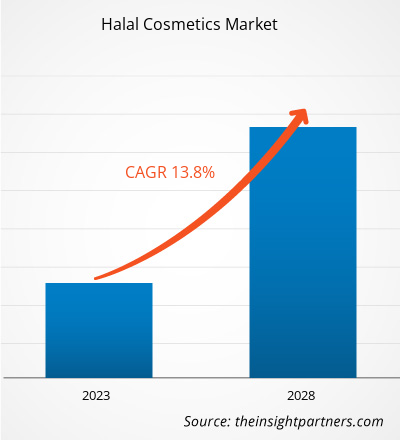

[Research Report] The halal cosmetics market is expected to grow from US$ 36,686.54 million in 2022 to US$ 79,861.73 million by 2028; it is estimated to grow at a CAGR of 13.8% from 2022 to 2028.

Market Insights and Analyst View:

Halal cosmetic products are cosmetic products that adhere to Islamic standards, i.e., cosmetic products free from pig-derived and other forbidden ingredients. Halal cosmetic products are also wudu–friendly (permeable to water), as required by Islamic standards. The halal cosmetic products are sourced and manufactured with ‘permissible’ ingredients under Islamic law. Halal cosmetic does not contain any alcohol or any ingredients from animals that are forbidden for Muslims.

Growth Drivers and Challenges:

Halal cosmetics have witnessed significant adoption among the Muslim population owing to the increasing demand for personal grooming and trending cosmetic and beauty products that adhere to religious loyalties. The growth of the global halal cosmetics market has driven due to the rise in purchasing power of the growing Muslim population across the globe. The desire of young Muslim women to associate their interest in fashion & makeup with Islamic loyalties in countries such as Saudi Arabia, Malaysia, Iran, UAE, and Indonesia and consumers equally interested in fashion and makeup trends have boosted the consumption of halal cosmetics, which will drive the global halal cosmetics industry. Moreover, some vegan varieties also extend the market opportunity for the non-Muslim population. For example, Eco trail, an Indian company, and UK-based PHB Ethical Beauty offer products that are not only Halal certified but also cruelty-free and free from harmful substances. This trend is being followed by leading global brands, such as The Body Shop and Forest Essentials, which, in turn, is supporting the market expansion. However, the prices of halal-certified cosmetics are much higher than standard cosmetic products, which can restrain market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Halal Cosmetics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Halal Cosmetics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Halal Cosmetics Market” is segmented based on product type, category, distribution channel, and geography. Based on product type, the halal cosmetics market is segmented into skincare, haircare, makeup, and others. Based on category, the market is classified into men, women, and unisex. Based on distribution channel, the halal cosmetics market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The halal cosmetics market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on product type, the halal cosmetics market is segmented into skincare, haircare, makeup, and others. The skincare segment held the significant share in the halal cosmetics market and is expected to register the significant growth over the forecast period. Most cosmetics contain ingredients that cause skin irritation and may have a long-term effect on health. As a result, halal cosmetics have proven to be an alternative and effective solution for consumers. Increasing disposable income coupled with adopting a modern lifestyle is presumed to be the significant factor potentially boosting the halal cosmetics market worldwide.

Regional Analysis:

Based on geography, the halal cosmetics market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The global halal cosmetics market was dominated by Asia Pacific, which accounted for US$ 14,838.48 million in 2022. Middle East & Africa is a second major contributor holding more than 20% share in the global market. Europe is expected to register the considerable growth at a CAGR of over 13.9% over the forecast period. has been noticed as one of the prominent markets for halal cosmetics due to the surge in awareness about cruelty-free products and the increased population. The rise in foreign direct investments also leads to regional economic growth. Moreover, Middle East & Africa has a large Muslim population, thus giving halal cosmetic products a lucrative opportunity for growth. Such factors have allowed global brands and online retailers to expand their offerings to capture the demand. Due to the demand for halal-certified products in the region, Saudi Arabian PIF (Public Investment Fund) launched its new Halal Products Development Company in October 2022. The company aims to manufacture personal care and cosmetic products locally in Saudi Arabia and export halal-certified products worldwide.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the halal cosmetics market are listed below:

- In November 2022, Iba Cosmetics, a Halal cosmetics manufacturer, partnered with Believe company based in Singapore. Believe company has invested US$ 10 million to partner with Iba Cosmetics to distribute and expand their retail market space across operating countries such as Middle Eastern and European and South Asia countries.

- In November 2022, Iba Cosmetics partnered with Believe company based in Singapore. Believe company has invested USD 10 million to partner with Iba Cosmetics to distribute and expand their retail market space across operating countries such as Middle Eastern and European and South Asia countries.

- In April 2022, Inika Organic launched its new cosmetics collection, Pure with Purpose. The range of products included in the group is Lash & Brow Serum, Hydrating Toning Mist, Eyeshadow Quads, Brow Palette, and more. These products are claimed to be 100% natural, vegan-certified, halal-certified, and cruelty-free.

- In August 2021, Kao Corporation, a Japanese manufacturer of halal-certified cosmetics, collaborated with lion corporation to develop recyclable packaging and minimize the plastic footprint.

