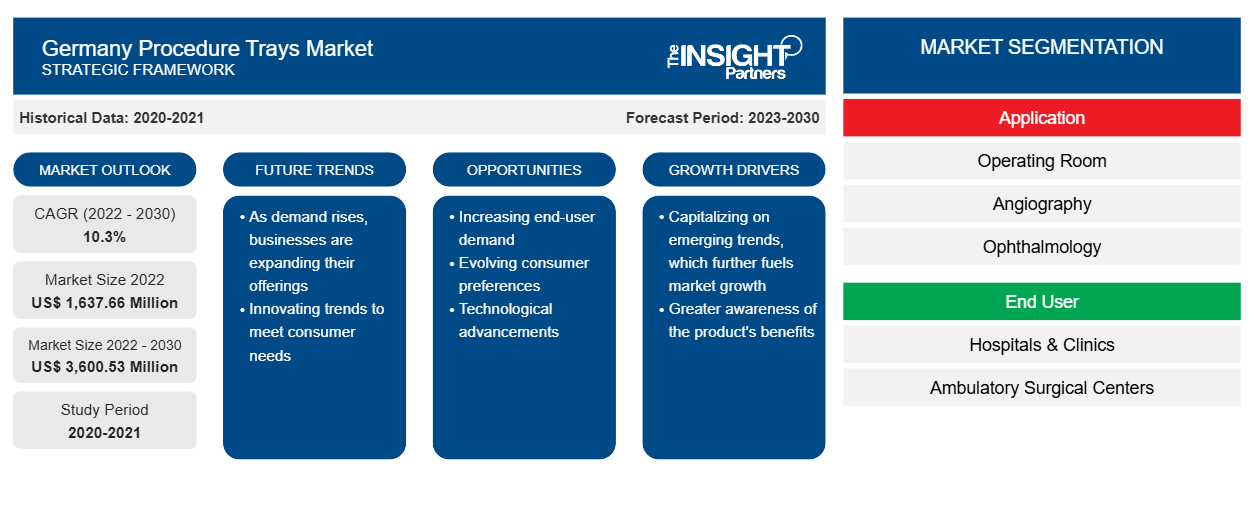

The Germany procedure trays market size is projected to grow from US$ 1,637.66 million in 2022 to US$ 3,600.53 million by 2030; the market is estimated to record a CAGR of 10.3% during 2022–2030.

Market Insights and Analyst View:

A set of prepackaged medical devices used to provide disposable materials in a surgical procedure is called a procedure tray. These trays can be customized as per the surgery, and they are also known as surgical instrument trays (ST). These trays are a very common tool in hospitals, laboratories, and clinics. They are sterile and hence used on a large scale.

The increasing number of surgeries and surge in medical tourism are the key driving factors behind the market development. According to the Medical Tourism Association (MTA), ~14 million people travel to other countries for medical care yearly. The advancements in medical devices and non-invasive surgical procedures are the major factors responsible for the increasing medical tourism. According to the Centers for Disease Control and Prevention (CDC), millions of Americans travel abroad yearly for medical care. Medical tourism destinations for US citizens include Argentina, Brazil, Canada, Colombia, Costa Rica, Cuba, Dominican Republic, Ecuador, Germany, India, Malaysia, Mexico, Nicaragua, Peru, Singapore, and Thailand. According to the MedicalTourism, Germany is one of the world's leading destinations for medical tourism, as it combines high-quality healthcare services with cutting-edge medical technology. Also, travelers who visit Germany for medical tourism are usually from the UAE, Russia, Bulgaria, Romania, France, Saudi Arabia, and Kuwait. On average, 250,000 patients are treated in German hospitals, and from medical tourism, they receive more than 1.2 billion euros annually. According to an article published in the Medical Tourism Journal, European countries offer high-quality and low-cost medical care. Medical technology and pharmaceutical companies in Europe are well-known for providing a cutting-edge research environment for continuous medical innovations. Europe has several major medical clusters that specialize in caring for medical tourists from all over the world. Thus, developments in healthcare services lead to an increase in medical tourism, thereby bolstering the number of surgical procedures, which, in turn, boosts the growth of the procedure trays market.

However, the concerns about the disposal and standardization of procedure trays are hampering the market growth.

