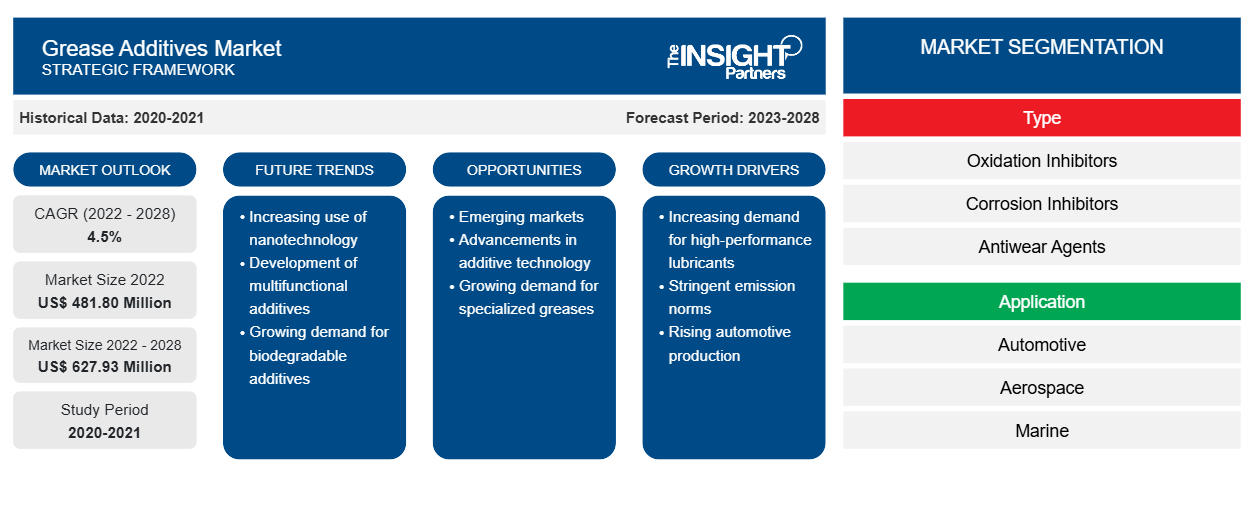

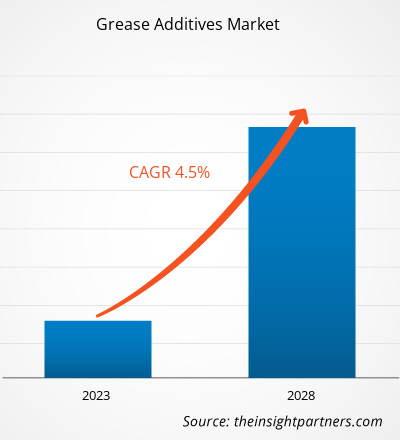

[Research Report] The grease additives market size was valued at US$ 481.80 million in 2022 and is projected to reach US$ 627.93 million by 2028; it is estimated to grow at a CAGR of 4.5% from 2022 to 2028.

Grease additives are organic or inorganic chemicals that are dissolved or suspended in oil as solids. A surge in passenger automobile and commercial vehicle sales is driving the grease additives market. Grease additives are used in greases that are used as lubricants to enhance the performance of equipment and extend its life span.

Industrial greases primarily constitute base oil, thickener, and additives; additives are the second most important component after base oil. Three types of base oils are used in grease manufacturing: mineral oil, vegetable oil, and synthetic oil. Synthetic greases are manufactured using synthetic oils such as polyalphaolefin. They are widely used in the industrial sector, especially in the automotive industry. Their superior characteristics, ability to induce operational consistency, and affordable costs make them a preferred category of lubricants. Synthetic greases are used in applications involving extreme temperatures, loads, and speeds. Synthetic grease additives enhance physical and chemical properties by increasing the viscosity index, lowering volatility, and reducing the pour point of lubricants. Viscosity index improvers, pour point depressants, dispersants, and detergents are a few of the widely used categories of additives. With the rising demand for synthetic grease, the need for additives for these greases is likely to surge during the forecast period.

