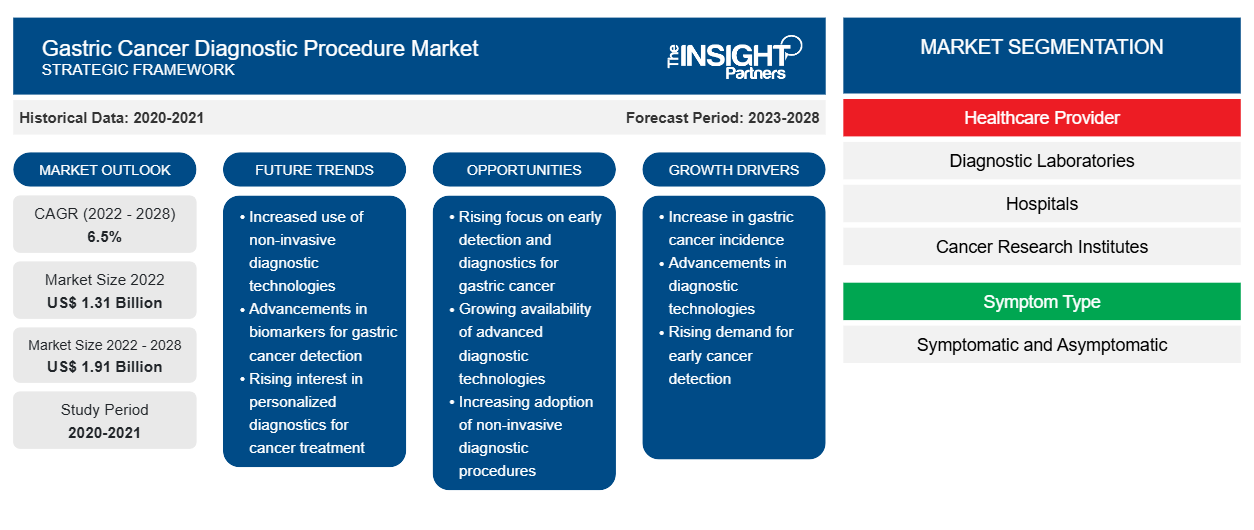

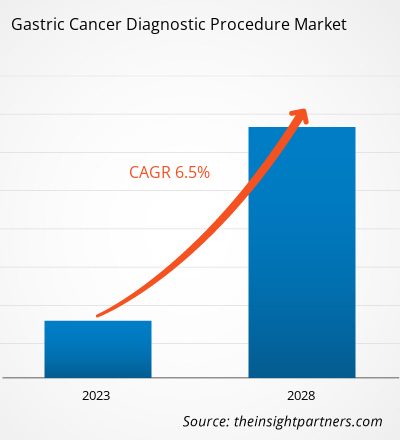

The gastric cancer diagnostic procedure market is expected to grow from US$ 1307.96 million in 2022 to US$ 1912.03 million by 2028; it is estimated to register a CAGR of 6.5% from 2022 to 2028.

The gastric cancer diagnostic procedure market is segmented on the basis of healthcare provider, symptom type, body fluid, procedure, offering, disease indication, and geography. The report offers insights and in-depth analysis of the market, emphasizing parameters such as dynamics, trends, and opportunities in the gastric cancer diagnostic procedure market and competitive landscape analysis of leading market players across various regions. It also includes the impact analysis of COVID–19 pandemic on the market across these regions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Gastric Cancer Diagnostic Procedure Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Gastric Cancer Diagnostic Procedure Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rise in Prevalence of Gastrointestinal Diseases

Despite declining incidence and mortality during the last decades, stomach cancer is perceived as one of the main health challenges worldwide. According to the GLOBOCAN, stomach cancer caused ~800,000 deaths (accounting for 7.7% of all cancer-related deaths) in 2020. The disease ranks as the fourth leading cause of cancer deaths in both genders combined. ~1.1 million new cases of stomach cancer were diagnosed in 2020, accounting for 5.6% of all cancer cases. Asia accounts for ~75% of the new stomach cancer cases and deaths reported globally. Western countries, such as the US and Canada, report high GI disease incidence rates, which can be attributed to increasing obesity in the adult population and less consumption of dietary fibers. According to data released by the Centers for Disease Control and Prevention in December 2022, physicians’ offices in the US record ~37.2 million cases of digestive system diseases.

The prevalence of irritable bowel syndrome (IBS) has increased across the world in the last few decades. According to the International Foundation for Gastrointestinal Disorders, Inc., IBS is the most common functional GI disorder, with a global prevalence rate of 10–15%. Also, physicians in the US record ~2.4–3.5 million visits of IBS patients annually. Although the overall incidence rate of gastric cancer has been declining over the years, it has surged among young adults during the past several decades. Thus, the increasing prevalence of gastrointestinal (GI) disease results in a high risk of developing gastric cancer, which drives the growth of the gastric cancer diagnostic procedure market.

Healthcare Provider-Based Insights

The global gastric cancer diagnostic procedure market, based on healthcare provider, is segmented into diagnostic laboratories, hospitals, cancer research institutes, oncology specialty clinics, and others. In 2022, the hospitals segment held the largest share of the market. The market for the cancer research institutes segment is expected to grow at the highest CAGR during the forecast period.

