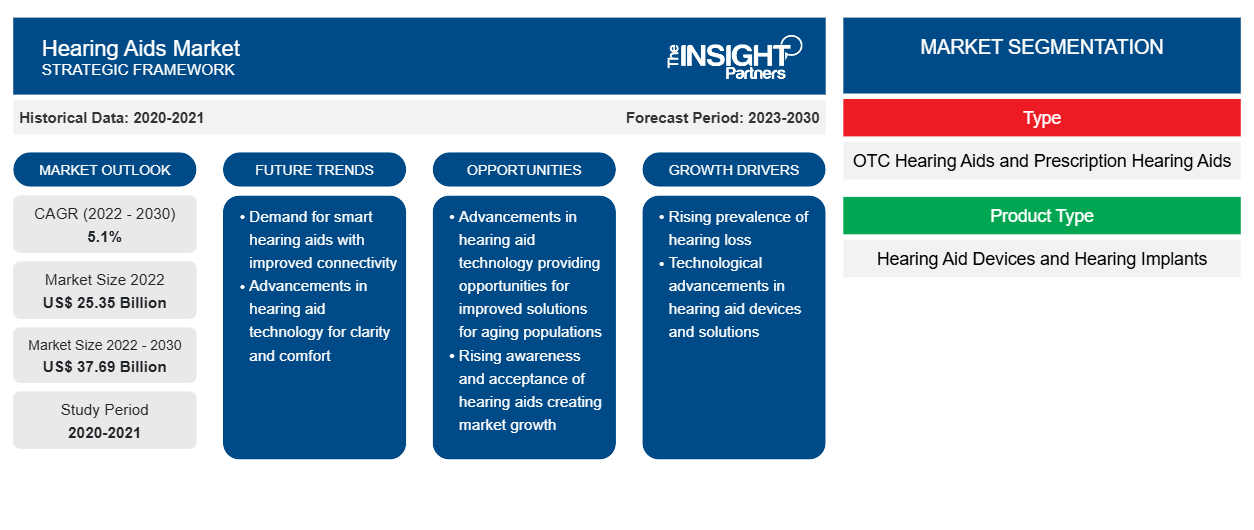

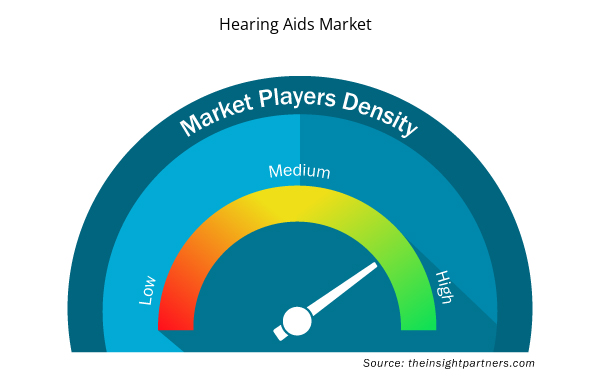

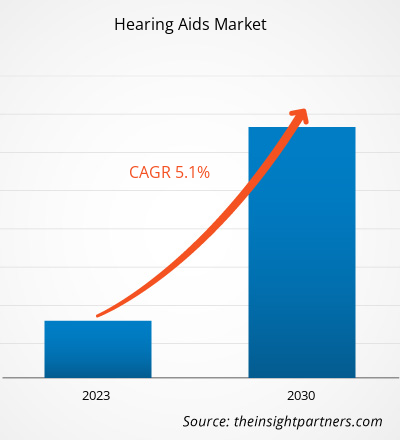

[Research Report] The hearing aids market size is projected to grow from US$ 25,352.23 million in 2022 to US$ 37,689.20 million by 2030; it is estimated to record a CAGR of 5.1% during 2022–2030.

Market Insights and Analyst View:

Hearing aids are sound-amplifying devices that treat hearing loss. Hearing implants are one type of hearing aid designed to be worn behind or in the ear to improve the hearing ability of patients with hearing loss. Hearing aids are gaining popularity due to technological advancements and rising desire for attractive designs. The number of patients suffering from hearing loss and hearing impairment is a key factor advancing the production of these devices. The FDA approval of OTC hearing aids has increased the number of new product developments and launches in the market contributing to market growth. Moreover, ongoing technological innovation in the hearing aids market is expected to drive the hearing aids market growth.

Growth Drivers:

Hearing loss profoundly impacts every dimension of the human experience, including physical, emotional, and mental health. The rising geriatric population contributes to the growing number of people with hearing loss, as the risk of hearing loss is higher in this age group. According to the World Health Organization (WHO), there were nearly 1 billion people in 2020 aged 60 years and above globally, which is expected to reach 1.4 billion by the end of 2030 and is projected to reach 2.1 billion by 2050. As per WHO, , ~5% of the global population (432 million people) will require rehabilitation to address their hearing loss in 2023, which is expected to reach over 700 million by the end of 2050. Although hearing loss is more common among aged people, people of all ages can be affected. Exposure to excessive noise is one of the leading causes of hearing loss for millions of young and old Americans. Both short-term and repeated noise exposure can cause lasting damage to the inner ear, resulting in permanent hearing loss. It's a particular risk for people working around loud noises. According to the Hearing Loss Association of America (HLAA), Hearing Loss Facts and Statistics, ~22 million US workers are exposed to dangerous noise levels in their workplaces yearly. The same source further stated that one out of five men and one of eight women in the country report hearing trouble.

