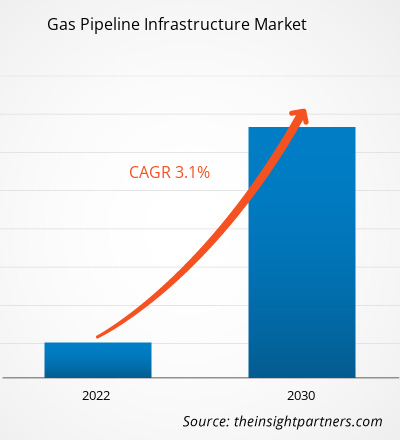

The Gas Pipeline Infrastructure Market size is projected to reach US$ 40,703.5 million by 2030 from US$ 31,782.8 million in 2022. The market is expected to register a CAGR of 3.1% in 2022–2030.

Gas Pipeline Infrastructure Market Analysis

The natural gas market is highly dynamic and requires liquidity, flexibility, and transparency to function effectively. Therefore, multiple sources of supply, multiple users, and a comprehensive infrastructure for transmission and distribution are required. The natural gas market is significantly developed in the US, Europe, and Asia Pacific, which is expected to drive the growth of the gas pipeline infrastructure with the rise in demand for gas in the future.

Gas Pipeline Infrastructure Market Overview

The gas pipeline infrastructure ecosystem includes the production phase, where natural gas is extracted from underground reservoirs. Exploration and production companies employ drilling technologies to extract raw natural gas. Once extracted, the gas is typically processed to remove impurities and then compressed for transportation. The production phase involves considerations of geological factors, extraction technologies, and environmental impact assessments. The primary players engaged in the production of natural gas are Royal Dutch Shell, ExxonMobil Corporation, Gazprom, ConocoPhillips, and TotalEnergie. The key players in the gas pipeline transmission network include Kinder Morgan Inc., Enbridge Inc., TC Energy Corporation, Pembina Pipeline Corporation, and Texas Gas Transmission LLC, among others.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Gas Pipeline Infrastructure Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Gas Pipeline Infrastructure Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Gas Pipeline Infrastructure Market Drivers and Opportunities

Increase in energy demand across the globe is Expected to be the Prime Driver for the Gas Pipeline Infrastructure Market

The rising population and growing urbanization are a few factors boosting the consumption of energy worldwide. Natural gas has the potential application in electricity generation, which boosts its demand. Furthermore, due to the increasing energy uncertainties in Europe owing to the Russia-Ukraine war, governments of several countries are also boosting the application of natural gas. Thus, the increase in energy demand fuels the growth of the gas pipeline infrastructure market

Rise in Shale Gas Production in North America

North America has secured its position as one of the leading shale gas producers worldwide. Canada is the fifth-largest producer and fourth-largest exporter of natural gas worldwide. The main Canadian shale gas plays include the Horn River Basin and Montney shales in northeast British Columbia, the Utica Shale of Quebec, the Colorado Group of Alberta and Saskatchewan, and the Horton Bluff Shale of New Brunswick and Nova Scotia. Energy uncertainties owing to geopolitical disturbances are boosting the production of shale gas in North America, which is likely to create major opportunities for the gas pipeline infrastructure market growth in the coming years.

Gas Pipeline Infrastructure Market Report Segmentation Analysis

Key segments that contributed to the derivation of the gas pipeline infrastructure market analysis are operation, equipment, and application.

- Based on the operation, the gas pipeline infrastructure market has been divided into transmission and distribution. The distribution segment held a larger market share in 2022.

- In terms of equipment, the market has been segmented into pipeline, compressor station, metering skids, and others. The pipeline segment dominated the market in 2022.

- In terms of application, the market has been segmented into onshore and offshore. The onshore segment dominated the market in 2022.

