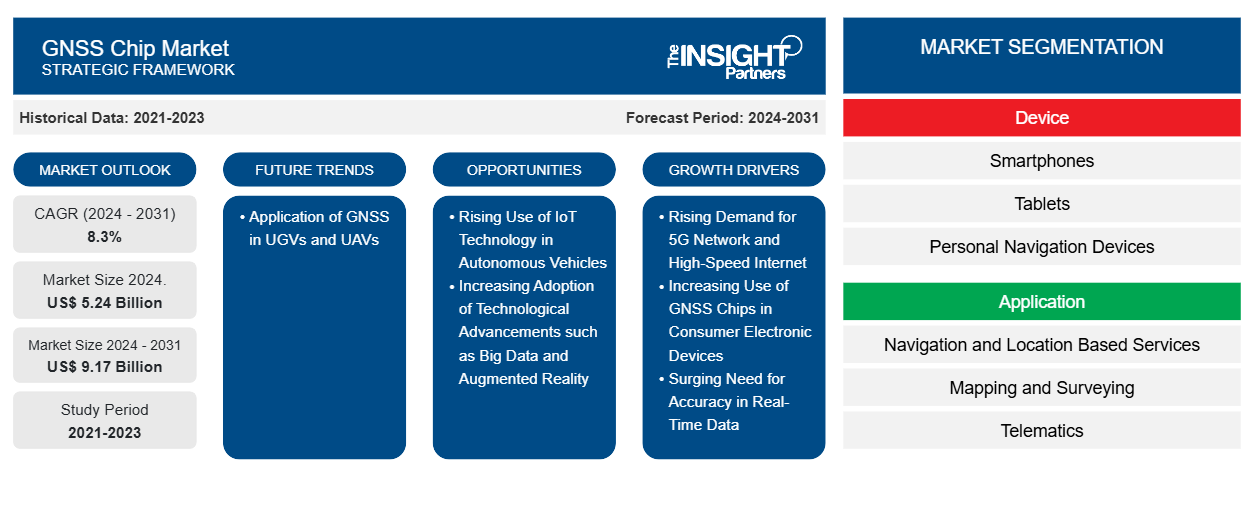

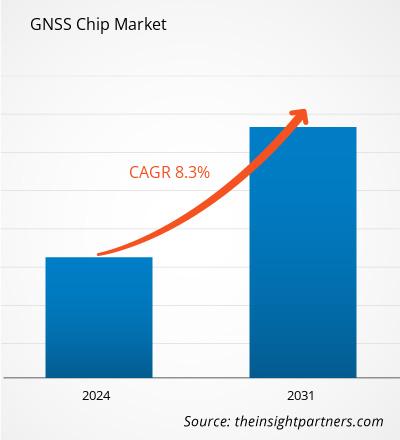

The GNSS chip market size is expected to reach US$ 9.17 billion by 2031 from US$ 5.24 billion in 2024. The market is estimated to record a CAGR of 8.3% during 2024–2031. The application of GNSS in UGVs and UAVs is likely to bring new trends in the market in the coming years.

GNSS Chip Market Analysis

GNSS users expect near-instantaneous positioning; however, achieving this requires signals from at least four satellites, which can take minutes or hours or even fail in poor signal conditions or extreme environments. Integrating GNSS data with mobile network information can enhance performance for various IoT applications. The demand for low-power GNSS chips is expected to rise as more consumer products incorporate navigation and positioning features. Currently, technologically advanced wearable devices such as fitness bands and smartwatches are in high demand. GNSS chips are widely used in these devices to provide exact location information to users while running, walking, or driving.

GNSS Chip Market Overview

The global navigation satellite system (GNSS) is a network of satellites transmitting positioning and timing data to receivers, which combine this data with sensor inputs to calculate location, speed, and altitude. The accuracy of GNSS chips depends on the number of visible satellites and signal quality. As a result, several governments are attempting to deploy regional constellations to improve navigation and mapping. China, Russia, the US, India, Japan, and the European Union have all developed and operationalized their own GNSS solutions, offering competitive alternatives in the global market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

