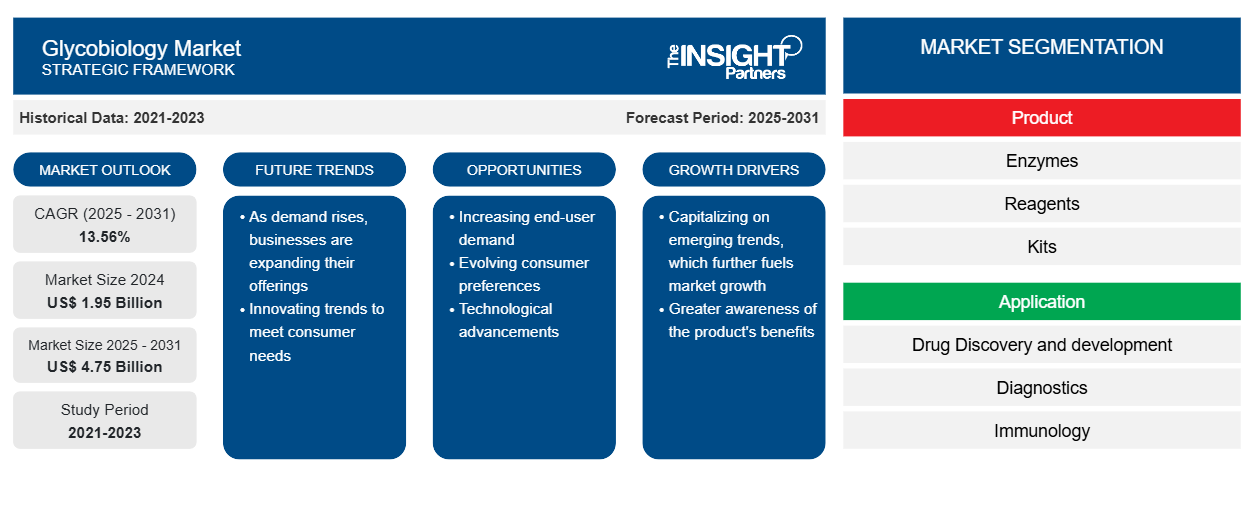

[Research Report] The glycobiology market size is projected to grow from US$

1,512.96 million in 2022 to US$ 4,178.93 million by 2031; the market is estimated to record a CAGR of 13.56% during 2022–2031.

Market Insights and Analyst View:

Glycobiology is the study of the structure, biology, biosynthesis, and evolution of saccharides (also called carbohydrates, sugar chains, or glycans) that are widely distributed in nature and of the proteins that recognize them. Glycobiology is used in diagnostics, drug discovery research, immunology, oncology, and other applications. Technological advancements in glycomic instruments are among the significant factors driving the global market. Rising investment in research by the government, along with the increasing focus of pharmaceutical and biotechnology companies on novel drug development, is further contributing to the expansion of the glycobiology market. In addition, the rising focus on glycobiology research studies is also contributing to the growth of the market. For instance, the University of California is making significant efforts to advance clinical glycomics. In September 2021, Investigators at the University of California San Diego developed a tool that permits glycomics datasets to be examined using AI and other machine learning methods. The investigators named the approach as GlyCompare. It takes a systems-level perception that accounts for shared biosynthetic pathways of glycans within and across samples. With this approach, the researchers aim to develop clinical breakthroughs in cancer diagnostics.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Glycobiology Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Glycobiology Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growth Drivers:

Increased Glycomics Research and Expanding R&D Investments Bolsters Glycobiology Market Growth

Glycomics is the study of glycans, or sugar structures, found in the human body. These glycans, which may be exceedingly complex, are found in many microbiome components, such as proteins and cell surfaces. Researchers and market players are actively involved in the glycomics industry and are continuously focusing on advancing technologies that can offer better alternatives to conventional techniques. For instance,

- In April 2021, the Government of Canada announced US$ 10 million in federal funding over the next seven years by appointing glycomics researcher Lara Mahal as a Canada Excellence Research Chair (CERC) at the University of Alberta.

