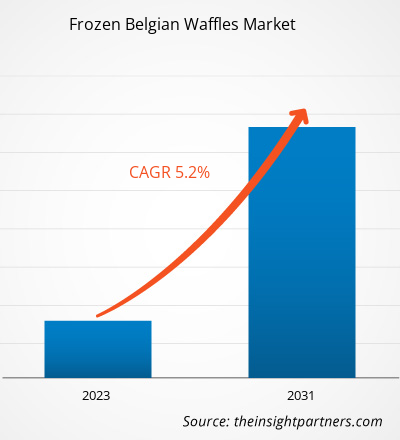

The frozen Belgian waffles market size is projected to reach US$ 2.05 billion by 2031 from US$ 1.37 billion in 2023. The market is expected to register a CAGR of 5.2% during 2023–2031. The increasing demand for gluten-free products is likely to continue as a key trend in the market.

Frozen Belgian Waffles Market Analysis

Quick service restaurants (QSRs) have gained major traction as consumers increasingly prioritize convenience owing to their fast-paced lifestyle. Due to the growth and expansion of QSRs, the demand for frozen Belgian waffles has also increased. The QSRs mainly demand frozen products, such as waffles, which require less preparation time and are easy to use. This helps the QSRs provide consumers with their food quickly. Thus, the expansion of quick-service restaurants is driving the frozen Belgian waffles market

Frozen Belgian Waffles Market Overview

Frozen Belgian waffle is a convenience food product mainly consumed as breakfast. Consumers prefer ready-to-eat, microwavable, and ready-to-prepare food products as they are highly suitable for on-the-go consumption and require minimal preparation time. Additionally, after the pandemic, out-of-home consumption drove the demand for frozen Belgian waffles from the foodservice sector. Owing to the aforementioned factors, frozen Belgian waffles are witnessing increasing global demand, mainly in developed countries. However, due to the strong cultural influence on people's consumption habits in various developing countries, including India, Japan, and China, there is a high predominance of traditional breakfast food. Thus, the adoption of frozen Belgian waffles in these countries is limited, which is creating hurdles in the growth of the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Frozen Belgian Waffles Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Frozen Belgian Waffles Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Frozen Belgian Waffles Market Drivers and Opportunities

Expansion of Quick Service Restaurants

Consumers are not able to focus on their personal lives due to the increasing number of single-person households and dual-income families. Therefore, they seek convenient products that help save time and effort. QSRs and fast-food restaurants offer mass-produced products in no time, offering huge convenience to consumers. These restaurants are becoming popular because they offer a variety of food in less time and at affordable prices. Consumers seek convenience and quick service with their food. According to the National Restaurant Association, QSR enjoyed a 3% traffic uptick in 2023 in the US than 2020. QSR caters to the needs of the consumers as they offer to sit and dine, along with numerous services such as drive-thru, takeout, and home delivery, which suit the modern lifestyle of the consumers. Due to the growth and expansion of QSRs, the demand for frozen Belgian waffles has also increased.

Advancements in Cold Chain Infrastructure

The expansion of cold chain capacity in emerging countries varies for each country. In most countries, such as Mexico, South Africa, and Kenya, the cold chain is present in urban areas and transportation terminals, such as airports, where exporters may be situated. Moreover, market service providers are constantly enhancing their technologies to stay ahead of the competition and maintain integrity, efficiency, and safety across the globe. For example, vendors have implemented Radio Frequency Identification (RFID) technology and Hazard Analysis and Critical Control Points (HACCP) to enhance efficiency with smaller shipments. Further, to provide additional service to consumers, they are expanding their multi-compartment refrigerated vehicle fleets. Thus, advancements in cold chain infrastructure are expected to offer lucrative opportunities for the frozen Belgian waffles market players.

Frozen Belgian Waffles Market Report Segmentation Analysis

Key segments that contributed to the derivation of the frozen Belgian waffles market analysis are product type, nature, category, and end user.

- Based on product type, the frozen Belgian waffles market is divided into Brussel waffles and Liege waffles/Belgian sugar waffle. The Brussel waffles segment held a larger market share in 2023.

- By category, the market is bifurcated into plain and flavored. The flavored segment held a larger share of the market in 2023.

- By category, the market is bifurcated into conventional and gluten-free. The conventional segment held a larger share of the market in 2023.

- In terms of end use, the market is segmented into foodservice and food retail. The food retail segment held a significant share of the market in 2023.

