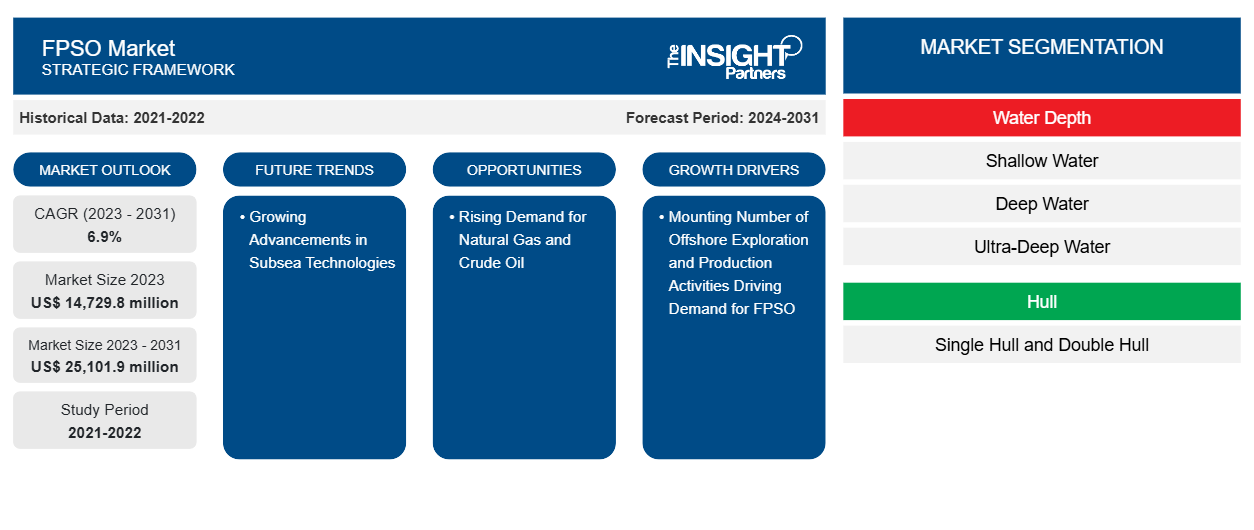

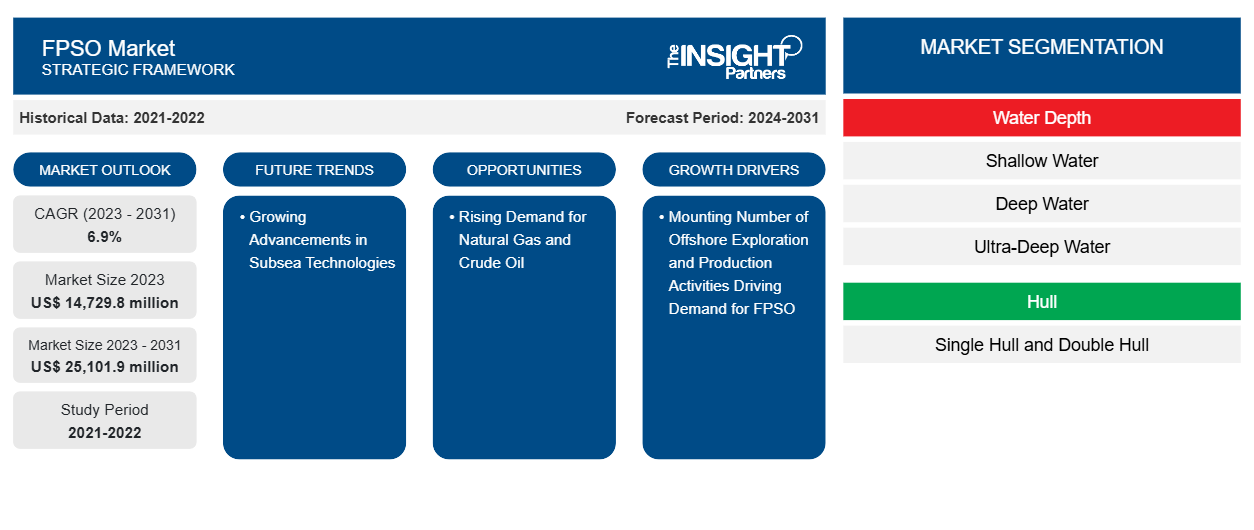

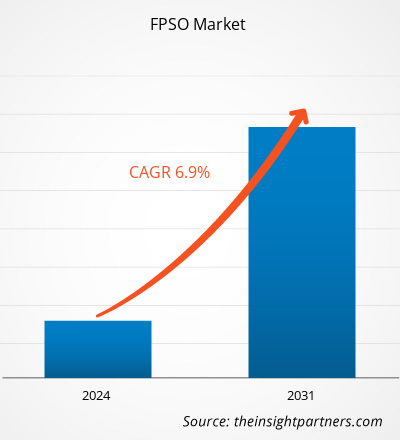

The FPSO Market size is projected to reach US$ 25,101.9 million by 2031 from US$ 14,729.8 million in 2023. The market is expected to register a CAGR of 6.9% in 2023–2031. Increasing development of the oil and gas sector and mounting oil and gas exploration activities are some other trends for the FPSO Market.

FPSO Market Analysis

The growing expansion of oil and gas projects is the key factor stimulating the demand for FPSO. The demand for FPSO, especially offshore, coupled with a moderately stable oil price paired with an upsurge in offshore exploration and oil production activities is anticipated to boost strong growth in the global demand for FPSO vessels in the next five years. Some of the key FPSO companies such as Total Energies, Petrobras, CNOOC Ltd, Equinor ASA, and Exxon Mobil among others are focusing on driving the development of the FPSO market.

FPSO Market Overview

The oil and gas exploration firms, like Equinor ASA are concentrating on deepwater and ultra-deepwater oil and gas exploration activities. For instance, in 2022, Shell initiated a projects on producing oil at the PowerNap field. In addition, oil and gas firms are implementing novel technologies owing to the developments in offshore technologies, such as separable turrets, cylindrical hull designs, and double hull designs. In addition, the technological developments in FPSO over other production systems, such as the digitalization of FPSO and penetration of automation and lot in the oil & gas industry, increase the focus of market companies on R&D activities and development of new products would generate trends for the FPSO market growth in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

FPSO Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

FPSO Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

FPSO Market Drivers and Opportunities

Mounting Number of Offshore Exploration and Production Activities Driving Demand for FPSO

