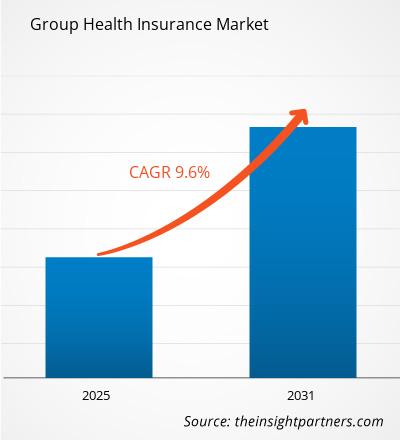

The group health insurance market size is expected to grow at a CAGR of 9.6% from 2025 to 2031. The group health insurance market includes growth prospects owing to the current group health insurance market trends and their foreseeable impact during the forecast period. The group health insurance market is a large and expanding sector. The group health insurance market is growing due to increasing economic growth, a rise in employee retention, rising insurance premium costs, and increased insurance accessibility.

Group Health Insurance Market Analysis

Group health insurance provides insurance plans to a group of people, typically workers of the firm or members of the organization. Members of group health typically pay less for insurance since a larger number of policyholders share the insurer's risk. Companies and organizations purchase group health insurance policies, which are subsequently made available to their staff members or members. Individuals cannot obtain coverage through these programs; only groups are able to do so. For a plan to be valid, participation must typically reach at least 70%.

Group Health Insurance Market Industry Overview

- The group health insurance market provides coverage for healthcare expenses for a group of people, typically employees of a company or members of an organization. It's a crucial benefit offered by employers to attract and retain talent.

- Factors like healthcare costs, regulatory changes, and employer preferences influence the group health insurance market. With rising healthcare expenses, employers often seek cost-effective options without compromising coverage quality. Insurers compete by offering competitive premiums, comprehensive coverage, and value-added services like wellness programs.

- Additionally, technological advancements, such as telemedicine, are reshaping how healthcare services are delivered and accessed within group health insurance plans. Overall, the group health insurance market continues to evolve to meet the needs of both employers and employees in managing healthcare expenses.

Group Health Insurance Market Driver

Increasing Insurance Premium Costs To Drive The Group Health Insurance Market

- Rising insurance premium costs play a pivotal role in shaping the dynamics of the group health insurance market. As premiums rise, businesses are seeking more cost-effective ways to provide health coverage to their employees, leading to a surge in demand for group health insurance plans.

- Cost-sharing mechanisms enable employees to divide the risk among a larger group of individuals, group health insurance plans can often offer more competitive premiums compared to individual policies. This makes it an attractive option for businesses looking to provide affordable healthcare benefits to their employees. Additionally, group plans typically offer broader coverage and lower deductibles, further enhancing their appeal to both employers and employees

- Moreover, the Affordable Care Act (ACA) has incentivized businesses to offer health insurance coverage to their employees by imposing penalties on large employers that fail to provide affordable and adequate coverage. This regulatory framework has propelled many organizations to explore group health insurance options as a means of compliance while simultaneously addressing the rising costs of healthcare.

- Thus, with the rising cost of insurance premiums, businesses are increasingly turning to group plans as a cost-effective means of providing comprehensive healthcare benefits to their employees while navigating the complexities of regulatory compliance and competitive pressures within the insurance industry

Group Health Insurance Market Report Segmentation Analysis

- Based on plan type, the group health insurance market is segmented into fully insured plans, mixed-insured plans, and self-insured plans. The fully insured plan segment is expected to hold a substantial group health insurance market share in 2023.

- The fully insured plan segment is also expected to hold the highest CAGR over the forecast period.

Group Health Insurance Market Share Analysis By Geography

The scope of the group health insurance market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant group health insurance market share with various providers offering coverage to businesses and organizations. The market in North America is influenced by factors such as regulatory changes, healthcare costs, and employer demand for benefits.

Group Health Insurance Market Report Scope

The "Group Health Insurance Market Analysis" was carried out based on type, mode, distribution channel, and geography. On the basis of plan type, the market is segmented into fully insured plans, mixed-insured plans, and self-insured plans. On the basis of enterprise size, the market is segmented into large enterprises and SMEs. Based on distribution channels, the market is segmented into agents, direct sales, banks, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Group Health Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the group health insurance market. A few recent key market developments are listed below:

- In January 2024, Bharti Group announced plans to sell its wholly-owned life insurance venture, Bharti AXA Life Insurance, to SBI Life. With this, Bharti Group has been looking to exit the insurance business and focus on telecom.

[Source: Bharti Group, Press Release]

- In December 2023, Everest Insurance, the insurance division of Everest Group, announced the launch of a fixed indemnity insurance product. This fixed indemnity insurance was designed for companies and association groups that are looking for non-ACA health insurance.

[Source: Everest Group, Press Release]

Group Health Insurance Market Report Coverage & Deliverables

The group health insurance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Group Health Insurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Group Health Insurance Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 9.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For