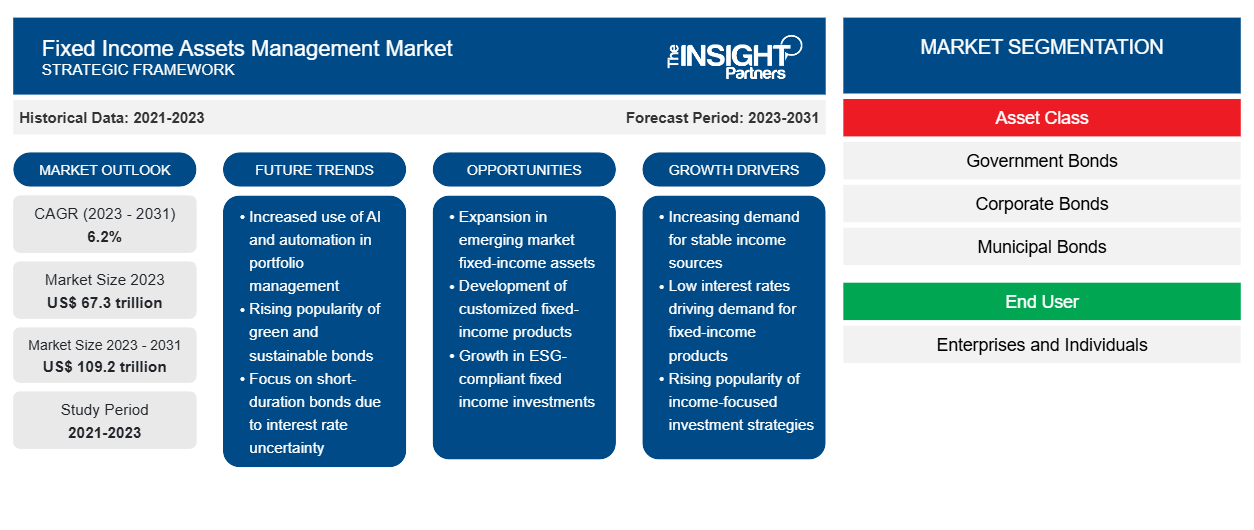

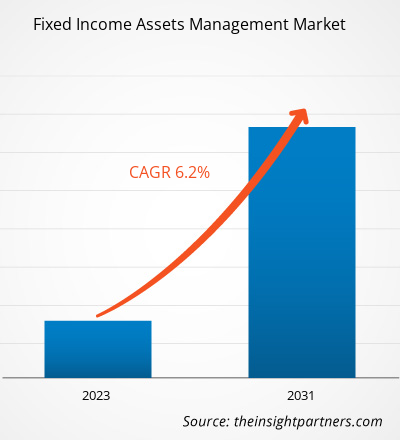

The fixed income assets management market size is expected to grow from US$ 67.3 trillion in 2023 to US$ 109.2 trillion by 2031; it is anticipated to expand at a CAGR of 6.2% from 2023 to 2031. The fixed income assets management market trends include changing demographics and diversification of investment portfolios.

Fixed Income Assets Management Market Analysis

The fixed income assets management market growth is attributed to the growing importance of balancing asset risk, including a variety of assets in their portfolios. Numerous fixed-income securities, including government & corporate bonds, offer stability and regular income, making them attractive components for diversification. Asset managers play a vital role in creating well-diversified portfolios to meet investors' risk tolerance and financial goals is fueling the market. Furthermore, the expansion of fixed income asset management business and the introduction of exclusive fixed income ETFs are expected to create opportunities in the market during the forecast period.

Fixed Income Assets Management Industry Overview

- Fixed income assets are a type of security that recompenses investors with a fixed interest rate or dividend until the fund matures. An investor receives their original principal back when the fund matures. Fixed income securities are debt instruments issued by governments, corporations, or other entities to finance their operations.

- Furthermore, fixed income funds are one of the most efficient types of investment other than mutual funds. It offers a steady stream of returns over time to investors. Fixed income funds lower the investment risk by providing a predetermined amount to the investor. Investors further use this amount to diversify their portfolios.

- The growing need for loans among customers across the globe is driving the market growth during the forecast period.

Fixed Income Assets Management Market Drivers and Opportunities

- The increasing popularity of regular interest payments among customers across the globe is driving the fixed income assets management market growth. Fixed-income instruments are attractive to investors due to their stable and predictable interest earnings; providing a reliable income stream to the income holder is propelling the market.

- Asset managers are adding a range of fixed income products in their portfolios to meet the growing consumer demand is fueling the market during the forecast period.

- Moreover, the growing focus on tax savings and lower market risk for fixed income funds is boosting the fixed income assets management market growth during the forecast period.

Fixed Income Assets Management Market Report Segmentation Analysis

- Based on asset Class, the fixed income assets management market is segmented into government bonds, corporate bonds, municipal bonds, high-yield bonds, and others.

