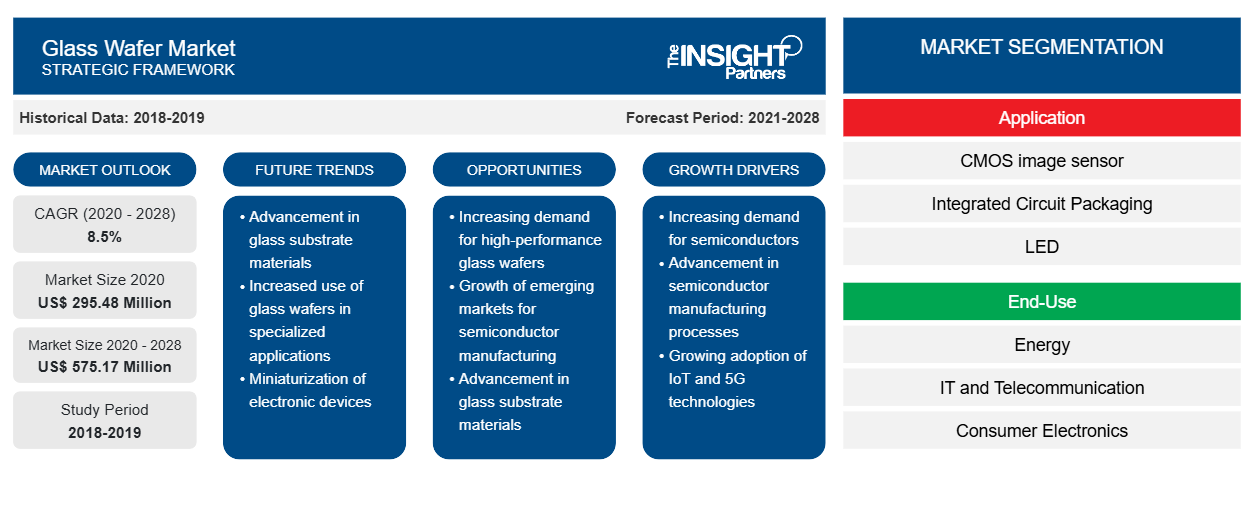

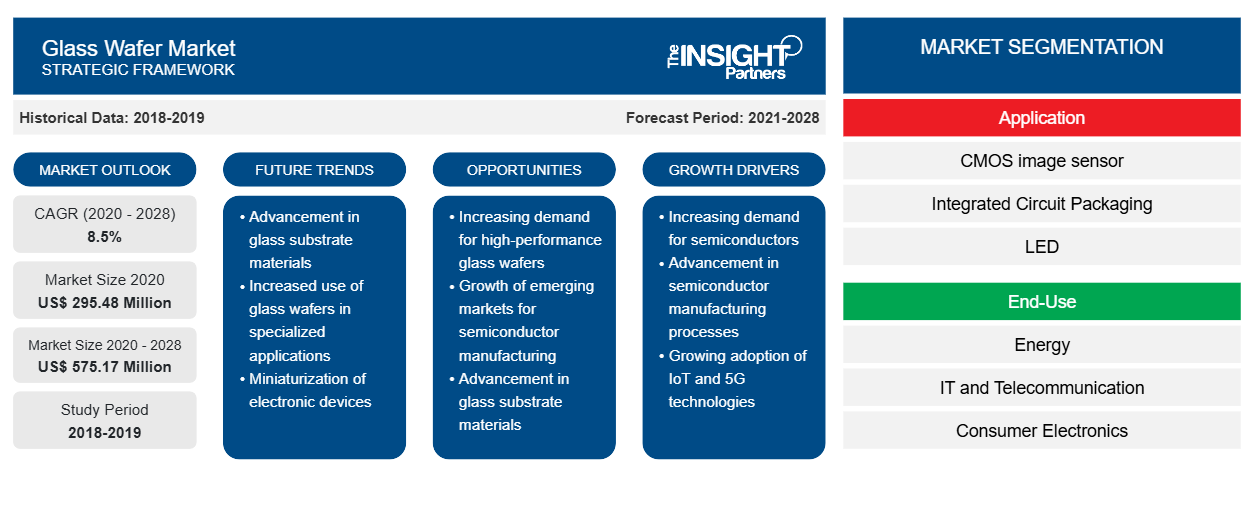

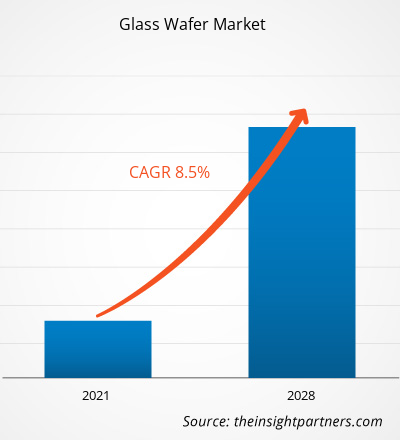

The glass wafer market was valued at US$ 295.48 million in 2020 and is projected to reach US$ 575.17 million by 2028; it is expected to grow at a CAGR of 8.5% from 2020 to 2028.

