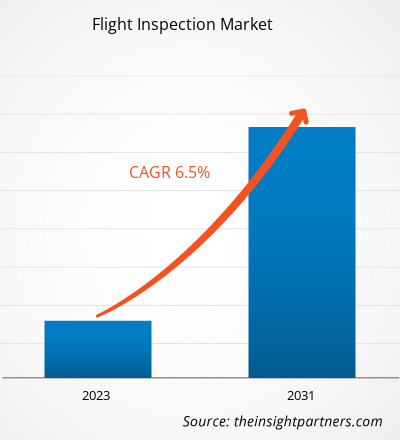

The flight inspection market size is projected to reach US$ 9.25 billion by 2031 from US$ 5.60 billion in 2023. The market is expected to register a CAGR of 6.5% in 2023–2031. Reducing the flight inspection cost and increase in investment towards flight inspection services are among the key trends driving the flight inspection market.

Flight Inspection Market Analysis

Increasing air traffic dictated the establishment of a common flight inspection system for all air navigation facilities to handle aircraft landing operations more effectively. Rapid development in aircraft technologies, such as advanced navigation and communication systems, creates the need for improved inspecting systems and service. Increasing number of aircraft in commercial and defense sectors, owing to rise in passengers and defense operations, is fueling the market growth. Developing economies are a potential market for companies as increasing number of airports creates a lucrative opportunity for ground-based flight inspection systems. The advancement in flight inspection systems is reducing the operational time and expenses to offer cost-effective solution for customers.

Flight Inspection Market Overview

The global aviation industry is witnessing considerable growth due to increased number of international and domestic flights. This, in turn, is propelling the growth of the flight inspection market. Increasing number of aircraft at airports generates the demand for advanced flight inspection systems and services to ensure that aircraft are safe to fly and airworthy. The importance of flight inspection is growing as modern aircraft come with a complex system and require additional skills to inspect. Trained and licensed inspectors carry out the inspection process to measure the performance of navigation, surveillance, and communication systems. Flight inspection ensures safety at the time of takeoff and landing of aircraft. Further, increased safety standards and improved guidelines for airport terminals are enhancing the importance of flight inspection systems. Besides, increased use of automatic flight inspection systems reduces operational time and improves process efficiency. There is an increase in demand for automated flight inspection systems from airport facilities to perform flight inspection due to their time-saving and cost-saving benefits.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Flight Inspection Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Flight Inspection Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Flight Inspection Market Drivers and Opportunities

Increase in Air Traffic Volume is Boosting the Market Growth

The global aviation sector is experiencing significant growth in air traffic volume in terms of passenger count and aircraft fleet. With the rise in aircraft fleet and traffic volume, routine inspection is of utmost importance for airport authorities to smoothen the operationality of aircraft movements. Apart from routine inspection, the commissioning of inspection services is also being carried out in several countries, as numerous new airports are coming up in developed and developing countries. Over the past couple of years, several airport authorities have been investing toward the expansion of runways and terminals. APAC is foreseen to contribute significantly toward the growth of flight inspection market, as the airport authorities in countries such as China, India, Japan, and other South East Asian countries are investing toward the expansion of existing airports and construction of newer airports. Thus, higher inclination toward flight inspection activities, growth in construction of new airports, rising number of flight inspection service providers, and increase in air traffic volumes are the key factors catalyzing the flight inspection market growth.