- The government bonds segment is anticipated to hold a significant fixed income assets management market share by 2030. The growth of the segment is attributed to the rising number of collaborations and partnerships between asset management firms to provide investment advisory services and project portfolio management. For instance, in September 2022, Nippon Life India Asset Management partnered with DWS Group to launch an Indian Government Bond Exchange Traded Fund in Europe. This partnership involved a variety of offerings such as portfolio management and investment advisory services to customers in Europe.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fixed Income Assets Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fixed Income Assets Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

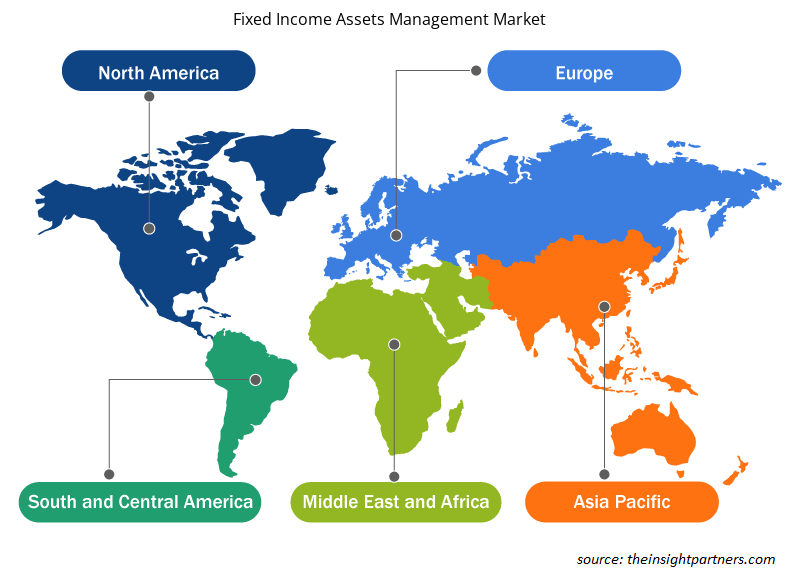

Fixed Income Assets Management Market Share Analysis By Geography

The scope of the fixed income assets management market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant fixed income assets management market share. The presence of a large number of players such as Goldman Sachs Group Inc, BlackRock Inc, American Vanguard Corp, Invesco Ltd, Oppenheimer & Co Inc, Putnam U.S. Holdings I, LLC, and Capital Group, among others. The rising aging population and growing popularity of fixed income securities among retirees and conservative investors. Moreover, companies are allocating a significant share of their portfolio to fixed income, fueling the market during the forecast period.

Fixed Income Assets Management Market Regional Insights

Fixed Income Assets Management Market Regional Insights

The regional trends and factors influencing the Fixed Income Assets Management Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Fixed Income Assets Management Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fixed Income Assets Management Market

Fixed Income Assets Management Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 67.3 trillion |

| Market Size by 2031 | US$ 109.2 trillion |

| Global CAGR (2023 - 2031) | 6.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Asset Class

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Fixed Income Assets Management Market Players Density: Understanding Its Impact on Business Dynamics

The Fixed Income Assets Management Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fixed Income Assets Management Market are:

- Goldman Sachs Group Inc

- JPMorgan Chase & Co

- HSBC Holdings Plc

- BlackRock Inc

- American Vanguard Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fixed Income Assets Management Market top key players overview

The "Fixed Income Assets Management Market Analysis" was carried out based on asset class, end user, and geography. Based on asset class, the market is segmented into government bonds, corporate bonds, municipal bonds, high-yield bonds, and others. In terms of end users, the fixed income assets management market is categorized into enterprises and individuals. By region, the fixed income assets management market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Fixed Income Assets Management Market News and Recent Developments

The fixed income assets management market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. Companies adopt inorganic and organic strategies such as mergers and acquisitions in the fixed income assets management market. A few recent key market developments are listed below:

- In June 2023, HSBC Holdings Plc partnered with Capital Group Global Corporate Bond fund of asset managers to numerous private clients, including retail, banking, and wealth management clients. This partnership allows investors to use their funds in high-quality bonds with attractive yields and potentially generate high future income.

(Source: HSBC Holdings, Company Website)

- In March 2023, DWS Group extended its five-year strategic alliance with Nippon Life to work on expanding distribution reach, research acuity, and product innovations. The partnership supports both companies in providing insurance advisory and solutions and helps DWS Group introduce exchange-traded fund options for Japanese investors.

(Source: DWS Group, Company Website)

Fixed Income Assets Management Market Report Coverage & Deliverables

The market report on “Fixed Income Assets Management Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aircraft Landing Gear Market

- Rare Neurological Disease Treatment Market

- Playout Solutions Market

- Long Read Sequencing Market

- Cosmetic Bioactive Ingredients Market

- Thermal Energy Storage Market

- Micro-Surgical Robot Market

- Microcatheters Market

- Point of Care Diagnostics Market

- Smart Grid Sensors Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Asset Class, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global fixed-income assets management market are Goldman Sachs Group Inc; JPMorgan Chase & Co; HSBC Holdings Plc; BlackRock Inc; American Vanguard Corp; FMR LLC; Invesco Ltd; Oppenheimer & Co Inc; Putnam U.S. Holdings I, LLC; and Capital Group.

The global fixed income assets management market is expected to reach US$ 109.2 trillion by 2031.

The global fixed income assets management market was estimated to be US$ 67.3 trillion in 2022 and is expected to grow at a CAGR of 6.2% during the forecast period 2023 - 2031.

Changing demographics and diversification of investment portfolios which is anticipated to play a significant role in the global fixed income assets management market in the coming years.

The increasing popularity of regular interest payments, growing focus on tax savings, and lower market risk for fixed income funds are the major factors that propel the global fixed income assets management market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Goldman Sachs Group Inc

- JPMorgan Chase & Co

- HSBC Holdings Plc

- BlackRock Inc

- American Vanguard Corp

- FMR LLC

- Invesco Ltd

- Oppenheimer & Co Inc

- Putnam U.S. Holdings I, LLC

- Capital Group

Get Free Sample For

Get Free Sample For