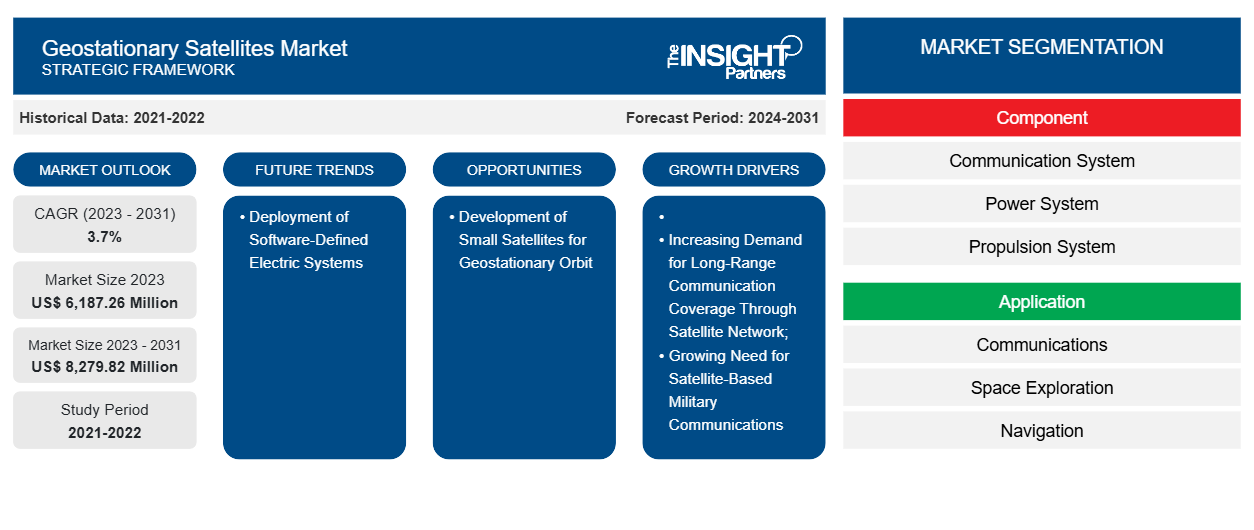

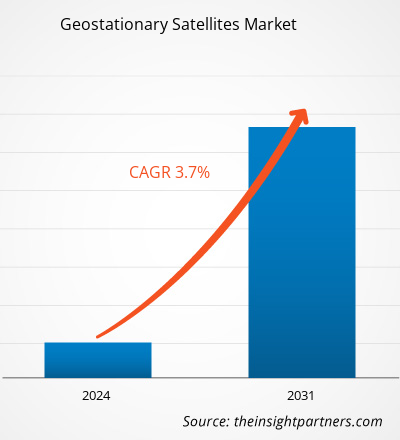

The geostationary satellites market size is projected to reach US$ 8.28 billion by 2031 from US$ 6.19 billion in 2023. The market is expected to register a CAGR of 3.7% during 2023–2031. Deployment of software-defined electric systems is likely to remain a key trend in the market.

Geostationary Satellites Market Analysis

The increasing investment in the space sector boosts the geostationary satellites market growth. For instance, in May 2024, SKY Perfect JSAT, the Japanese flagship operator, ordered a communications satellite from Europe's Thales Alenia Space for launching in 2027. This geostationary satellite will provide broadband connectivity across Japan, Australia, New Zealand, Southeast Asia, and Pacific island countries. JSAT-31 will be based on Thales Alenia Space's software-defined Space INSPIRE (Instant Space In-orbit Reconfiguration) platform, which would enable the operator to adjust its Ka and Ku-band capacity while in GEO to meet changing mission needs. Eiichi Yonekura, SKY Perfect JSAT's president and CEO, said JSAT-31 would have nearly 50 gigabits per second of capacity, the largest in its fleet of 17 satellites.

The geostationary satellites market is witnessing strong growth and development globally in the space sector, owing to their rising adoption in spacecraft. Increased funding and investments in satellite launching programs reflect a growing focus on space exploration, satellite deployment, and space-based services. The public sector propels the demand for heavy- and super-heavy-lift space launch services, whereas the private sector leads the demand for small- and medium-lift satellites. For instance, in April 2023, The Indian Space and Research Organization (ISRO) successfully launched GSAT-29, one of the Geostationary communication satellites, through the Geosynchronous Satellite Launch Vehicle Mark III (GSLV Mk III). GSLV Mk III has successfully launched the satellite in geosynchronous transfer orbit (GTO), which is further placed in the geostationary orbit.

