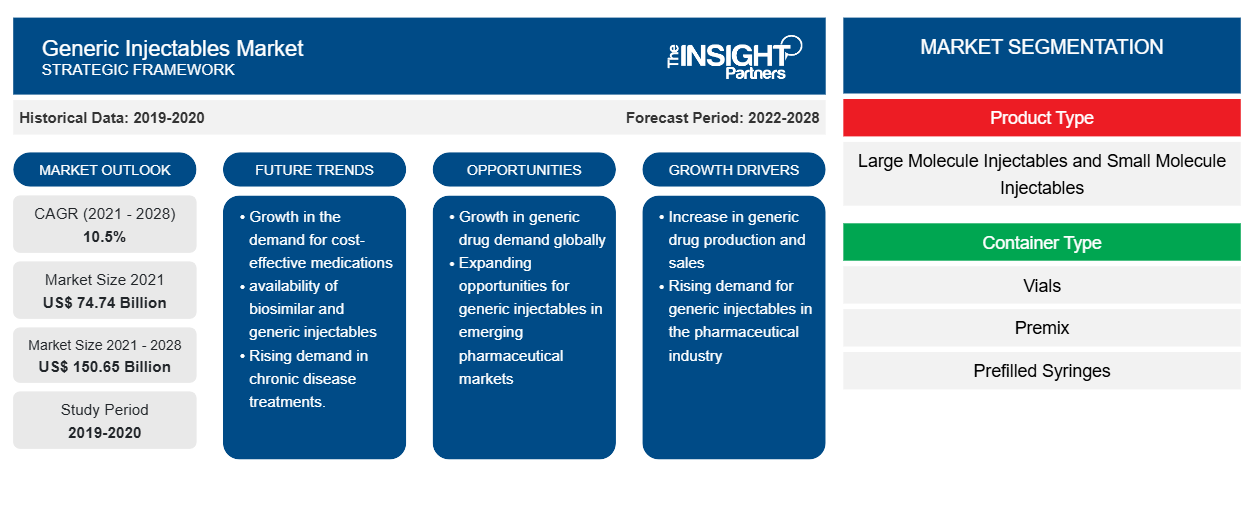

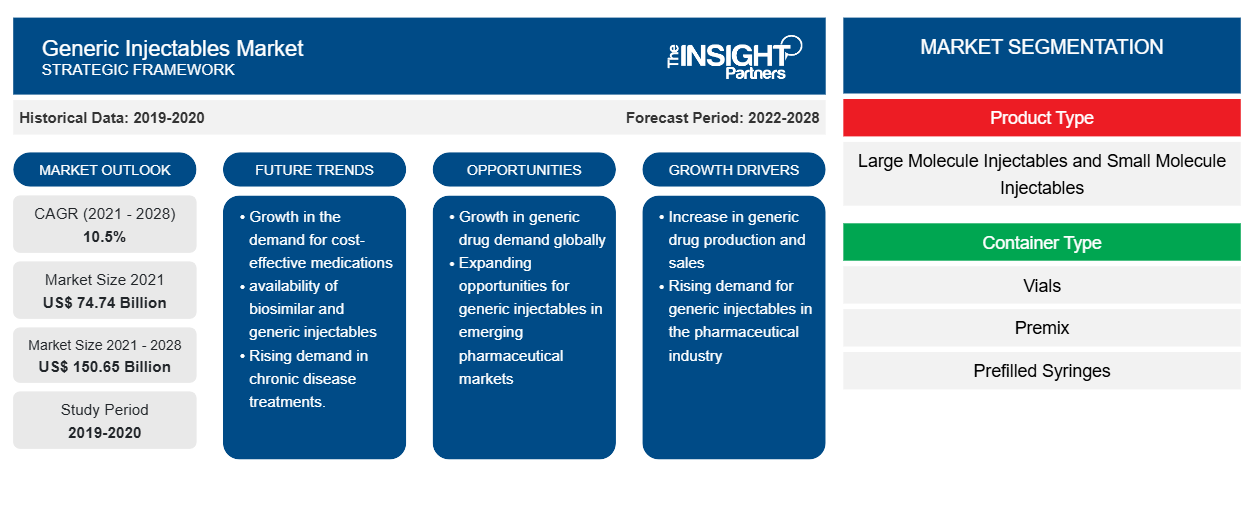

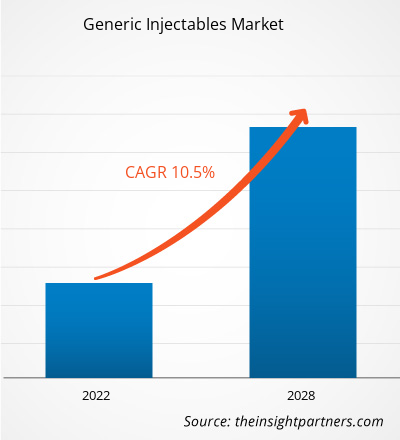

The generic injectables market is projected to reach US$ 150.65 billion by 2028 from US$ 74.74 billion in 2021; it is expected to register a CAGR of 10.5% from 2021 to 2028.