- In December 2019, The National Health and Medical Research Council (NHMRC) gave US$ 2.66 million in Ideas Grant funding to Griffith University's Institute for Glycomics to support 4 crucial glycomics research projects.

- In June 2021, The Bioprocessing Technology Institute (BTI), a research organization run by Singapore's Agency for Science, Technology, and Research (A*STAR), and the Waters Corporation expanded their collaborative efforts. To ensure the overall safety, accuracy, and efficiency of biologics manufacturing, Waters and BTI have begun work on one of their new joint projects: deploying analytics that can quickly identify and display complicated chemicals within glycomics and metabolomics data.

- Genos is the top laboratory in the world for high-throughput glycan analytics, and at its current rate of over 30,000 studies annually, it has examined more than 150,000 distinct glycomes. Non-dilutive grant funds of US$ 23.43 million were given to Genos, of which 15 million euros were spent for IgG research over ten years, resulting in more than 100 scientific articles being published. The research team behind Genos is using a systems biology approach to integrate vast genetic, epigenetic, biochemical, and physiological data with glycomic data.

- In March 2022, Japanese researchers uncovered the precise mechanism of a beta-1,2-glucan-associated enzyme, providing new information on complicated sugar metabolism. A team of researchers from Niigata University and Tokyo University of Science has recently identified the structure and function of a new enzyme with glycosyltransferase activity. The findings of this investigation were made public on January 19, 2022, and were printed in the Journal of Biological Chemistry, Volume 298, Issue 3.

- According to a study published in February 2022 by researchers at the University of Copenhagen's Center for Glycomics, Heparin can now be produced without using animal through glycomics studies.

- In June 2022, Thermo Fisher Scientific Inc. and TransMIT GmbH Center for Mass Spectrometric Developments established a co-marketing partnership to promote the use of mass spectrometry imaging (MSI) technology for spatial multi-omics applications in pharma and clinical laboratories. This instrument can be used for omics applications, such as pharmaco-kinetic research in various tissues, metabolomics, lipidomics, proteomics, and glycomics.

These advancements and the rising investments are propelling the glycobiology market significantly.

Report Segmentation and Scope:

The “Glycobiology Market” is segmented based on product, application, and end user. Based on product, the market is categorized into enzymes, reagents, kits, and instruments. The enzyme segment is sub-segmented into glycosidases, glycosyltransferases, Sialyltransferases, neuraminidases, and others. In terms of application, the glycobiology market is segmented into drug discovery and development, diagnostics, immunology, cancer, and others. Based on end users, the market is categorized into pharmaceutical and biotechnology companies, academic and research institutes, and contract research organizations.

Segmental Analysis:

Based on product, the glycobiology market is segmented into enzymes, reagents, kits, and instruments. In 2022, the enzyme segment held a significant market share, and the same segment is estimated to register the fastest CAGR during 2022–2031. The major driving factors for the product segment's growth are the growing need for drug discovery and development, increasing preference for relatively efficient instruments, and rising adoption of advanced analytical methods such as high-performance liquid chromatography (HPLC), mass spectrometry (MS), and others. The enzyme segment is sub-segmented into glycosidases, glycosyltransferases, Sialyltransferases, neuraminidases, and others. The glycosidases segment is expected to hold the largest share in 2022, and the same segment is expected to grow with the highest CAGR during the forecast period. The major driving factors for the growth of the enzymes segment are developing applications in molecular biology, protein engineering, and diagnostics and increasing research activities in the life science industry.

Based on the application, the glycobiology market is segmented into drug discovery and development, diagnostics, immunology, cancer, and others. In 2022, the drug discovery and development segment held the largest share of the market. However, the diagnostics segment is anticipated to grow with the highest CAGR during 2022-2031. The major driving factors for the growth of the application segment are increasing research for orphan and rare diseases, rising need for drug development, and growing awareness about early diagnosis. The increasing prevalence of infectious and rare diseases is boosting the demand for state-of-the-art diagnostic systems. Technological advancements enabled healthcare systems from different countries to diagnose these diseases effectively. In addition to continuous R&D activities and significant investments, the increasing focus on reagents and kit formulation development for glycomics studies contributes substantially to the launch of rapid and reliable diagnostics. Glycan analysis is used to diagnose infectious diseases by providing an efficient way to release and label glycoforms of antigens and antibodies. Moreover, the COVID-19 pandemic led to an increased demand for disease testing to identify the variants of SARS-CoV-2, as the virus has been mutating significantly in various geographic locations worldwide. Thus, the increasing incidence of infectious diseases leading to diagnosis is expected to propel the segment's growth.