Growth Drivers:

Increasing Number of Surgical Procedures Propels Germany Procedure Trays Market Growth

The prevalence of health conditions such as cardiovascular diseases, obstructed labor, injuries, and malignancies trigger the need for surgical procedures. According to the Statistisches Bundesamt (Destatis) data, the number of cesarean sections continues to increase worldwide, and it has nearly doubled over the last 30 years. In 2020, roughly 220,700 women delivered by cesarean section, i.e., nearly one out of three births in hospitals in Germany was by cesarean section. Advances in surgical, anesthetic, and critical care techniques have resulted in a greater proportion of the growing elderly population undergoing surgical procedures. According to the Statistisches Bundesamt (Destatis), the population aged 67 and over in Germany will increase from 4 million to 20 million by 2030.

According to the data provided by the National Institutes of Health (NIH), ~20 million major surgeries are carried out each year in Europe. According to Eurostat, in 2020, ~3.66 million cataract surgeries and ~1.12 million cesarean sections were performed in the European Union (EU). In most EU member countries, the number of cesarean sections performed varied from 200 to 400 per 100,000 habitants in 2020. According to Eurostat, transluminal coronary angioplasties were most common in Croatia and Germany in 2020; on average, the procedures were performed 462 and 384 times per 100,000 inhabitants, respectively. Thus, owing to the increasing number of surgeries, there is a growing demand for procedure trays that are used to hold instruments while performing surgical procedures.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Germany Procedure Trays Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Germany Procedure Trays Market” is segmented on the basis of application and end user. The procedure trays market, by application, is segmented into operating room, angiography, ophthalmology, and others. The operating room segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 10.9% during 2022–2030. Every surgeon and surgical procedure have special requirement for surgical instrument above basic instrument setup; therefore, surgical technicians must understand surgeon-specific requirements. The operating room surgical trays provide instruments according to the surgery needs, reducing the pressure on technical staff and enabling hassle-free surgery. Owens & Minor, Inc. provides custom procedure trays for general surgery, orthopedic procedure, plastic surgery, cardiology/vascular, and others. According to new research from the World Health Organization (WHO), cesarean section procedure rates continue to rise globally, accounting for more than 1 in 5 (21%) childbirths. This number is set to continue increasing over the coming decade, with nearly a third (29%) of all births likely to take place by cesarean section by 2030. According to Eurostat, in 2020, hip replacement surgeries were performed in ~294 people per 1,000 inhabitants in Germany. According to the American Joint Replacement Registry, more than two million hip and knee replacement surgeries were performed in 2021 in the US. Increase in the number of surgeries carried out is fuelling the use of the procedure trays in the operating rooms.

The Germany procedure trays market, by end user, is segmented into hospitals & clinics, ambulatory surgical centers, and others. The hospitals & clinics segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR of 10.7% from 2022 to 2030. Every healthcare facility includes the usage of tool trays. They are utilized in hospitals, laboratories, clinics, and emergency centers.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The procedure trays market, by end user, is divided into hospitals & clinics, ambulatory surgical centers, and others. The hospitals & clinics segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR of 10.7% during 2022–2030. Every healthcare facility includes the usage of tool trays. They are utilized in hospitals, laboratories, clinics, and emergency centers. Hospitals provide health care to people through complicated but specialized scientific equipment. Hospitals are classified as general, specialty, or government, depending on their source of income. The most common form of the hospital is a general hospital, which has an emergency department to deal with medical emergencies and sudden illnesses. Hospitals play an important role in the healthcare system and offer advanced treatment options for patients with chronic and hard-to-heal wounds. Most surgeries are performed in hospitals, as they provide continuous patient care and monitoring. The increasing population has further enhanced the demand for healthcare services, which increases the number of hospitals and staff. Clinics are smaller than hospitals; however, they offer almost all medical services. Most of the time, clinics are associated with universities and offer cost-effective services. People often prefer going to clinics as they provide inexpensive services and create a positive environment for the patient.

Clinics can be run under government services and incorporate groups and other organizations. Clinics have limited appointments and operate in fixed working hours. Surgical instrument trays are a very common tool in hospitals, laboratories, and clinics. They allow easy access to instruments that would otherwise be difficult or impossible without them. Therefore, the procedure trays market for the hospitals & clinics segment is likely to experience significant growth during the forecast period.

