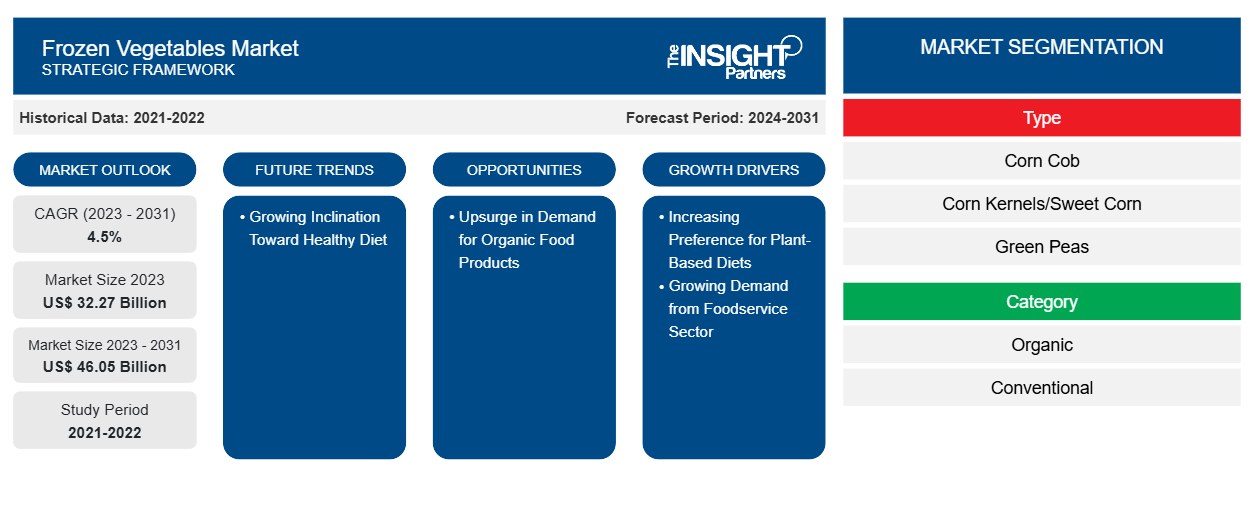

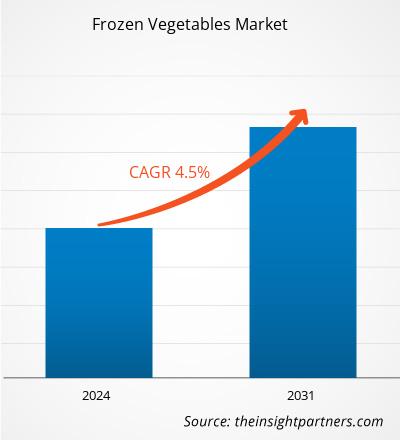

The frozen vegetables market size is projected to reach US$ 46.05 billion by 2031 from US$ 32.27 billion in 2023. The market is expected to register a CAGR of 4.5% during 2023–2031. The rising preference for healthy eating is one of the rapidly emerging market trends, favoring the growth of the market.

Frozen Vegetables Market Analysis

Frozen vegetables are made by freezing root vegetables, cruciferous vegetables, leafy green vegetables, and others. In food processing, frozen vegetables are used as key ingredients in a wide range of products, from frozen meals and baked goods. In food retail, end users stock shelves with various frozen vegetables to cater to consumer demand for convenient and nutritious options. In food service, end users, such as restaurants and catering companies, rely on frozen vegetables to streamline food preparation, maintain consistent quality, and create diverse menu offerings. The versatility, convenience, and extended shelf life of frozen vegetables make them indispensable to these end users in meeting the needs of their customers and optimizing their operations. Further, the rising demand for organic food products is expected to create a significant opportunity for companies operating in the frozen vegetables market during the forecast period.

