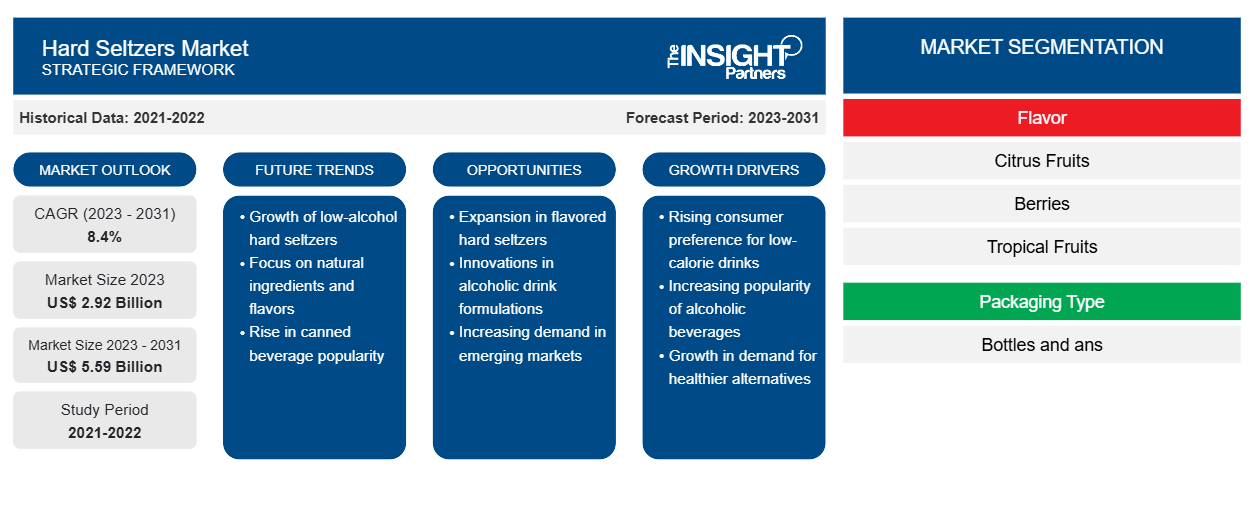

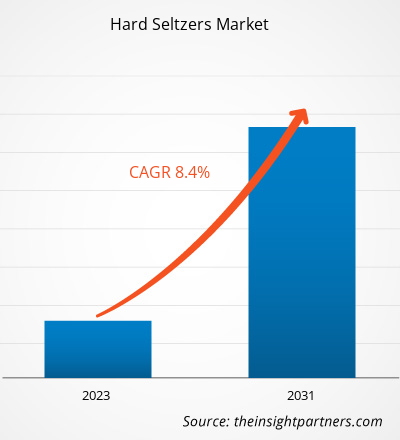

The hard seltzers market size is projected to reach US$ 5.59 billion by 2031 from US$ 2.92 billion in 2023. The market is expected to register a CAGR of 8.4% during 2023–2031. Social media campaigns by prominent market players and campaign’s influence on people are likely to remain key trends in the hard seltzers market.

Hard Seltzers Market Analysis

Over the past few years, consumers have become highly conscious about their health and fitness owing to changing lifestyles, consumption patterns, and increasing obesity. According to the US Department of Health and Human Services, from 2018 to 2020, more than 20% of adults were obese in the US states and territories. This figure has declined significantly in comparison to past years as Americans have become more health conscious. There is a high inclination toward low-calorie food and beverages that allow them to eat and drink guilt-free. With the rising popularity of low-calorie food and beverages, hard seltzers have also gained popularity, especially across the US. Hard seltzers are often made with natural flavors, extracts, and no sugar, resulting in low-sugar and low-calorie beverages. Moreover, hard seltzers have low alcohol by volume (ABV) content, which further drives their popularity as consumers attempt to minimize their alcohol intake or become “sober-curious.”

Consumers are rapidly substituting beers and spirits with hard seltzers since hard seltzers satisfy consumer’s low-calorie, low-sugar, and low-ABV requirements. Furthermore, as customers have become more conscious of the ingredients used in products, hard seltzers brands are promoting their products by emphasizing low sugar and calorie content. For instance, Smirnoff hard seltzers are sugar-free and contain only 90 calories, whereas White Claw offers a line of hard seltzers of only 70 calories. These beverages offer health benefits and fit into the keto diet as a beer substitute. Therefore, the rising demand for low-calorie and low-ABV beverages is one of the crucial factors driving the growth of the global hard seltzers market.