Based on end users, the glycobiology market is segmented into pharmaceutical and biotechnology companies, academic and research institutes, and contract research organizations. In 2022, the pharmaceutical and biotechnology companies segment held a significant share of the market, and the same segment is estimated to register the fastest CAGR during 2022–2031. The major driving factors for the growth of the end-user segment are the increasing need for novel treatment solutions for a broad range of health disorders and growing market consolidation. The rise in the demand for pharmaceutical and biotechnological products has resulted in massive market consolidations between biotechnology and pharmaceutical companies for enhanced and better treatment options. The growing investments made by companies have grown the market's pharmaceutical and biotechnology companies segment. For instance, in March 2021, Agilent Technologies acquired Resolution Bioscience, a genomic sequencing solutions provider, for up to US$ 695 million. This acquisition was aimed at enhancing Agilent's product offerings in the molecular diagnostics market, including liquid biopsy-based cancer detection. Thus, such inorganic strategies followed by companies for better utilization of opportunities to cater to customers are expected to boost the growth of this segment during the forecast period.

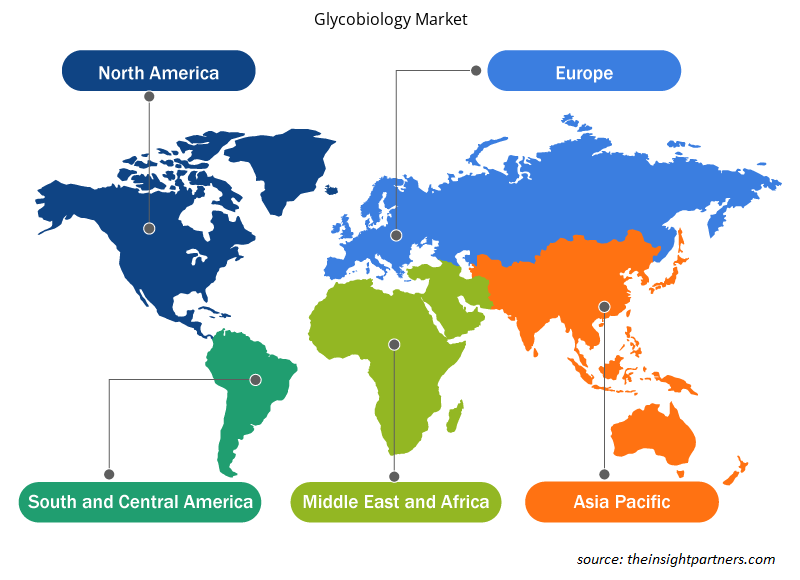

Regional Analysis:

Based on geography, the global glycobiology market is segmented into Asia Pacific, Europe, Middle East and Africa, North America, and South and Central America. In 2022, North America held the largest share of the global glycobiology market. Asia Pacific is expected to register the highest CAGR during 2022–2031.

The glycobiology market in North America is split into the US, Canada, and Mexico. Rising research and collaboration activities by various departments, increasing investments in glycomics research, and increasing awareness about glycomics ultimately drive the overall Glycomics market during the forecast period.

The US is the largest contributor to the glycobiology market in North America and the world. The market growth is due to rising research activities by various agencies and departments and increasing investments in glycomics research. Moreover, rising investment initiatives for research are another factor responsible for the growth of the glycobiology market. For instance, in February 2022, the National Science Foundation (NSF) awarded almost US$23 million to a new multi-university partnership jointly managed by Virginia Tech and the University of Georgia 2021 to accelerate glycomaterials research in the United States. This partnership brought together top scientists and engineers from these institutions, as well as Brandeis University, Rensselaer Polytechnic Institute, and the University of North Carolina at Chapel Hill, to establish a national geomaterials research center.

