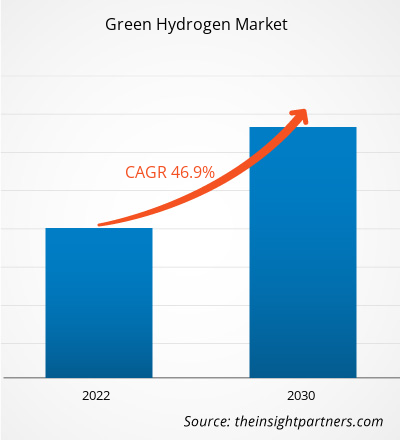

The green hydrogen market size is expected to grow from US$ 4,061.21 million in 2022 to US$ 88,055.64 million by 2030; it is estimated to record a CAGR of 46.9% from 2022 to 2030. The significantly growing government investment in renewable energy is likely to remain a key green hydrogen market trend.

Green Hydrogen Market Analysis

Governments of various across the globe are recognizing the advantages of green hydrogen as a clean and sustainable energy solution. They are taking proactive measures to support its development and deployment across various sectors. The increasing focus on decarbonization and climate change mitigation is prompting governments to prioritize investments in green hydrogen as a means to reduction carbon emissions. For instance, in June 2022, Protium, one of the leading green hydrogen energy companies in the UK, provided end-to-end net-zero energy solutions. Thus, increasing investments in green hydrogen projects are anticipated to create worthy opportunities for market expansion in the coming years.

Green Hydrogen Market Overview

Electrolysis is used to produce green hydrogen by separating water molecules into oxygen and hydrogen using electricity. Technological advancements in electrolysis contribute to improving the efficiency, cost-effectiveness, and scalability of the production, storage, and utilization of green hydrogen. Enhanced electrolyzer designs, advanced catalyst materials, and optimized operating conditions are a few factors that might lead to higher energy conversion efficiencies, shorter response times, and longer equipment lifetimes. In July 2023, the Korea Research Institute of Standards & Science (KRISS) showcased a potential solution for the durable and efficient carrier transport procedure of a photoanode with a protective film to develop the production of green hydrogen. Such advancements are also expanding the range of applications of green hydrogen. Thus, technological advancements associated with green hydrogen are projected to fuel the market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Green Hydrogen Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Green Hydrogen Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Green Hydrogen Market Drivers and Opportunities

Increasing Demand for FCEV to Favor Market

Fuel cell electric vehicles (FCEVs) use hydrogen as a fuel and employ fuel cells to produce electricity, offering a clean and competent alternative to traditional internal combustion engine vehicles. With countries striving to reduce carbon emissions and transition to low-carbon transportation, the demand for FCEVs is increasing across the globe. As a result, various market players are involved in strategic development, such as partnerships, collaborations, and agreements, to enhance their product offerings and fulfil the growing demand for FCEVs. The adoption of FCEVs drives the need for green hydrogen production, as it is the primary source of fuel in these vehicles.

Growing Establishment of Large Green Hydrogen Plants– An Opportunity in Green Hydrogen Market

The establishment of large-scale green hydrogen plants attracts significant investments from both the public and private sectors. In June 2023, a group of companies announced their plan to invest US$ 79.75 in a project for the expansion of a hydrogen production facility and a hydrogen liquefaction facility in Queensland, Australia. The group of companies includes Kansai Electric Power Company (Japan), Marubeni Corporation (Japan), Iwatani Corporation (Japan), Keppel Infrastructure (Singapore), and Stanwell Corporation (Australia). The rise in infrastructure development is expected to create a positive environment for the implementation of green hydrogen in different sectors, which is likely to offer growth prospects to the market players during the forecast period.

Green Hydrogen Market Report Segmentation Analysis

Key segments that contributed to the derivation of the green hydrogen market analysis are technology, renewable sources, and end-use.

- Based on the technology, the green hydrogen market has been divided into Alkaline Electrolysis and PEM Electrolysis. The Alkaline Electrolysis segment held a larger market share in 2022.

- In terms of renewable source, the market has been segmented into wind energy, solar energy, and others. The solar energy segment dominated the market in 2022.

- In terms of end-use Industry, the market has been segmented into chemical, power, food & beverages, medical, petrochemicals, and others. The power segment dominated the market in 2022.

Green Hydrogen Market Share Analysis by Geography

The geographic scope of the green hydrogen market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

Europe led the green hydrogen market. Several European countries, including Spain, France, Germany, and Portugal, have taken steps to cooperate and build a hydrogen pipeline by 2030. This pipeline will facilitate the transportation of ~2 million metric tonnes of hydrogen annually from these countries to France. As Europe looks to secure its energy supply and accelerate the transition to a carbon-neutral future, green hydrogen emerges as a vital resource and a key solution to reduce reliance on fossil fuels and achieve ambitious climate targets. Germany, France, Italy, UK are some of the prime countries operating in the green hydrogen market in Europe. The German government has already taken steps to promote the hydrogen economy, including the adoption of a National Hydrogen Strategy. For instance, in March 2022, Germany announced the contribution of US$ 572 million toward a new global green hydrogen economy. This is a significant step in promoting the adoption and development of clean energy solutions worldwide.

Green Hydrogen Market Regional Insights

The regional trends and factors influencing the Green Hydrogen Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Green Hydrogen Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Green Hydrogen Market

Green Hydrogen Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,061.21 Million |

| Market Size by 2030 | US$ 88,055.64 Million |

| Global CAGR (2022 - 2030) | 46.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

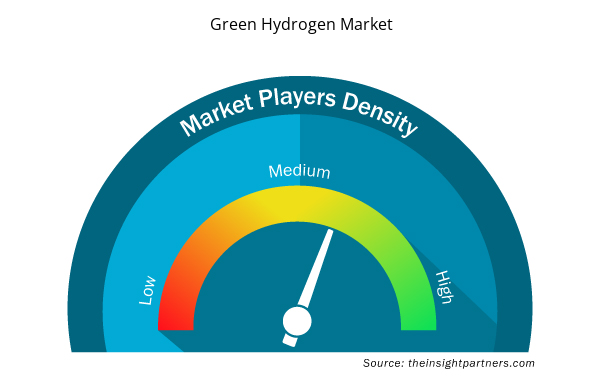

Green Hydrogen Market Players Density: Understanding Its Impact on Business Dynamics

The Green Hydrogen Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Green Hydrogen Market are:

- Air Liquide

- Siemens Energy

- Cummins Inc.

- Linde Plc

- NEL ASA

- Ørsted A/S

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Green Hydrogen Market top key players overview

Green Hydrogen Market News and Recent Developments

The Green Hydrogen Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In October 2022, NTPC and Siemens Ltd signed a Memorandum of Understanding (MoU) for the feasibility of demonstrating hydrogen co-firing blended with natural gas in Siemens V94.2 gas turbines installed at NTPC Faridabad gas power plant. (Source: Siemens Ltd, Press Release/Company Website/Newsletter)

- In December 2022, Cummins Inc. supplied a 35-megawatt (MW) proton exchange membrane (PEM) electrolyzer system for Linde’s new hydrogen production plant in Niagara Falls, New York. (Source: Cummins Inc, Press Release/Company Website/Newsletter)

Green Hydrogen Market Report Coverage and Deliverables

The “Green Hydrogen Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering the following areas:

- Green Hydrogen Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Green Hydrogen Market Trends

- Detailed PEST and SWOT analysis

- Green Hydrogen Market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Green Hydrogen Market Industry, landscape and competition analysis, covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, Renewable Source, and End-use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For