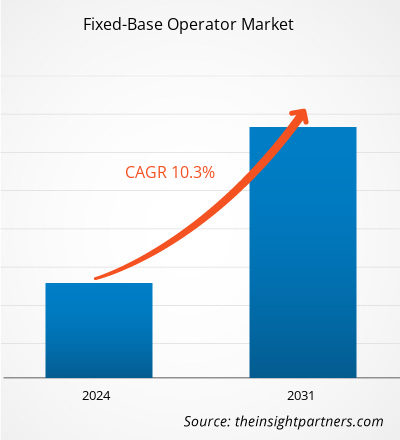

The Fixed-Base Operator Market size is projected to reach US$ 53.45 billion by 2031 from US$ 24.45 billion in 2023. The market is expected to register a CAGR of 10.3% in 2023–2031. The escalating demand for hangaring services for wide body aircraft is likely to remain a key fixed-base operator market trend.

Fixed-Base Operator Market Analysis

At airports, the FBOs provide ground handle and fuelling services to the commercial airlines operating from the particular airport. The most important thing that the buyers are looking for is the smaller airfields with quick response of the FBO, as the purchasing power varies and impacts the margins on each gallon of fuel sold. For instance, Jet Aviation (subsidiary of General Dynamics), provides fuelling services to corporate, by following the ISAGO rules set for airport operations. The company also holds relevant license and certification training – FAR 139 fuel and fire safety, NATA safety first, and CDL. Similarly, Ascent Aviation Services offers full range of fuel services to private, commercial, and military aircraft. The company offers different fuel services such as Jet A, Jet A w/Prist, and 100LL, AV GAS services, military fuel, checking fuel quality compliant with ATA 103, 24-hour service, and de-Fuelling services.

Recently, in November 2022, IFS signed a multi-year agreement for jet fuel and FBO services at Pitt Meadows Regional airport in Canada wherein the company will set up full service FBO in the main airport terminal. Similarly, in June 2021, Signature Aviation announced the offering of Sustainable Aviation Fuel (SAF) to various customers at three different US airports namely - Austin-Bergstrom Int’l Airport in Austin, Houston-Hobby Airport in Houston, Texas, and the Norman Y. Mineta San Jose Int’l Airport in San Jose, California. The demand for SAF is consistently growing among the aviation companies to reduce carbon footprint, and owing to this, the Signature Aviation has strategized to offer SAF. This strategy is expected to boost Signature Aviation’s brand image, customer base, and revenues in the coming years.

Fixed-Base Operator Market Overview

The fixed-base operator market ecosystem comprises stakeholders, such as airport, fixed-base operator (FBO), and end users. The airport authority across the globe allocates space and permit the FBO to operate from their premises. In the current scenario, the airport authorities worldwide are actively participating in offering premises to different FBO in order to boost their year-on-year revenue generation. The fixed-base operator (FBO) offers different types of services such as hangaring, fueling, flight instructions, aircraft maintenance, and aircraft rental. The growing demand of business aviation and leisure aviation globally is supporting the growth of FBO market. The end user of this market are business aviation operators and leisure aviation operators. These aviation operators are robustly focusing on boosting the overall travel experience of the traveler whether it’s for business purpose or tourism purpose. The FBOs also offer fascinating additional services to their customers such as SPA, VIP lounges, and many more.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fixed-Base Operator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fixed-Base Operator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Fixed-Base Operator Market Drivers and Opportunities

Increasing Expansion and Collaboration of FBO Companies

The top FBO companies are actively participating in offering robust FBO services to meet the consistently growing demand. In addition, these players invest substantial capitals in respective services to gain customer attraction with enhanced services. Also, the companies engage themselves in expanding their businesses to different geographies to increase their customer base. The significant rise in business aviation and leisure aviation in the past few years across the globe has led these players to offer their advanced services, which helped the companies to position themselves among the key players worldwide. For instance:

- In March 2022, Signature Aviation signed an agreement to acquire TAC Air and its 14 FBO units across different locations in the US.