Hard Seltzers Market Overview

Hard seltzer is an alcoholic drink containing a larger proportion of flavored carbonated water with low to moderate concentration of alcohol, i.e., 4.5–7% ABV. It is available in flavors such as lemon, watermelon, and tangerine. A can of hard seltzer may contain 100 calories or less owing to which it is claimed to be a healthier alternative over calorically heavy alcoholic beverages. Thus, the rising demand for beverages with lesser concentrations of alcohol, low calories, and low carbohydrates is likely to boost the demand for hard seltzers in countries such as Japan, the US, and Australia. Moreover, the increasing number of product launches is estimated to boost the hard seltzer market in the coming years. Further, new product developments are likely to offer lucrative opportunities for the key players operating in the hard seltzer market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hard Seltzers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hard Seltzers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Hard Seltzers Market Drivers and Opportunities

Increasing Consumption of RTD Beverages to Favor Market

Ready-to-drink (RTD) beverages are gaining popularity as they are convenient to consume and not restricted to a specific location or time. Due to hectic lifestyles and busy schedules, people prefer products in RTD packaging; it is ideal for on-the-go consumption. Additionally, due to COVID-19-induced lockdowns, alcohol consumption patterns have changed dramatically. Owing to the restriction to stay at home, visits to bars have decreased, resulting in a surge in the demand for products that could be consumed at home.

According to ISWR Drinks Market Analysis, the RTD category—including hard seltzers—accounted for the highest rate of consumption in the US in 2020. Hard seltzers come in various flavor combinations, and their ready-to-drink packaging caters to the need for ease and convenience. Moreover, RTD hard seltzers usually come in recyclable cans to meet the sustainability concerns of consumers. These cans are sleek and compact for convenient carrying and are printed in vibrant colors to appeal to a broad spectrum of consumers. Thus, these factors significantly increase the popularity of RTD hard seltzers across regions, thereby promoting the market growth.

Innovative Flavors of Seltzers to Provide Massive Growth Opportunities

With the increasing number of hard seltzer manufacturers, players operating in the market are experiencing fierce competition. Therefore, existing players are focusing on developing innovative products that offer them a competitive advantage over other products available in the market. Manufacturers are investing heavily in launching hard seltzers with new flavors. Although hard seltzers are known for their fruity flavors, several manufacturers have used flavors from alcoholic and non-alcoholic beverages to derive similarities. For instance, the Evil Water range of hard seltzers from Evil Twin Brewing includes hard "pastry" seltzers with flavors such as chocolate, egg cream, and gummy bears. Consumers prefer experimenting with innovative flavors, offering a significant competitive advantage to the manufacturers of hard seltzers. Brands that wish to enter the hard seltzers market may try developing crossover beverages that combine unusual ingredients with seltzers in an innovative way. Continuing experimentation for launching innovative flavors, rising consumer demand for creative brews, and companies competing for originality and craftsmanship are among the factors boosting product innovations in the hard seltzers market, thereby offering lucrative growth opportunities to market players.

Hard Seltzers Market Report Segmentation Analysis

Key segments that contributed to the derivation of the hard seltzers market analysis are flavor, packaging type, and distribution channel.

- Based on flavor, the hard seltzers market is divided into citrus fruits, berries, tropical fruits, and others. The tropical fruits segment held the largest market share in 2023. Tropical flavors are gaining popularity owing to their unique flavor profile and high nutritional value. Manufacturers are launching hard seltzers with a range of tropical flavors such as kiwi, watermelon, and passion fruit. For instance, in August 2021, Vizzy (a Molson Coors Beverage Co. brand) launched new hard seltzer flavors such as kiwi & watermelon and passion fruit & watermelon. The rising demand for tropical-flavored hard seltzers is expected to offer ample opportunities for product innovation in the future.

- In terms of packaging type, the market is bifurcated into bottles and cans. The cans segment dominated the market in 2023. Cans are portable, leak-proof, and an excellent packaging alternative, as they require less maintenance than glass. Cans are easy to carry and are ideal for grab-and-go or food-on-the-go trends. Moreover, cans are fancy and attractive, which is why most people prefer cans over bottles. Manufacturers are also launching innovative cans with attractive prints to differentiate themselves from other brands in the market.