Geostationary Satellites Market Overview

Geostationary satellites revolve in the geostationary orbits that are ~36,000 km above the Earth's equator. These satellites are best known for a wide range of applications, including telecommunication, earth observation, and space exploration. In telecommunication, these satellites are used to improve connectivity and increase internet speed.

The space sector is driven by the rising number of satellite launches and the increasing investments by private and government authorities. In addition, the growing focus on deploying satellites in geostationary orbits is boosting the geostationary satellites market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Geostationary Satellites Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Geostationary Satellites Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Geostationary Satellites Market Drivers and Opportunities

Increasing Demand for Long-Range Communication Coverage Through Satellite Network

The rising need for longer coverage satellites for satellite-based communication operations is driving the demand for geostationary satellites. Several countries have been pushing their respective investments for the procurement of GEO satellites for scheduled space launch programs. For instance:

- In May 2023, SKY Perfect JSAT placed an order for the JSAT-31 satellite to Thales Alenia Space for a launch in 2027 for establishing broadband communication across different APAC locations, including Australia, Japan, Southeast Asia, New Zealand, and the Pacific Islands.

- In March 2024, Astranis announced a new partnership with Orbith, a fast-growing Latin American internet service provider, to provide a dedicated MicroGEO communications satellite for Argentina.

- In March 2024, Thaicom placed an order for a small geostationary satellite from Astranis to provide broadband services across multiple remote locations in Asia. This satellite is expected to be launched in 2025.

- In April 2024, Astranis announced its next-generation product, "Astranis Omega," which is a broadband communications system with better pound-for-pound performance than any other geostationary satellite in orbit. Astranis Omega will offer 50+ Gbps of dedicated, uncontended throughput per satellite. The first satellites are expected to be launched in 2026.

- In August 2023, Astranis announced the launch of UtilitySat, which is the world's first multimission commercial GEO satellite capable of conducting multiple fully operational broadband connectivity missions. UtilitySat can provide connectivity on standard Ku, Ka, and Q/V bands and has the flexibility to dial in exact frequencies using Astranis's proprietary ultra-wideband software-defined radio.

- In July 2023, Astranis announced that it was planning to launch a dedicated satellite for the Philippines, with enough bandwidth to connect up to two million people to reliable, affordable internet in the geostationary orbit.

Therefore, the increasing demand for long-range communication coverage through satellite networks is boosting the procurement and launch of GEO satellites, propelling the growth of the geostationary satellites market across different regions.

Development of Small Satellites for Geostationary Orbit

Satellite manufacturers such as Maxar Space Systems, Astranis, Terran Orbital, SWISSto12, and Saturn Satellite Network have already been focusing on the development of small satellites that can be deployed into the GEO . This will further provide relief to the satellite operators and launch companies, reducing their operational costs for placing a satellite into the GEO orbit with lesser size, weight, and cost of manufacturing. During the conference of" SATELLITE 2020," several satellite companies announced that they have been focusing on the development of smallsat constellations for geostationary orbits that can be deployed through small satellite-specialized launch vehicles, which will ultimately reduce the overall cost of satellite launches and orbit placement of satellites into the GEO orbits. The development of small satellites for deployment into geostationary orbit is likely to generate new opportunities for market vendors in the coming years.

Geostationary Satellites Market Report Segmentation Analysis

Key segments that contributed to the derivation of the geostationary satellites market analysis are component and application.

- Based on component, the global geostationary satellites market is segmented into communication system, power system, propulsion system, and others. The communication system segment held the largest market share in 2023.

- Based on application, the market is divided into communications, space exploration, navigation, Earth observation, and others. The communications segment held the largest share of the market in 2023.

Geostationary Satellites Market Share Analysis by Geography

The geographic scope of the geostationary satellites market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North America region is further classified into US, Canada, and Mexico. In 2023, the US government's space budget reached ~US$ 117 billion, recording an upsurge of 15% compared to 2022. Nearly US$ 59 billion of this investment was made in defense expenditures, including satellite launches. The US leads the geostationary satellites market owing to the prominent presence of several geostationary satellite system manufacturers and government investments in the space sector. Moog Inc., Northrop Grumman Corporation, Lockheed Martin, and AQST Canada Inc. are among the major manufacturers of geostationary satellite solutions in North America. The Government of Canada invests significant resources in the space sector. In 2023, the government announced a multi-year plan to support the privately built rocket launching initiatives in the country. Thus, a surge in investments by governments in the space industry and new product innovations in the space sector are anticipated to propel the geostationary satellites market growth in North America.