- In June 2021, Signature Aviation introduced and announced permanent supply of Sustainable Aviation Fuel (SAF) at three airports: Austin-Bergstrom Int’l Airport in Austin, Houston-Hobby Airport in Houston, Texas, and the Norman Y. Mineta San Jose Int’l Airport in San Jose, California

High Potential for FBOs in Asia Pacific Region – An Opportunity in Fixed-Base Operator Market

The overall FBO market in APAC is witnessing slow growth as compared to other regions such as North America and Europe, which is mainly attributed to the presence of a smaller number of business as well as private jets across the region. The fixed-base operator market is observing decent growth in the Southeast countries such as Indonesia, Singapore, and Macau. The general aviation sector in APAC is expected to rise during the forecast period, which is also demanding the FBO service provider to offers enhanced services to the traveler. Currently, there are total 72 FBOs operating in Asia Pacific countries; of these, 23 are operating in Australia and serve a business aviation fleet of ~200 aircraft. The FBOs in Hong Kong operate with ~122 business jets. Tag Aviation has expanded its footprint in Macau in 2020, and it was the very first company to officially open its office in the region. Similarly, as per the survey conducted by the Aviation International News (AIN), in 2020, MJets FBO topped the list of FBOs operating in Asia Pacific, and it ranked seventh among the world’s top FBOs for the for fifth consecutive year. MJets operates in Thailand for only Private Jet Terminal and has its FBO facility at Bangkok’s Don Mueang International Airport. Thus, slow but promising increase in the number of FBOs in APAC is emerging as one of the significant opportunities for the growth of the fixed-base operator market players.

Fixed-Base Operator Market Report Segmentation Analysis

Key segments that contributed to the derivation of the fixed-base operator market analysis are services offered and application.

- Based on services offered, the fixed-base operator market is divided into hangaring, fuelling, flight training, aircraft maintenance, and aircraft rental. The fuelling segment held a larger market share in 2023.

- Based on application, the market is segmented into business aviation and leisure aviation. The business aviation segment held a larger market share in 2023.

Fixed-Base Operator Market Share Analysis by Geography

The geographic scope of the fixed-base operator market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America.

In 2023, North America accounted for a major share of the global fixed-base operator market followed by Europe and Asia Pacific. High demand among customers and the widespread presence of fixed-base operator service providers in North America, especially in the US, boosted the growth of the fixed-base operator market. On the other hand, the APAC region is projected to showcase tremendous demand for FBOs in the upcoming years, thus, registering the highest CAGR during 2023 – 2031. This is due to the significant growth in the general aviation segment, particularly in Australia, China, and Southeast Asian countries.

Fixed-Base Operator Market Regional Insights

Fixed-Base Operator Market Regional Insights

The regional trends and factors influencing the Fixed-Base Operator Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Fixed-Base Operator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fixed-Base Operator Market

Fixed-Base Operator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 24.45 billion |

| Market Size by 2031 | US$ 53.45 billion |

| Global CAGR (2023 - 2031) | 10.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Services Offered

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

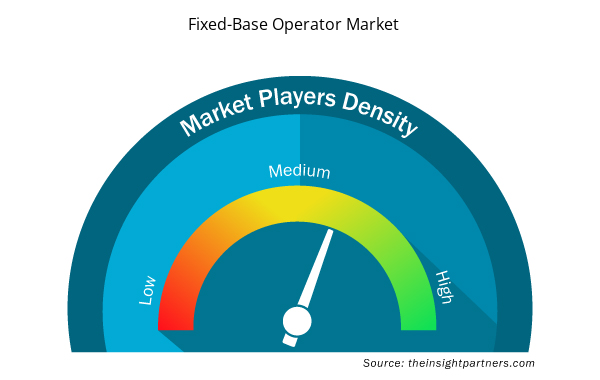

Fixed-Base Operator Market Players Density: Understanding Its Impact on Business Dynamics

The Fixed-Base Operator Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fixed-Base Operator Market are:

- ABILENE AERO

- AVEMEX SA DE CV

- DEER JET CO. LTD.

- DNATA CORPORATION

- JET AVIATION (GENERAL DYNAMICS CORPORATION)

- JETEX

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fixed-Base Operator Market top key players overview

Fixed-Base Operator Market News and Recent Developments

The fixed-base operator market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In September 2023, Dubai-based private aircraft flight support chain Jetex soft opened its new FBO at Al Bateen Executive Airport (Source: Jetex, Press Release)

- In February 2024, Signature Aviation opened a new FBO terminal at Florida's Key West International Airport (KEYW), where the company is the one and only aviation service provider serving the southernmost city in the US. (Source: Signature Aviation, Newsletter)

Fixed-Base Operator Market Report Coverage and Deliverables

The “Fixed-Base Operator Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Fixed-Base Operator Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Fixed-Base Operator Market trends

- Detailed Porter’s Five Forces

- Fixed-Base Operator Market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Fixed-Base Operator Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Services Offered, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Malaysia, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For