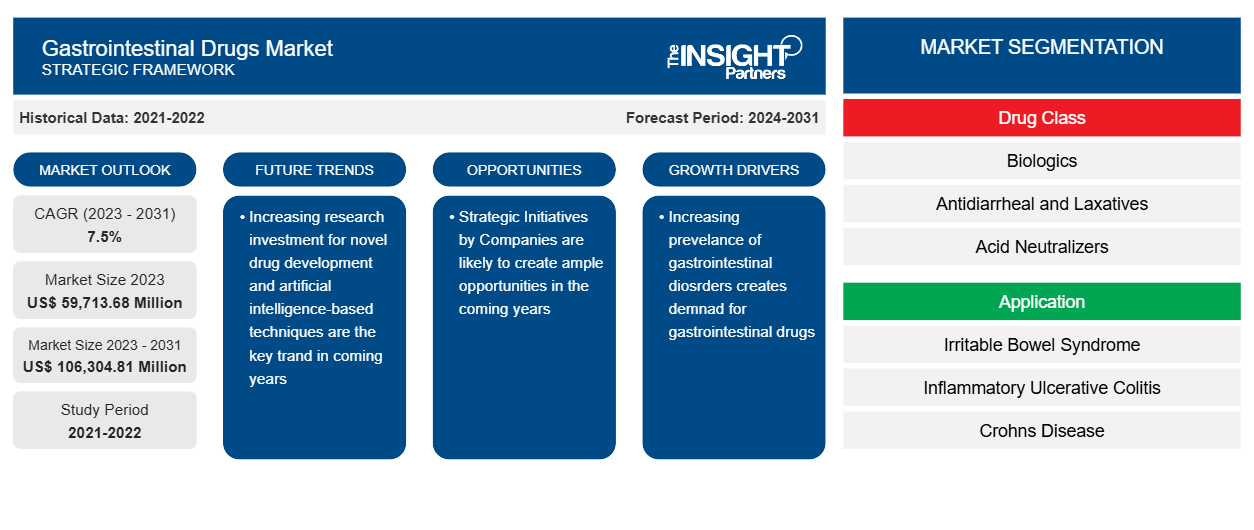

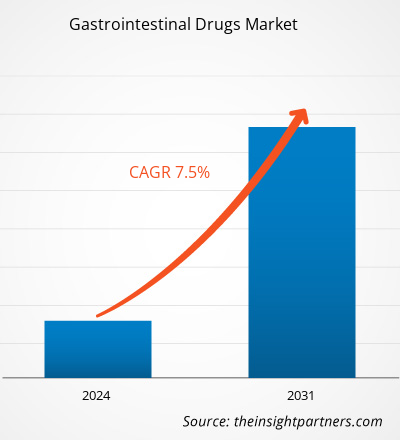

The gastrointestinal drugs market size is projected to reach US$ 106,304.81 million by 2031 from US$ 59,713.68 million in 2023. The market is expected to register a CAGR of 7.5% during 2023–2031. Increasing research investment for novel drug development and artificial intelligence-based techniques is likely to bring new trends in the gastrointestinal drugs market in the coming years.

Gastrointestinal Drugs Market Analysis

The factors driving the gastrointestinal drugs market include the growing cases of chronic constipation among all age groups, a surge in sales of over-the-counter remedies, a growing need for laxatives, and increasing product offerings from manufacturers. Pharmaceutical companies are investing in research and development aimed at creating new and more effective gastrointestinal medications. Rising investments in the development of biologics and the introduction of biosimilars are fueling the expansion of the market for gastrointestinal drugs. The advancements and improved gastrointestinal drugs have resulted in the creation of innovative drugs that offer better results, improved tolerability, and reduced adverse effects. With heightened patient awareness, there is also a greater demand for medications that can effectively manage symptoms and enhance the patient's overall well-being. Moreover, the presence of state-of-the-art medical facilities and high spending on healthcare are boosting the growth of the gastrointestinal drugs market.

