experiences.

MARKET DYNAMICS

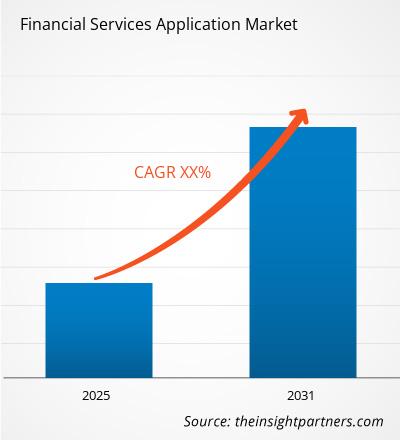

The financial services application market is anticipated to grow in the forecast period owing to driving factors such as increased focus towards customer experience, coupled with the introduction of digital channels for banking. High demand for workforce optimization solution is further expected to fuel the growth of the financial services application market. However, high deployment cost may hinder the growth of the financial services application market during the forecast period. Nevertheless, big data and cloud technologies offer lucrative opportunities for market players in the coming years.

MARKET SCOPE

The "Global Financial Services Application Market Analysis to 2031" is a specialized and in-depth study of the technology, media and telecommunications industry with a special focus on the global market trend analysis. The report aims to provide an overview of financial services application market with detailed market segmentation by offering, application, deployment, organization size, and geography. The global financial services application market is expected to witness high growth during the forecast period. The report provides key statistics on the market status of the leading financial services application market players and offers key trends and opportunities in the market.

MARKET SEGMENTATION

The global financial services application market is segmented on the basis of offering, application, deployment, and organization size. Based on offering, the market is segmented as solution and services. On the basis of the application, the market is segmented as auditing, customer relationship, transaction processing, and others. By deployment, the market is classified into on premise and cloud. The market on the basis of the end user is classified as small & medium enterprises and large enterprises.

REGIONAL FRAMEWORK

The report provides a detailed overview of the industry including both qualitative and quantitative information. It provides an overview and forecast of the global financial services application market based on various segments. It also provides market size and forecast estimates from the year 2021 to 2031 with respect to five major regions, namely; North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. The financial services application market by each region is later sub-segmented by respective countries and segments. The report covers the analysis and forecast of 18 countries globally along with the current trend and opportunities prevailing in the region.

The report analyzes factors affecting financial services application market from both demand and supply side and further evaluates market dynamics affecting the market during the forecast period, i.e., drivers, restraints, opportunities, and future trend. The report also provides exhaustive PEST analysis for all five regions namely; North America, Europe, APAC, MEA, and South & Central America after evaluating political, economic, social and technological factors affecting the financial services application market in these regions.

MARKET PLAYERS

The reports cover key developments in the financial services application market as organic and inorganic growth strategies. Various companies are focusing on organic growth strategies such as product launches, product approvals and others such as patents and events. Inorganic growth strategies activities witnessed in the market were acquisitions, and partnership & collaborations. These activities have paved the way for the expansion of business and customer base of market players. The market players from financial services application market are anticipated to lucrative growth opportunities in the future with the rising demand for financial services application in the global market. Below mentioned is the list of few companies engaged in the financial services application market.

The report also includes the profiles of key financial services application companies along with their SWOT analysis and market strategies. In addition, the report focuses on leading industry players with information such as company profiles, components and services offered, financial information of the last three years, key developments in the past five years.

- Accenture plc

- Fidelity National Information Services Inc.

- Fiserv Inc.

- Microsoft Corporation

- Oracle Corporation

- Salesforce.com Inc.

- SAP SE

- SAS Institute Inc

- SS&C Technologies, Inc.

- Temenos AG

Financial Services Application Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | XX% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies

1.Accenture plc2.Fidelity National Information Services Inc.3.Fiserv Inc.4.Microsoft Corporation5.Oracle Corporation6.Salesforce.com Inc.7.SAP SE8.SAS Institute Inc9.SS and C Technologies, Inc.10.Temenos AG

1.Accenture plc2.Fidelity National Information Services Inc.3.Fiserv Inc.4.Microsoft Corporation5.Oracle Corporation6.Salesforce.com Inc.7.SAP SE8.SAS Institute Inc9.SS and C Technologies, Inc.10.Temenos AG

Get Free Sample For

Get Free Sample For