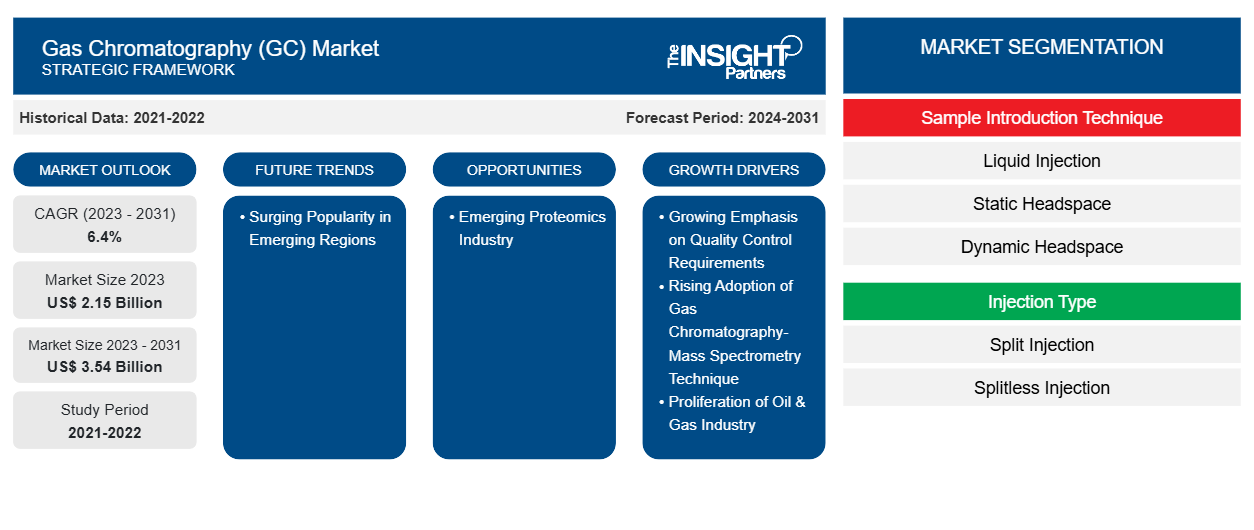

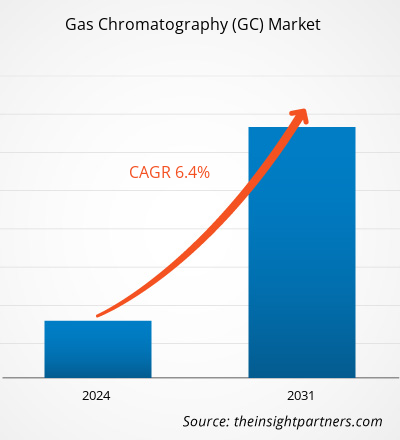

The gas chromatography (GC) market is projected to reach US$ 3.54 billion by 2031 from US$ 2.15 billion in 2023. The market is expected to register a CAGR of 6.4% during 2023–2031.

The growing popularity of gas chromatography solutions in emerging regions is anticipated to bring new growth trends in the gas chromatography (GC) market during the forecast period.

Gas Chromatography (GC) Market Analysis

The need for strict quality control protocols drives the demand for gas chromatography instruments and consumables. Industries such as automotive, culinary arts, petrochemicals, and environmental stewardship prioritize the thorough examination of their products and processes. Gas chromatography plays a crucial role in certifying the integrity of raw materials, intermediates, and final outputs by effectively separating, identifying, and quantifying complex compounds and mixtures. Regulatory bodies governing these sectors impose stringent standards to ensure public well-being and environmental harmony. To meet these standards, organizations invest in advanced gas chromatography instrumentation and teams to ensure compliance and detect the smallest quantities of impurities and contaminants that could compromise product quality. The ability of gas chromatography to identify trace-level anomalies is essential in preventing quality discrepancies.

Gas Chromatography (GC) Market Overview

Gas chromatography is an analytical technique used in the pharmaceuticals, environmental analysis, food & beverages, forensics, and petrochemicals industries, among others, to separate and analyze compounds that can be converted into gaseous or liquid form without decomposition. It is a powerful tool for testing the purity of substances. The process of gas chromatography involves injecting a gaseous or liquid sample into a mobile phase, known as the carrier gas, which carries the sample through a stationary phase. The mobile phase is typically an inert gas such as helium, argon, nitrogen, or hydrogen. The stationary phase can be either solid or liquid, depending on the specific application. Sample components segregate between the stationary and mobile phases based on their affinity for each phase. As the components move through the column, they interact with the stationary phase, leading to separation based on differential retention times. High sensitivity, fast analysis times, and a broad analysis range (entailing a wide range of compounds) are among the major benefits of gas chromatography. The technique provides quantitative and qualitative information about the composition of a sample, allowing for the accurate identification and quantification of individual components.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Gas Chromatography (GC) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Gas Chromatography (GC) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Gas Chromatography (GC) Market Drivers and Opportunities

