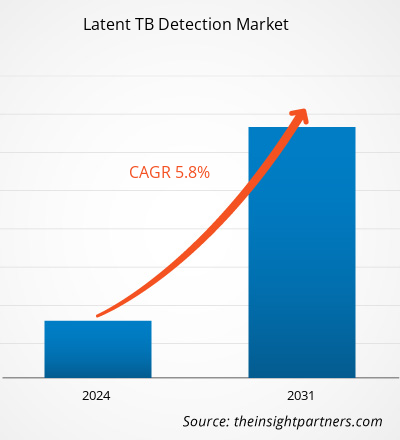

The latent TB detection market size was estimated to be US$ 1.23 billion in 2021 and US$ XX billion in 2023 and is expected to reach US$ 2.00 billion by 2031; it is estimated to record a CAGR of 5.8% in 2023–2031. Government initiatives to promote tuberculosis detection and advancements in tuberculosis diagnosis are driving factors. Outsourcing locations for tuberculosis diagnosis will likely remain key latent TB detection market trends.

Latent TB Detection Market Analysis

In low-middle-income nations, where TB prevalence is high, have inadequate healthcare services, limited drug supply, underdiagnosed cases, and a lack of registered cases by the community due to lacking information, all of which contribute to an increase in TB cases. Globally, an estimated 10 million people develop TB, and over a million deaths occur annually. India accounts for more than 25% of the global TB burden, with an estimated TB incidence of 2.77 million in 2022. Furthermore, as per the field study in Indonesia, the population residing in rural areas had restricted information about TB causes and transmission, leading to stigma in the community towards TB patients. Therefore, the Indonesian Ministry of Health has declared that Indonesia must be free of TB by 2035. Furthermore, in 2021, Southeast Asia reported almost half of TB cases globally, reporting 4.82 million or 45.4%.

Latent TB Detection Market Overview

Asia Pacific is the fastest-growing market for Latent TB Detection. The growth is mainly urged by the increasing prevalence of TB, increasing government initiatives to eliminate TB infection and adoption of advanced diagnostic products. New latent TB test kits, IGRA, provide more accurate results than tuberculin skin tests. The country has launched the Chinese Infectious and Endemic Disease Control (IEDC) TB Project to control the TB infection. The IEDC project achieved huge success. As a result, between 1990 and 2000, the number of people with TB declined by 36.1%. However, despite the achievements of the IEDC project, there were still problems with the TB control program in China.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Latent TB Detection Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Latent TB Detection Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Latent TB Detection Market Drivers and Opportunities

Government Initiatives to Promote Tuberculosis Detection

Evidence from various sources such as the World Health Organization (WHO) and the United Nations (UN) exhibits that countries such as India and Indonesia in the Asia Pacific are highly crowded by TB patients. Thus, these countries' government bodies are adopting certain schemes and initiatives to contain the disease. For instance, the Indian National Strategic Plan (NSP), which aims at eliminating TB, was established from 2017 to 2025; it institutes several patient support groups, protection measures, free TB diagnostic tests, and treatment for Indians. Furthermore, In May 2019, the Centers for Disease Control and Prevention (CDC) and the National Tuberculosis Controllers Association (NTCA) released updated recommendations on the frequency of TB screening, testing, and treatment for healthcare personnel.

Advancements in Tuberculosis Diagnosis – An Opportunity

Manufacturers and researchers consistently work toward finding new and viable solutions based on potent technologies to diagnose TB accurately. For instance, in July 2020, together, Cepheid, Inc. and The Foundation for Innovative New Diagnostics (FIND) established a new drug-resistant tuberculosis profiling test that provides results in 90 min. Moreover, the accessibility of blood-based diagnostics in interferon γ release assays (IGRAs) has relieved clinicians delivering dependable test results for detecting latent TB infection with high specificity and sensitivity. Newer latent TB test kits, Interferon-Gamma Release Assays (IGRAs), deliver more accurate results than the century-old tuberculin skin test.