In the last few decades, offshore oil and gas exploration and production have intensified substantially. Further, the findings of new oil and gas reserves are expanding exponentially across the globe. Increasing presence of major oil and gas extraction firms, such as Petrobras, in offshore exploration and production activities. In Petrobras, most of the oil reserves are in offshore fields, which has directed the drilling activities. In addition, according to the IEA, by 2040, annual capital expenses for offshore oil and gas production activities in Brazil would total US$ 60 billion. Moreover, the mounting number of exploitations of marginal oil reserves in remote offshore areas, along with the flexibility of FPSOs to operate without the support of a fixed structure, boosts market growth.

Rising Demand for Natural Gas and Crude Oil – An Opportunity in FPSO Market

The increasing requirement for crude oil and natural gas is constantly increasing , which is one of the major reason behind the growth of the FPSO market. The demand for oil is projected to witness upsurge trend during 2022-2025 in the OECD countries, as per the OPEC. However, the demand in non-OECD countries is anticipated to increase by 22.5 mb/day during the forecast period to 2045. The OPEC report identified that natural gas is anticipated to be the fastest-growing fossil fuel and would be the second-largest contributor to the energy mix, which is projected to hold a ~25% share in 2045. In the coming years, Asia Pacific is anticipated to witness high demand for natural gas owing to the rising use of natural gas in diverse industrial sectors. Thus, the expanding demand for natural gas and crude oil globally is anticipated to offer worthwhile opportunities for the FPSO market growth in coming years.

FPSO Market Report Segmentation Analysis

Key segments that contributed to the derivation of the FPSO Market analysis are water depth, hull, mooring, and construction.

- Based on the water depth, the FPSO Market has been divided into shallow water, deep water, and ultra-deep water. The shallow water segment held a larger market share in 2023.

- Based on the hull, the FPSO Market has been divided into single hull and double hull. The double hull segment held a larger market share in 2023.

