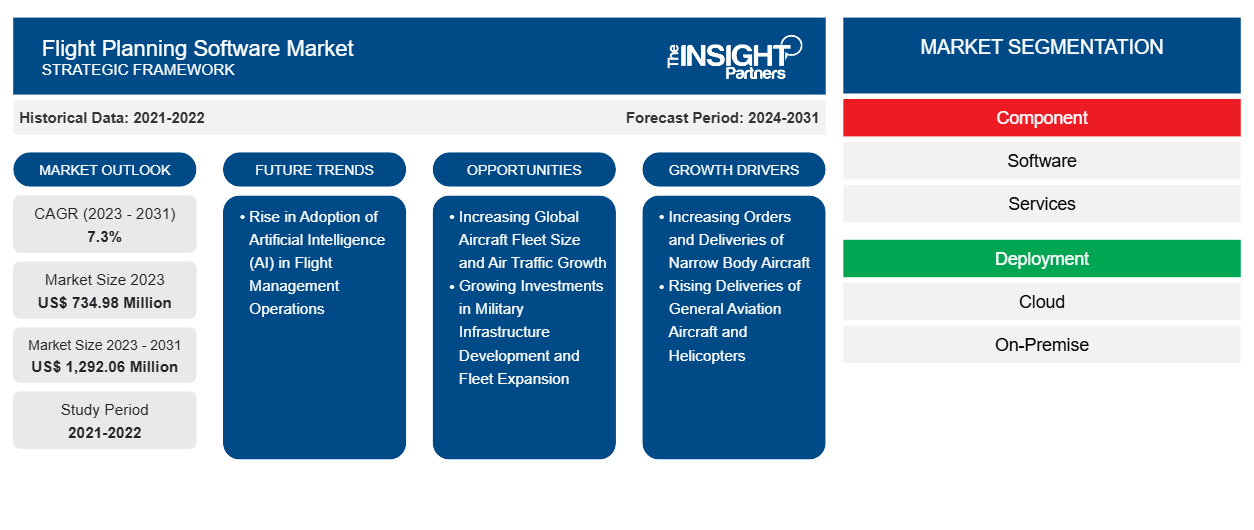

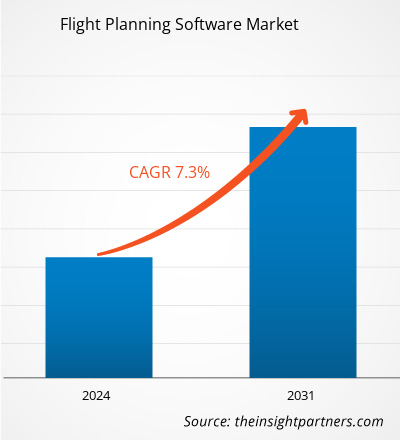

The flight planning software market size is projected to reach US$ 1,292.06 million by 2031 from US$ 734.98 million in 2023. The market is expected to register a CAGR of 7.3% during 2023–2031. The rise in adoption of artificial intelligence (AI) in flight management operations is likely to trend in the market.

Flight Planning Software Market Analysis

The key factors fueling the growth of the flight planning software market include increasing orders and deliveries of narrow-body aircraft, general aviation aircraft, and helicopters. However, challenges associated with flight management data are hindering the growth of the flight planning software market. Moreover, increasing global aircraft fleet size and air traffic and rising investment toward military infrastructure development and fleet expansion are projected to create opportunities for the key players operating in the flight planning software market during the forecast period. Further, the rise in the adoption and role of artificial intelligence (AI) in flight management operations is expected to be the key trend in the flight planning software market from 2023 to 2031.

Flight Planning Software Market Overview

Flight planning software has become indispensable in modern aviation, offering tools for route optimization, weather analysis, and fuel estimates. Flight planning software keeps a pilot updated on all pertinent weather conditions as they change and develop over time. Knowing ahead of time what weather an aircraft will encounter can assist a pilot in making measured decisions about the aircraft's position. The market serves commercial airlines, business aviation, military operations, and general aviation segments, offering solutions ranging from basic flight calculators to sophisticated enterprise-level systems. Optimal utilization of dispatch, accurate flight plans, dynamic mid-air replanning, and dynamic route optimization are a few of the variables that impact the overall performance of flight operations. Flight planning algorithms can use the latest meteorological forecasts to determine flight routes that are unlikely to experience turbulence. Air traffic management solutions are integrated with route optimization to reduce the cost generated due to flight planning issues.