Symptom Type-Based Insights

The gastric cancer diagnostic procedure market, by symptom type, is bifurcated into symptomatic and asymptomatic. In 2022, the asymptomatic segment held a larger market share. However, the symptomatic segment is estimated to register a higher CAGR during the forecast period.

Body Fluid-Based Insights

Based on body fluid, the gastric cancer diagnostic procedure market is segmented into blood, urine, saliva, stomach wash/gastric juice, tissue, and others. In 2022, the blood segment held the largest market share. However, the market for the tissue segment is expected to grow at the fastest CAGR during the forecast period.

Procedure-Based Insights

Based on procedure, the gastric cancer diagnostic procedure market is segmented into endoscopic procedures, biopsy and tissue tests, lab tests, in-vitro diagnostic tests, imaging tests, molecular diagnostics, multiplexing molecular diagnostics and immunoassays, and others. In 2022, the imaging tests segment held the largest market share. The market for the biopsy and tissue tests segment is estimated to register a higher CAGR during the forecast period.

Offering-Based Insights

The gastric cancer diagnostic procedure market, based on offerings, is segmented into instruments, reagents and consumables, and services. In 2022, the reagents and consumables segment held the largest share of the market. The market for the services segment is estimated to register a higher CAGR during the forecast period.

Disease Indication-Based Insights

Based on disease indication, the gastric cancer diagnostic procedure market is segmented into early gastric cancer and advanced gastric cancer. In 2022, the advanced gastric cancer segment held a larger share of the market. The market for the same segment is expected to grow at a higher CAGR during the forecast period.

COVID-19 Insights

Preventive measures such as deliberately expanding the physical space to avoid close contacts and spread of illness, and mandating the use of masks in workplaces were implemented in several countries for reducing the spread of SARS-CoV-2. However, various restrictions resulted in the cancellation or rescheduling of appointments for gastric cancer diagnosis and treatments. According to a study published in 2021 in PubMed, significantly fewer patients were diagnosed with stage-I gastric and colorectal cancers during the COVID-19 phase. After the first quarter of 2020, the demand for gastric cancer diagnostics increased in the government and private institutions for testing COVID-19 patients for H. pylori infection. Furthermore, patients with advanced stages of gastric cancer were prioritized for diagnosis and treatment, which led to the gastric cancer diagnostic procedure market growth amid the COVID-19 crisis.

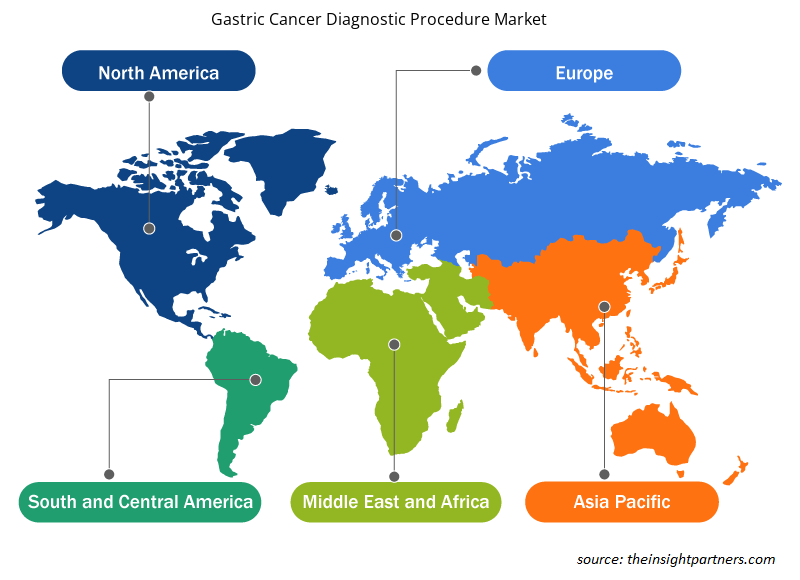

Gastric Cancer Diagnostic Procedure Market Regional Insights

The regional trends and factors influencing the Gastric Cancer Diagnostic Procedure Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Gastric Cancer Diagnostic Procedure Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Gastric Cancer Diagnostic Procedure Market

Gastric Cancer Diagnostic Procedure Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.31 Billion |

| Market Size by 2028 | US$ 1.91 Billion |

| Global CAGR (2022 - 2028) | 6.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Healthcare Provider

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

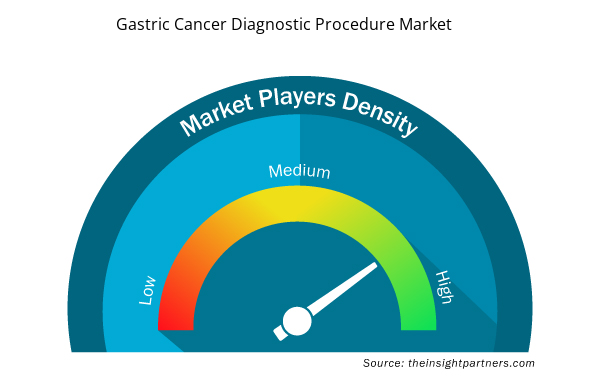

Gastric Cancer Diagnostic Procedure Market Players Density: Understanding Its Impact on Business Dynamics