Gastrointestinal Drugs Market Overview

The market growth is ascribed to the rising prevalence of gastrointestinal disorders, such as inflammatory bowel disease (IBD) and irritable bowel syndrome (IBS), along with a surge in research and development activities, leading to the innovation of advanced therapeutics for the treatment of various gastrointestinal conditions. In April 2021, Intract Pharma Limited initiated a collaborative research program with Ferring Pharmaceuticals to investigate oral delivery of a monoclonal antibody (mAb) targeting an undisclosed interleukin for the treatment of IBD. The research focuses on the evaluation of Intract’s Phloral and Soteria technologies for precision oral delivery of the therapeutic mAb directly to gastrointestinal tissue to improve efficacy and minimize systemic exposure.

Increasing awareness campaigns in the UK lead to increased awareness among a large population and fuel the demand for gastrointestinal drugs for the treatment of various gastrointestinal disorders. For instance, Takeda Pharmaceuticals created the “In My Shoes” app in collaboration with Crohn’s and Colitis UK to increase awareness about the need for more consistent care for patients suffering from IBD across the country.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Gastrointestinal Drugs Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Gastrointestinal Drugs Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Gastrointestinal Drugs Market Drivers and Opportunities

Improving Development of Biologics Favors Market Growth

In the past few years, there has been a rise in the development of advanced new treatments, such as biologics, which are utilized for the treatment of inflammatory diseases. In addition, biologics have transformed the IBD treatment, and their success in the treatment of these conditions, which supports the use of biologics in other gastrointestinal conditions. Biologics are also effective in treating eosinophilic esophagitis, celiac disease, autoimmune hepatitis, and other gastrointestinal diseases, as they target the disease-causing elements in the immune system. Many ulcerative colitis medications have wide-ranging effects on the immune system. To block such effects of the inflammatory process, biologics are widely used. One such group of biologic drugs for ulcerative colitis is known as anti-TNF drugs that block a protein called tumor necrosis factor-alpha (TNF alpha). This protein promotes inflammation in the intestines and specific other organs. Anti-TNF agents were the first class of biologics to be authorized for IBD treatment and have tremendously changed IBD management. A few types of anti-TNF drugs include Humira, Simponi, and Remicade. A variety of biological drugs can reduce IBD symptoms in adults and help achieve remission. Biologic medications can be an effective substitute to help control the symptoms of ulcerative colitis. The FDA has approved many biologic drugs such as Humira (adalimumab), Cimzia, Simponi (golimumab), Tysabri, Remicade (infliximab), Entyvio (Vedolizumab), and Stelara (ustekinumab) for the treatment of Crohn’s disease and ulcerative colitis.

Many companies are involved in developing a wide range of biological drugs. In July 2020, Takeda Pharmaceutical launched the biologic drug—Vedolizumab—as part of its gastrointestinal portfolio in India. Vedolizumab is sold in the country under the brand name Kynteles. It is used to treat a variety of chronic IBD. Vedolizumab has become the first choice among second-line biologics for the treatment of moderate to severe Crohn's disease and ulcerative colitis patients who have experienced failure with conventional medications or anti-TNF agents. In February 2024, Celltrion Healthcare’s Remsima SC obtained approval from Health Canada for its use as maintenance therapy for IBD. As cases of gastrointestinal disease are on the rise in developing countries, new biologics are introduced in these markets. Thus, the increasing development of biologics for treating gastrointestinal diseases drives the gastrointestinal drugs market.

Strategic Initiatives by Companies

Companies operating in the gastrointestinal drugs market constantly focus on strategic developments, which help them improve their sales, increase their geographic reach, and improve their capacities to cater to a greater than existing customer base. A few strategic initiatives taken by key players operating in the gastrointestinal drugs market are mentioned below:

• On April 19, 2024, Takeda received US Food and Drug Administration (FDA) approval for ENTYVIO (vedolizumab) subcutaneous administration as a maintenance therapy to treat adults suffering from mild to severe active Crohn’s disease. FDA also approved the subcutaneous administration of the same drug in September 2023 for the treatment of adults diagnosed with moderate to severe ulcerative colitis, and it is available as a single-dose prefilled pen in the US.