Frozen Vegetables Market Overview

Frozen vegetables are a versatile and convenient food option that benefits the foodservice sector. Popular restaurant chains specializing in multiple traditional cuisines, such as McDonald's, Subway, Starbucks, Burger King, Wendy's, and Taco Bell, and international chains operating in North America rely on frozen produce to enhance the flavor and broaden the variety of their dishes. By utilizing frozen ingredients, restaurants can save preparation time, minimize food waste, and maintain consistent quality, especially during peak dining hours.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Frozen Vegetables Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Frozen Vegetables Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Frozen Vegetables Market Drivers and Opportunities

Growing Demand from Foodservice Sector

Restaurants, cafes, hotels, and catering services strive to meet consumer preferences for high-quality ingredients. In such a scenario, frozen vegetables emerge as a practical solution to ensure consistency, convenience, and cost-effectiveness in their operations. In Europe, renowned chains such as Pret A Manger, Wagamama, and Nando's have integrated frozen produce into their menus to maintain standards as well as streamline kitchen operations across numerous locations. Frozen vegetables preserve their freshness and nutritional value. Frozen produce is often picked and flash-frozen at its peak growth, locking in nutrients and flavors. This allows chefs and kitchen staff to access a wide range of frozen vegetables regardless of seasonal limitations, ensuring a consistent supply of ingredients for different food items. Catering services for events, hotels, and institutional food providers also propel the demand for frozen vegetables. Large-scale operations catering to weddings, conferences, and banquets in major regions rely on the convenience and versatility of frozen produce to meet the volume and quality standards expected by their clients. Thus, the growing demand for frozen vegetables from the foodservice sector boosts the market growth.

Upsurge in Demand for Organic Food Products

Consumers are increasingly prioritizing organic food products, including organic frozen vegetables, owing to the growing awareness regarding the adverse impact of conventional farming practices on the environment and rising concerns about pesticide residues in food products. Consumers perceive organic products as healthier, safer, and more environmentally sustainable food options. As a result, manufacturers and retailers are expanding their organic product offerings and investing in sourcing organic ingredients to cater to the growing consumer demand. Consumers are becoming increasingly aware of organic produce's health benefits and are seeking organic options as part of their dietary preferences.

Growing interest in sustainable farming practices and rising support for local farmers who produce organic vegetables are a few factors that impact the demand for organic frozen vegetables across the globe, especially in developed countries. As a result, manufacturers are introducing organic frozen vegetables sourced from certified organic farms to cater to consumers' demand for healthier and environmentally friendly food choices. This indicates a broader global movement toward organic agriculture and sustainable food systems, with consumers increasingly consuming organic options such as frozen organic vegetables. Thus, the rising demand for organic food products is expected to create a significant opportunity for companies operating in the frozen vegetables market during the forecast period.

Frozen Vegetables Market Report Segmentation Analysis

Key segments that contributed to the derivation of the frozen vegetables market analysis are type, category, and end user.

- Based on type, the frozen vegetables market is segmented into corn cob, corn kernels, green peas, baby corn, carrot, cauliflower, green beans, spinach, broccoli, onions, brussel sprouts, mixed vegetables, and others. The mixed vegetable segment accounted for the largest share of the market in 2023.

- In terms of category, the market is bifurcated into organic and conventional. The conventional segment held a larger share of the market in 2023.

- Based on end user, the market is segmented into food processing, food retail, and foodservice. The food retail segment dominated the market in 2023.

Frozen Vegetables Market Share Analysis by Geography

The geographic scope of the frozen vegetables market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Europe held the largest share in 2023, followed by Asia Pacific and North America.

In North America, the latest consumer preference trends exhibit a shift toward healthy and nutritious food options, which has surged the demand for vegan, gluten-free, high-fiber, high-protein, or low-calorie food, as well as frozen vegetables. According to the "2023 Power of Frozen in Retail" by The Food Industry Association and the American Frozen Food Institute, frozen food sales in the US increased by 7.9%, reaching US$ 74.2 billion between July 2022 and July 2023. The report also reveals that the number of online grocery shoppers' share who purchase frozen food through e-commerce channels is rising significantly. The research also revealed that 86% of shoppers who bought groceries online purchased frozen products in 2023.

