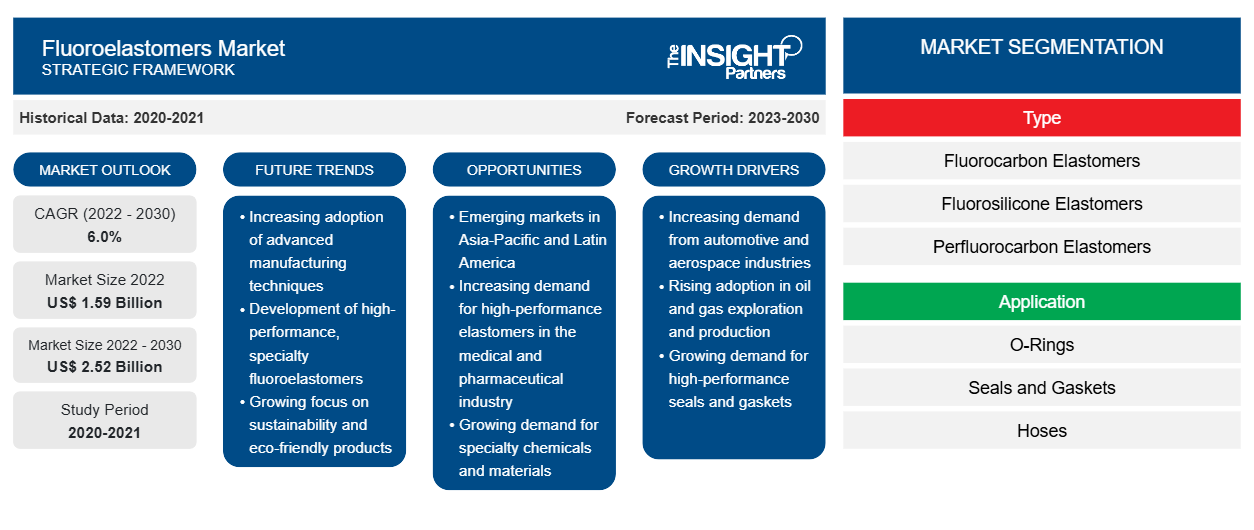

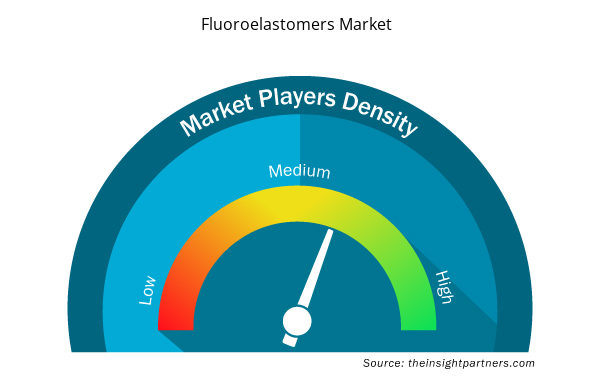

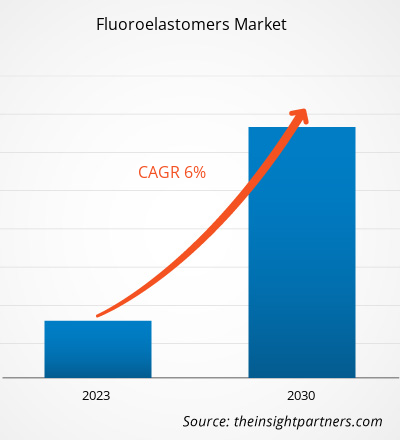

[Research Report] The fluoroelastomers market size was valued at US$ 1,586.06 million in 2022 and projected to reach US$ 2,523.84 million by 2030; it is anticipated to record a CAGR of 6.0% from 2022 to 2030.

MARKET ANALYSIS

Fluoroelastomers offer superior sealing properties, making them indispensable in manufacturing O-rings, gaskets, and seals for critical applications where leakage can cause severe consequences. Their longevity and durability reduce maintenance and replacement costs. However, their high cost and limited low-temperature flexibility are among the restraints. In the automotive industry, fluoroelastomer seals and gaskets are used in fuel, transmission, and engines. Their ability to withstand heat and exposure to various fuels ensures a tight, long-lasting seal, contributing to vehicle efficiency and safety. Fluoroelastomer hoses also exhibit low gas permeability, reducing the risk of fluid loss or contamination. Their exceptional resistance to oils and fuels makes them suitable for automotive and oil and gas applications.

