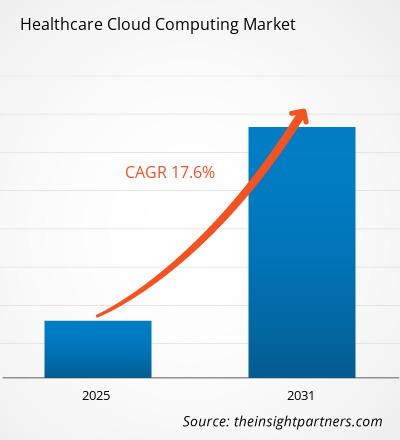

[Research Report] The cloud computing healthcare market size is projected to grow from

US$ 40.12 billion in 2022 to US$ 143.71 billion by 2031; the market is estimated to record a CAGR of 17.6% during 2022–2031.

Market Insights and Analyst View:

Healthcare cloud computing uses cloud-based services and technologies to store, manage, and analyze healthcare data. This includes electronic health records, medical imaging, genomic data, and other patient information, as well as advanced analytics and predictive modeling to improve patient care and outcomes. Cloud computing in healthcare also supports remote access and collaboration, enabling healthcare organizations to securely share and access patient data from anywhere, supporting telemedicine, remote monitoring, and virtual care delivery. The healthcare cloud computing market is expected to grow due to increasing numbers of startups in the sector. MedRabbits, lvlAlpha, Spire Automation, lifetrons, and Hidoc Dr are some startups.

Electronic health records, a healthcare cloud computing solution, are becoming increasingly popular with the growing digitization of the healthcare industry. As per The New England Journal of Medicine, as soon as the Health Information Technology for Economic and Clinical Health (HITECH) Act became law in 2009, the federal government dedicated US$ 300 million to help healthcare facilities adopt a nationwide health information exchange system. The Centers for Medicare and Medicaid Services (CMS) also offered more than US$ 35,000 million in incentive payments for adopting electronic health records. According to the Office of the National Coordinator for Health Information Technology (ONC), as of 2021, about 4 in 5 office-based physicians (78%) and almost all non-federal acute care hospitals (96%) adopted certified Electronic Health Records. This marked considerable 10-year progress when 28% of hospitals and 34% of physicians had adopted Electronic Health Records since 2011. As per Definitive Healthcare data from 2021, more than 89% of all hospitals had employed inpatient or ambulatory Electronic Health Records. The rapid increase in advanced healthcare analytics has also emerged as a significant growth factor for the market.

Growth Drivers:

Increasing Adoption of EHR, E-prescribing, Telehealth, and Other Healthcare IT solutions

One of the key drivers for the healthcare cloud computing market is the increasing volume and complexity of healthcare data. With the growing adoption of electronic health records, medical imaging, and genomic data, healthcare organizations face the challenge of managing and analyzing large amounts of data. Cloud computing offers a scalable, cost-effective solution for storing, processing, and accessing this data. It is an attractive option for healthcare providers looking to improve their data management capabilities. The shift towards value-based care and population health management also drives the demand for advanced analytics and predictive modeling in healthcare. Cloud computing enables healthcare organizations to leverage these technologies to identify trends, patterns, and risk factors in patient data, ultimately leading to more proactive and personalized care. This aligns with the industry's focus on improving patient outcomes and reducing costs, making cloud-based analytics a valuable driver for the healthcare cloud computing market.

Moreover, the increasing need for remote access and collaboration in healthcare is fueling the demand for cloud computing solutions. With the rise of telemedicine, remote monitoring, and virtual care delivery, healthcare organizations require secure and reliable platforms for sharing and accessing patient data from anywhere. Cloud computing provides the flexibility and accessibility needed to support these remote care models, making it an essential driver for the healthcare cloud computing market. Overall, the growing volume of healthcare data, the demand for advanced analytics, and the need for remote access and collaboration are key drivers for the healthcare cloud computing market. As healthcare organizations continue to prioritize data-driven decision-making, personalized care, and remote care delivery, cloud computing will play a crucial role in enabling these advancements in the industry.

