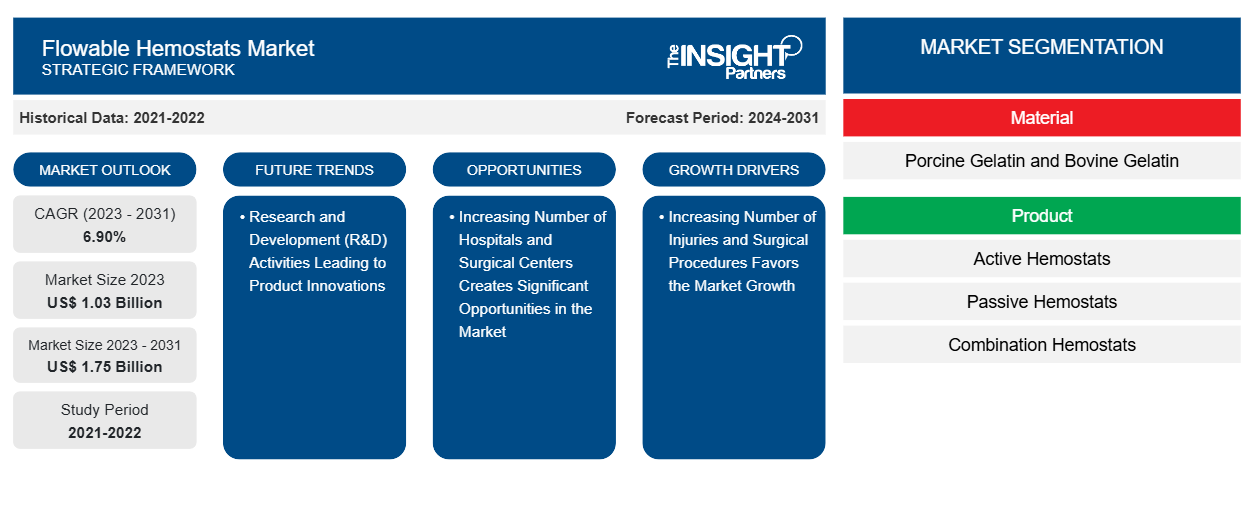

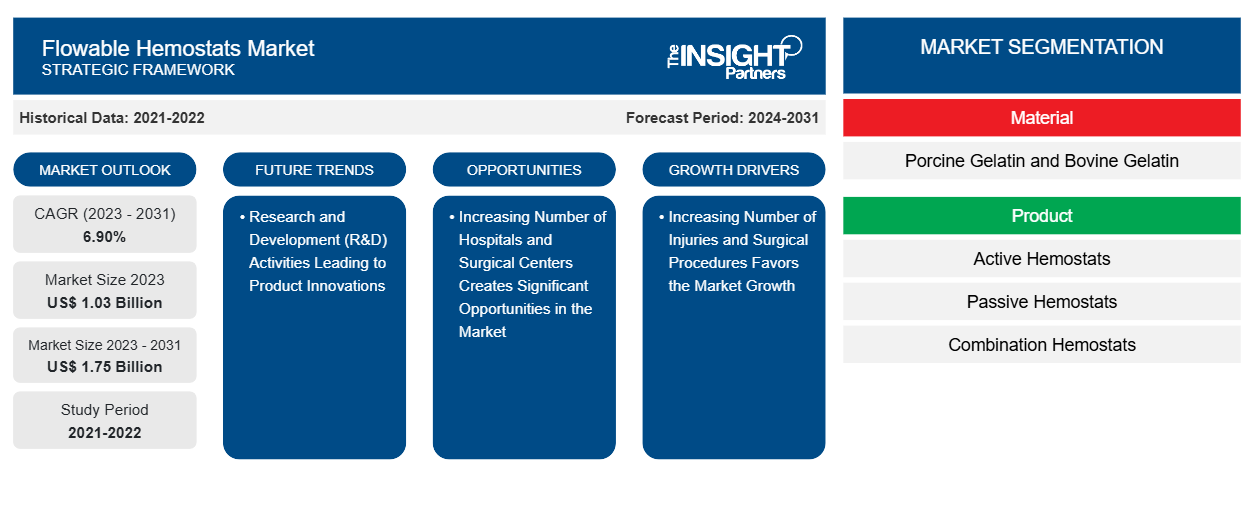

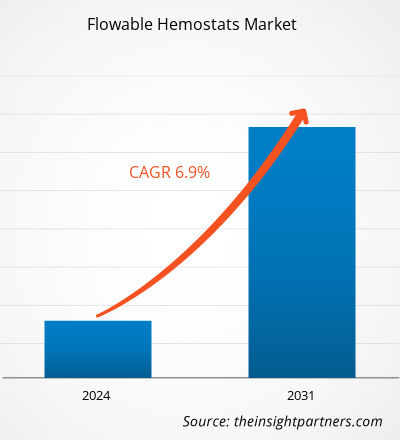

The flowable hemostats market size is projected to reach US$ 1.75 billion by 2031 from US$ 1.03 billion in 2023. The market is expected to register a CAGR of 6.90% during 2023–2031. Research and development (R&D) activities leading to product innovations will likely remain a key trend in the market.

Flowable Hemostats Market Analysis

The number of hospitals and surgical centers is expected to increase, driving demand for flowable hemostats. The increasing frequency of surgical and trauma cases is the main factor driving market growth. Due to the enormous volume of surgical procedures, the rise in organ transplant cases, the entry of local players, and the increasing ability of surgeons to perform more technically complex procedures, China is thought to be the region with the fastest growth rate.

Flowable Hemostats Market Overview

Population aging is an international phenomenon; in other words, the number and percentage of older people in every nation are rising. The need for hemostats is directly impacted by the growing elderly population, mainly because of their increased vulnerability to different diseases and, consequently, higher surgical rates. The World Health Organization (WHO) reports that the proportion of the population that is 60 years of age and older is rising. There were one billion individuals sixty years of age or older in the world in 2019. By 2030, there will be 1.4 billion, and by 2050, there will be 2.1 billion. This increase is happening at a never-before-seen rate, and it will pick up speed in the following decades, especially in developing nations. A study by the William Harvey Research Institute at Queen Mary University of London found that from 544,998 in 1999 to 1,012,517 in 2015, there was a significant increase in the number of individuals 75 years of age or older having surgery. Patients undergoing surgery had an average age increase from 47.5 years in 1999 to 54.2 years in 2015.