Several major market players are developing additives for synthetic greases to improve their efficiency. For instance, in September 2022, Clariant launched extreme pressure/antiwear additives, lubricity improvers, corrosion inhibitors, neutralizing agents, and guide formulations for fully synthetic metalworking fluids that increase the efficiency of machines. Thus, with the growing demand for synthetic grease, additives used in these greases are bringing new trends into the grease additives market.

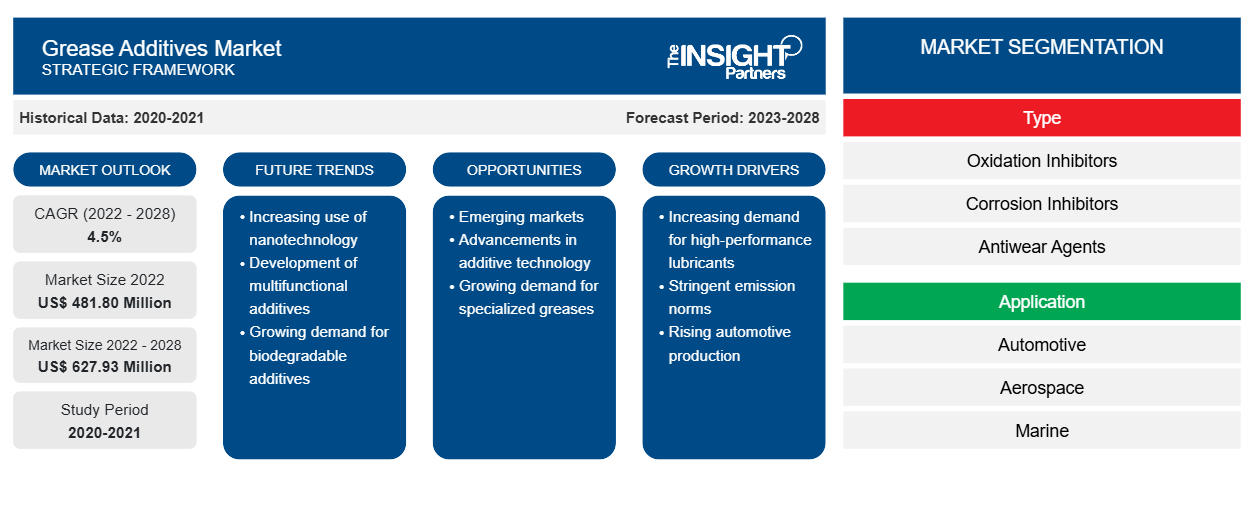

In 2022, Asia Pacific held the largest share of the grease additives market and is estimated to register the highest CAGR during the forecast period. Europe is another attractive region and holds a prominent share of the market. Growing installation of onshore and offshore wind energy plants, and increasing scale of automotive manufacturing contribute to the grease additives market growth in Europe. Sweden, Finland, Germany, and France are experiencing a prominent rise in the installation of wind turbines, coupled with the rising demand for renewable energy. According to the WindEurope VZW/ASBL, Europe recorded 19.1 GW of new wind installations in 2022, including ~16.7 GW onshore and 2.5 GW offshore projects. Grease is used to enhance the performance of wind turbines as it aids in resistance to corrosion, heat, weather, and flames.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Grease Additives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Grease Additives Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Grease Additives Market

The COVID-19 pandemic affected economies and industries in several countries across the globe. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several industries, including automotive, construction, aerospace, and mining. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies witnessed delays in product deliveries and a slump in sales of their products in 2020. Moreover, the bans imposed by governments of different countries in Europe, Asia Pacific, and North America on international travel compelled companies to discontinue their collaboration and partnership plans temporarily. All these factors hampered various industries in 2020 and early 2021, thereby restraining the growth of multiple markets, including the grease additives market.

During the initial phase of the COVID-19 pandemic, implementing lockdown restrictions and shutdown of manufacturing units led to a production shortfall, creating a demand and supply gap. These factors hampered the profitability of various small-scale and large-scale grease additives manufacturers. In 2021, several economies resumed operation as governments of various countries announced relaxations in the previously imposed restrictions, which boosted the global marketplace. Manufacturers were permitted to operate at full capacities, which helped them overcome the demand and supply gap and other repercussions. The growing demand for automobile and industrial machinery post-COVID-19 pandemic has been generating demand for grease additives.