Proliferation of Oil & Gas Industry

The oil & gas industry stands as one of the most significant sectors globally, boasting a staggering US$ 5 trillion in global revenue as of 2022. Industry plays a pivotal role in the global economic landscape. Oil serves as a vital resource that influences various aspects of business operations, ranging from powering transportation systems to providing heat and electricity for residential and commercial purposes, thus aiding industrial production and manufacturing processes. Gas chromatography is used as an indispensable analytical tool in the oil & gas industry, particularly when dealing with complex crude oil samples containing numerous distinct components. This technique is extensively utilized to analyze samples at every stage of the petroleum supply chain, from exploration and production to transportation and refining. It enables the comprehensive analysis of both raw materials and refined finished products. Analysts employ gas chromatography to simulate the crude oil distillation process, optimizing yield and maximizing efficiency. Meeting the quality and consistency of finished products is a top priority of oil & gas businesses, ensuring regulatory compliance and customer satisfaction. The LowOx UOP 960 analyzer, a specialized instrument employed in refineries, utilizes gas chromatography to detect trace levels of individual oxygenates in liquefied petroleum gas (LPG), naphtha, and other gas streams, which enables them to adhere to stringent quality standards and regulatory requirements.

Emerging Proteomics Industry

Proteomics, a study of proteins and their functions, plays a crucial role in industries such as pharmaceuticals, biotechnology, and healthcare. Gas chromatography serves as a powerful analytical technique that enables the separation and analysis of complex mixtures, including proteins. Incorporating gas chromatography in proteomics opens new avenues for research and development. By utilizing gas chromatography in proteomic analysis, scientists can effectively separate and identify proteins, leading to a deeper understanding of their structure, function, and interactions. This information is vital for drug discovery, biomarker identification, and personalized medicine, among other applications. As proteomics continues to gain prominence in various industries, there is a need for precise and reliable tools to simplify the analytical processes. Gas chromatography offers high resolution, sensitivity, and reproducibility, making it an ideal choice for proteomic research. For instance, Creative Proteomics, offers a Finnigan TRACE DSQ GC-MS system with Electron Ionization (EI) and Chemical Ionization (CI) capability, allowing for identification of unknown compounds down to below part-per-billion levels. Thus, the flourishing field of proteomics presents significant opportunities for the gas chromatography (GC) market.

Gas Chromatography (GC) Market Report Segmentation Analysis

The “gas chromatography (GC) market analysis” has been performed by considering the following segments: sample introduction techniques, injection type, detector type, end user, and geography.

- Based on detector type, the gas chromatography (GC) market is segmented into flame ionization detector, thermal conductivity detector, electron capture detector, thermionic specific detector, flame photometric detector, photo ionization detector, mass spectrometers, and others. The flame ionization detector segment held the largest share in the gas chromatography (GC) market in 2023. The flame ionization detector (FID) is widely used in GC due to its exceptional sensitivity and selectivity. It operates on the principle of ionizing organic compounds in a hydrogen-air flame, producing electrically charged particles that are measured as a current. This process allows for precise compound detection across a wide range of analytes, including hydrocarbons, making it indispensable in industries such as petrochemicals, environmental analysis, and food safety. The high sensitivity of FIDs enables the detection and quantification of compounds at low levels, ensuring accurate results and compliance with regulatory standards. This is particularly crucial in industries such as pharmaceuticals and environmental monitoring, where precise measurements are essential for quality control and safety.

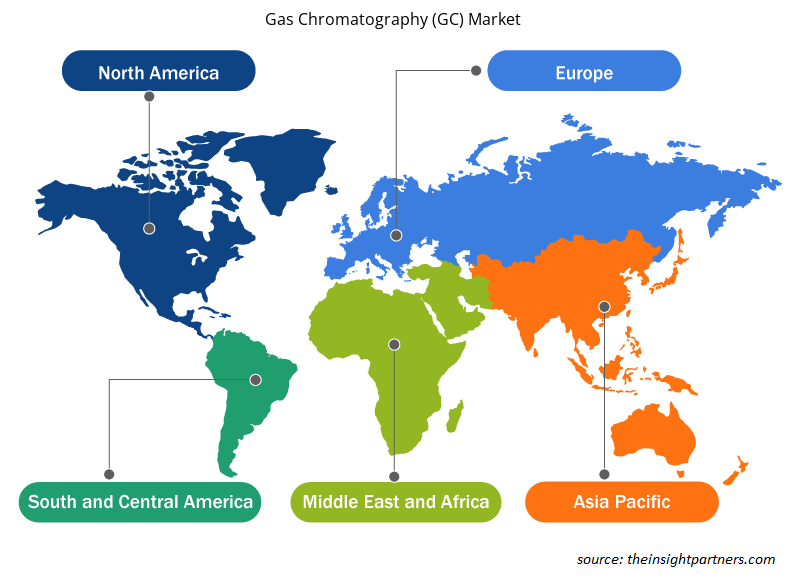

Gas Chromatography (GC) Market Share Analysis by Geography

The geographic scope of the gas chromatography (GC) market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America.