According to National Restaurant Association (US), the food and beverage sales from the full-service segment (including family-dining, casual-dining, and fine-dining full-service restaurants) grew from US$ 199 billion in 2020 to US$ 289 billion in 2022, while the sales from the limited-service segment (including quick-service restaurants, fast-casual restaurants, and cafeteria) in the US increased from US$ 297 billion in 2020 to US$ 355 billion in 2022. Frozen vegetables are widely purchased by foodservice operators, as these vegetables keep the menu options consistent throughout the year, aids in meeting the demand of the foodservice industry, and minimizes overall food losses. Thus, the growth in the foodservice industry and rising demand for frozen food are a few factors that drive the frozen vegetables market in the region.

Frozen Vegetables Market Regional Insights

The regional trends and factors influencing the Frozen Vegetables Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Frozen Vegetables Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Frozen Vegetables Market

Frozen Vegetables Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 32.27 Billion |

| Market Size by 2031 | US$ 46.05 Billion |

| Global CAGR (2023 - 2031) | 4.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

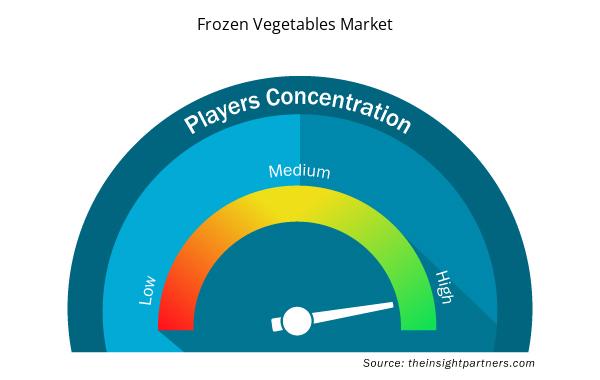

Frozen Vegetables Market Players Density: Understanding Its Impact on Business Dynamics

The Frozen Vegetables Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Frozen Vegetables Market are:

- General Mills Inc

- Bonduelle SA

- McCain Foods Ltd

- Grupo Virto

- La Fe Foods

- Alasko Food Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Frozen Vegetables Market top key players overview

Frozen Vegetables Market News and Recent Developments

The frozen vegetables market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few developments in the frozen vegetables market are mentioned below:

- McCain Foods completed the acquisition of Irish plant-based frozen food manufacturer Strong Roots. The acquisition follows McCain and Strong Roots' strategic partnership, which began in 2021 and resulted from a US$ 55 million investment. (Source: McCain Foods Ltd, Company Website, April 2024)

- Hanover Foods received a US$ 1 million grant toward an update of the Delaware location's infrastructure and equipment. (Source: Hanover Foods, Press Release, September 2024)

Frozen Vegetables Market Report Coverage and Deliverables

The "Frozen Vegetables Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Frozen vegetables market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Frozen vegetables market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Frozen vegetables market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the frozen vegetables market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

General Mills Inc, Bonduelle SA, McCain Foods Ltd, Grupo Virto, La Fe Foods, Alasko Food Inc., Dawtona Frozen, Ardo Foods NV, Seneca Foods Corp, Goya Foods Inc, Mondial Foods BV, Simplot Global Food, Hanover Foods, B&G Foods, and Mother Dairy Fruit & Vegetable Pvt. Ltd are a few of the key players operating in the market.

The market size is projected to reach US$ 46.05 billion by 2031.

Europe accounted for the largest share of the market in 2023.

Rising interest in plant-based diets and increasing demand for frozen vegetables from the foodservice sector are major factors contributing to the growth of the market.

The growing inclination toward a healthy diet is likely to emerge as a key trend in the market in the future.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Frozen Vegetables Market

- General Mills Inc

- Bonduelle SA

- McCain Foods Ltd

- Grupo Virto

- La Fe Foods

- Alasko Food Inc.

- Dawtona Frozen

- Ardo Foods NV

- Seneca Foods Corp

- Goya Foods Inc

Get Free Sample For

Get Free Sample For