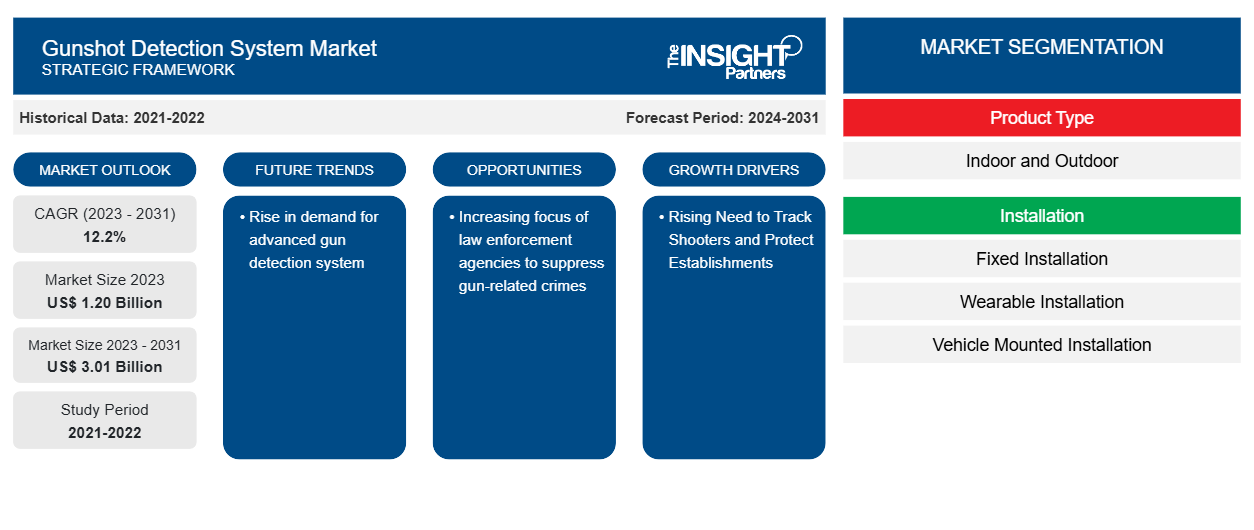

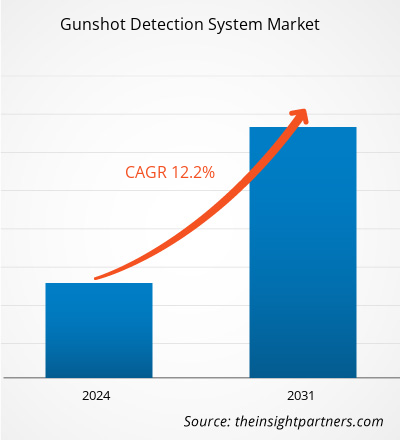

The gunshot detection system market size is expected to grow from US$ 1.20 billion in 2023 to US$ 3.01 billion by 2031; it is anticipated to expand at a CAGR of 12.2% from 2023 to 2031. The rise in demand for advanced gun detection system is likely to remain a key gun detection system market trends.

Gunshot Detection System Market Analysis

The rising need to track shooters and protect defense establishments effectively has led to increased adoption of gun detection system solutions, thereby driving the market.

Gunshot Detection System Market Overview

Gunshot detection systems use sophisticated sensor networks to detect and localize gunshots in a specific region. These systems use a variety of technologies, including acoustic and electro-optic sensors, to reliably detect and pinpoint the source of gunfire. Auditory systems examine acoustic patterns to distinguish between gunshots and other surrounding sounds, whereas electro-optic systems employ infrared imaging to locate enemy snipers. These systems are frequently utilized by law enforcement, security agencies, military groups, government offices, schools, and corporations to improve safety and security.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Gunshot Detection System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Gunshot Detection System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Gunshot Detection System Market Drivers and Opportunities

Rising Need to Track Shooters and Protect Establishments to Favor Market

Gunshot detection systems are critical tools in disputed areas where defending forces must identify the source of gunfire and respond appropriately. These devices have been adopted into defense platoons across the world to reduce the chance of injuries among deployed personnel. For example, the United States Army has purchased improved sniper detection equipment for its troops stationed in Iraq and Afghanistan. These technologies give real-time information regarding the distance and direction of rounds fired, allowing soldiers to plan an effective reaction. The US Army also intends to integrate gunshot detection technology into its existing systems for future uses, therefore improving dismounted soldiers' tactical awareness.

Increasing focus of law enforcement agencies to suppress gun-related crimes

Law enforcement agencies are increasingly looking for external specialists to help them with digital transformation projects. They are working with managed service providers to improve their current systems and expand the coverage given by gunshot detection technology. Gunshot detection is a critical technology that may significantly improve civilian security services. Several communities in the United States, including Fresno, California and Peoria, Illinois, have adopted it. ShotSpotter Inc. signed new contracts in December 2020 with seven US communities to implement its main gunshot detection product, ShotSpotter Respond, to their respective populations. This represents a increasing trend in which smaller communities use innovative methods to prevent and minimize gun violence.

Gunshot Detection System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the gunshot detection system market analysis are product type, installation, and application.

- Based on product type, the market is divided into indoor and outdoor. The outdoor segment held a larger market share in 2023.

- Based on installation, the market is divided into fixed installation, wearable installation, and vehicle mounted installation. The fixed installation segment held a larger market share in 2023.