Generic injectables are the bioequivalents of their branded counterparts and are not protected by patents. They are safe and effective as the innovator drugs since they have similar active ingredients, dosages, strength, qualities, form, etc.

The report offers insights and in-depth analysis of the generic injectables market, emphasizing various parameters such as market trends, technological advancements, and market dynamics; it also provides the competitive landscape analysis of leading market players and the impact of the COVID-19 pandemic on the market across all major regions. The COVID-19 pandemic has disrupted the socioeconomic conditions of various countries across the world. As per the recent WHO statistics, the US is the world's worst-affected country due to the pandemic with the highest number of cases. The high number of COVID cases has negatively impacted the economy of the US, and consequently that of North America. There has been a decline in overall business activities and growth of various industries operating in the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Generic Injectables Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Generic Injectables Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

However, there was an unusual demand for Remdesivir, an antiviral medicine used to treat patients, when the outbreak was at its peak. Thus, manufacturers in the generic injectables market are now prepared for the future as they focus on keeping adequate stock for keeping supply chain operations unaffected dur to any type of vulnerabilities. Gilead Sciences and other big pharma companies, for example, have reduced the prices of their generic versions of remdesivir considerably. Companies are utilizing government programs and financing schemes offered by the BFSI industries to streamline their operations. In May 2020, the US government entered into an agreement, worth US$ 812 million, with a group of American generic medicine manufacturers, with the goal of bolstering the country's drug supply amid the global COVID-19 pandemic.

Furthermore, the pandemic strained pharmaceutical industries globally, interrupting and delaying supply of various critical drugs. Many market players came to rescue with immediate actions. For instance, in January 2021, Civica Rx teamed up with the brand-new Phlow Corp. in an effort to support drug manufacturing in the US and supply critical medications to hospitals fighting the pandemic. Civica invested US$ 124.5 million in the construction of a sterile injectable manufacturing facility in Petersburg, Virginia, which rose to prominence last year owing to a large government contract to produce COVID-19-related drugs.

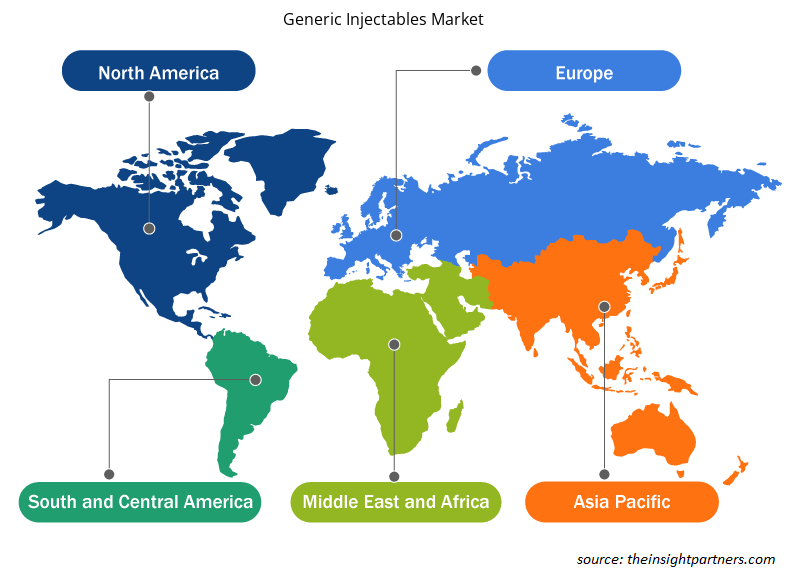

Based on region, the generic injectables market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Market Insights

High Demand for Affordable Drugs Drives Generic Injectables Market

High Demand for Affordable Drugs Drives Generic Injectables Market

Innovator drugs are expensive owing to high investments made in the research & development of molecules; these drugs are specifically unaffordable for a large share of the population in developing countries. However, generic drugs are affordable and provide greater access to healthcare. As published by the Association for Accessible Medicines (AAM), the average primary copay (the amount set by the insurance plans) of a generic drug is US$ 6.06 and US$ 40.30 for branded drugs. This fact indicates the falling prices of generic medicines by at least ~7%. According to the American Association of Retired Person (AARP), branded drug prices continue to increase at a pace that is 100-times greater than inflation. Moreover, as mentioned by the USFDA, 9/10 prescriptions filled in the US are for generic drugs. Additionally, the generic drug’s average manufacturer prices (AMP) are ~39% lower than the branded drug’s AMP. For instance, as published by Association for Accessible Medicines (AAM), 93% of generic prescriptions are filled for US$ 20 or less. The facts mentioned above boost the demand and availability of generic injectables, thus driving the entry of more players into the generic injectables market.