The space sector in the US has witnessed significant investments in satellite launches. For instance, in January 2024, the US government launched a satellite constellation award worth US$ 10 billion in the Pentagon, US. The scope of this award includes the launch of more than 400 satellites in space, including the geostationary orbit (GEO) and lower earth orbit (LEO). This contract was awarded to major manufacturers, including Northrop Grumman, Lockheed Martin, and L3Harris. The US led the market in terms of satellite launches in 2023. SpaceX independently launched 98 of the 109 satellite launch attempts made by the US in 2023, and 1,937 of the 2,234 US-built satellites were successfully orbited. The growing number of satellite launches, along with a rise in product development in the satellite industry, is fueling the geostationary satellites market progress in the US. In January 2024, the Geostationary Operational Environmental Satellite U (GOES-U) was ready to launch in Florida, US. The satellite was developed by NASA and the National Oceanic and Atmospheric Administration (NOAA) in continuation of the GOES-R Series for weather observation and environmental monitoring. The GOES-R Series satellite enables forecasters to observe, predict, and track local weather events such as thunderstorms, wildfires, hurricanes, and solar storms. Thus, the emphasis on satellite launches and an upsurge in government budget allocations for the space sector drive the geostationary satellites market growth.

Geostationary Satellites Market Regional Insights

Geostationary Satellites Market Regional Insights

The regional trends and factors influencing the Geostationary Satellites Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Geostationary Satellites Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Geostationary Satellites Market

Geostationary Satellites Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.19 Billion |

| Market Size by 2031 | US$ 8.28 Billion |

| Global CAGR (2023 - 2031) | 3.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Geostationary Satellites Market Players Density: Understanding Its Impact on Business Dynamics

The Geostationary Satellites Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Geostationary Satellites Market are:

- Airbus SE

- The Boeing Company

- Ball Corporation

- Korea Aerospace Industries Ltd

- Lockheed Martin Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Geostationary Satellites Market top key players overview

Geostationary Satellites Market News and Recent Developments

The geostationary satellites market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the geostationary satellites market are listed below:

- Intelsat, the operator of the world's largest integrated satellite and terrestrial network, was selected by Japan Airlines to provide multi-orbit inflight connectivity service on more than 20 Boeing 737 MAX aircraft to be delivered in the coming years. The airline will become one of the first in Asia Pacific to offer reliable, multi-orbit service using Intelsat's new electronically steered array (ESA) antenna. The Intelsat ESA is less than seven centimeters tall and interoperates on both Intelsat's family of geostationary satellites and its partner's constellation of low earth orbit satellites. (Source: Intelsat, Press Release, May 2024)

- Ball Aerospace successfully launched its Tropospheric Emissions: Monitoring of Pollution (TEMPO) instrument aboard a commercial satellite from Cape Canaveral Space Force Station in Florida. TEMPO is NASA's first Earth Venture instrument mission and will provide critical data on air pollution across North America. The TEMPO instrument uses a geostationary ultraviolet/visible spectrometer to determine the concentration and hourly variations of pollutants such as ozone, nitrogen dioxide, and more in the atmosphere. (Source: Ball Aerospace, Press Release, April 2023)

Geostationary Satellites Market Report Coverage and Deliverables

The "Geostationary Satellites Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Geostationary satellites market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Geostationary satellites market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Geostationary satellites market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the geostationary satellites market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The geostationary satellites market is likely to register of 3.7% during 2023-2031.

The estimated value of the geostationary satellites market by 2031 would be around US$ 8.28 billion.

North America region dominated the geostationary satellites market in 2023.

Increasing demand for long-range communication coverage through satellite network and growing need for satellite-based military communications are some of the factors driving the growth for geostationary satellites market.

Airbus SE, The Boeing Company, Ball Corporation, Korea Aerospace Industries Ltd, Lockheed Martin Corporation, Maxar Technologies Inc, Northrop Grumman Corporation, Thales Group, Israel Aerospace Industries Ltd, and OHB SE are some of the key players profiled under the report.

Deployment of software-defined electric systems is one of the major trends of the market.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Geostationary Satellites Market

- Airbus SE

- The Boeing Company

- Ball Corporation

- Korea Aerospace Industries Ltd

- Lockheed Martin Corporation

- Maxar Technologies Inc

- Northrop Grumman Corporation

- Thales Group

- Israel Aerospace Industries Ltd

- OHB SE

Get Free Sample For

Get Free Sample For