• In October 2023, Eli Lilly and Company received US FDA approval for Omvoh (mirikizumab) infusion/injection, the first and only interleukin-23p19 (IL-23p19) antagonist for the treatment of moderate to severe ulcerative colitis in adults. Unlike existing treatments, mirikizumab also provides relief from a key symptom—bowel urgency—that significantly impacts patients’ quality of life.

• In September 2023, Vivante Health closed US$ 31 million in a Series B funding round led by Mercato Partners, a new investor, to advance the digital digestive health platform. The new funding is mainly received due to the latest GIThrive platform enhancements that highlight the platform's unique ability to provide proper care at the right time. Series B Capital provides continued technological advancements designed to predict the onset and progression of gastrointestinal conditions and provide complete virtual care.

Therefore, strategic initiatives by various companies focusing on developing drugs for treating digestive diseases are likely to offer lucrative opportunities for the gastrointestinal drugs market growth in the coming years.

Gastrointestinal Drugs Market Report Segmentation Analysis

Key segments that contributed to the derivation of the gastrointestinal drugs market analysis are drug class, application, route of administration, and distribution channel.

- Based on drug class, the gastrointestinal drugs market is categorized into biologics, antidiarrheal and laxatives, acid neutralizers, anti-inflammatory drugs, antiemetic and antinauseants, and others. The biologics segment held the largest share of the market in 2023. The antiemetic and antinauseants segment is expected to register the highest CAGR in the market during 2023–2031.

- By application, the gastrointestinal drugs market is segmented into irritable bowel syndrome, inflammatory ulcerative colitis, Crohn’s disease, gastroenteritis, celiac disease, and others. The irritable bowel syndrome segment held the largest share of the market in 2023. The gastroenteritis segment is projected to register the highest CAGR in the market during 2023–2031.

- Based on route of administration, the market is bifurcated into oral and parenteral. The oral segment held a larger market share in 2023, and it is expected to register a higher CAGR in the market during the forecast period.

- In terms of distribution channel, the gastrointestinal drugs market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominated the market in 2023 and is anticipated to register the highest CAGR during 2023–2031.

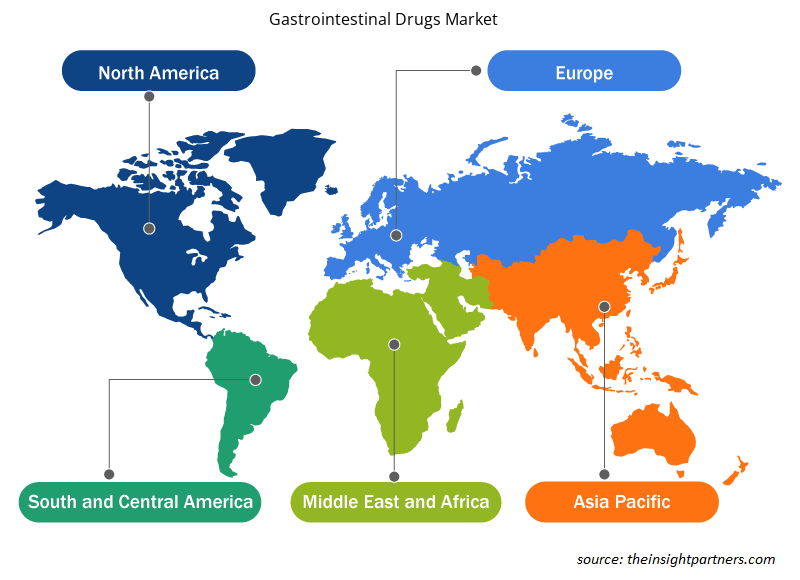

Gastrointestinal Drugs Market Share Analysis by Geography

The geographic scope of the gastrointestinal drugs market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held a significant share of the market in 2023. The growth of the market in this region is attributed to the rising incidence of gastrointestinal diseases and the existence of governmental and nongovernmental organizations supporting research efforts for gastrointestinal treatments. In addition, the involvement of numerous market players, along with different strategic initiatives undertaken by them, are boosting the growth of the market in the region. In addition, easy availability of products and heightened awareness among patients are a few of the other factors contributing to the expansion of the market across North America.