GROWTH DRIVERS AND CHALLENGES

Rising demand for fluoroelastomers in the automotive industry and the growing oil and gas industry drive the fluoroelastomers market growth. Automotive manufacturers focus on decreasing the size of powertrains, engines, and engine compartments to reduce fuel consumption, in addition to the development of electric vehicles. The advancement in air management systems increases the temperature of components and exposes them to corrosive fluids and fumes. The heat and chemical-resistant properties of fluoroelastomers offer a wide range of applications in fuel, air management, and electric vehicle systems. Fluoroelastomers withstand harsh chemical exposure and offer retention of critical properties under extreme conditions. Hence, the oil & gas sector uses fluoroelastomers in drilling equipment, pipeline systems, seals, and gaskets. Further, the demand for oil and gas is increasing in Asia Pacific. Governments of various countries in Asia Pacific have initiated projects to cater to the rising demand for oil and gas in the region. Rising demand for high-performance materials in the automotive industry and growing number of oil and gas projects fuel the fluoroelastomers market growth.

Environmental regulations related to fluoroelastomers pose a challenge to the fluoroelastomers market. Environmental regulations and concerns over the production and disposal of fluoroelastomers impact its utilization, especially in regions with stringent environmental regulations. The production of fluoroelastomers involves the emission of greenhouse gases. Disposal of fluoroelastomer products as incineration can release toxic by-products. Further, recycling of fluoroelastomers is challenging due to their complex chemical structure. Governments and international organizations have implemented various regulations to control and limit the use of certain fluorinated compounds and substances with fluoroelastomers due to their potential environmental risks. Stringent environmental regulations related to producing and disposing of fluoroelastomers restrain the growth of fluoroelastomers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fluoroelastomers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fluoroelastomers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Fluoroelastomers Market Analysis and Forecast to 2030" is a specialized and in-depth study focusing significantly on global market trends and growth opportunities. The report aims to provide an overview of the global market with detailed market segmentation based on type, application, end user, and geography. The report provides key statistics on the consumption of fluoroelastomers worldwide, along with their demand in major regions and countries. In addition, the report provides a qualitative assessment of various factors affecting the fluoroelastomers market performance in major regions and countries. It also includes a comprehensive analysis of the leading players in the fluoroelastomers market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global fluoroelastomers market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global fluoroelastomers market is segmented on the basis of type, application, and end user. Based on type, the market is segmented into fluorocarbon elastomers, fluorosilicone elastomers, and perfluorocarbon elastomers. Based on application, the market is segmented into O-rings, seals and gaskets, hoses, molded parts, and others. Based on end-user, the market is segmented into automotive, aerospace, oil and gas, semiconductors, energy and power, and others.

Based on type, the fluorocarbon elastomers segment accounted for a significant share of the fluoroelastomers market in 2022. Fluorocarbon elastomers offer superior sealing properties, making them indispensable in manufacturing O-rings, gaskets, and seals for critical applications where leakage can cause severe consequences. Their longevity and durability reduce maintenance and replacement costs. Despite high costs, fluorocarbon elastomers remain indispensable in demanding industries where their unmatched resistance to harsh conditions is a fundamental requirement. Based on application, the O-rings segment accounted for a significant share in 2022. Fluoroelastomer O-rings exhibit excellent resistance to high temperatures, chemicals, and fuels. They can effectively create a tight, durable seal in demanding environments. Based on end-user, the automotive segment accounted for a significant share in 2022. With the industry’s constant drive for innovation, the demand for fluoroelastomers is surging. This is particularly evident in the shift toward electric vehicles (EVs), where the need for superior sealing materials in battery systems, electric drivetrains, and cooling systems has intensified.