Covid-19 Impact:

The COVID-19 pandemic affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the consumer goods industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies witnessed delays in product deliveries and a slump in sales of their products in 2020. Various halal cosmetic manufacturers had to temporarily close their operations or limit their production capacities, negatively impacting the growth of the halal cosmetics market. Also, in the early period of the crisis, manufacturers were majorly dependent on the existing inventory. Due to the pandemic-induced economic recession, consumers became more cautious and selective in purchasing decisions. Consumers significantly reduced nonessential purchases due to lower incomes and uncertain earning prospects, especially in developing regions. However, by the end of 2021, many countries were fully vaccinated, and governments announced relaxation in certain regulations, including lockdowns and travel bans. Post-pandemic consumers increasingly demand skincare and haircare products as there has been a growing trend of self-care post the COVID-19 pandemic. The growth of online retail during the pandemic has also provided growth opportunities for halal cosmetic manufacturers. Along with this, the relaxation of trade restrictions has led to the import and export of halal cosmetics, positively impacting the market.

Halal Cosmetics Market Regional Insights

Halal Cosmetics Market Regional Insights

The regional trends and factors influencing the Halal Cosmetics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Halal Cosmetics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Halal Cosmetics Market

Halal Cosmetics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 36.69 Billion |

| Market Size by 2028 | US$ 79.86 Billion |

| Global CAGR (2022 - 2028) | 13.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

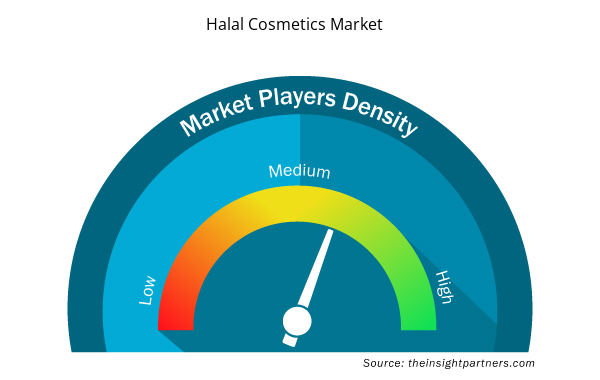

Halal Cosmetics Market Players Density: Understanding Its Impact on Business Dynamics

The Halal Cosmetics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Halal Cosmetics Market are:

- Clara International Beauty Group

- Inglot Cosmetics

- Inika Organic Australia

- IVY Beauty Corporation

- MMA Bio Lab Sdn Bhd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Halal Cosmetics Market top key players overview

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global halal cosmetics market include Clara International Beauty Group; Inglot Cosmetics; Inika Organic Australia; IVY Beauty Corporation; MMA Bio Lab Sdn Bhd; OnePure, LLC; PT Paragon Technology and Innovation; PHB Ethical Beauty Ltd.; Sampure Minerals; and IBA Cosmetics among others.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Micro-Surgical Robot Market

- Underwater Connector Market

- Online Recruitment Market

- Cell Line Development Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Mobile Phone Insurance Market

- Wheat Protein Market

- Cling Films Market

- Ceramic Injection Molding Market

- Europe Industrial Chillers Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Category, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

In 2021, Asia-Pacific accounted for the largest share of the global halal cosmetics market. The high popularity of halal cosmetics among non-muslim consumers was the primary factor responsible for the high market share of the Asia Pacific region.

During the forecast period, the skincare segment is expected to be the fastest-growing segment. The primary factors influencing the halal skincare demand include the growing demand for self-care or health-promoting products. Consumer inclination for health and well-being, as well as product innovation are expected to fuel market expansion.

The major players operating in the halal cosmetics market are Clara International Beauty Group, Inglot Cosmetics, Inika Organic Australia, IVY Beauty Corporation, MMA Bio Lab Sdn Bhd, OnePure LLC, PT Paragon Technology and Innovation, PHB Ethical Beauty Ltd., Sampure Minerals, and IBA Cosmetics.

In 2021, the skincare segment held the largest market share. Skincare products are widely used daily by women as well as men. Increased concern for skin nourishment due to acne, scars, black spots, and dullness has fuelled the demand for skincare products in 2020.

Based on category, women is expected to be the fastest-growing segment during the forecast period. Female consumers are significantly opting for halal, natural & herbal cosmetics products, as they are more concerned about the long-term impact of chemicals on their skin and body, which is driving the women segment of the halal cosmetics market.

Rising awareness about cruelty-free and chemical-free products has propelled the growth of halal cosmetics market. Moreover, the increasing young population and popularity of halal cosmetics is sparking the demand for halal cosmetics market growth.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - Halal Cosmetics Market

- Clara International Beauty Group

- Inglot Cosmetics

- Inika Organic Australia

- IVY Beauty Corporation

- MMA Bio Lab Sdn Bhd

- OnePure, LLC

- PT Paragon Technology and Innovation

- PHB Ethical Beauty Ltd.

- Sampure Minerals

- IBA Cosmetics

Get Free Sample For

Get Free Sample For