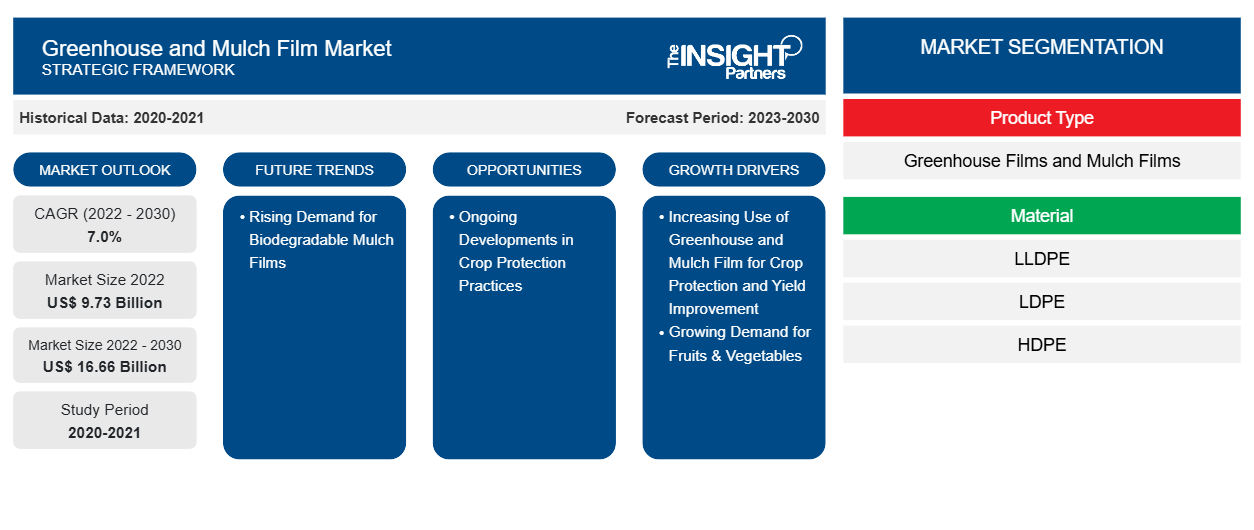

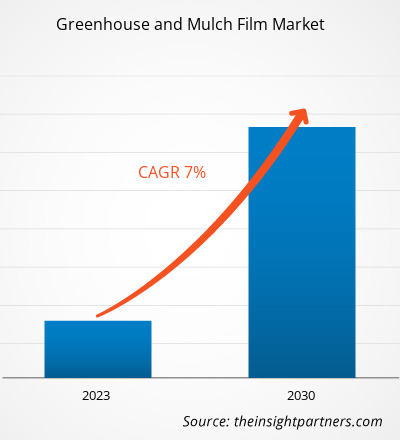

[Research Report] The greenhouse and mulch film market size was valued at US$ 9.73 billion in 2022 and is expected to reach US$ 16.66 billion by 2030; it is estimated to register a CAGR of 7.0% from 2022 to 2030.

Market Insights and Analyst View:

Greenhouse and mulch films are essential components in modern agriculture, playing distinct roles in enhancing crop cultivation practices. Greenhouse films are typically transparent or translucent sheets made from polyethylene or other materials designed to cover and enclose a greenhouse structure. These films serve multiple purposes, such as trapping solar radiation inside the greenhouse. This controlled climate allows farmers to extend the growing season, protect crops from adverse weather conditions, and optimize conditions for plant growth. On the other hand, mulch films are used directly on the soil surface, serving as a protective layer. These films are usually made from plastic materials and come in various colors. Mulch films offer several benefits, including weed suppression by blocking sunlight and preventing weed growth, moisture conservation by reducing evaporation from the soil, and temperature regulation, creating a more stable environment for plant roots. Additionally, mulch films can enhance soil structure and nutrient retention, contributing to improved crop health and productivity.

Growth Drivers and Challenges:

Consumers across the globe have become more health-conscious and prioritize diverse and nutritious diets, owing to which there has been a surge in demand for fresh produce. Fruits & vegetables are essential components of a balanced diet, contributing to overall well-being. Farmers are turning to greenhouse cultivation and mulch films to meet this rising demand and ensure a consistent supply of high-quality produce. Greenhouse films play a crucial role in this scenario by creating a controlled environment that extends the growing season and protects crops from adverse weather conditions. These films allow farmers to cultivate fruits & vegetables outside their typical growing seasons, enabling a more continuous and reliable supply. By providing a shield against extreme temperatures, frost, and excessive rainfall, greenhouses help maintain optimal conditions for the growth of a variety of crops, ensuring a steady and abundant harvest.

