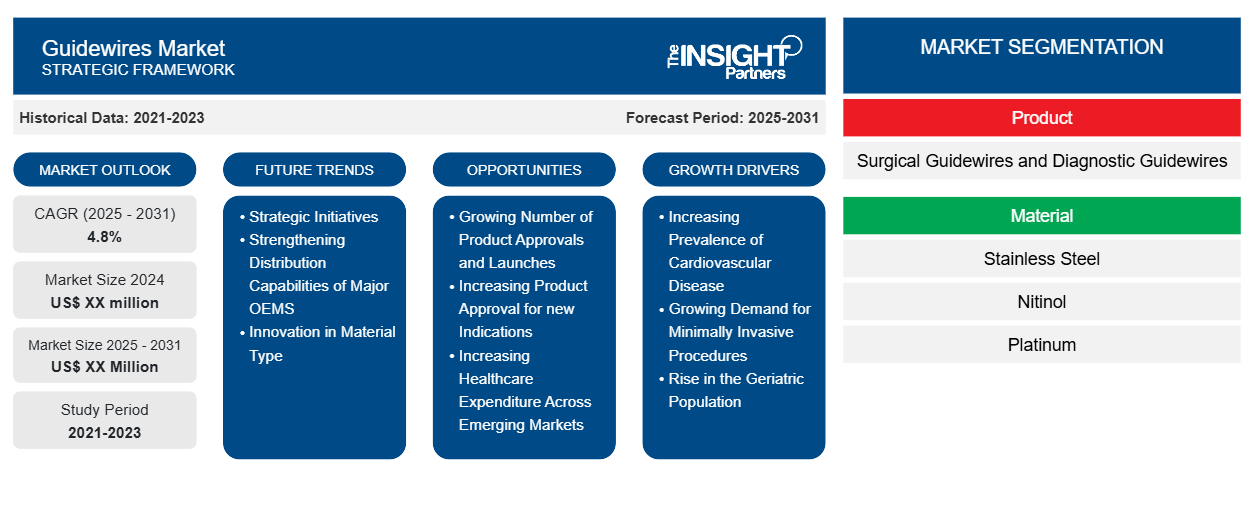

The Guidewires Market is expected to register a CAGR of 4.8% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Product (Surgical Guidewires and Diagnostic Guidewires). The report further presents analysis based on the Material (Stainless Steel, Nitinol, Platinum, Titanium, Tungsten, and Others). The report is further segmented based on Application (Cardiology, Urology, Vascular, Oncology, Neurology, Gastroenterology, and Others). Further, it is segmented based on End User (Hospitals, Diagnostic Centers, and Ambulatory Surgical Centers). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Guidewires Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Guidewires Market Segmentation

Product

- Surgical Guidewires and Diagnostic Guidewires

Material

- Stainless Steel

- Nitinol

- Platinum

- Titanium

- Tungsten

- Others

Application

- Cardiology

- Urology

- Vascular

- Oncology

- Neurology

- Gastroenterology

- Others

End User

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Guidewires Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Guidewires Market Growth Drivers

- Increasing Prevalence of Cardiovascular Disease : Cardiovascular Disease (CVD) is one of the prominent causes of mortality globally, with its prevalence steadily increasing. There is a rising demand for guidewires as they are required for performing interventional procedures like angioplasty and stenting. Growing Demand for Minimally Invasive Procedures: These procedures involve smaller incisions, reducing pain and quicker recovery times. Guidewires are essential to ensure precise and accurate treatment through blood arteries. Rise in the Geriatric Population : The geriatric population is particularly susceptible to cardiovascular disease. the rise in the geriatric population fuels the minimally invasive surgery market growth because aged individuals are more susceptible to chronic diseases

Guidewires Market Future Trends

- Strategic Initiatives : Several market players are implementing various strategic initiatives, such as product innovations and launches, contributing to the region's market growthStrengthening Distribution Capabilities of Major OEMS : OEMS such as Yokowo Co., Ltd., Merit Medical Systems, Inc, and Others are expanding their presence from every major time zone and every major regulatory zoneInnovation in Material Type: The development of innovative stainless steel and coated guidewires is creating a positive outlook for the market