REGIONAL ANALYSIS

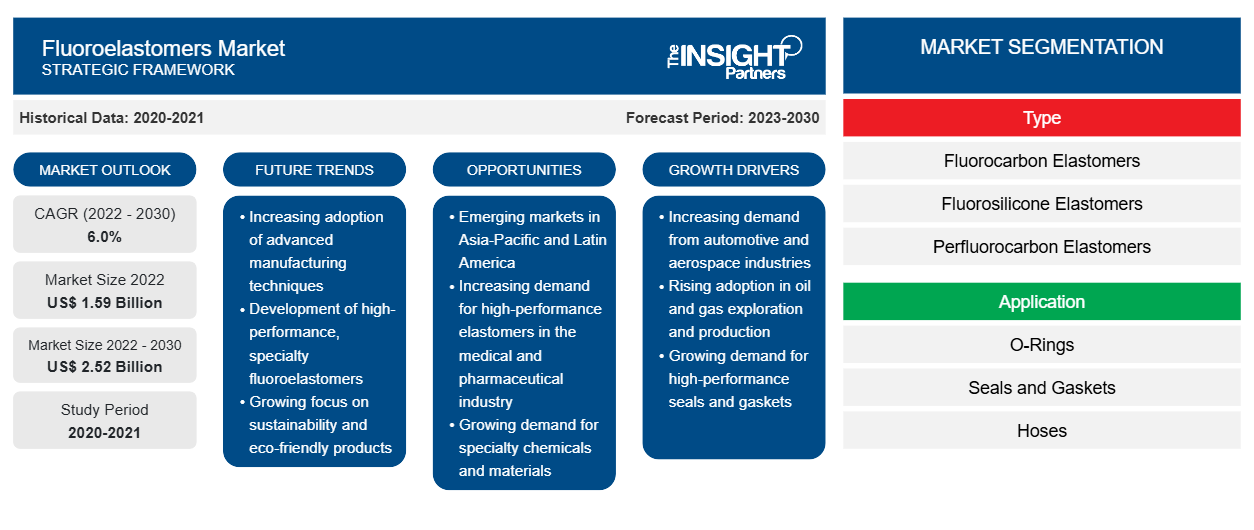

The report provides a detailed overview of the global fluoroelastomers market with respect to five major regions—North America, Europe, Asia-Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific accounted for a significant share of the global fluoroelastomers market and was valued at over US$ 750 million in 2022. Asia Pacific marks the presence of major automotive and semiconductor manufacturers and a hub for small-sized businesses operating in the region. China's major industries include mining, manufacturing, construction, chemicals, and power. Asia Pacific is a global hub for producing and exporting technical consumer goods (TCG), including consumer electronics. Europe is expected to reach over US$ 350 million by 2030. The automobile industry is one of the most rapidly growing industries in the European economy. According to the European Commission, Europe is among the world's largest producers of motor vehicles. North America is expected to record a CAGR of ~6% from 2022 to 2030. In North America, passenger vehicles are the most common mode of transportation, and their use is increasing with the rise in per capita income. As the automotive industry continues to evolve and innovate, these high-performance materials are increasingly in demand, contributing to market growth.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Various initiatives taken by the key players operating in the fluoroelastomers market are listed below:

- In September 2023, AGC Chemicals Americas Inc added two new grades to its line of perfluoroelastomers.

- In June 2022, Solvay SA introduced a new portfolio of high-performance Tecnoflon peroxide curable fluoroelastomers (FKM) produced without fluorosurfactants.

Fluoroelastomers Market Regional Insights

Fluoroelastomers Market Regional Insights

The regional trends and factors influencing the Fluoroelastomers Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Fluoroelastomers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fluoroelastomers Market

Fluoroelastomers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.59 Billion |

| Market Size by 2030 | US$ 2.52 Billion |

| Global CAGR (2022 - 2030) | 6.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Fluoroelastomers Market Players Density: Understanding Its Impact on Business Dynamics

The Fluoroelastomers Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fluoroelastomers Market are:

- The Chemours Co

- AGC Inc

- 3M Company

- Solvay SA

- Daikin Industries Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fluoroelastomers Market top key players overview

IMPACT OF COVID-19 PANDEMIC/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Before the COVID-19 pandemic, many countries across the globe reported economic growth. The key manufacturers invested in the research and development of fluoroelastomers. They also focused on expanding geographic reach through mergers and acquisitions to cater to a broad customer base. Before the COVID-19 pandemic, the fluoroelastomers market reported steady growth due to increasing demand from the automotive industry. As per the US International Trade Commission (USITC), vehicle sales in the US decreased by 15% in 2020 compared to 2019, owing to the high vulnerability of the automotive industry. During the pandemic, supply chain disruptions, raw material and labor shortages, and operational difficulties created a demand and supply gap, adversely affecting the growth of the chemicals and materials industry. Manufacturers reported challenges in sourcing raw materials and ingredients from suppliers, impacting the production rate of fluoroelastomers.