Mulch films also contribute significantly to meeting the demand for fruits & vegetables. In open-field cultivation, mulch films are employed to suppress weed growth, conserve soil moisture, and regulate soil temperature. Weeds compete with crops for nutrients and water, and their control becomes crucial in maximizing the yield and quality of fruits & vegetables. Mulch films help create a favorable microenvironment by reducing water evaporation, preventing soil erosion, and enhancing soil structure. These factors collectively contribute to healthier plants and improved yields, meeting the increasing consumer demand for a diverse range of fresh and high-quality produce. Thus, the growing consumer preference for fruits & vegetables, coupled with the desire for year-round availability and sustainability, has led to an increased adoption of greenhouse and mulch films. These technologies empower farmers to overcome seasonal limitations, protect crops from environmental challenges, and enhance overall crop productivity. The synergy between demand for fresh produce and the adoption of advanced agricultural practices, such as greenhouse and mulch films, reflects a dynamic response to evolving consumer preferences and global food needs. Thus, growing fruit & vegetable production across the globe and the need to reduce water usage are further driving demand for greenhouse and mulch films.

However, microplastics, resulting from the degradation of these agricultural plastic films, threaten ecosystems, soil quality, and potentially human health as they infiltrate the food chain. This heightened awareness has triggered a growing demand for sustainable practices within the agriculture sector, pressuring the greenhouse and mulch film industry to adopt sustainable practices. The greenhouse sector, which traditionally utilizes plastic materials for construction and coverings, is grappling with increased scrutiny. The potential for plastic materials to release microplastics during their lifecycle is raising concerns about their long-term environmental impact. Consequently, there is a growing impetus within the industry to adopt more sustainable practices and materials, further influencing the greenhouse and mulch film market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Greenhouse and Mulch Film Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Greenhouse and Mulch Film Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Greenhouse and Mulch Film Market Analysis to 2030" is a specialized and in-depth study with a major focus on market trends and growth opportunities across the globe. The report aims to provide an overview of the market with detailed market segmentation by product type, material, application, and geography. The market has witnessed high growth in recent years and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of greenhouse and mulch film globally. In addition, the report provides a qualitative assessment of key factors affecting the greenhouse and mulch film market performance. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and factors affecting the global greenhouse and mulch film market growth.

Segmental Analysis:

On the basis of product type, the market is bifurcated into greenhouse films and mulch films. Based on material, the market is divided into LLDPE, LDPE, HDPE, EVA, PHA, PVC, PC, and others. In terms of application, the market is segmented into vegetable farming, horticulture, floriculture, and others. The vegetable farming segment registered a significant greenhouse and mulch film market share in 2022. Greenhouse films, typically made of polyethylene or other polymer materials, are instrumental in vegetable farming by creating a controlled environment. These films act as a barrier, trapping heat from the sun and preventing its escape, thereby regulating temperature within the greenhouse. This control allows farmers to extend the growing season and cultivate crops even in unfavorable weather conditions.

Greenhouse films can also diffuse sunlight, promoting uniform light distribution for optimal photosynthesis. They also protect against harsh weather elements, pests, and diseases, resulting in improved crop yields and quality. Mulch films, on the other hand, are laid directly on the soil surface around plants. These films, often composed of plastic or biodegradable materials, serve multiple functions. One of their key roles is moisture conservation. By reducing water evaporation from the soil, mulch films help maintain optimal soil moisture levels, which is especially crucial in arid or semi-arid regions. The films also act as a weed barrier, suppressing weed growth and minimizing competition for nutrients.

They also regulate soil temperature, preventing extreme fluctuations that can stress plants. The combination of greenhouse and mulch films in vegetable farming creates a synergistic effect. Greenhouse films provide a controlled microclimate for plant growth, while mulch films contribute to water conservation, weed control, and temperature regulation at the soil level. This integration optimizes resource use, promotes sustainable agricultural practices, and enhances overall farm productivity. All these factors are driving the greenhouse and mulch film market for the vegetable farming segment.