The Gastric Cancer Diagnostic Procedure Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Gastric Cancer Diagnostic Procedure Market are:

- Atlas-Link Biotech Co Ltd

- Bio-Rad Laboratories Inc

- MiRXES Pte Ltd

- Agilent Technologies Inc

- F. Hoffmann-La Roche Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Gastric Cancer Diagnostic Procedure Market top key players overview

The gastric cancer diagnostic procedure market players adopt organic strategies such as product launch and expansion to expand their footprint and product portfolio worldwide and meet the growing demand. Partnerships and collaborations are among the inorganic growth strategies witnessed in the market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence. Additionally, acquisitions, partnerships, and other growth strategies help companies to strengthen customer base and increase their product portfolios.

- In February 2023, CARsgen Therapeutics announced a collaboration agreement with F. Hoffmann-La Roche (Roche) to assess AB011 and atezolizumab to treat gastric cancer. The collaboration will evaluate CARsgen’s investigational drug AB011, Roche’s PD-L1 checkpoint inhibitor atezolizumab, and the standard-of-care chemotherapy combination in gastric or gastroesophageal junction carcinoma patients.

- In January 2023, Agilent Technologies announced a partnership with Akoya Biosciences to develop chromogenic and immunofluorescent multiplex assays that include spatial analysis for biopharma companies engaged in developing precision cancer therapeutics. This partnership enables an ecosystem that assists the development of novel precision cancer therapeutics and offers a streamlined workflow to the customers of both these companies in the clinical research market.

- In August 2022, MiRXES launched a series of new capabilities—including an Industry 4.0 manufacturing facility, two new laboratories, and a collaborative multi-cancer screening research project. The new developments are aligned with MiRXES’ goal of advancing its research and production capabilities to develop miRNA-based disease detection tests.

- In July 2022, MiRXES Pte Ltd launched the world’s first large-scale clinical research project—CADENCE (CAncer Detected Early caN be CurEd). The Project CADENCE aims to develop a multi-cancer early detection test for up to nine high-incidence and high-mortality cancers: lung, breast, colorectal, liver, stomach (gastric), esophageal, ovarian, pancreatic, and prostate cancers.

Gastric Cancer Diagnostic Procedure Market - Company Profiles

- Atlas-Link Biotech Co Ltd

- Bio-Rad Laboratories Inc

- MiRXES Pte Ltd

- Agilent Technologies Inc

- F. Hoffmann-La Roche Ltd

- bioMerieux SA

- Thermo Fisher Scientific Inc

- Illumina Inc

- Vela Diagnostics Holding Pte Ltd

- Myraid Genetics Inc

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Healthcare Provider, Symptom Type, Body Fluid, Procedure, Offering, and Disease Indication

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The factors that are driving the growth of the gastric cancer diagnostic procedure market are the rise in alcohol consumption, smoking, surging cases of Helicobacter pylori infection, and the rise in the prevalence of gastrointestinal diseases. These are some of the major factors contributing to the growth of the gastric cancer diagnostic procedure industry.

Gastric cancer is a type of malignant cancer that forms the stomach's inner lining. Risk factors such as age, diet, and stomach diseases can lead to the development of gastric cancer. Symptoms of gastric cancer include indigestion, heartburn, bloating, and stomach discomfort or pain.

The gastric cancer diagnostic procedure market majorly consists of the players, such as Atlas-Link Biotech Co Ltd, Bio-Rad Laboratories Inc, MiRXES Pte Ltd, Agilent Technologies Inc, F. Hoffmann-La Roche Ltd, bioMerieux SA, Thermo Fisher Scientific Inc, Illumina Inc, Vela Diagnostics Holding Pte Ltd, and Myraid Genetics Inc.

The gastric cancer diagnostic procedure market is estimated to be valued at US$ 1307.96 million in 2022.

The CAGR value of the gastric cancer diagnostic procedure market during the forecasted period is 6.5%%.

The Asia Pacific is expected to be the fastest-growing region in the gastric cancer diagnostic procedure market over the forecast period due to the increasing surging cases of helicobacter pylori infection and the rise in the prevalence of gastrointestinal diseases.

The gastric cancer diagnostic procedure market is expected to be valued at US$ 1912.03 million by 2028.

The hospitals segment held the largest share of the market in 2022. Also, the cancer research institutes segment is estimated to register the highest CAGR in the market during the forecast period.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Gastric Cancer Diagnostic Procedure Market

- Atlas-Link Biotech Co Ltd

- Bio-Rad Laboratories Inc

- MiRXES Pte Ltd

- Agilent Technologies Inc

- F. Hoffmann-La Roche Ltd

- bioMerieux SA

- Thermo Fisher Scientific Inc

- Illumina Inc

- Vela Diagnostics Holding Pte Ltd

- Myraid Genetics Inc.

Get Free Sample For

Get Free Sample For