Gastrointestinal Drugs Market Regional Insights

The regional trends and factors influencing the Gastrointestinal Drugs Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Gastrointestinal Drugs Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Gastrointestinal Drugs Market

Gastrointestinal Drugs Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 59,713.68 Million |

| Market Size by 2031 | US$ 106,304.81 Million |

| Global CAGR (2023 - 2031) | 7.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Drug Class

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

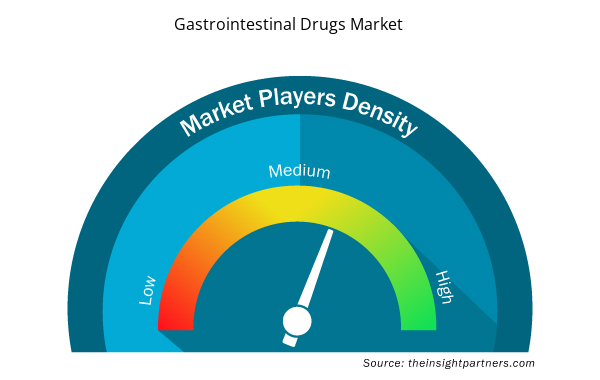

Gastrointestinal Drugs Market Players Density: Understanding Its Impact on Business Dynamics

The Gastrointestinal Drugs Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Gastrointestinal Drugs Market are:

- Sanofi SA

- GSK Plc

- Johnson & Johnson

- Bausch Health Companies Inc

- AstraZeneca Pl,

- Takeda Pharmaceutical Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Gastrointestinal Drugs Market top key players overview

Gastrointestinal Drugs Market News and Recent Developments

The gastrointestinal drugs market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the gastrointestinal drugs market are listed below:

- Bayer Consumer Health introduced Iberogast, a plant-based digestive relief product, to millions of people in the US who experience gut health issues. Formulated with a clinically proven, proprietary six-herb blend, Iberogast harnesses the power of nature to provide dual-action relief for those who experience occasional digestive symptoms by helping to relieve stomach upsets and restore digestive function. (Source: Bayer AG, Press Release, April 2024)

- AbbVie Inc. and Landos Biopharma, Inc. entered into a definitive agreement under which AbbVie acquired Landos, a clinical-stage biopharmaceutical company focused on developing novel oral therapeutics for patients with autoimmune diseases. Landos' lead investigational asset is NX-13, a first-in-class, oral NLRX1 agonist with a bimodal mechanism of action, which is anti-inflammatory and facilitates epithelial repair. (Source: AbbVie Inc., Press Release, March 2024)

Gastrointestinal Drugs Market Report Coverage and Deliverables

The “Gastrointestinal Drugs Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Gastrointestinal drugs market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Gastrointestinal drugs market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Gastrointestinal drugs market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the gastrointestinal drugs market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Drug Class, Route of Administration, Application, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global gastrointestinal drugs market is estimated to register a CAGR of 7.5% during the forecast period.

Sanofi SA, GSK Plc, Johnson & Johnson, Bausch Health Companies Inc, AstraZeneca Plc, Takeda Pharmaceutical Co Ltd, AbbVie Inc, Bayer AG, Pfizer Inc, and Celltrion Inc. are among the key players operating in the gastrointestinal drugs market.

North America dominated the gastrointestinal drugs market in 2023.

The rising incidence of gastrointestinal diseases and increasing development of biologics are the most influential factors responsible for the market growth.

The estimated value of the gastrointestinal drugs market can reach US$ 1,06,304.81 million by 2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Gastrointestinal Drugs Market

- Sanofi SA

- GSK Plc

- Johnson & Johnson

- Bausch Health Companies Inc

- AstraZeneca Plc

- Takeda Pharmaceutical Co Ltd

- AbbVie Inc

- Bayer AG

- Celltrion Inc

- Pfizer Inc

Get Free Sample For

Get Free Sample For