The supportive environment in the US accelerates the growth of the development and commercialization of glycomics pharmaceutical and biopharmaceutical products. Therefore, the pharmaceutical and biopharmaceutical industry's growth is significantly contributing to the regional market, which will boost the Glycomics market growth and opportunities.

Industry Developments and Future Opportunities:

Various initiatives taken by leading players operating in the glycobiology market are listed below:

- In March 2022, Vector Laboratories, the pioneer of innovative proteomic and glycobiology solutions, opened its new facility in Newark, California. These immunofluorescence (IF) kits enable the profiling and characterization of complex glycans in biological systems and are completely integrated for the detection of glycan expression in tissue sections.

- In June 2022, Thermo Fisher Scientific announced a co-marketing agreement with TransMIT GmbH Center for Mass Spectrometric Developments to encourage the use of a mass spectrometry imaging platform for spatial multi-omics applications in pharma and clinical labs.

- In April 2022, Bruker launched a novel MALDI HiPLEX-IHC tissue imaging solution for timsTOF flex using AmberGen's HiPLEX-IHC peptide code antibody probes, combined with unbiased lipidomics, glycomics, and metabolomics tissue imaging.

- In January 2022, Agilent Technologies invested US$ 20 million to expand its Shanghai manufacturing center to meet growing demand in China for the company’s advanced liquid chromatography (LC), spectrometer, and mass spectroscopy (MS) systems.

Competitive Landscape and Key Companies:

Merck KGaA, Agilent Technologies, Inc., New England Biolabs, Thermo Fisher Scientific Inc., Waters Corporation, Asparia Glycomics, Bruker Corporation, Takara Bio Inc., S-BIO, and Shimadzu Corporation are the prominent glycobiology market companies. These companies focus on new technologies, existing product advancements, and geographic expansions to meet the burgeoning consumer demand worldwide.

Report ScopeGlycobiology Market Regional Insights

The regional trends and factors influencing the Glycobiology Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Glycobiology Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Glycobiology Market

Glycobiology Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.95 Billion |

| Market Size by 2031 | US$ 4.75 Billion |

| Global CAGR (2025 - 2031) | 13.56% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

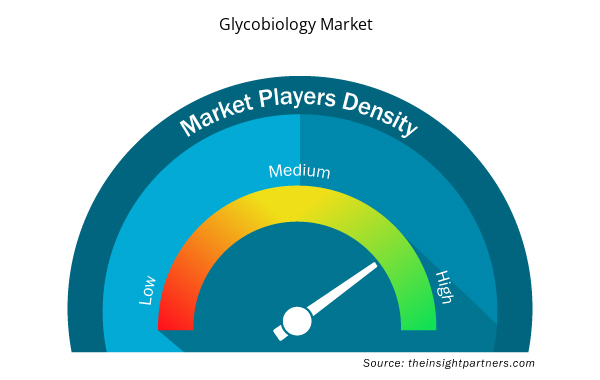

Glycobiology Market Players Density: Understanding Its Impact on Business Dynamics

The Glycobiology Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Glycobiology Market are:

- Merck KGaA

- Agilent Technologies, Inc.

- New England Biolabs

- Thermo Fisher Scientific Inc.

- Waters Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Glycobiology Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Nuclear Waste Management System Market

- Medical and Research Grade Collagen Market

- Point of Care Diagnostics Market

- Europe Tortilla Market

- Embolization Devices Market

- E-Bike Market

- Biopharmaceutical Contract Manufacturing Market

- Vertical Farming Crops Market

- Investor ESG Software Market

- Data Center Cooling Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Merck KGaA

- Agilent Technologies, Inc.

- New England Biolabs

- Thermo Fisher Scientific Inc.

- Waters Corporation

- Asparia Glycomics

- Bruker Corporation

- Takara Bio Inc.

- S-BIO

- Shimadzu Corporation

Get Free Sample For

Get Free Sample For