Further, low prices of generic injectables contribute to greater and effective chronic illness treatments. As per the World Health Organization (WHO), ~422 million people worldwide were diabetic in 2021. Generic injectables such as insulin injections offer immediate solutions for such ailments, alongside ensuring affordable treatments in developing countries.

Product Type-Based Insights

Based on product type, the generic injectables market is segmented into large molecule injectables and small molecule injectables. In 2021, the large molecule injectables segment accounted for a greater market share. The market position of this segment is credited to a surge in the adoption of biologics in the healthcare sector, and the progress of monoclonal antibody and antibody-drug conjugates (ADCs) into the drug development.

Container Type-Based Insights

Based on container type, the generic injectables market is segmented into vials, premix, prefilled syringes, ampoules, and others. The vials segment is likely to dominate the market in 2021.

Application-Based Insights

The generic injectables market, based on application, has been categorized into oncology, infectious diseases, cardiology, diabetes, immunology, and others. The oncology segment is likely to hold the largest share of the market in 2021. An increase in cancer incidences and rise in the launch of drugs is anticipated drives the growth of the oncology market segment.

Generic Injectables Market Regional Insights

Generic Injectables Market Regional Insights

The regional trends and factors influencing the Generic Injectables Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Generic Injectables Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Generic Injectables Market

Generic Injectables Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 74.74 Billion |

| Market Size by 2028 | US$ 150.65 Billion |

| Global CAGR (2021 - 2028) | 10.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

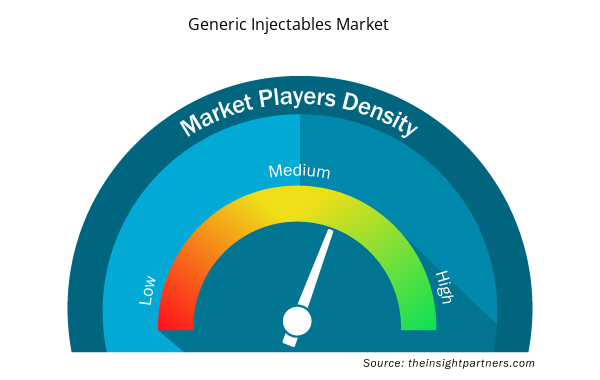

Generic Injectables Market Players Density: Understanding Its Impact on Business Dynamics

The Generic Injectables Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Generic Injectables Market are:

- Astrazeneca

- Baxter International, Inc.

- Biocon

- Fresenius SE & Co. KGaA

- GlaxoSmithKline Plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Generic Injectables Market top key players overview

Route of Administration-Based Insights

Based on the route of administration, the generic injectables market has been categorized into intravenous, intramuscular, subcutaneous, and others. The intravenous segment held the largest market share in 2021.

The generic injectables market players adopt organic strategies such as product launch and expansion to expand their footprint and product portfolio worldwide.

By Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Spain

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

South and Central America (SCAM)

- Brazil

- Argentina

- Rest of SCAM

Company Profiles

- Astrazeneca

- Baxter International, Inc.

- Biocon

- Fresenius SE & Co. KGaA

- GlaxoSmithKline Plc

- Hikma Pharmaceuticals

- Johnson & Johnson Services, Inc.

- Lupin, Ltd.

- Merck & Co., Inc.

- Mylan N.V.

- Pfizer, Inc

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Container Type, Application, and Route of Administration, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Global generic injectables market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In North America, the U.S. is the largest market for generic injectables market. The US is estimated to hold the largest share in the generic injectables market during the forecast period. The presence of top players and favorable regulations related to product approvals coupled with commercializing new products are the contributing factors for the regional growth. Additionally, the increasing number of technological advancements is the key factor responsible for the Asia-Pacific regional growth for generic injectables accounting fastest growth of the region during the coming years.

The oncology segment dominated the global generic injectables market and accounted for the largest revenue of 21.62 Bn in 2021.

Astrazeneca, Baxter International, Inc., Biocon, Fresenius SE & Co., KGaA, GlaxoSmithKline Plc, Hikma Pharmaceuticals, Johnson & Johnson Services, Inc., Lupin, Ltd., Merck & Co., Inc., Mylan N.V., Pfizer, Inc. are among the leading companies operating in the global generic injectables market

Generic Injectables are safe and effective innovator bio-equivalent drugs of their branded counterparts which are not protected by drug patents. They have a similar ingredient, dosage, strength, quality, form, etc.

High demand for affordable drugs is one of the most significant factors responsible for the overall market growth.

Based on product type, large molecule injectables took the forefront leaders in the worldwide market by accounting largest share in 2020 and is expected to continue to do so till the forecast period.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Generic Injectables Market

- Astrazeneca

- Baxter International, Inc.

- Biocon

- Fresenius SE & Co. KGaA

- GlaxoSmithKline Plc

- Hikma Pharmaceuticals

- Johnson & Johnson Services, Inc.

- Lupin, Ltd.

- Merck & Co., Inc.

- Mylan N.V.

- Pfizer, Inc.

Get Free Sample For

Get Free Sample For