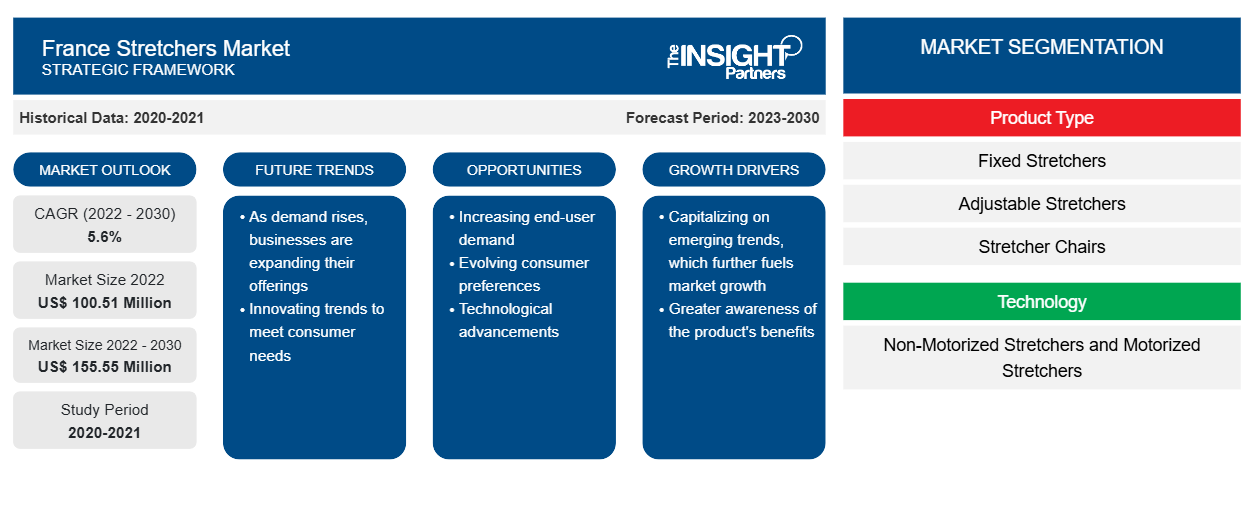

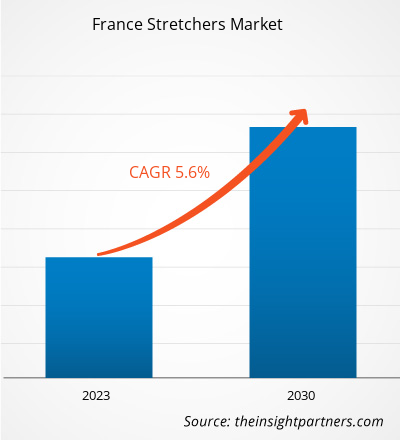

The France stretchers market size is projected to grow from US$ 100.51 million in 2022 to US$ 155.55 million by 2030; the market is estimated to record a CAGR of 5.6% during 2022–2030.

Market Insights and Analyst View:

Stretchers are used to facilitate a non-emergency or emergency transport of patients in an ambulance. Electric, manual, or pneumatic stretchers are among the key types available in the market. A paramedic is required to operate and manage a manual stretcher, including mechanical, auto loading, and non-powered stretchers. Pneumatic stretchers are sometimes referred to as hydraulic stretchers; their movements are controlled via hydraulic mechanisms. Therefore, pneumatic stretchers are in high demand and have a high market value. The rising number of hospitals investing in new technologies to enhance their services benefits the France stretchers market.

Key players in the France stretchers market are significantly opting for growth strategies such as mergers and acquisitions. Large players are acquiring smaller businesses and new entrants to gain access to their technologies to improve and expand their product offerings.

Growth Drivers:

Increasing Need for Emergency Medical Services and Rising Number of Road Accidents Fuel France Stretchers Market Growth