- In terms of application, the market is bifurcated into military and law enforcement. The military segment held a larger market share in 2023.

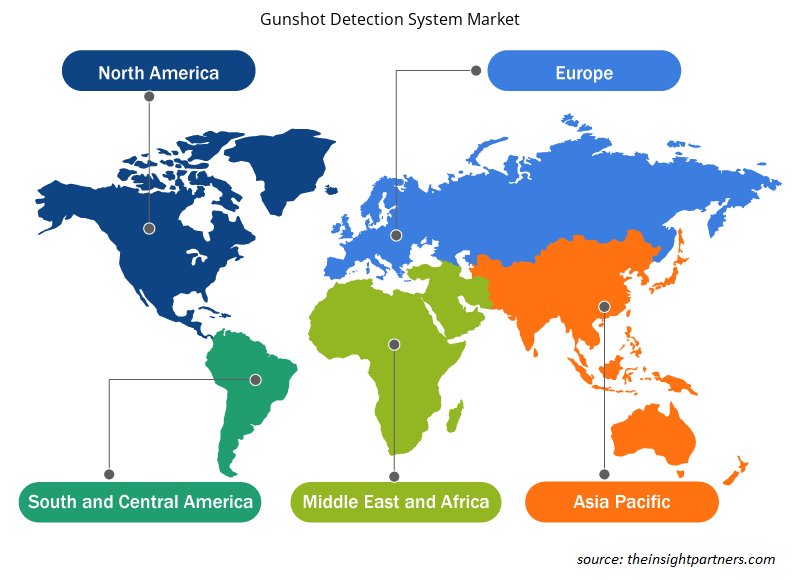

Gunshot Detection System Market Share Analysis by Geography

The geographic scope of the Gun Detection System market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. North America dominated the Gun Detection System market in 2023. North America is projected to show the highest growth in the Gunshot Detection Systems market during the forecast period. Growing investments by the US government in equipping officials with advanced gunshot detection technologies, coupled with the involvement of various key players in the market, are anticipated to drive market growth in the coming years. Governments worldwide are also planning to invest in advanced gun control detection systems to enhance public safety and security

Gunshot Detection System Gunshot Detection System Market Regional Insights

The regional trends and factors influencing the Gunshot Detection System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Gunshot Detection System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Gunshot Detection System Market

Gunshot Detection System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.20 Billion |

| Market Size by 2031 | US$ 3.01 Billion |

| Global CAGR (2023 - 2031) | 12.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

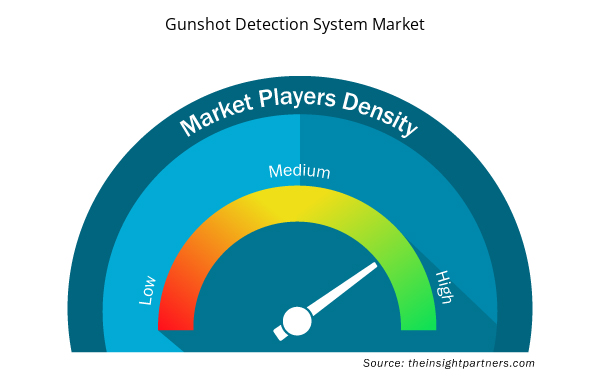

Gunshot Detection System Market Players Density: Understanding Its Impact on Business Dynamics

The Gunshot Detection System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Gunshot Detection System Market are:

- Raytheon Company

- ShotSpotter

- Shooter Detection Systems LLC

- AmberBox Gunshot Detection

- Safety Dynamics Inc.

- Microflown Avisa BV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Gunshot Detection System Market top key players overview

Gunshot Detection System Market News and Recent Developments

The Gun Detection System market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In April 2024, Shooter Detection Systems joins Partner Alliance for Safer Schools. As part of its commitment to PASS, Shooter Detection Systems promotes the PASS guidelines for layered school safety and security among school administrators and public safety professionals.

(Source: Shooter Detection Systems, Press Release, 2024)

- In May 2022, Raytheon Company announced that it had delivered 34 Boomerang gunshot detection systems to the Lithuanian armed forces to protect soldiers and its fleet of next-generation combat vehicles.

(Source: Raytheon Company, Press Release, 2022)

Gunshot Detection System Market Report Coverage and Deliverables

The "Gunshot Detection System Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Emergency Department Information System (EDIS) Market

- Antibiotics Market

- Blood Collection Devices Market

- Bio-Based Ethylene Market

- Analog-to-Digital Converter Market

- Third Party Logistics Market

- Formwork System Market

- Hydrolyzed Collagen Market

- Carbon Fiber Market

- Vision Guided Robotics Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type ; Installation and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

The gunshot detection system market size is expected to grow from US$ 1.20 billion in 2023 to US$ 3.01 billion by 2031; it is anticipated to expand at a CAGR of 12.2% from 2024 to 2031.

The rising need to track shooters and protect defense establishments effectively are some factors that propel the global gunshot detection system market.

The rise in demand for advanced gun detection system is likely to remain a key gun detection system market in future trends.

The key players holding the majority of shares in the global gunshot detection system market are Raytheon Company, ShotSpotter, Shooter Detection Systems LLC, AmberBox Gunshot Detection, and Safety Dynamics Inc.

The global gunshot detection system market is expected to reach US$ 3.01 billion by 2031.

Get Free Sample For

Get Free Sample For