Germany Procedure Trays Market, by End User – 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Country Analysis - Germany Procedure Trays Market:

An open, prospective study was performed as a case study in different hospitals in Germany. A total of 11 different Mölnlycke Procedure trays were used. The single-use material process was studied for each hospital, from ordering materials to disposal. The study results showed that following the introduction of Mölnlycke Procedure trays, time-savings in the single-use material process were between 40% and 59% in the hospitals studied.

Furthermore, expanding outpatient surgeries in Germany will propel the procedure trays market in the country. For instance, on June 23, 2022, the National Association of Statutory Health Insurance Physicians (KBV) announced the first steps aimed at expanding the utilization of surgical procedures within day case/outpatient settings. In the first stage, additional funding of around US$ 63.22 million was available from January 1, 2023, leading to an increase in the tariffs of the selected surgical procedures by about 30%. Thus, using procedure trays during various hospital procedures, such as surgeries, helped reduce the time duration required to complete the overall process within the hospital.

The Germany procedure trays market is expected to reach US$ 3,600.53 million in 2030 from US$ 1,637.66 million in 2022. The market is estimated to grow with a CAGR of 10.3% from 2022 to 2030.

Industry Developments and Future Opportunities - Germany Procedure Trays Market:

During 2019–2022, various companies have made organic growth strategies in the Germany procedure trays market. Companies such as Nelipak Corporation have been implementing various strategies that have helped them grow and, in turn, brought about various changes in the Germany procedure trays market. The companies have utilized strategies such as new product launches, partnerships, mergers and acquisitions to expand their geographic reach and capacity to cater to a large number of customers. Some of the developments are listed below:

- In May 2020, Nelipak Healthcare Packaging launched Nelipak Academy, a seven-part educational webinar series. The free series covers various topics, including automated handling trays, NeliSim, polymer basics and film properties, rigid barrier packaging design, lab testing services, and heat seal coating technology.

- In October 2022, Pioneering med-tech company BD India partnered with the Government of India’s renowned research organization, Raja Ramanna Centre for Advanced Technology (RRCAT), to sterilize its medical device—Venflon Pro—by electron beam (e-beam) technology at RRCAT’s Indore facility. It is the only facility approved by regulatory authorities for irradiation of class A and Class B medical devices in India and is also ISO-13485 certified.

- In October 2019, 3M completed the acquisition of Acelity, Inc. and its KCI subsidiaries worldwide from a consortium comprised funds advised by Apax Partners, together with controlled affiliates of the Canada Pension Plan Investment Board (CPPIB) and the Public Sector Pension Investment Board (PSP Investments) for a total enterprise value of ~US$ 6.7 billion, including the assumption of debt and other adjustments.

- In January 2022, ICU Medical Inc. acquired Smiths Medical from Smiths Group plc. The Smiths Medical business includes syringes, ambulatory infusion devices, vascular access, and vital care products. Combined with ICU Medical’s existing businesses, the companies create a leading infusion therapy company with estimated pro forma combined revenues of approximately US$ 2.5 billion.

- In December 2021, Owens & Minor, Inc. acquired American Contract Systems (ACS), a Minnesota-based provider of kitting and sterilization services for Custom Procedure Tray (CPT) solutions. This acquisition will enhance combined abilities to serve customers with a stronger CPT offering.

Competitive Landscape and Key Companies - Germany Procedure Trays Market:

McKesson Corp, Becton Dickinson and Company, Capsa Solutions LLC, Omnicell Inc, Oracle Corp, Deenova Srl, ScriptPro LLC, Veradigm LLC, Innovation Associates, YUYAMA Manufacturing Co Ltd, and Swisslog Healthcare AG are the prominent Germany procedure trays market companies. These companies focus on new technologies, existing product advancements, and geographic expansions to meet the growing consumer demand worldwide.

Germany Procedure Trays Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,637.66 Million |

| Market Size by 2030 | US$ 3,600.53 Million |

| CAGR (2022 - 2030) | 10.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Application

|

| Regions and Countries Covered |

Germany

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Who are the key players in the Germany procedure trays market?

Which application segment held the largest market share in the Germany procedure trays market?

What are the driving factors for the procedure trays market across the Germany?

Which segment led the Germany procedure trays market?

What is meant by the procedure trays?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For