In France, emergency medical services are provided by various organizations under the umbrella of public health services. Service d'Aide Médicale Urgente – Emergency Medical Assistance Service (SAMU) is the central organization that provides these services. Service Mobile d’Urgence et Réanimation – Mobile Emergency and Resuscitation Service (SMUR) refers to ambulances and emergency vehicles that provide advanced medical care. In 2021, the French SMUR registered 722,500 operations. From December 2021 to February 2023, over 30,000 patients had to sleep on stretchers due to a shortage of beds in emergency service departments at hospitals across the country. Before the onset of the COVID-19 pandemic, emergency rooms reported over 21 million visits annually. Although emergency room visits dropped significantly during the pandemic, numbers from 2021 showed an increasing trend, suggesting that footfall at emergency rooms would continue to surge in the coming years as well. In 2022, emergency service facilities across metropolitan France reported an average of 53,300 daily visits. In 2021, over 148,000 referrals were carried out under specialist supervision, while the SMUR registered over 28,000 referrals under nursing supervision. In 2021, only a quarter of emergency rooms in the country relied on ambulances or rescue and victim assistance vehicles (VSAVs). In France, a total of 3,244 people died in reported traffic accidents in 2019. Thus, the increasing need for emergency services and the rising number of road accidents favor the France stretchers market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “France Stretchers Market” is segmented on the basis of product type, technology, application, scale, and end user. Based on product type, the market is segmented into fixed stretchers, adjustable stretchers, and stretcher chairs. In terms of technology, the France stretchers market is bifurcated into non-motorized stretchers and motorized stretchers. The France stretchers market, by application, is segmented into emergency and transport stretchers, pediatric stretchers, radiology stretchers, bariatric stretchers, procedural stretchers, and OB/GYN stretchers. Based on scale, the France stretchers market is divided into with-scale stretchers and without-scale stretchers. The market, by end user, is segmented into public sector and private sector.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The France stretchers market, by product type, is segmented into fixed stretchers, adjustable stretchers, and stretcher chairs. The adjustable stretchers segment held the largest share of the market in 2022, and it is expected to record a CAGR of 11.81% during 2022–2030. Adjustable stretchers are robust, comfortable, and innovative, and the ease of operation is the most significant advantage associated with them. These stretchers are equipped with a height-adjustment mechanism, which is enabled by hydraulic or electric columns and levers. The movement of the backrest and the thigh section occurs independently of each other and is supported by gas springs with lever control on both sides. The height of the loungers is adjusted via two centrally located pedals; in the electric version, it is adjusted via a practical push-button strip. The forward and first-aid stretchers are safe, durable, and robust, and they are manufactured to excellent quality standards to offer the highest level of comfort. Adjustable stretchers are made of high-strength aluminum alloy as the main material and are surface-hardened.

France Stretchers Market, by Product Type – 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Based on technology, the France stretchers market is segmented into non-motorized stretchers and motorized stretchers. The motorized stretchers segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 5.9% during 2022–2030. Motorized stretchers are breakthrough products, and they are a core component of a revolutionary new generation of motorized medical transport systems, representing a breakthrough in emergency and logistics operations in medical facilities. Motorized stretchers allow hospital staff to move stretchers with bariatric patients, reducing back strain for nursing staff. The stretchers are comfortable and safe for patients, and can be self-driven or pushed on foot using a unique trolley platform offered with each unit. It has a hydraulic motorized lifting system that facilitates the transfer of patients, and the loading and unloading of the stretcher into the ambulance without assistance or fatigue. However, motorized stretchers are expensive, and come with features such as adjustable height, side rails, and backrests.

Based on application, the France stretchers market is segmented into emergency and transport stretchers, pediatric stretchers, radiology stretchers, bariatric stretchers, procedural stretchers, and OB/GYN stretchers. The emergency and transport stretchers segment held the largest market share in 2022. The procedural stretchers segment is anticipated to register the highest CAGR of 6.3% during 2022–2030. Emergency and transport stretchers are designed to confer ease of use and smooth movements. Thus, injured persons receive help as quickly as possible when these stretchers are deployed in medical facilities. These stretchers ensure safety and comfort for patients while supporting specialists through easy adjustment and manageability. They are an essential part of emergency equipment. Procedural stretchers are the ideal choice for emergencies, operating rooms (OR), intensive care units, and outpatient settings where their reliability, versatility, and robust exterior are critical. These carriers offer excellent mobility, comfort, and quality. Surgical stretchers are designed for versatility and simplicity of use. They reduce physical strain on patients and caregivers, as they are easy to steer and stop while providing precise cornering and control. In addition to providing patients with comfort, treatment stretchers are fully compatible with various medical devices, such as C-arms and X-ray machines.

Based on scale, the France stretchers market is segmented into with-scale stretchers and without-scale stretchers. The without-scale stretchers segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 5.9% during 2022–2030. Stretchers without scales are normal carriers that do not have scales attached. Stretchers without scale include types such as OB/GYN stretchers and procedural stretchers.

Based on end user, the France stretchers market is segmented into public sector and private sector. The public sector segment held a larger market share in 2022. It is anticipated to register a higher CAGR of 5.5% during 2022–2030. The French healthcare system is largely financed by national health insurance policies supported by the government. The regional health authorities (ARS) of the country are morally and financially autonomous public entities operating under the supervision of the central Ministry of Social Affairs and Health. Public hospitals and clinics in France offer specialized medical services. Emergency and transport stretchers play a critical role in facilitating the quick and safe transport of patients. The public sector is one of the main end users of emergency and transport stretchers, as they are used in all situations where patient movement is required.

Country Analysis:

According to Newsweek and Statista's World's Best Smart Hospitals 2023, France is home to more than 6% of the world's most modern hospitals. Technological improvements play a crucial role in the good and effective treatments of patients. As per a report by the World Health Organization (WHO), France has been considered the best healthcare system in the world since the beginning of the 21st century. The country's government also funds some advanced medical procedures. The France stretchers market growth is attributed to factors such as the increasing need for emergency medical services and rising number of road accidents, and the burgeoning population of elderly people.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the France stretchers market are listed below:

- In October 2023, Stryker Corp launched a smart, connected hospital stretcher—Prime Connect. The stretcher is designed to support fall prevention protocols from anywhere in a healthcare facility. Prime Connect was launched at the Emergency Nursing 2023 event in San Diego, California. in September 2023.