Another driver for the healthcare cloud computing market is the increasing adoption of mobile and wearable devices in healthcare. As more patients use smartphones, tablets, and wearable devices to track their health and communicate with healthcare providers, there is a growing need for secure and efficient cloud-based storage and analysis of the data generated by these devices. Healthcare organizations are also increasingly using mobile and wearable technology to remotely monitor patients and deliver personalized care, creating a demand for cloud computing solutions that can support these initiatives. Additionally, using mobile and wearable devices can generate large amounts of data that can be effectively managed and analyzed through cloud computing, leading to insights that can improve patient care and outcomes. Overall, the increasing use of mobile and wearable devices in healthcare drives the demand for healthcare cloud computing solutions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Healthcare Cloud Computing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Healthcare Cloud Computing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

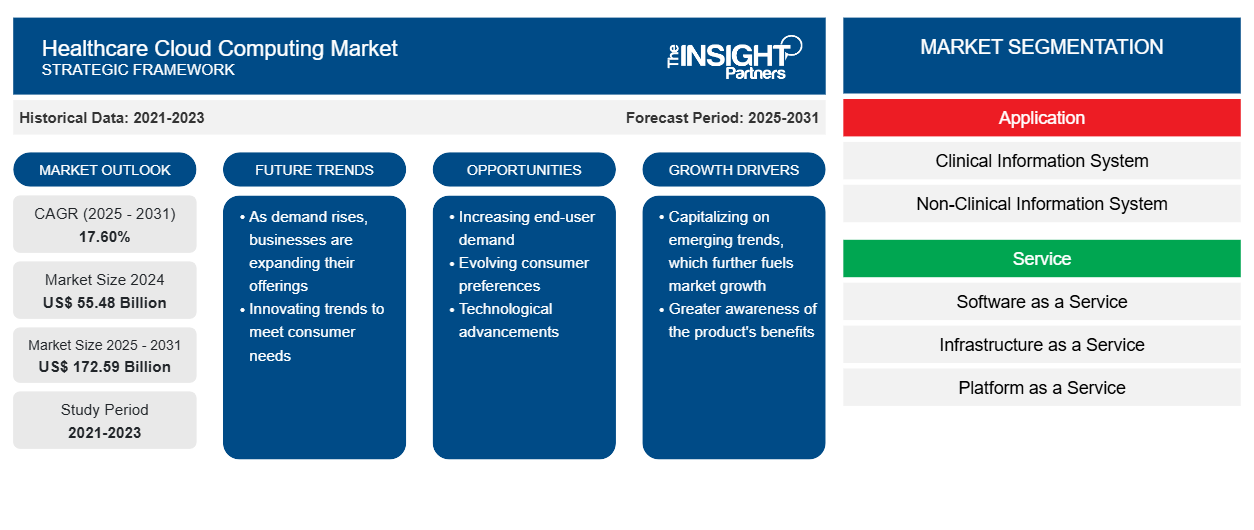

Report Segmentation and Scope:

The “Healthcare Cloud Computing Market” is segmented based on Application, Services, Deployment, End Users and Geography. The market is segmented based on application into clinical information systems (CIS) and Non-clinical Information Systems (NCIS). Clinical information systems (CIS) are further classified into Electronic Health Record (EHR), Picture Archiving and Communication Systems (PACS), Radiology Information Systems (RIS), Computerized Physician Order Entry (CPOE), and other applications. The Non-clinical Information Systems (NCIS) are segmented into Revenue Cycle Management (RCM), Automatic Patient Billing (APB), Payroll Management System, and other Non-clinical Information Systems. Based on Service, the market is classified into Software as a Service, Infrastructure as a Service, and Platform as a Service. Based on Deployment, the healthcare cloud computing market is bifurcated into Private Cloud and Public Cloud. Based on End Users, the market is bifurcated into Healthcare Providers and Healthcare Payers.

Segmental Analysis:

Based on application, the cloud computing healthcare market is divided into clinical and non-clinical information systems. The clinical information system (CIS)-based solutions segment held a larger market share in 2022, and the same segment is expected to register a higher CAGR during 2022–2031. In contrast, the non-clinical information system will grow at the highest CAGR during the forecasted year. The growth is attributed to the technological developments in the healthcare industry and the increasing adoption of cloud-based solutions in clinical practice. The cloud-based model offers several benefits, such as flexibility, scalability, and collaboration. Such benefits associated with the cloud-based model are expected to propel the market. In addition, the cloud-based model also eliminates the requirement of buying, maintaining, and deploying on-premises services, thereby minimizing installation and maintenance costs and contributing to the overall expansion.