The adoption of latent TB detection diagnosis has increased significantly across various North American, European, and Asian countries.

Latent TB Detection Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Latent TB Detection market analysis are product type, portability, treatment type, application, and end user.

- Based on the test, the latent TB detection market is segmented into tuberculin skin test (TST) and interferon-related gamma assay (IGRA). The interferon-related gamma assay (IGRA) segment held the largest share of the market in 2023. Also, the similar segment is estimated to register the highest CAGR in the market during the forecast period.

- Based on end users, the latent TB detection market is segmented into hospitals, diagnostic centers, laboratories, and others. The hospitals segment held the largest share of the market in 2023. Moreover, the same segment is estimated to register the highest CAGR in the market during the forecast period.

Latent TB Detection Market Share Analysis by Geography

The geographic scope of the Latent TB Detection market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

Asia Pacific is predicted to grow with the highest CAGR in the coming years in the Latent TB Detection market. The growth in Asia Pacific is characterized by rising TB cases and increasing government initiatives. As per the World Health Organization's estimation, one-fourth of the global population is ill with Mycobacterium tuberculosis, and 5-10 percent of those who are infected will develop active tuberculosis. Out of which, India has 27% of global tuberculosis patients. Therefore, initiatives are taking place. For instance, the National Tuberculosis Elimination Programme included the Cy-TB test on the Ni-kshay platform. This marks a leap forward in the country’s tuberculosis control.

Latent TB Detection Market Regional Insights

The regional trends and factors influencing the Latent TB Detection Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Latent TB Detection Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Latent TB Detection Market

Latent TB Detection Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1.23 Billion |

| Market Size by 2031 | US$ 2.00 Billion |

| Global CAGR (2023 - 2031) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Test

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

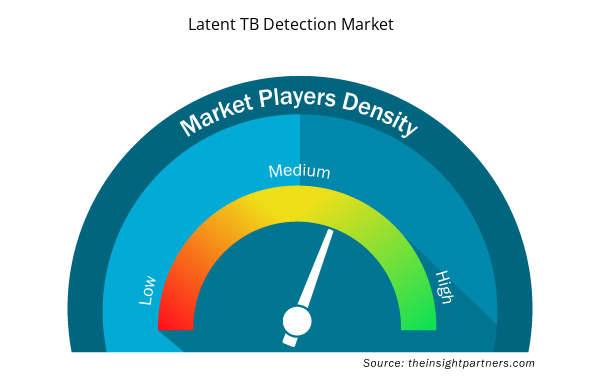

Latent TB Detection Market Players Density: Understanding Its Impact on Business Dynamics

The Latent TB Detection Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Latent TB Detection Market are:

- QIAGEN

- BioMeriux S.A.

- F. Hoffmann La-Roche Ltd.

- BD

- ARKRAY, Inc.

- Abbott

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Latent TB Detection Market top key players overview

Latent TB Detection Market News and Recent Developments

The latent TB detection market is evaluated by gathering qualitative and quantitative data from primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for latent TB detection:

- Serum Institute of India (SII) and Mylab Discovery Solutions launched a point-of-care skin test for detecting latent tuberculosis infections (LTBI) at a cost the companies claimed to be 50-70 percent lower than comparable tests available. Through several interventions, this partnership works on tuberculosis diagnosis, treatment, and prevention. (Source: Serum Institute of India (SII)/Press Release, October 2023)

- Mylab launches kit for detecting TB, multidrug resistance variant in a single test. The kit has been named PathoDetect MTB RIF and INH drug resistance kit. This RT-PCR-based kit for accurate detection will be used with Mylab Compact device systems, which will allow automated testing of multiple samples within two hours. (Source: Reveal Lasers, Press Release, October 2023)

Latent TB Detection Market Report Coverage and Deliverables

The “Latent TB Detection Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Test and Interferon Gamma Released Assay ); End User and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For