Utilization of UAVs for Flight Inspection

The unmanned aerial vehicles (UAVs) have been showcasing tremendous benefits across industries for various applications worldwide. Witnessing the importance of flight inspection over the years, several UAV manufacturers are eyeing on introducing and facilitating airport authorities and flight inspection service providers to gain benefit by using UAVs. Canard Drones Ltd., a Spanish drone manufacturer, is among the forerunners in developing and commercializing drones for flight inspection and inspection activities. The company anticipates that the use of drones would revolutionize the flight inspection activities by shortening the time required to conduct routine inspections at lower cost. Similarly, AltiGator, a Belgian drone manufacturer, devised ATLAS, an UAV, with an aim to offer flight inspection activity. As drones are much smaller in size and have lesser capability to carry payload than aircraft, flight inspection equipment manufacturers are expected to introduce compact, lightweight, and powerful systems that can be installed on the UAVs to conduct flight inspection. Thus, innovation in the field of small, lightweight flight inspection equipment for drones is also foreseen to catalyze the flight inspection market in the forthcoming years. Moreover, the flight inspection governing authorities are emphasizing on modifying the requisites of the flight inspection procedures to conduct UAV-based flight inspection (UFIS). The modifications would benefit the airport authorities and flight inspection service providers, which is, in turn, anticipated to propel the growth of the flight inspection market.

Flight Inspection Market Report Segmentation Analysis

Key segments that contributed to the derivation of the flight inspection market analysis are solution and end user.

- Based on solution, the flight inspection market has been divided into systems and services. The systems segment held a larger market share in 2023.

- On the basis of end user, the market has been segmented into defense airport and commercial airport. The commercial airport segment dominated the market in 2023.

Flight Inspection Market Share Analysis by Geography

The geographic scope of the flight inspection market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East and Africa, and South America.

North America has dominated the flight inspection market in 2023. The North America region includes US, Canada, and Mexico. The aerospace industry in North America is matured with the existence of a large number of aircraft manufacturers, MRO service providers, and skilled workforce. The demand for advanced technologies is tremendous in the region, with all the end users mentioned above are well aware of newer technologies. Owing to this, the adoption of flight inspection solutions in commercial airports begun decades ago in the region and are still continuing to integrate the technology on the new airport facilities. The commercial aerospace sector in the region is majorly dominated by Boeing, which is also integrating its B787 and B777 models for inspection to ensure that flights are meeting the expected standards and safe to fly. The flight inspection service providers and airports with self-owned flight inspection systems have started exercising retrofitting of older aircraft with modern navigational aids, which is also a catalyzer for the North American flight inspection market. The presence of a large number of flight inspection solution providers in the region is supporting the ever-rising demand, which is thereby boosting the flight inspection market.

Flight Inspection Market Regional Insights

The regional trends and factors influencing the Flight Inspection Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Flight Inspection Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Flight Inspection Market

Flight Inspection Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.60 Billion |

| Market Size by 2031 | US$ 9.25 Billion |

| Global CAGR (2023 - 2031) | 6.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

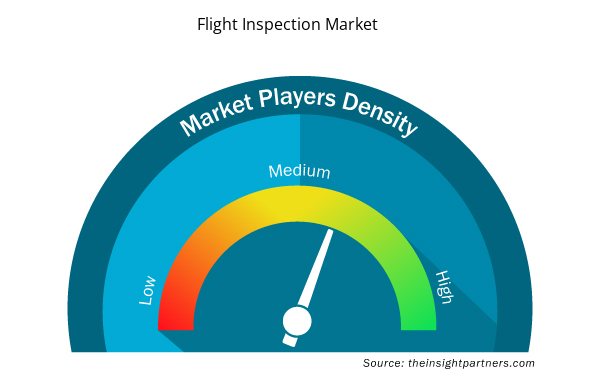

Flight Inspection Market Players Density: Understanding Its Impact on Business Dynamics

The Flight Inspection Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Flight Inspection Market are:

- Aerodata AG

- Airfield Technology, Inc.

- Norwegian Special Mission AS

- Radiola Limited

- Bombardier Inc.

- ENAV S.p.A.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Flight Inspection Market top key players overview

Flight inspection market News and Recent Developments

The flight inspection market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for flight inspection market and strategies:

- In February 2024, Asian Corporate Aviation Management (ACAM) acquired German flight inspection operator named Svege. Through this acquisition, ACAM expanded its footprint in Europe.

- In May 2022, Textron Aviation signed agreement with Turkish Aerospace Industries for the flight inspection missions by the government of Turkey.

Flight inspection market Report Coverage and Deliverables

The “Flight Inspection Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Solution and Services ) and End User and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For