- Based on the mooring, the FPSO Market has been divided into spread mooring and disconnectable mooring. The spread mooring segment held a larger market share in 2023.

- Based on the construction, the FPSO Market has been divided into newly built and converted. The newly built segment held a larger market share in 2023.

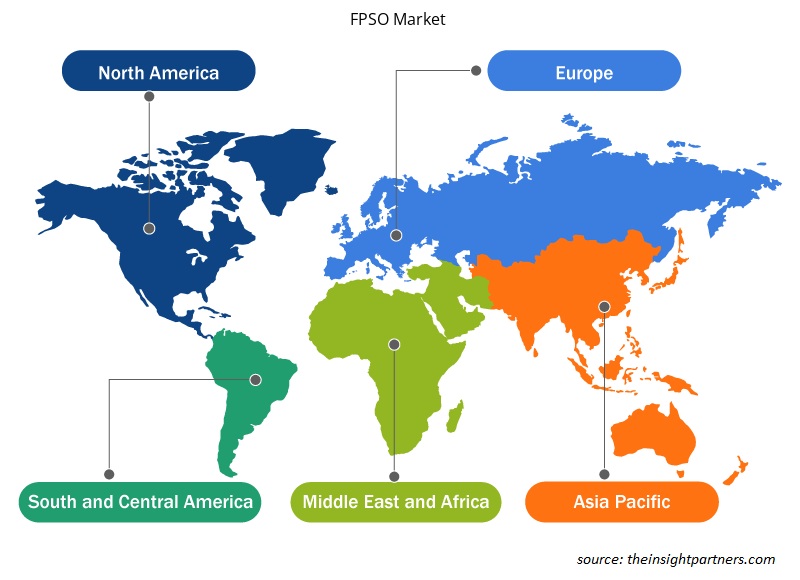

FPSO Market Share Analysis by Geography

The geographic scope of the FPSO Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

South America region includes Brazil, Argentina, and the Rest of SAM. The Rest of SAM includes Chile, Colombia, Guatemala, and Peru. Technological developments have strongly impacted Brazil and Argentina's economy, which helped in advancing it to a large degree. The application of oil in South America has gradually decreased over the last three years. Nevertheless, with the regaining of the crude oil extraction, the condition is probable to change, and firms are now focusing on more oil and gas exploration and production activities, which is driving the demand for the FPSO market in South America.

FPSO Market Regional Insights

FPSO Market Regional Insights

The regional trends and factors influencing the FPSO Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses FPSO Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for FPSO Market

FPSO Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 14,729.8 million |

| Market Size by 2031 | US$ 25,101.9 million |

| Global CAGR (2023 - 2031) | 6.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Water Depth

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

FPSO Market Players Density: Understanding Its Impact on Business Dynamics

The FPSO Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the FPSO Market are:

- MODEC, Inc.

- Petróleo Brasileiro S.A.

- Bumi Armada Berhad

- SBM Offshore N.V.

- CNOOC Limited

- TotalEnergies SE

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the FPSO Market top key players overview

FPSO Market News and Recent Developments

The FPSO Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In May 2023, MODEC, Inc. announced to proceed with engineering, procurement, and construction on the Uaru Floating Production, Storage, and Offloading vessel for the Uaru project by ExxonMobil Guyana. (Source: MODEC, Inc., Press Release/Company Website/Newsletter)

- In April 2024, ExxonMobil made a final investment for the Whiptail development offshore Guyana, after obtaining required government and regulatory approvals. (Source: ExxonMobil Corporation, Press Release/Company Website/Newsletter)

FPSO Market Report Coverage and Deliverables

The “FPSO Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- FPSO Marketsize and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- FPSO Market Trends

- Detailed PEST and SWOT analysis

- FPSO Market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- FPSO Industry, landscape and competition analysis, covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Trade Promotion Management Software Market

- Collagen Peptides Market

- Procedure Trays Market

- Medical and Research Grade Collagen Market

- Virtual Pipeline Systems Market

- Environmental Consulting Service Market

- Foot Orthotic Insoles Market

- Aerosol Paints Market

- Greens Powder Market

- Human Microbiome Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Water Depth, Hull,, Mooring, and Construction

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For