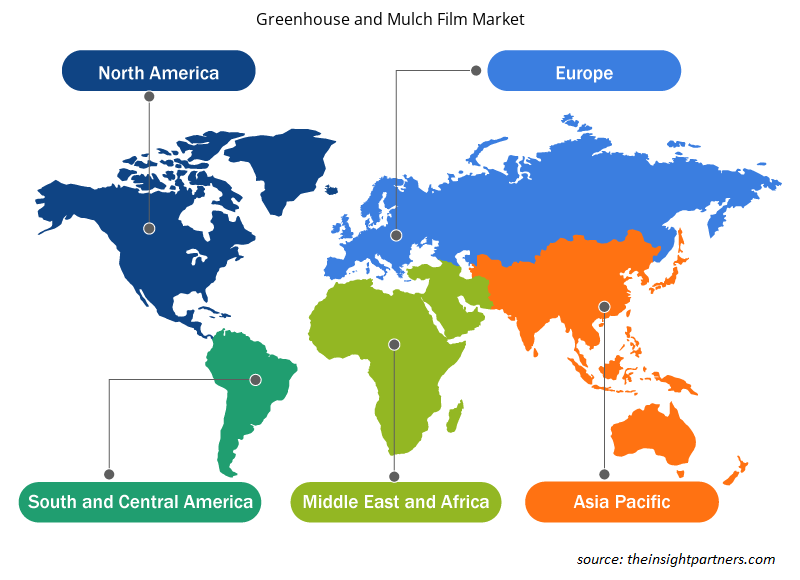

Regional Analysis:

Based on geography, the greenhouse and mulch film market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The market was dominated by Asia Pacific, which accounted for over ~US$ 3 billion in 2022. The growing fruits & vegetables industry has increased the demand for greenhouse and mulch film in Asia Pacific. India, China, Japan, and other countries in the region are among the top fruit & and vegetable-producing countries. According to the Ministry of Agriculture & Farmers Welfare, in 2021, India was ranked second-largest producer of horticulture after China, producing ~12% of the global fruit and vegetable production. As consumers worldwide emphasize healthier dietary choices, there has been a notable surge in the production of fresh and diverse produce such as fruits and vegetables. This increased production of fruits and vegetables is bolstering the demand for greenhouse and mulch films in the region.

Europe is expected to register a CAGR of over 7% from 2022 to 2030. The agricultural sector has been facing challenges about rising productivity to feed the growing population in Europe. With growing concerns about global food security and dependence on imports, European countries are prioritizing domestic agricultural production. Greenhouse and mulch films enable farmers to maximize yields and extend the growing season, contributing to greater food self-sufficiency. Governments of various countries in Europe are actively promoting sustainable agricultural practices through policies and programs. This includes financial aid and subsidies for farmers who utilize technologies such as greenhouses and biodegradable mulch films. Such support accelerates the adoption of these technologies and fosters a more environmentally responsible agricultural sector. Further, North America is expected to reach ~US$ 4 billion in 2030.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the greenhouse and mulch film market are listed below:

- In August 2020, Carbiolice, a French start-up developing and producing biobased, biodegradable, and compostable plastic solutions, joined forces with agricultural film manufacturer Barbier Group to develop a PLA-based mulch film.

Greenhouse and Mulch Film Market Regional Insights

The regional trends and factors influencing the Greenhouse and Mulch Film Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Greenhouse and Mulch Film Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Greenhouse and Mulch Film Market

Greenhouse and Mulch Film Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 9.73 Billion |

| Market Size by 2030 | US$ 16.66 Billion |

| Global CAGR (2022 - 2030) | 7.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

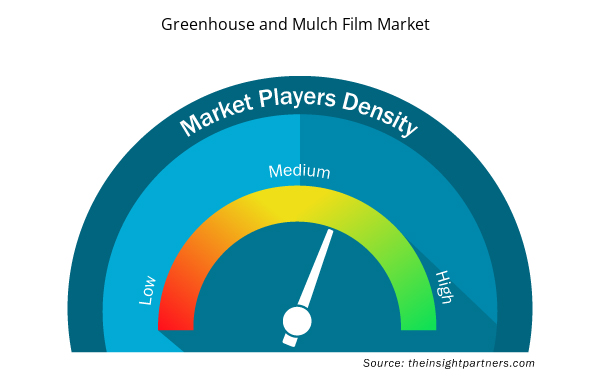

Greenhouse and Mulch Film Market Players Density: Understanding Its Impact on Business Dynamics

The Greenhouse and Mulch Film Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Greenhouse and Mulch Film Market are:

- Dow Inc

- Berry Global Group Inc

- Cag Plastik San and Trade Ltd Sty

- RKW SE

- FVG Folien-Vertriebs GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Greenhouse and Mulch Film Market top key players overview

COVID-19 Impact:

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries across the globe. The crisis disturbed supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. These disruptions restricted the availability of greenhouse and mulch film. It caused delays in production and increased costs, negatively impacting the overall supply of greenhouse and mulch film. Many manufacturing facilities were temporarily halted or scaled back during the COVID-19 pandemic to comply with lockdown measures and ensure the safety of workers. In addition, the pandemic impacted the global economy, leading to fluctuations in commodity prices and reduced demand for these agricultural films.