A glass wafer is a thin disc that is used as a base for manufacturing integrated circuits and for protection in consumer electronics. The glass wafer is usually made up of quartz, borosilicate glass, or fused silica. These wafers are used in a wide variety of industrial and technical applications. Borosilicate glass wafers provide a higher chemical stability against water or any other type of chemical. The rise in demand for compact and advanced consumer electronic devices is going to drive the growth of the glass wafer market. The increase in the demand for automotive electronics because of electric and hybrid vehicles, will lead to an increase in demand for glass wafers.

In 2020, Asia Pacific contributed to the largest share in the global glass wafers market. The dominance of this region is primarily attributed to rapid growth in the automotive and electronics industry in the region. The exponential growth in the industrial sector, including automotive, medical, and others, has influenced the demand for glass wafers. Asia is one of the leading electrical and electronics manufacturing regions.

The COVID-19 outbreak was first reported in Wuhan (China) during December 2020. As of January 2021, the US, India, Brazil, Russia, France, the UK, Turkey, Italy, and Spain are among the worst affected countries in terms confirmed cases and reported deaths. According to the latest WHO figures updated on January 2021, there are ~83,322,449 confirmed cases and 1,831,412 total deaths globally. The outbreak is adversely affecting economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The global chemicals & materials industry is one of the major industries suffering serious disruptions such as supply chain breaks, technology events cancellations, and office shutdowns. Although, China is the global manufacturing hub and largest raw material supplier for various industries, it is also one of the worst affected countries. The lockdown of various plants and factories in China is restricting the global supply chains and disrupting the manufacturing activities, delivery schedules, and various chemicals and materials sales. Various companies have already announced possible delays in product deliveries and slump in future sales of their products. In addition, the global travel bans imposed by countries in Europe, Asia, and North America are hindering the business collaborations and partnerships opportunities. All these factors are hampering the chemicals & materials industry, thus restraining the growth of various markets related to this industry.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Glass Wafer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Glass Wafer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Demand for MEMs

There is increase in demand for Micro-Electro-Mechanical Systems (MEMS) across the world, owing to their applications in communication systems, automotive sensors, as well as portable medical devices. The miniature design of these MEMs makes them a suitable for use in all electronic devices, which has increased the application of MEMs. Glass wafers are mostly used in wafer packaging of sensitive components, owing to their superior functionality, reliability, and capacity to withstand harsh environments. These glass wafers are also used as carrier substrates due to their chemical resistance and thermal stability. The demand for portable medical equipment, which includes patient monitoring devices, has been on the rise during the pandemic, owing to the increased usage and demand by health workers across the world. The COVID-19 pandemic has boosted the demand for personal monitoring devices among the consumers. These devices are integrated with MEMS. Hence, there is an increase in demand for MEMs, which in turn is propelling the growth of the glass wafers market.

Application Insights

Based on application, the glass wafer market is segmented into CMOS image sensor, integrated circuit (IC) packaging, LED, Microfluidics, FO-WLP, and mems and RF. The CMOS image sensor segment led the market with the largest share in 2020. An image sensor or imager is a sensor that detects and conveys information, which are used to make an image. There are two types of electronic image sensors that are charge-coupled device (CCD) and active-pixel sensor (CMOS sensor). Active pixel sensor is an image sensor in which every pixel sensor has a photodetector. Different types of active pixel sensor include the early NMOS APS and the common one that is the complementary MOS(CMOS) APS, which is known as the CMOS sensor, and is widely used in digital camera technologies as well as in cellphones. CMOS image sensor has various properties such as low power consumption, high integration, and fast IO readout speed due to which it has become one of the most widely used sensors.

A few key market players operating in the glass wafer market are SCHOTT AG; AGC Inc.; Corning Incorporated; Plan Optik AG; Shin-Etsu Chemical Co., Ltd; Samtec, Inc; Bullen; Nippon Electric Glass; Swift glass; and Coresix Precision Glass, Inc. Major players in the market are focusing on strategies such as mergers and acquisitions and product launches to expand the geographical presence and consumer base globally.