Therefore, it is projected that during the forecast period, a rise in the elderly population will drive the global flowable hemostats market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Flowable Hemostats Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Flowable Hemostats Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Flowable Hemostats Market Drivers and Opportunities

Increasing Number of Injuries and Surgical Procedures Favors the Market Growth

Public health is still greatly concerned about injuries. The rise in trauma and accident cases worldwide is vital to propelling the global market for flowable hemostats. The World Health Organization (WHO) estimates that every year, road traffic crashes claim the lives of about 1.3 million people. Twenty to fifty million individuals sustain non-fatal injuries each year, many of which result in disability. Worldwide, more than one-third of pre-hospital deaths and more than 40% of deaths that occur within the first 24 hours are caused by hemorrhage or excessive bleeding. In addition, a US Armed Forces study revealed that 25% of battlefield deaths may have been avoided with medical intervention. Uncontrolled blood loss is the cause of nearly 90% of these fatalities. This resulted in a rising number of surgical procedures. A growing number of musculoskeletal disorders associated with sports, work-related injuries, and age-related dysfunction are leading to an increase in surgical procedures. However, sports-related injuries cause a significant amount of health gains to be lost. The BMJ Publishing Group Ltd. report estimates that in hospitals, 4.5 million adults in the EU receive treatment for sports-related injuries yearly.