Further, disruption in supply chains and shortage of skilled labor reduced production and created a demand-supply gap in many regions, particularly Asia Pacific, Europe, and North America. The demand and supply gap was also recorded in several regions due to fluctuating demand from the automotive industry. In 2021, rising vaccination rates contributed to improvements in the overall conditions in different countries, which led to conducive environments for the chemicals & materials industry. The sales of fluoroelastomers increased with the resumption of production & sales operations of companies operating in the automotive industry. The increasing demand for high-quality sealing solutions and gasket materials in these industries has propelled the fluoroelastomers market growth.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

The Chemours Co, AGC Inc, 3M Co, Solvay SA, Daikin Industries Ltd, Shandong Huaxia Shenzhou New Material Co Ltd, Gujarat Fluorochemicals Ltd, Shin-Etsu Chemical Co Ltd, HaloPolymer, and Eagle Elastomer Inc are among the key players operating in the fluoroelastomers market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Fluoroelastomers are used in a wide range of applications in the automotive industry. It is used in fuel system components, seals, gaskets, and hoses due to its high resistance to heat, chemicals, and fuels. According to the report by the European Commission, turnover generated by the automotive industry in Europe represents 7% of the region's total GDP. A report by Germany Trade & Invest stated that Germany is a major automotive market in Europe, and it registered a foreign market revenue of US$ 289 billion in 2021 (a 10% rise from 2020) from passenger car and light commercial vehicle original equipment manufacturers.

Asia Pacific accounted for the largest share of the global fluoroelastomers market. The market growth in Asia Pacific is driven by the strong presence of the automotive industry. The demand for fluoroelastomers in Asia Pacific is in parallel with industrialization and vehicular production in the region.

Based on end-user, the fluoroelastomers market is segmented into automotive, aerospace, oil and gas, semiconductors, energy and power, and others. The automotive segment held the largest fluoroelastomers market share in 2022. Fluoroelastomers are indispensable in the automotive industry, serving many critical functions such as acting as a sealant in fuel systems, cooling systems, and intake and exhaust systems.

Based on type, the fluoroelastomers market is segmented into fluorocarbon elastomers, fluorosilicone elastomers, and perfluorocarbon elastomers. The fluorocarbon elastomers segment held the largest market share in 2022, and the perfluorocarbon elastomers segment is expected to record the highest CAGR from 2022 to 2030. Fluorocarbon elastomers have exceptional resistance to high temperatures, aggressive chemicals, and a wide range of fluids, which makes them a preferred choice in industries such as aerospace, automotive, and chemical processing..

The major players operating in the global fluoroelastomers market are The Chemours Co, AGC Inc, 3M Company, Solvay SA, Daikin Industries Ltd, Shandong Huaxia Shenzhou New Material Co Ltd, Gujarat Fluorochemicals Ltd, Shin-Etsu Chemical Co Ltd, HaloPolymer, Eagle Elastomer Inc.

Many manufacturers in the fluoroelastomers market are entering into a partnership with suppliers, logistics companies, and end users to streamline the fluoroelastomer supply chain. For instance, in 2021, CDI Energy Products and Corken Inc. announced their plan to enter a long-term partnership for polymer supply. Under this partnership, CDI Energy aimed to supply polymers, fluoroelastomers, and thermoplastics to Corken Inc. in order to increase the latter company’s equipment efficiency, sustainable operations, and competitive capabilities.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Fluoroelastomers Market

- The Chemours Co

- AGC Inc

- 3M Company

- Solvay SA

- Daikin Industries Ltd

- Shandong Huaxia Shenzhou New Material Co Ltd

- Gujarat Fluorochemicals Ltd

- Shin-Etsu Chemical Co Ltd

- HaloPolymer

- Eagle Elastomer Inc.

Get Free Sample For

Get Free Sample For