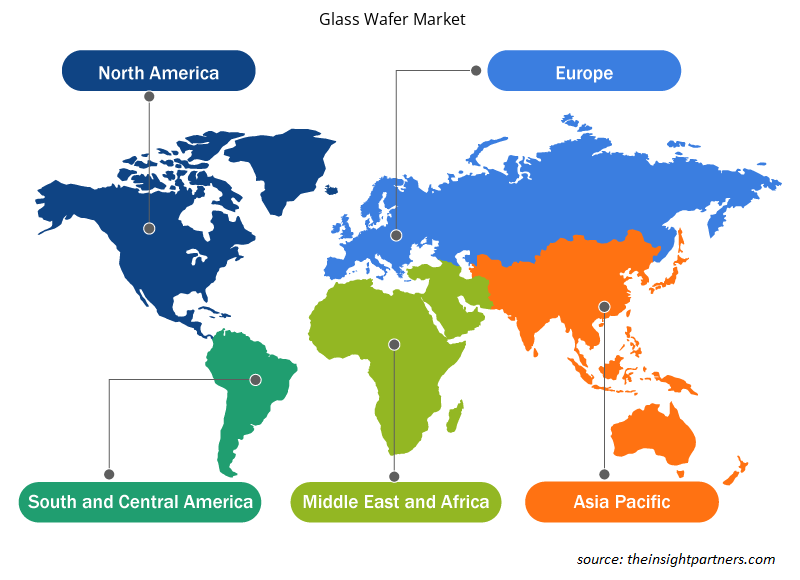

Glass Wafer Market Regional Insights

The regional trends and factors influencing the Glass Wafer Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Glass Wafer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Glass Wafer Market

Glass Wafer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 295.48 Million |

| Market Size by 2028 | US$ 575.17 Million |

| Global CAGR (2020 - 2028) | 8.5% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

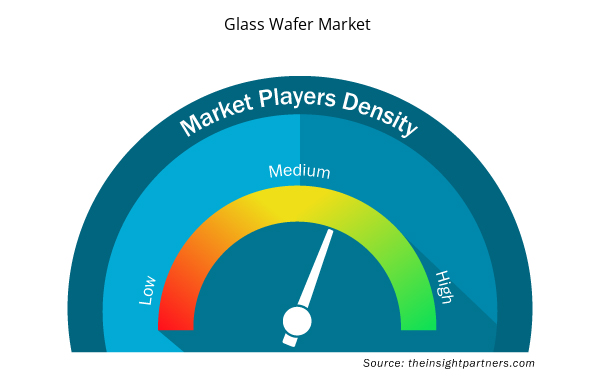

Glass Wafer Market Players Density: Understanding Its Impact on Business Dynamics

The Glass Wafer Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Glass Wafer Market are:

- SCHOTT

- AGC Inc.

- Corning Incorporated

- Plan Optik AG

- Bullen

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Glass Wafer Market top key players overview

Report Spotlights

Progressive industry trends in the global

- glass wafer market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the global glass wafer market from 2017 to 2028

- Estimation of the demand for glass wafer across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and the demand for glass wafer

- Market trends and outlook coupled with factors driving and restraining the growth of the glass wafer market

- Decision-making process by understanding strategies that underpin commercial interest with regard to global glass wafer market growth

- Glass wafer market size at various nodes of market

- Detailed overview and segmentation of the global Glass wafer market as well as its dynamics in the industry

- Glass wafer market size in various regions with promising growth opportunities

Glass wafer Market, by Application

- CMOS Image Sensor

- Integrated circuit (IC) packaging

- LED

- Microfluidics

- FO-WLP

- MEMS and RF

- Others

Glass wafer Market, by End-Use

- Energy

- IT and Telecommunication

- Consumer Electronics

- Aerospace and Defense

- Automotive

- Healthcare and Biotechnology

- Others

Company Profiles

- SCHOTT AG

- AGC Inc.

- Corning Incorporated

- Plan Optik AG

- Shin-Etsu Chemical Co., Ltd

- Samtec, Inc.

- Bullen

- Nippon Electric Glass

- Swift glass

- Coresix Precision Glass, Inc

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application Packaging and End-Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, Spain, United Kingdom, United States

Frequently Asked Questions

Among the seven segments of application, CMOS image sensor segment led the market with the largest share in 2020. An image sensor or imager is a sensor that detects and conveys information, which are used to make an image. There are two types of electronic image sensors that are charge-coupled device (CCD) and active-pixel sensor (CMOS sensor). Active pixel sensor is an image sensor in which every pixel sensor has a photodetector. These sensors are widely used in cameras and cellphones, the growing demand for these products is expected to drive the glass wafers market.

The major players operating in the global glass wafer market are SCHOTT AG; AGC Inc.; Corning Incorporated; Plan Optik AG; Shin-Etsu Chemical Co., Ltd; Samtec, Inc; Bullen; Nippon Electric Glass; Swift glass; and Coresix Precision Glass, Inc.

In 2020, the glass wafer market was predominant by Asia Pacific at the global level. The dominance of this region is primarily attributed to rapid growth in the automotive and electronics industry in the region. The exponential growth in the industrial sector, including automotive, medical, and others, has influenced the demand for glass wafers. Asia is one of the leading electrical and electronics manufacturing regions.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Glass Wafers Market

- SCHOTT

- AGC Inc.

- Corning Incorporated

- Plan Optik AG

- Bullen

- Nippon Electric Glass Co., Ltd.

- SAMTEC, Inc.

- Shin-Etsu Chemical Co., Ltd

- Coresix Precision Glass, Inc.

- Swift Glass

Get Free Sample For

Get Free Sample For