Market Insights

Strategic Developments by Key Players Favor Grease Additives Market Growth

Key players in the market are engaged in adopting various marketing strategies such as product launch, mergers and acquisitions, and collaborations, which favor the growth of the market.

Type Insights

Based on type, the grease additives market is segmented into oxidation inhibitors, corrosion inhibitors, antiwear agents, pressure additives, metal deactivators, and others. The oxidation inhibitors segment held the largest market share in 2022. The pressure additives segment is expected to register the highest CAGR during the forecast period. The growth of the grease additives market for the pressure additive segment is attributed to increasing demand for greases in applications with high pressure conditions, including aerospace, marine, mining, and steel mill. In addition, the rising occurrence of mechanical wear in various applications underlines the need for effective grease lubricants supplemented with apt grease additives.

Afton Chemical Corp, BASF SE, Clariant AG, Croda International plc, Evonik Industries AG, Shamrock Technologies Inc, The Lubrizol Corp, RT Vanderbilt Holding Co Inc, Lanxess AG, and IPAC Inc are among the major players operating in the grease additives market. These companies mainly focus on product innovation to expand their market size and follow emerging market trends.

Grease Additives Market Regional Insights

Grease Additives Market Regional Insights

The regional trends and factors influencing the Grease Additives Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Grease Additives Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Grease Additives Market

Grease Additives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 481.80 Million |

| Market Size by 2028 | US$ 627.93 Million |

| Global CAGR (2022 - 2028) | 4.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Grease Additives Market Players Density: Understanding Its Impact on Business Dynamics

The Grease Additives Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Grease Additives Market are:

- Afton Chemical Corp

- BASF SE

- Clariant AG

- Croda International Plc

- Evonik Industries AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Grease Additives Market top key players overview

Report Spotlights

- Progressive industry trends in the grease additives market to help companies develop effective long-term strategies

- Business growth strategies adopted by the grease additives market players in developed and developing countries

- Quantitative analysis of the market from 2020 to 2028

- Estimation of global demand for grease additives

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the grease additives market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, and factors driving or restraining the growth of the grease additives market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the grease additives market at various nodes

- Detailed overview and segmentation of the market and growth dynamics of the grease additives industry

- Size of the grease additives market in various regions with promising growth opportunities

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The major players operating in the global grease additives market are Afton Chemical Corp, BASF SE, Clariant AG, Croda International plc, Evonik Industries AG, Shamrock Technologies Inc, The Lubrizol Corp, RT Vanderbilt Holding Co Inc, Lanxess AG, and IPAC Inc.

The renewable energy industry, a subsegment of the power sector, is emerging as a prominent consumer of industrial greases. Grease is primarily used in turbines and transformers in this industry. In recent years, the increasing demand for renewable energy has led to an upsurge in wind turbine installations worldwide. The IEA states that 830 GW of wind capacity was installed globally as of 2021, of which 93% were onshore systems while 7% were offshore wind farms.

Asia Pacific accounted for the largest share of the global grease additives market. Asia Pacific is one of the most significant regions for the grease additives market owing to growth in operations of industries such as automotive, wind energy, marine, aerospace, and construction, along with increased grease production.

Based on application, construction machinery segment is projected to grow at the fastest CAGR over the forecast period. The growth of the segment is attributed to growing construction activities in emerging economies and rising renovation activities.

The automotive industry has witnessed tremendous growth over the last few decades and is expected to rise steadily during the forecast period. According to a report published by the European Automobile Manufacturers’ Association (ACEA), global motor vehicle production increased by 1.3% from 2020 to 2021; 79.1 million motor vehicles, including 61.6 million passenger cars, were produced across the world in 2021. Thus, an upsurge in automobile manufacturing and the growing adoption of electric vehicles boost the demand for grease, thereby bolstering the grease additives market growth.

Based on type, oxidation inhibitors segment held the largest revenue share. The growth of the segment is attributed to increasing demand from various end use industries including aerospace, automotive, mining, construction machinery, and others.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Grease Additives Market

- Afton Chemical Corp

- BASF SE

- Clariant AG

- Croda International Plc

- Evonik Industries AG

- Shamrock Technologies Inc

- The Lubrizol Corp

- RT Vanderbilt Holding Co Inc

- Lanxess AG

- IPAC Inc

Get Free Sample For

Get Free Sample For