Guidewires Market Opportunities

- Growing Number of Product Approvals and Launches : Extended functionalities and technologies incorporated in new devices are contributing to the rise in demand for guidewiresIncreasing Product Approval for new Indications : The new device incorporates capabilities to gain access of nervous system during hemorrhagic and ischemic stroke and other associated vascular procedures. Thus, the growing number of product launches and approvals are estimated to offer lucrative opportunities for the growth of the target market during the forecast period. Increasing Healthcare Expenditure Across Emerging Markets : Healthcare costs

are rising at an alarming rate in both developed and

emerging economies such as China, India, Brazil. This is expected to be an lucrative opportunity for the players operating in the market

Guidewires Market Regional Insights

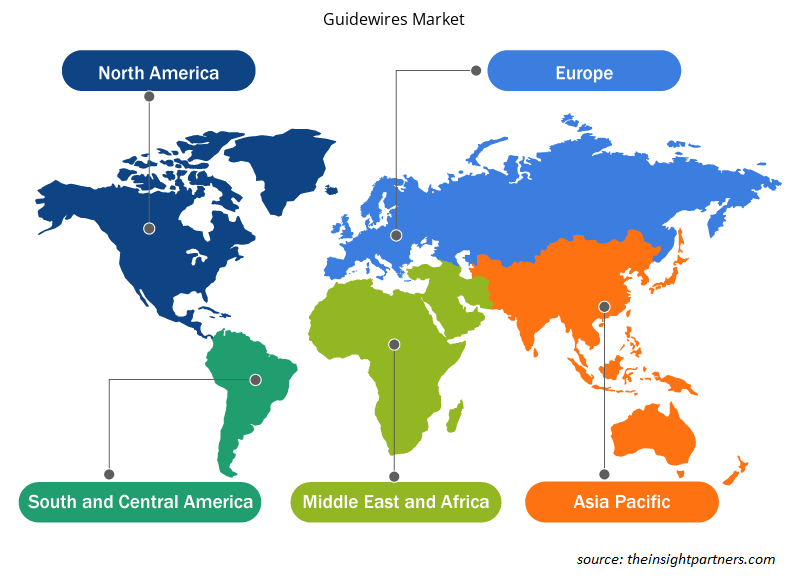

The regional trends and factors influencing the Guidewires Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Guidewires Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Guidewires Market

Guidewires Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 4.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

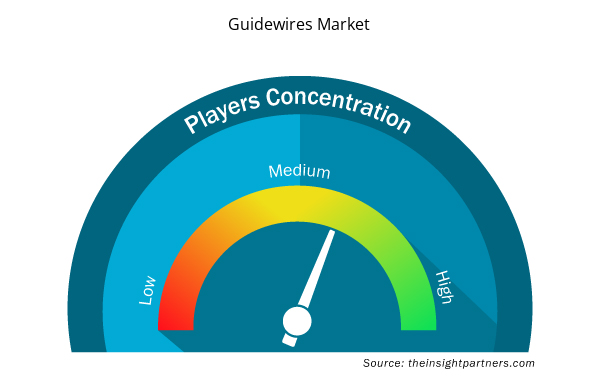

Guidewires Market Players Density: Understanding Its Impact on Business Dynamics

The Guidewires Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Guidewires Market are:

- Abbott

- B. Braun Melsungen AG

- Boston Scientific Corporation

- C. R. Bard, Inc.

- Cardinal Health

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Guidewires Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Guidewires Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Guidewires Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Material, Application, End User, Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Guidewires Market is estimated to witness a CAGR of 4.8% from 2023 to 2031

The major factors driving the guidewires market are:

1. Increasing Prevalence of Cardiovascular Disease.

2. Growing Demand for Minimally Invasive Procedure

3. Rise in the Geriatric Population

North America region dominated the guidewires market in 2023

Asia Pacific region dominated the guidewires market in 2023

The surgical guidewires segment accounts for highest revenue in product type the guidewires market in 2023

Abbott, B. Braun Melsungen AG, and Boston Scientific Corporation accounting for higesh market shares and are some of the major players operating in the market

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. Abbott

2. B. Braun Melsungen AG

3. Boston Scientific Corporation

4. C. R. Bard, Inc.

5. Cardinal Health

6. Cook

7. Johnson & Johnson Services, Inc.

8. Medtronic

9. Olympus Corporation

10. Terumo Medical Corporation

Get Free Sample For

Get Free Sample For