Gas Pipeline Infrastructure Market Share Analysis by Geography

The geographic scope of the Gas Pipeline Infrastructure Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America is one of the leading gas exporters. The mounting demand for energy and the growing application of natural gas are boosting the market development of gas pipeline infrastructure in North America. In 2022, the US showcased the highest natural gas production capacity, followed by Canada and Mexico. Ixachi, Coulomb Phase 2, Quesqui, Nejo (IEPC), Leo, May, Koban, and Powerball are a few of the natural gas-producing fields in North America. The Ixachi plant is in Veracruz, Mexico, and it produced 618.09mmcfd (million cubic feet per day) in 2022. Also, the growing number of government initiatives and funding for the development of gas pipeline infrastructure is anticipated to boost the market for gas pipeline infrastructure over the forecast period.

Gas Pipeline Infrastructure Market Regional Insights

The regional trends and factors influencing the Gas Pipeline Infrastructure Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Gas Pipeline Infrastructure Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Gas Pipeline Infrastructure Market

Gas Pipeline Infrastructure Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 31,782.8 Million |

| Market Size by 2030 | US$ 40,703.5 Million |

| Global CAGR (2022 - 2030) | 3.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Operation

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

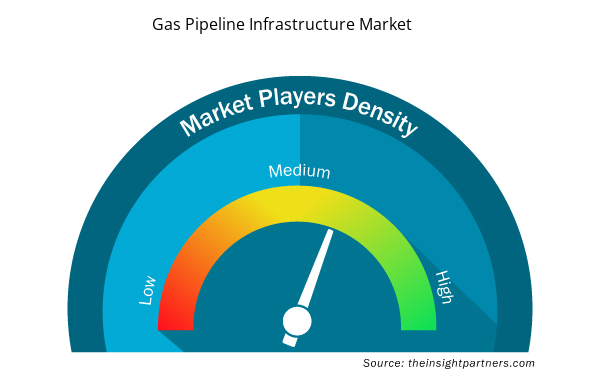

Gas Pipeline Infrastructure Market Players Density: Understanding Its Impact on Business Dynamics

The Gas Pipeline Infrastructure Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Gas Pipeline Infrastructure Market are:

- Enbridge Inc

- Kinder Morgan Inc

- TC Energy Corporation

- Pembina Pipeline Corporation

- Sinopec Group

- Pipeline Infrastructure Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Gas Pipeline Infrastructure Market top key players overview

Gas Pipeline Infrastructure Market News and Recent Developments

The Gas Pipeline Infrastructure Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Gas Pipeline Infrastructure Markets market and strategies:

- On February 2023, Enagas S.A. signed an agreement with Reganosa in which Enagas paid US$ 58.14 million to Reganosa to procure a network of 130 km of natural gas pipelines. The Iberian gas market's efficient operation and supply security are dependent on this network. (Source: Enagas S.A., Press Release/Company Website/Newsletter)

- On August 2022, A strategic agreement was agreed upon by TC Energy Corp and the CFE, the state-owned electric utility in Mexico, with the aim of expediting the development of natural gas infrastructure in the central and southeast parts of the country. In connection with the natural gas pipeline assets in central Mexico, TC Energy and the CFE have decided to combine earlier take-or-pay agreements (TSAs) underwritten by TC Energy's Mexico-based subsidiary TGNH and the CFE into a single, take-or-pay agreement priced in US dollars that would run through 2055. Related new infrastructure projects that are being planned in collaboration with the CFE will also be governed by this new TSA. (Source: TC Energy, Press Release/Company Website/Newsletter)

Gas Pipeline Infrastructure Market Report Coverage and Deliverables

The “Gas Pipeline Infrastructure Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Hummus Market

- Biopharmaceutical Tubing Market

- Arterial Blood Gas Kits Market

- Ceiling Fans Market

- Wind Turbine Composites Market

- Constipation Treatment Market

- Bioremediation Technology and Services Market

- Virtual Production Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Wire Harness Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Operation, Equipment, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For