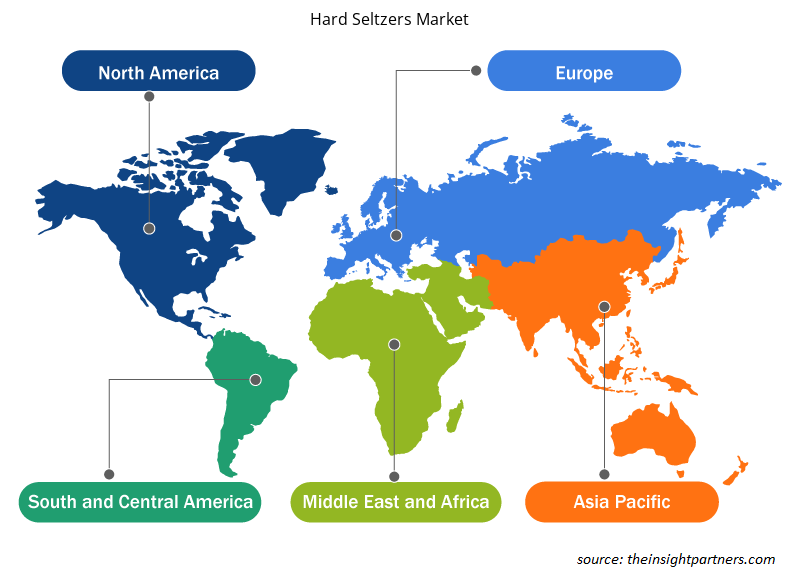

Hard Seltzers Market Share Analysis by Geography

The geographic scope of the hard seltzers market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

The North America hard seltzers market held the largest market share in 2023. Alcoholic beverages are not usually healthy, but consumers prefer healthier alternatives to lower alcohol and sugar intake, leading to a major market shift. An average can of hard seltzer contains around 5% ABV, 90‒110 calories, 0‒4 grams of sugar, and no gluten. Considering this, hard seltzers are rapidly gaining traction in the US. The hard seltzers market in North America is expected to witness a boost as new flavors are introduced and the product gets widely available.

North America has been witnessing high demand for hard seltzers, especially from young consumers. Some of the hard seltzer brands are Truly, White Claw, Kona Brewing Co., and Lift Bridge Brewing Co. Wide customer base with a strong desire for hard seltzers in the region, as well as growing online liquor sales and increasing number of cafes and bars, is expected to generate growth opportunities for manufacturers of hard seltzers in the future.

Hard Seltzers Market Regional Insights

The regional trends and factors influencing the Hard Seltzers Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Hard Seltzers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Hard Seltzers Market

Hard Seltzers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.92 Billion |

| Market Size by 2031 | US$ 5.59 Billion |

| Global CAGR (2023 - 2031) | 8.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Flavor

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

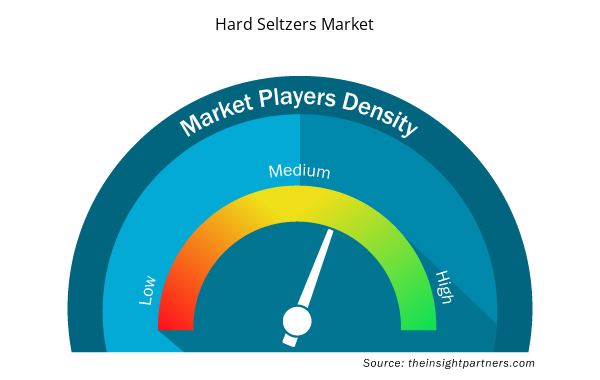

Hard Seltzers Market Players Density: Understanding Its Impact on Business Dynamics

The Hard Seltzers Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Hard Seltzers Market are:

- The Boston Beer Company

- Anheuser-Busch InBev

- Constellation Brands, Inc.

- Kona Brewing Co.

- Kopparbergs Bryggerier

- Lift Bridge Brewing Co.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Hard Seltzers Market top key players overview

Hard Seltzers Market News and Recent Developments

The hard seltzers market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for speech and language disorders:

- Boston Beer Co’s Truly Hard Seltzer is bringing the OG snack of football watch parties – hot wings – to both fans and cans with the launch of the first-ever Hot Wing Sauce Hard Seltzer. (Source: Hard Seltzers – Boston Beer Co, Press Release/Company Website/Newsletter, 2024)

- International alcoholic beverage producer Constellation Brands has released four new flavoured hard seltzers under its Corona beer brand. Corona Hard Seltzer Limonada comprises Classic Lemon Lime, Strawberry, Watermelon and Grapefruit. The product is inspired by the classic Mexican limonada recipes and is made with lemon and lime juice. (Source: Hard Seltzers Constellation Brands Inc, Press Release/Company Website/Newsletter, 2023)

Hard Seltzers Market Report Coverage and Deliverables

The “Hard Seltzers Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Ceramic Injection Molding Market

- Compounding Pharmacies Market

- Electronic Signature Software Market

- Educational Furniture Market

- Broth Market

- Terahertz Technology Market

- Point of Care Diagnostics Market

- Medical and Research Grade Collagen Market

- Battery Testing Equipment Market

- Sports Technology Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Flavor, Packaging Type, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For