North America held the largest share of the gas chromatography (GC) market in 2023, followed by Europe and Asia Pacific. North America has been experiencing growth in several industries, such as oil & gas and energy, which supports the gas chromatography (GC) market progress in North America. The region is home to most of the gas chromatography (GC) market players, which is one of the key factors fueling the adoption of gas chromatography technology in North America. Countries in the region are further investing in launching new oil refineries and power plants, which generates the demand for gas analysis technologies.

Gas Chromatography (GC) Market News and Recent Developments

The gas chromatography (GC) market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Following is a list of developments in the market:

- In 2023, VUV Analytics, Inc. raised US$ 20 million in equity financing—led by existing investors S3 Ventures and New Science Ventures—bringing its total funding to over US$ 36 million. The announcement follows the recent launch of the company's LUMA product and a record year for revenue, with its unit sales run rate doubling year-over-year. (Source: VUV Analytics, Inc, Press Release)

- In 2022, PerkinElmer, a global leader in end-to-end solutions for diagnostics, life sciences, food, and environmental markets, announced a long-term partnership with P1 Fuels, a specialist in the formulation, production, and delivery of advanced, fossil-free performance fuels for racing teams and the automotive industry. The ultimate goal of this collaboration was to help the automotive sector, including motorsports, transition to climate-neutral, fossil-free fuels. Through its gas chromatography and infrared spectroscopy platforms, which perform fast and reliable analysis of fuels and their chemical compositions, PerkinElmer played a key role in the transition to sustainable mobility. P1 Fuels used PerkinElmer's technology in its Berlin headquarters, as well as trackside, to perform quality-control checks. (Source: PerkinElmer, Press Release)

Gas Chromatography (GC) Market Regional Insights

The regional trends and factors influencing the Gas Chromatography (GC) Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Gas Chromatography (GC) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Gas Chromatography (GC) Market

Gas Chromatography (GC) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.15 Billion |

| Market Size by 2031 | US$ 3.54 Billion |

| Global CAGR (2023 - 2031) | 6.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Sample Introduction Technique

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

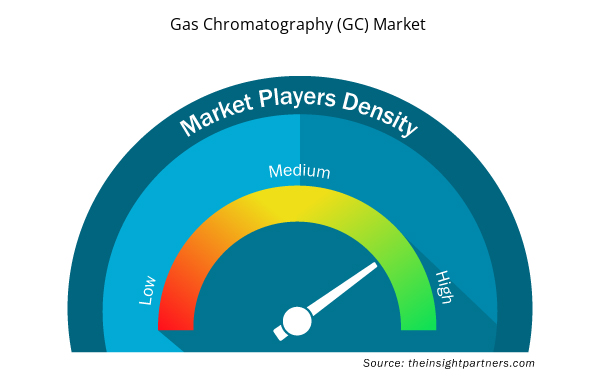

Gas Chromatography (GC) Market Players Density: Understanding Its Impact on Business Dynamics

The Gas Chromatography (GC) Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Gas Chromatography (GC) Market are:

- Agilent Technologies

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc.

- Restek Corporation

- VUV Analytics, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Gas Chromatography (GC) Market top key players overview

Gas Chromatography (GC) Market Report Coverage and Deliverables

The “gas chromatography (GC) market Size and Forecast (2021-2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The gas chromatography (GC) market was estimated to be valued at US$ 2.14 billion in 2023 and is anticipated to grow at a CAGR of 6.4% over the forecast period.

The growing emphasis on quality control requirements, rising adoption of gas chromatography-mass spectrometry technique, and the growth in the oil and gas industry, are driving the growth of the gas chromatography (GC) market.

The key players holding majority shares in the gas chromatography (GC) market include Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Shimadzu Corporation, PerkinElmer, Inc., and Restek Corporation.

The surging popularity of gas chromatography in emerging regions is expected to drive the growth of the gas chromatography (GC) market in the coming years.

The flame ionization detector segment led the gas chromatography (GC) market with a significant share in 2023.

The gas chromatography (GC) market is expected to reach US$ 3.53 Billion by 2031.

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Gas Chromatography (GC) Market

- Agilent Technologies

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- Restek Corporation

- VUV Analytics, Inc.

- Wasson ECE Instrumentation

- YOUNGIN Chromass

- Da Vinci Laboratory Solutions B.V.

- Separation Systems, Inc.

- Merck KGaA

- PerkinElmer

Get Free Sample For

Get Free Sample For