Furthermore, a BMJ Publishing Group Ltd. report states that nearly 40% of sports injuries treated in hospitals occur in team ball sports. Concussions are thought to be the most pervasive brain injuries responsible for altering mental status, and they are a significant cause of both mortality and morbidity. Statistics from the BMJ Publishing Group Ltd. report show that head injuries, the leading cause of death for individuals under 40, result in approximately 1.4 million hospital visits in England and Wales each year. According to a National Library of Medicine study, China has a higher-than-average number of patients suffering from traumatic brain injury (TBI), which raises serious concerns about the condition's impact on public health. The market is expected to grow during the forecast period due to the high adoption of flowable hemostats due to increasing surgical procedures and injuries.

Increasing Number of Hospitals and Surgical Centers Creates Significant Opportunities in the Market

Developed and developing regions are seeing a sharp rise in hospitals and surgical centers. The demand for surgical equipment, such as medical devices and hemostat products, is increasing due to this growth, particularly for newly established surgical centers and hospitals. The UK Prime Minister declared in October 2020 that approximately US$ 4.3 billion would be invested in establishing 40 hospitals and a plan for future funding of 48 hospitals by 2030. Additionally, healthcare infrastructure has seen noticeable advancements in nations like China and India over the last ten years. The opening of 22 new AIIMS hospitals around the country was announced by the Indian Ministry of Health and Family Welfare in June 2019. According to a report by the Ministry of Internal Affairs and Communications and the Statistics Bureau, as of October 2019, there were 8,300 hospitals in Japan and roughly 1,529,215 hospital beds (1,212.1 per 100,000 people).

Additionally, the market for flowable hemostats has a lot of lucrative opportunities due to the expansion of the healthcare industry. In recent years, there has been a rapid transformation in the healthcare industry. Advanced technologies in healthcare have been favored by many countries worldwide. Technology-enabled care (TEC) solutions are being mentioned in the healthcare systems, particularly in emerging economies, due to the need for better healthcare facilities. The aging population, increased prevalence of chronic illnesses, and the provision of pediatric care are some of the main drivers of the healthcare industry's expansion. The efficacy of topical hemostats may contribute to improved clinical outcomes with increasing technical procedures. Therefore, the best topical hemostats would provide accurate and effective bleeding control. The substantial increase in hospitals and surgical centers necessitates a high uptake of flowable hemostat products, ultimately presenting profitable growth prospects for the market in the upcoming years.

Flowable Hemostats Market Report Segmentation Analysis

Key segments that contributed to the derivation of the flowable hemostats market analysis are material, product, application, and end user.

- Based on material, the flowable hemostats market is segmented into porcine gelatin and bovine gelatin. The bovine gelatin segment held the most significant market share in 2023.

- By product, the market is categorized into active hemostats, passive hemostats, and combination hemostats. The combination hemostats segment held the largest share of the market in 2023.

- Based on application, the flowable hemostats market is segmented into general surgery, cardiac surgery, vascular surgery, orthopedic surgery, neuro & spine surgery, and others. The general surgery segment held the most significant market share in 2023.

- By end user, the market is segmented into hospitals & clinics, ambulatory surgery centers, and others. The hospital & clinics segment held a significant market share in 2023.