Frozen Belgian Waffles Market Share Analysis by Geography

The geographic scope of the frozen Belgian waffles market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Constant changes in consumer preferences and a rise in diverse culinary experiences led to the popularity of convenience food options, which boosted the demand for frozen Belgian waffles in Europe. Consumers are also seeking convenient and versatile options for various dishes, such as breakfast plates and sweet baked goods, which contributes to the growing sales of frozen Belgian waffles.

A rise in the working population and dual-income families promotes the consumption of processed foods such as frozen Belgian waffles in Europe. For instance, Eurostat reported that ~73.1% of the population in the region, amounting to 250 million people, were working professionals in 2021. In the same year, the Department of Public Health of Belgium estimated that ultra-processed food and drink consumption increased to 44% in the UK and 14% in countries such as Italy and Romania.

The strong presence of the retail sector and inclination toward online shopping are boosting the demand for frozen Belgian waffles in Europe. Retailers offer frozen Belgian waffles from various brands and implement promotional strategies to boost sales. For instance, the brands that provide frozen Belgian waffles extend significant discounts and deals to draw in customers who prefer them.

Frozen Belgian Waffles Market Regional Insights

The regional trends and factors influencing the Frozen Belgian Waffles Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Frozen Belgian Waffles Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Frozen Belgian Waffles Market

Frozen Belgian Waffles Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.37 Billion |

| Market Size by 2031 | US$ 2.05 Billion |

| Global CAGR (2023 - 2031) | 5.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

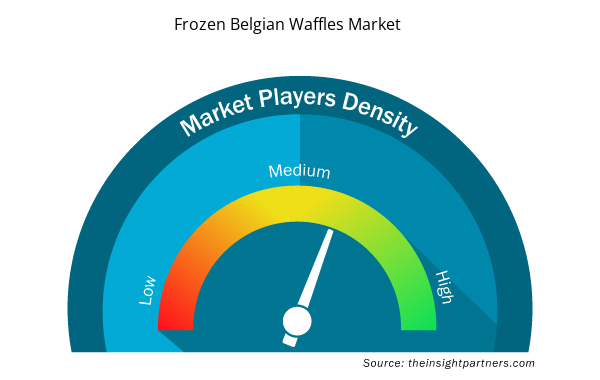

Frozen Belgian Waffles Market Players Density: Understanding Its Impact on Business Dynamics

The Frozen Belgian Waffles Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Frozen Belgian Waffles Market are:

- H E B, LP

- DELY Wafels SRL

- Deligout Sprl

- Avieta SA

- VDB Frozen Food

- Kellanova

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Frozen Belgian Waffles Market top key players overview

Frozen Belgian Waffles Market News and Recent Developments

The frozen Belgian waffles market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A key recent development in the frozen Belgian waffles market is mentioned below:

- Kellanova launched higher-protein breakfast offerings: Eggo Fully Loaded Frozen Belgian Waffles, which contain 10 grams of protein in each two waffle servings. These waffles are available in two flavors: Chocolate Chip Brownie and Strawberry Delight. (Source: Kellanova, Company Website, May 2024)

- Central Foods, a frozen foods manufacturer, launched its KaterBake Belgian Waffle in vegan form. (Source: Central Foods, Press Release, January 2024)

Frozen Belgian Waffles Market Report Coverage and Deliverables

The "Frozen Belgian Waffles Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Frozen Belgian waffles market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Frozen Belgian waffles market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Frozen Belgian waffles market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the frozen Belgian waffles market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Water Pipeline Leak Detection System Market

- Electronic Toll Collection System Market

- Vision Care Market

- Medical and Research Grade Collagen Market

- Industrial Valves Market

- Arterial Blood Gas Kits Market

- Hair Extensions Market

- Sodium Bicarbonate Market

- Rare Neurological Disease Treatment Market

- Power Bank Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The increasing preference for gluten-free products is likely to emerge as a key trend in the market in the future.

Europe accounted for the largest share of the market in 2023.

The expansion of quick-service restaurants and business development initiatives by key market players are major factors contributing to the growth of the market.

The market size is projected to reach US$ 2.05 million by 2031.

H E B, LP, DELY Wafels SRL, Deligout Sprl, Avieta SA, VDB Frozen Food, Kellanova, Conagra Brands Inc, General Mills Inc, McCain Foods Ltd, Belgian Waffles Thijs, and La Lorraine Bakery Group are a few of the key players operating in the market.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Frozen Belgian Waffles Market

- DELY Wafels SRL

- Deligout Sprl

- Avieta SA

- VDB Frozen Food

- Kellanova

- Conagra Brands Inc

- General Mills Inc

- McCain Foods Ltd

- Belgian Waffles Thijs

- La Lorraine Bakery Group

Get Free Sample For

Get Free Sample For