Based on end users, the healthcare cloud computing market is segmented into healthcare providers and healthcare payers. The healthcare provider segment held a larger market share in 2022. It is expected to register a higher CAGR during 2022–2031. Global expansion of the information technology sector is expected to boost market revenue. The market demand is also anticipated to be further fuelled by a growing trend of outsourcing healthcare IT solutions, which lowers the overall cost of healthcare services. Therefore, increasing adoption of healthcare IT solutions after COVID-19, followed by increasing technological advancement in the healthcare IT sector, will positively impact market growth in the upcoming year.

Furthermore, partnerships with multinational companies or local market players drive the healthcare provider market growth. For instance, in February 2022, IBM acquired Neudesic, LLC, a move aimed at expanding IBM's portfolio of hybrid multi-cloud services and further advancing the company's hybrid cloud and AI strategy. Moreover, the company witnessed rapid growth during the COVID-19 pandemic due to increasing demand for technologically advanced healthcare assistance.

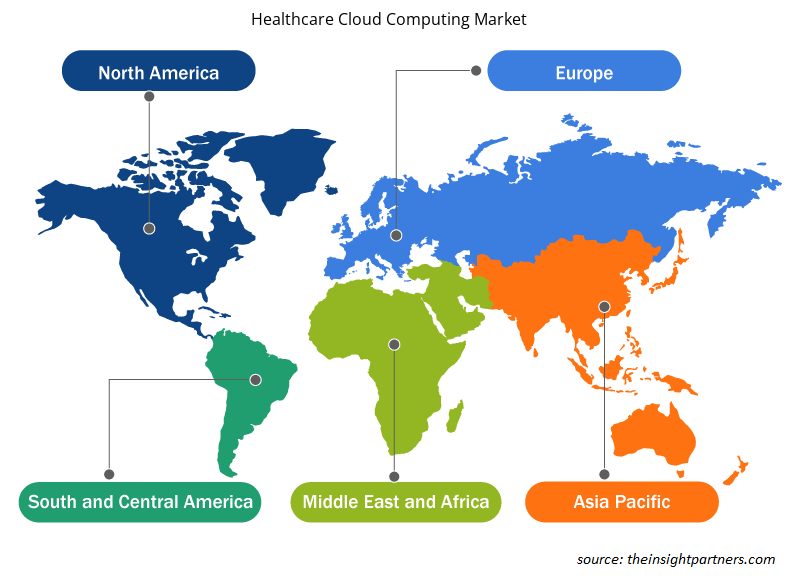

Regional Analysis:

Based on geography, the global cloud computing healthcare market is segmented into five key regions: North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America. In 2022, North America contributed the largest global cloud computing healthcare market share. Asia Pacific is expected to register the highest CAGR during 2022-2031.

North America holds the largest share of the cloud computing healthcare market. The market in this region is split into the US, Canada, and Mexico. The market growth in the region is ascribed to factors such as the presence of key players and the increasing adoption of technology in research and development. Favorable regulatory policies and increasing investment by pharmaceutical and medical companies also favor regional growth. In March 2022, The largest academic medical system in New York, Mount Sinai Health System, announced Accenture and Microsoft would assist it with a five-year cloud migration process to ensure a fast and smooth transition. Shifting towards the cloud will allow the healthcare system to reinvest cost savings and focus on its mission.

The US is the largest contributor to the cloud computing healthcare market in North America and the world. In March 2022, Microsoft announced it completed the acquisition of Nuance Communication, a speech recognition company and leading provider of conversational artificial intelligence to enhance healthcare artificial intelligence. The increasing usage of electronic health records and e-prescriptions, followed by the penetration of telehealth, will likely drive the market’s growth.