Flight planning software is used in route planning and optimization, crew scheduling and management, weather tracking and analysis, aircraft performance monitoring, flight tracking, flight planning, and fuel use optimization. The aviation industry is more dynamic, with futuristic alternative transportation such as Hyperloop and the importance of advanced AR/VR technology. Although air travel remains the preferred method for long-haul travel, the scenario can change as the industry adapts to advanced technologies such as artificial intelligence (AI), big data, machine learning, and in-flight connectivity. Companies are developing flight planning software solutions that can help airlines and airports increase productivity, reduce costs, and improve passenger experience.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Flight Planning Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Flight Planning Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Flight Planning Software Market Drivers and Opportunities

Increasing Orders and Deliveries of Narrow Body Aircraft

The aviation industry has matured rapidly over the years, recording a significant number of aircraft production and deliveries. This has showcased massive order volumes for various commercial aircraft manufacturers worldwide. Commercial aviation is foreseen to surge in the coming years with an increase in air travel passengers and aircraft volumes. The increase in orders of narrow-body passenger and commercial aircraft across the globe drives the demand for flight planning software. Hence, airlines plan to expand to more remote locations by launching routes to smaller city airports. With the increasing number of aircraft and airports, the demand for flight planning software is also rising.

Increasing Global Aircraft Fleet Size and Air Traffic Growth

According to Airbus GMF 2024 study on global aircraft fleet and traffic, the aviation fleet is expected to grow from 24,260 aircraft in 2023 to reach 48,230 aircraft by 2043. This is owing to the continued growth in demand for air travel, building on the rapid recovery since COVID-19 travel restrictions. According to the study by Avolon, China, India, Asia, and South America are expected to show more than 3.5% growth in air travel from 2023 to 2042; however, North America and Europe will register moderate growth between 2 and 3% during this timeframe. In addition, the massive rise in the number of aircraft fleets from the regions mentioned above is expected to create opportunities for key flight-planning software manufacturers across the globe.

According to the Airbus GMF, the demand for new aircraft between 2024 and 2043 was valued at 42,430 units. Asia Pacific is expected to register 45.98% of the total demand for new aircraft during the study period, followed by Europe & CIS and North America. Single aisle body aircraft is expected to account for more than 80% of the total new aircraft demand globally from 2024 to 2043. In addition, the demand for freight aircraft is expected to be valued at 2,470 units during 2024–2043.

Flight Planning Software Market Report Segmentation Analysis

Key segments that contributed to the derivation of the flight planning software market analysis are component, deployment, and application.

- Based on component, the global flight planning software market is segmented into software and services. The software segment held a larger market share in 2023.

- By deployment, the market is divided into cloud and on-premises. The cloud segment held a larger share of the market in 2023.

- Based on application, the market is divided into logistics and cargo, airport, private airlines, commercial airlines, flight school and training center, and military and defense. The commercial airlines segment held the largest share of the market in 2023.

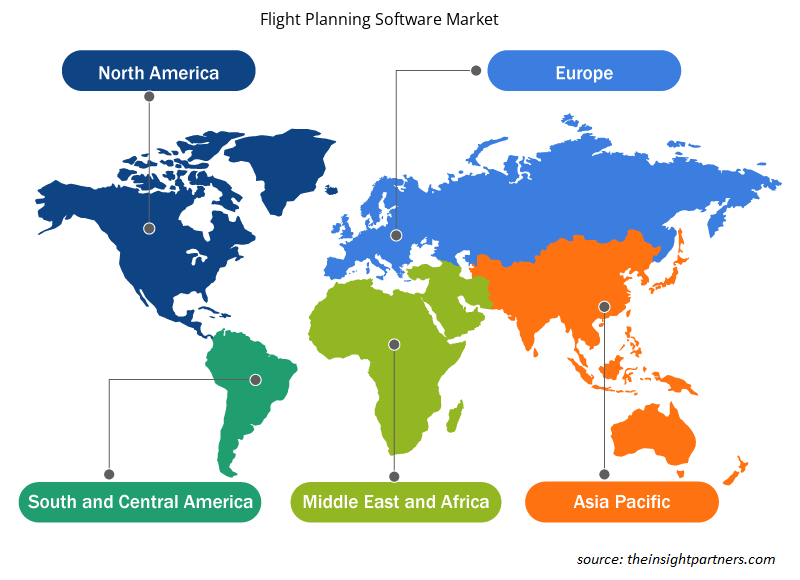

Flight Planning Software Market Share Analysis by Geography

The geographic scope of the flight planning software market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America.