GNSS Chip Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

GNSS Chip Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

GNSS Chip Market Drivers and Opportunities

Rising Demand for 5G Network and High-Speed Internet

5G networks offer faster data speeds and lower latency, which allow GNSS chips to provide more accurate and real-time location data, benefiting applications such as navigation and mapping. The demand for location-based services (LBS) is increasing due to these key advantages. Global navigation satellite system (GNSS) has been the source for accurate positioning of user devices due to the system's ability to enable cellular communication to offer mobile network operators various approaches to determining user's location. Many mobile network operators have announced the deployment of 5G networks in urban areas. In February 2024, Vodafone Idea (Vi) announced its projects to roll out 5G services in India, and the services are expected to roll out within the next 6–7 months in the country. The company plans to cover 75 major cities across 17 key regions, focusing on urban and industrial areas with high data demand. In April 2023, the telco launched 5G services for its 68 million prepaid users in Mexico, extending the benefits of 5G to over 80 million Telcel customers. Due to the increase in number of 5G base stations, the requirement for higher-level timing accuracy to secure stable connections over 5G networks is also increasing. The Quectel L26-T module can deliver 6.8 nanosecond timing accuracy and meet stringent timing synchronization requirements with 5G networks. Thus, the rising demand for 5G networks and high-speed internet is significantly driving the growth of the GNSS chips market.

Rising Use of IoT Technology in Autonomous Vehicles

IoT technologies create advanced solutions such as advanced driver-assistance systems (ADAS), connected car solutions, in-vehicle infotainment systems, and navigation and telematics solutions. Navigation systems are mainly being deployed in vehicles for tracking purposes and to display maps that offer information about speed, location, direction, nearby streets, and points of interest. IoT-enabled cars have GNSS chips integrated into them, which help drivers drive efficiently, and concerned agencies can track their location during emergencies. In October 2023, u-blox launched u-safe, a vehicle positioning safety solution to accelerate autonomous vehicle adoption. U-safe uses proven automotive navigation components to offer Tier 1 suppliers and OEMs a reliable ADAS positioning solution. In addition, in January 2021, Qualcomm Technologies, Inc. and Alps Alpine Co., Ltd. announced a camera-based sensing and positioning device called ViewPose to support absolute lane-level vehicle positioning. FocalPoint offers innovative S-GNSS Auto positioning technology that provides automotive original equipment manufacturers (OEMs) with increased reliability and accuracy of GNSS positioning. Moreover, the idea of autonomous vehicles is becoming a reality due to advancements in positioning and sensor integration technology. Fully autonomous vehicle needs an accurate localization solution to drive appropriately. High-precision GNSS technology provides key advantages, including reliability, accuracy, and precision required for self-driving vehicles. Thus, the rise in the demand for IoT-enabled cars is expected to create growth opportunities for the GNSS chip market in the coming years.

GNSS Chip Market Report Segmentation Analysis

Key segments that contributed to the derivation of the GNSS chip market analysis are device, application, and vertical.

- Based on device, the GNSS chip market is categorized into smartphones, tablets, personal navigation devices, in-vehicle systems, and others. The smartphones segment dominated the market in 2024.

- Based on application, the GNSS chip market is segmented into navigation & location-based services, mapping and surveying, telematics, timing & synchronization, and others. The navigation & location-based services segment dominated the market in 2024.

- Based on vertical, the GNSS chip market is segmented into consumer electronics, automotive & transportation, military and defense, marine, and others. The consumer electronics segment dominated the market in 2024.

GNSS Chip Market Share Analysis by Geography

- The GNSS chip market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America.

- The demand for GNSS chips in Asia Pacific is propelled by the presence of significant manufacturers in the region. In APAC, the major consumer electronics manufacturers focus on developing innovative products that require recording locations and real-time data for tracking by using devices such as smartphones, wearable devices, and tablets. The growing popularity of wearable devices and the ongoing technological advancements in the consumer electronics sector in APAC fuel the GNSS chip market growth. Moreover, several companies in the region are launching satellite positioning chips. For instance, in December 2023, Airoha Technology, specializing in fixed broadband network infrastructure and advanced Artificial Intelligence of Things, launched the AG3335MA satellite positioning chip series. This series passed the AEC-Q100 Grade 2 reliability qualification tests for automotive applications. Additionally, the company integrated this series of chips with its parent company, MediaTek, and its Dimensity auto platform, providing highly integrated solutions and technical testing services to automotive manufacturers worldwide.