However, in 2021, the global marketplace started recovering from the losses as governments of different countries announced the relaxation of the restrictions. Manufacturing activities are rebounding as countries gradually recover from the pandemic and vaccination efforts continue. Manufacturers are permitted to operate at full capacity to overcome the supply gap. Thus, the global greenhouse and mulch film market is anticipated to grow significantly during the forecast period.

Competitive Landscape and Key Companies:

Dow Inc, Berry Global Group Inc, Cag Plastik San and Trade Ltd Sty, RKW SE, FVG Folien-Vertriebs GmbH, AA Politiv (1999) Ltd, Ginegar Plastic Products Ltd, Plastika Kritis SA, BASF SE, and Armando Alvarez SA are among the key players operating in the global greenhouse and mulch film market. The global market players focus on providing high-quality products to fulfill customer demand.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Material, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Aramid fibers, particularly para-aramid variants such as Kevlar, are renowned for their exceptional strength, high modulus, and resistance to impact, making them ideal for applications where safety and protection are paramount. This fiber is extensively used in the manufacturing of ballistic vests and helmets. The inherent ballistic resistance of these fibers, coupled with their lightweight nature, makes them a preferred choice for body armor. Military and law enforcement agencies worldwide widely use aramid-based protective gear to provide personnel with effective protection against ballistic threats without compromising mobility. All these factors are expected to drive the safety & protection equipment from 2022 to 2030.

The automotive segment held the largest share of the global aramid fiber market in 2022. Aramid fibers are extensively used as a substitute for fiberglass and steel due to their lightweight, high tensile strength, and superior corrosion resistance in automotive hose manufacturing. Manufacturers in the automotive industry are constantly looking to stay competitive by bringing innovative products to market. Safety aspects, excellent performance, and the need for sustainability pressurizes the automotive industry to develop high-quality products.

The para-aramid fiber segment held the largest share in the global aramid fiber market in 2022. Para-aramids have high tensile strength (the highest stress that a material can withstand) and modulus behavior (the tendency of a material to deform when force is applied). The dry-jet, wet-spinning method is used to make these fibers, which results in fiber with completely extended liquid crystal chains generated along the fiber axis and a high degree of crystallinity, which boosts the fiber's strength. Their increasing use in security and safety applications drives the demand for para-aramid fibers. It is used in protective clothing such as bulletproof vests, helmets, and vehicle armor due to its ultra-high strength and rigid and highly oriented molecular structure. Thus, growing demand from the product type sectors led to the dominance of the para-aramid fiber segment in 2022.

Due to their excellent strength-to-weight ratio and heat resistance properties, aramid fibers play an essential role in composite materials and automotive and military applications. They can easily be integrated into textile applications in protective clothing, offer greater protection against heat, flame, and chemical products, and provide maximum comfort and absolute reliability. These fibers are a class of strong synthetic fibers commonly used in ballistic-rated body armor fabrics and composites. This reinforced fiber is lightweight and has a tensile strength five times stronger than the same weight, with high heat resistance and low cutting capacity. Growing demand from these end-used industries is driving the demand for aramid fiber from 2022 to 2030.

In 2022, Asia Pacific held the largest share of the global greenhouse and mulch film market. The growing fruits & vegetables industry has increased the demand for greenhouse and mulch film in Asia Pacific. India, China, Japan, and other countries in the region are among the top fruit & and vegetable-producing countries. As consumers worldwide emphasize healthier dietary choices, there has been a notable surge in the production of fresh and diverse produce such as fruits and vegetables. This increased production of fruits and vegetables is bolstering the demand for greenhouse and mulch films in the region.

A few players operating in the global greenhouse and mulch film market include Dow Inc, Berry Global Group Inc, Cag Plastik San and Trade Ltd Sty, RKW SE, FVG Folien-Vertriebs GmbH, AA Politiv (1999) Ltd, Ginegar Plastic Products Ltd, Plastika Kritis SA, BASF SE, and Armando Alvarez SA.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Greenhouse and Mulch Film Market

- Dow Inc

- Berry Global Group Inc

- Cag Plastik San and Trade Ltd Sty

- RKW SE

- FVG Folien-Vertriebs GmbH

- AA Politiv (1999) Ltd

- Ginegar Plastic Products Ltd

- Plastika Kritis SA

- BASF SE

- Armando Alvarez SA

Get Free Sample For

Get Free Sample For