Research and development budgets of pharmaceutical companies have also increased in the last few years in the region. For instance, In September 2022, LifePoint Health, a diversified healthcare delivery network dedicated to making communities healthier, and Google Cloud entered a multi-year strategic partnership to transform healthcare delivery in communities across the United States through LifePoint's implementation of Google Cloud's Healthcare Data Engine (HDE). Thus, the market is projected to grow during the forecast period due to rapid technological advancement and investments in the healthcare cloud computing market.

Competitive Landscape and Key Companies:

Amazon Web Services, Inc., IBM, CareCloud, Inc., eClinicalWorks, Koninklijke Philips N.V., eClinical Solutions LLC, Athenahealth Inc., Siemens Healthneers AG, and Allscripts Healthcare Solution, Inc. are the prominent cloud computing healthcare market companies. These companies focus on new technologies, existing product advancements, and geographic expansions to meet the growing consumer demand worldwide.

Industry Developments and Future Opportunities:

Various initiatives taken by leading players operating in the cloud computing healthcare market are listed below:

- In November 2023, Mental health startup UpLift announced it acquired a women-focused digital psychiatry platform. The New York-based companies will allow California, Illinois, Pennsylvania, New York, and Texas residents to access Uplift's platform, which will now include team-based therapy and psychiatric care.

- In February 2022, IBM acquired Neudesic, LLC, which was aimed at expanding IBM's portfolio of hybrid multi-cloud services and further advancing the company's hybrid cloud and AI strategy.

- In February 2022, Lyniate acquired SAP SE to provide technology and consulting expertise to make it easier for clients to embrace a hybrid cloud approach and move mission-critical workloads from SAP solutions to the cloud for regulated and non-regulated industries.

- In January 2022, Francisco Partners signed an agreement with IBM to acquire healthcare data and analytics assets from IBM that are currently part of the Watson Health business, including Health Insights, MarketScan, Clinical Development, Social Program Management, Micromedex, and imaging software offerings.

- In January 2022, IBM acquired ENVIZI aimed at building on IBM's growing investments in AI-powered Software.

- In September 2022, LifePoint Health, a diversified healthcare delivery network dedicated to making communities healthier, and Google Cloud entered a multi-year strategic partnership to transform healthcare delivery in communities across the United States through LifePoint's implementation of Google Cloud's Healthcare Data Engine (HDE).

Healthcare Cloud Computing Market Regional Insights

The regional trends and factors influencing the Healthcare Cloud Computing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Healthcare Cloud Computing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Healthcare Cloud Computing Market

Healthcare Cloud Computing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 55.48 Billion |

| Market Size by 2031 | US$ 172.59 Billion |

| Global CAGR (2025 - 2031) | 17.60% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

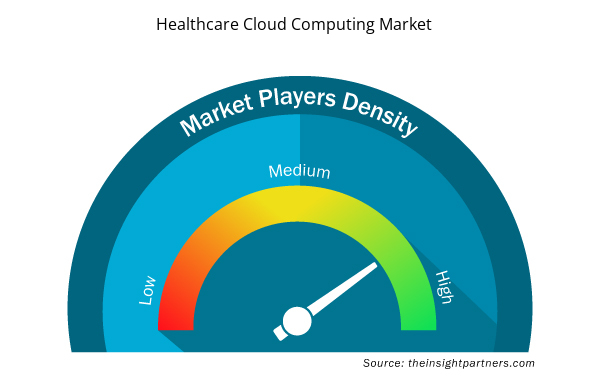

Healthcare Cloud Computing Market Players Density: Understanding Its Impact on Business Dynamics

The Healthcare Cloud Computing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Healthcare Cloud Computing Market are:

- Global Net Access (GNAX)

- Carecloud Corporation

- Dell Inc.

- Athenahealth, Inc.

- Carestream Health, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Healthcare Cloud Computing Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, Service, Deployment, End Users, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies

1. Global Net Access (GNAX)

2. Carecloud Corporation

3. Dell Inc.

4. Athenahealth, Inc.

5. Carestream Health, Inc.

6. VMWare, Inc.

7. Iron Mountain, Inc.

8. IBM Corporation

9. Cleardata Networks, Inc.

10. Merge Healthcare, Inc.

Get Free Sample For

Get Free Sample For