GNSS Chip Market Regional Insights

GNSS Chip Market Regional Insights

The regional trends and factors influencing the GNSS Chip Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses GNSS Chip Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for GNSS Chip Market

GNSS Chip Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024. | US$ 5.24 Billion |

| Market Size by 2031 | US$ 9.17 Billion |

| Global CAGR (2024 - 2031) | 8.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Device

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

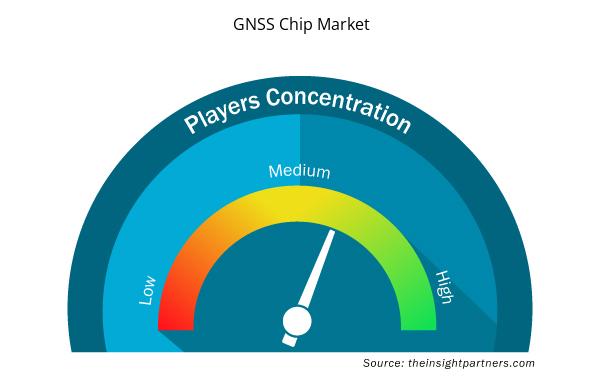

GNSS Chip Market Players Density: Understanding Its Impact on Business Dynamics

The GNSS Chip Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the GNSS Chip Market are:

- Qualcomm Inc

- Quectel Wireless Solutions Co Ltd

- Broadcom Inc

- Septentrio NV

- Trimble Inc

- Furuno Electric Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the GNSS Chip Market top key players overview

GNSS Chip Market News and Recent Developments

The GNSS chip market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the GNSS chip market are listed below:

- Septentrio announced AntaRx-Si3. This is the first GNSS/INS (Inertial Navigation System) Smart Antenna on the market in an ultra-rugged enclosure, designed for easy installation on machines such as agriculture robots. AntaRx-Si3 is the new member of the family of receivers leveraging GNSS/INS FUSE+ technology, which is designed to answer the need for position availability in tough industrial environments where GNSS signal reception may be temporarily compromised, such as under foliage. The IMU sensor in FUSE+ also improves positioning integrity and reliability, which is critical for autonomous systems. (Source: Septentrio NV, Press Release, February 2024)

- Trimble introduced the Trimble MPS566 Modular GNSS heading receiver, a next-generation Global Navigation Satellite System (GNSS) receiver designed for use in piling operations, drilling, and marine construction. The MPS566 provides accurate locations and orientations for tasks requiring precision heading because of its integrated dual GNSS antenna ports and constellation-agnostic Trimble ProPoint technology. (Source: u-blox Holding AG, Press Release, November 2023)

GNSS Chip Market Report Coverage and Deliverables

The "GNSS Chip Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- GNSS chip market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- GNSS chip market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- GNSS chip market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the GNSS chip market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Device, Application, Vertical, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global GNSS chip market was estimated to be US$ 5.24 billion in 2024 and is expected to grow at a CAGR of 8.3% during the forecast period 2025 – 2031.

The global GNSS chip market is expected to reach US$ 9.17 billion by 2031.

The incremental growth expected to be recorded for the global GNSS chip market during the forecast period is US$ 3.92 billion.

Application of GNSS in UGVs and UAVs is anticipated to play a significant role in the global GNSS chip market in the coming years.

The key players holding majority shares in the global GNSS chip market are Qualcomm Inc, Broadcom Inc, Septentrio NV, Trimble Inc, Furuno Electric Co Ltd, MediaTek Inc, STMicroelectronics NV, Skyworks Solutions Inc, u-blox Holding AG, and Quectel Wireless Solutions Co Ltd.

Rising demand for 5G network and high-speed internet; increasing use of GNSS chips in consumer electronic devices; and surging need for accuracy in real-time data are the major factors that propel the global GNSS chip market.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - GNSS Chip Market

- Qualcomm Inc

- Quectel Wireless Solutions Co Ltd

- Broadcom Inc

- Septentrio NV

- Trimble Inc

- Furuno Electric Co Ltd

- MediaTek Inc

- STMicroelectronics NV

- Skyworks Solutions Inc

- u-blox Holding AG

Get Free Sample For

Get Free Sample For