- In May 2023, LINET Group SE announced the launch of Sprint 200, a premium emergency and transportation stretcher. The product is designed to reduce musculoskeletal disorders among caregivers and optimize patient flow and the cost of care. The company also announced a new tagline, “The stretcher redefined,” for Sprint 200.

- In April 2023, Stryker Corp partnered with Project C.U.R.E. to supply hospital beds and stretchers in Ukraine. The Project C.U.R.E is the world’s largest distributor of donated medical equipment and supplies to resource-limited communities from over 135 countries. With the help of this partnership, Stryker Corp supplied emergency beds and stretchers in Kyiv City Children’s Hospital, Ukraine. The company also provided other essential supplies and implant surgical drills to the most hard-hit areas of the country for orthopedic and neurological interventions.

- In March 2021, Champion Manufacturing Inc completed the acquisition of Winco Manufacturing, LLC. The acquisition has enabled the former to enhance its clinical seating solutions to support caregivers in the healthcare continuum, including residential care, treatment, and specialty procedural care environments. After the acquisition, both companies have leveraged, strengthened, and advanced their legacy of innovation, quality, and high-value products and services.

Competitive Landscape and Key Companies:

LINET Group; Stryker; Hill-Rom Services Inc.; Medline Industries, Inc.; TransMotion Medical Inc.; Advanced Instruments SAS; Invacare Corporation; Paramount Bed Holdings Co., Ltd.; KARTSANA; BMB Medical; Acime; Schmitz Medical GmbH; and Drägerwerk AG & Co. KGaA are among the prominent companies operating in the France stretchers market. These companies focus on new technologies, existing products’ advancements, and geographic expansions to meet the growing consumer demand.

France Stretchers Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 100.51 Million |

| Market Size by 2030 | US$ 155.55 Million |

| Global CAGR (2022 - 2030) | 5.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | France

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Single-Use Negative Pressure Wound Therapy Devices Market

- Human Microbiome Market

- Battery Testing Equipment Market

- Pharmacovigilance and Drug Safety Software Market

- Aircraft Landing Gear Market

- Molecular Diagnostics Market

- HVAC Sensors Market

- Precast Concrete Market

- Surety Market

- Dry Eye Products Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Technology, Application, Scale, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Stretchers are used to transport patients in an ambulance for non-emergency or emergency transport. Electric, manual, or pneumatic stretchers are available on the market. A paramedic is required to operate and manage a manual stretcher, including mechanical, auto loading, and non-powered stretchers. Pneumatic stretchers are sometimes referred to as hydraulic stretchers. It has a hydraulic mechanism that controls the movement of the stretchers. Therefore, it is in high demand and has a high market value. The rising number of hospitals investing in new technologies to enhance healthcare is also expected to drive market expansion.

The increasing need for emergency medical services and rising number of road accidents and rising geriatric population in France are among the key factors driving the France stretchers market growth. However, the high costs of specialized stretchers and the growing adoption of home healthcare are hindering the growth of the market.

The France stretchers market majorly consists of the players such as LINET Group; Stryker; Hill-Rom Services Inc.; Medline Industries, Inc.; TransMotion Medical Inc.; Advanced Instruments SAS; Invacare Corporation; Paramount Bed Holdings Co., Ltd.; KARTSANA; BMB Medical; Acime; Schmitz Medical GmbH; and Drägerwerk AG & Co. KGaA.

The France stretchers market is analyzed on the product type, technology, application, scale, and end user. Based on product type, the France stretchers market is segmented into fixed stretchers, adjustable stretchers, and stretcher chairs. The adjustable stretchers segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2030. Based on technology, the France stretchers market is segmented into non-motorized stretchers and motorized stretchers. The motorized stretchers segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 5.9% during 2022–2030. The France stretchers market, based on application, is segmented into emergency and transport stretchers, pediatric stretchers, radiology stretchers, bariatric stretchers, procedural stretchers, and OB/GYN stretchers. The emergency and transport stretchers segment held the largest market share in 2022, and the procedural stretchers segment is anticipated to register the highest CAGR of 6.3% during 2022–2030. Based on scale, the France stretchers market is segmented into with scale stretchers and without scale stretchers. The without scale stretchers segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 5.9% during 2022–2030. Based on end user, the France stretchers market is segmented into public sector and private sector. The public sector segment held a larger market share in 2022. It is anticipated to register a higher CAGR of 5.5% during 2022–2030.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - France Stretchers Market

- LINET Group

- Stryker, Hill-Rom Services Inc.

- Medline Industries, Inc.

- TransMotion Medical Inc.

- Advanced Instruments SAS

- Invacare Corporation

- Paramount Bed Holdings Co., Ltd.

- KARTSANA

- BMB Medical, Acime

- Schmitz medical GmbH

- Drägerwerk AG & Co. KGaA

Get Free Sample For

Get Free Sample For