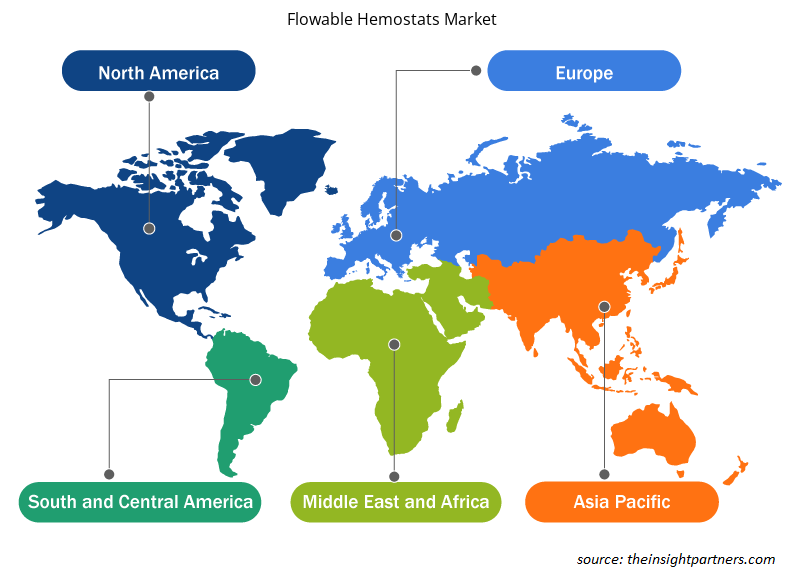

Flowable Hemostats Market Share Analysis by Geography

The geographic scope of the flowable hemostats market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North America flowable hemostats market is segmented into the US, Canada, and Mexico. The market for flowable hemostats in the US is expected to witness significant growth during the forecast period owing to the increasing number of surgical procedures, the launch of innovative products by the market players, and the availability of advanced healthcare facilities in the country. Flowable hemostats are used extensively in surgeries on the spine, abdomen, cardiovascular, and other critical surgical areas with high bleeding.

Market players have been focusing on establishing their presence in the country. For instance, gel-e, Inc., a United States-based company, has developed advanced hemostatic and wound treatment products. The company has developed an expanding injectable hemostat, Life Foam. The product rapidly provides temporary control of bleeding from non-compressible abdominal wounds that are difficult to handle in cases such as trauma and battlefield conditions. As per data from the CDC, trauma from accidents is the third most important cause of death in the US after heart disease and cancer. Almost 85% of hemorrhage-related deaths are due to non-compressible internal bleeding, which Life Foam notices. In 2018, the product received a Breakthrough Device Designation from the FDA, further accelerating the development and clinical application, especially in traumatic injuries. Hence, the abovementioned factors considerably drive the flowable hemostats market in the United States during the forecast period.

Flowable Hemostats Market Regional Insights

The regional trends and factors influencing the Flowable Hemostats Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Flowable Hemostats Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Flowable Hemostats Market

Flowable Hemostats Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.03 Billion |

| Market Size by 2031 | US$ 1.75 Billion |

| Global CAGR (2023 - 2031) | 6.90% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Flowable Hemostats Market Players Density: Understanding Its Impact on Business Dynamics

The Flowable Hemostats Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Flowable Hemostats Market are:

- Baxter Intemational Inc

- Teleflex Incorporated

- Johnson & Johnson

- Biom'up

- Pfizer Inc.

- Aegis Lifesciences

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Flowable Hemostats Market top key players overview

Flowable Hemostats Market News and Recent Developments

The flowable hemostats market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the flowable hemostats market are listed below:

- Baxter International has received US Food and Drug Administration (FDA) approval for faster preparation of its leading hemostatic, Floseal Hemostatic Matrix, at the 2019 Association of periOperative Registered Nurses (AORN) Global Surgical Conference and Expo. This next generation of Floseal has 20 percent fewer components and steps to prepare, making it easier and faster for operating room (OR) nurses to get Floseal in surgeons' hands to help stop bleeding during procedures. (Source: Baxter International Inc, Press Release, April 2019)

Flowable Hemostats Market Report Coverage and Deliverables

The “Flowable Hemostats Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Flowable hemostats market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Flowable hemostats market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Flowable hemostats market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the flowable hemostats market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Constipation Treatment Market

- Analog-to-Digital Converter Market

- Flexible Garden Hoses Market

- Water Pipeline Leak Detection System Market

- Neurovascular Devices Market

- Microplate Reader Market

- Medical and Research Grade Collagen Market

- Smart Water Metering Market

- Smart Parking Market

- Bathroom Vanities Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, Product, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is expected to register a CAGR of 6.90% during 2023–2031.

Baxter Intemational Inc, Teleflex Incorporated, Johnson & Johnson, Biom'up, Pfizer Inc., Aegis Lifesciences, 3-D Matrix Medical Technology

Research and development (R&D) activities leading to product innovations will likely remain a key trend in the market.

Key factors driving the market are the increasing number of injuries and surgical procedures and the rising geriatric population.

North America dominated the flowable hemostats market in 2023

Get Free Sample For

Get Free Sample For