Asia Pacific dominated the flight planning software market in 2023 with a share of 32.1%; it is likely to continue its dominance during the forecast period and account for 35.1% share by 2031. North America is the second-largest contributor to the flight planning software market, followed by Europe. North America is witnessing tremendous growth in the market owing to the presence of key players focused on the advancement of flight planning software and supporting its adoption in flight management operations. According to data released by Airlines for America in 2023, commercial aviation accounted for 5% of the US GDP, i.e., US$ 1.37 trillion in 2023. In addition, the rise in air passenger traffic and government initiatives to increase aircraft fleets in defense and commercial aviation sectors are expected to fuel the demand for flight management solutions such as flight planning software during the forecast period.

In Asia Pacific, the market growth has been primarily attributed to the rise in the expansion of aircraft fleet and airport infrastructure development in the region. The International Air Transport Association predicted that 2.1 billion travelers are likely to travel by 2036, particularly in China. The increasing number of passengers is expected to boost the demand for flight management software and services. This factor is expected to create an opportunity for the key players operating in the flight planning software market during the forecast period.

The flight planning software market in Europe is segmented into Germany, Italy, Russia, France, the UK, and the Rest of Europe. With more than 20,000 flights per day and ~500 million passengers per year, Europe is considered the busiest airspace worldwide. In addition, the defense and commercial aviation sectors in Europe are inclining toward advanced flight management technologies such as flight planning software. These sectors are expanding owing to strong economic conditions and favorable initiatives by governments of various countries in Europe.

Flight Planning Software Market Regional Insights

The regional trends and factors influencing the Flight Planning Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Flight Planning Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Flight Planning Software Market

Flight Planning Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 734.98 Million |

| Market Size by 2031 | US$ 1,292.06 Million |

| Global CAGR (2023 - 2031) | 7.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Flight Planning Software Market Players Density: Understanding Its Impact on Business Dynamics

The Flight Planning Software Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Flight Planning Software Market are:

- Amadeus IT Group SA

- Collins Aerospace

- CAE Inc

- NAV Flight Services

- Jeppesen

- Sabre GLBL Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Flight Planning Software Market top key players overview

Flight Planning Software Market News and Recent Developments

The flight planning software market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the flight planning software market are listed below:

- AIR SUPPORT announced that Sunlight Air had selected PPS Flight Planning software to optimize its flight operations. (Source: AIR SUPPORT, Press Release, 2024)

- eTT Aviation, a leading provider of innovative aviation software solutions, announced Aleutian Airways, operated by Sterling Airways, as its newest customer. (Source: eTT Aviation, Press Release, 2024)

- ForeFlight LLC launched Voyager, an innovative free app designed exclusively for Apple Vision Pro. (Source: ForeFlight LLC, Press Release, 2024)

Flight Planning Software Market Report Coverage and Deliverables

The "Flight Planning Software Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Flight planning software market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Flight planning software market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's and SWOT analysis

- Flight planning software market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the flight planning software market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The flight planning software marketis expected to reach US$ 1292.06 million by 2031.

The key players holding majority shares in the flight planning software market are Collins Aerospace, The Boeing Co, Honeywell International Inc, Amadeus IT Group, and Sabre.

Increasing orders and deliveries of narrow body aircraft, and rising deliveries of general aviation aircraft and helicopters are the major factors that propel the flight planning software market.

The incremental growth expected to be recorded for the flight planning software market during the forecast period is US$ 557.08 million.

The flight planning software market was estimated to be US$ 734.98 million in 2023 and is expected to grow at a CAGR of 7.3 % during the forecast period 2023 – 2031.

Rise in adoption of artificial intelligence (AI) in flight management operations is anticipated to play a significant role in the flight planning software market in the coming years.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Flight Planning Software Market

- Amadeus IT Group SA

- Collins Aerospace

- CAE Inc

- NAV Flight Services

- Jeppesen

- Sabre GLBL Inc

- AIR SUPPORT A/S

- FSS Flight Planning

- Navblue

- Laminaar Aviation Infotech Pvt Ltd.

- Universal Weather and Aviation, Inc.

- Lufthansa Systems

- ForeFlight

- Chetu Inc

- eTT Aviation

- GE Aerospace

- IBS Software

Get Free Sample For

Get Free Sample For