According to the Labour Force Survey, there were ~11,000 prevelant cases of hearing problems caused or made worse by work every year in great Britain.. Many people exposed to loud noise through music, equipment, and work-related or recreational activities do not realize the damage it causes until they notice hearing loss. The number of people with hearing loss will grow as the global population ages, and hearing loss in young population continues to increase.

When left untreated, hearing loss can worsen with time. Hearing aids can significantly improve an individual's quality of life by providing auditory stimuli that could have been lost or reduced due to loss of hearing. Thus, the rising prevalence of hearing loss, wholly or partially, is a key factor boosting the demand for hearing aid devices among the population, thereby driving the growth of the hearing aids market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hearing Aids Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hearing Aids Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Hearing Aids Market" is segmented on the basis of type, product type, technology, type of hearing loss, patient type, distribution channel, and geography. Based on type, the market is bifurcated into prescription hearing aids and OTC hearing aids. In terms of product type, the hearing aids market is segmented into hearing aid devices and hearing implants. The hearing aids market, by technology, is bifurcated into conventional hearing aids and digital hearing aids. Based on the type of hearing loss, the market is bifurcated into sensorineural hearing loss and conductive hearing loss. Based on patient type, the market is bifurcated into adults and pediatrics. The hearing aids market, based on distribution channels, is categorized into pharmacies, retail stores, and online.

Segmental Analysis:

The hearing aids market, by type, is bifurcated into prescription hearing aids and OTC hearing aids. The prescription hearing aids segment held a larger share of the market in 2022. However, the OTC hearing aids segment is anticipated to register a higher CAGR of 44.2% in the market during the forecast period. Devices conventionally known as hearing aids purchased through an audiologist are labeled by the Food and Drug Administration (FDA) as prescription hearing aids. If a person has severe hearing loss, they require prescription devices. These devices can be used for any level of hearing loss and all age groups based on the indications for use. Prescription hearing aids are available only through a licensed audiologist or a hearing instrument specialist who can program the device using advanced diagnostic tools to the specific level of individual hearing loss. Prescription hearing aids are expensive, although they offer the most sophisticated technology and can better address the nuances of various types of hearing loss. They cost an average of US$ 4,600 per pair, while premium models cost as much as US$ 12,000. The total price includes the cost of the devices, the cost of professional fitting and follow-up treatment, and the cost of maintenance and repair visits for the life of the device.

Based on product type, the hearing aids market is segmented into hearing aid devices and hearing implants. The hearing aid devices segment held a larger hearing aids market share in 2022 and is anticipated to register a higher CAGR of 5.3% during the forecast period. Hearing aids are small electronic sound-amplifying devices designed to help people with hearing loss. The hearing aid devices are further classified into behind-the-ear (BTE) hearing aids, canal hearing aids, in-the-ear (ITE) hearing aids, receiver-in-the-ear (RITE) hearing aids, and other hearing aid devices. BTE hearing aid holds the top of a person's ear and rests behind the ear. BTE hearing aids are among the best Bluetooth hearing aids. Vivtone Hearing launched its high-quality BTE hearing aids in July 2023. If comfort is an individual's top priority, the company's receiver-in-canal hearing aids are the best option. The segment is growing due to the availability of a broad range of advanced products offered by the market players, rising adoption of these devices, and growing cases of hearing loss among the population. The increasing focus of the government to reduce the price of hearing aids is also anticipated to fuel the adoption of hearing aid devices among the people.

Based on technology, the hearing aids market is segmented into conventional hearing aids and digital hearing aids. The conventional hearing aids segment held a larger market share in 2022. However, the digital hearing aids segment is anticipated to register a higher CAGR of 5.9% during the forecast period. Conventional hearing aids are noninvasive, i.e., not requiring surgery, and are positioned behind the pinna, in the canal, or are body-worn. These hearing aids do not restore hearing but make sounds more audible using electroacoustic amplification. Conventional hearing aid electronics use basic analog technology to deliver quality amplification to patients with a broad spectrum of hearing loss. The defining characteristic of conventional hearing aids is that they add the same amount of amplification to all sound intensity levels. These hearing aids provide significant benefits to several individuals who suffer from unilateral deafness.

Based on the type of hearing loss, the hearing aids market is segmented into sensorineural hearing loss and conductive hearing loss. The sensorineural hearing loss segment held a larger share of the market in 2022 and is anticipated to register a higher CAGR of 5.3% during the forecast period. Sensorineural hearing loss (SNHL) is caused by damage to the inner ear structure or auditory nerve. The cochlea in the inner ear has tiny hair known as stereocilia that convert vibration from sound waves into neural signals that are transferred to the brain through the auditory nerve. SNHL is the most common cause of hearing loss among adults, and more than 90% of hearing loss is sensorineural. Common causes of SNHL include genetic factors, loud noises, and natural aging. Exposure to the sound of more than 85 decibels can damage the stereocilia and can cause SNHL. SNHL can cause trouble in hearing sounds and high-pitched sounds, dizziness, balance problems, and tinnitus. As per the National Library of Medicine, SNHL affects 5–27 per 1,000 people yearly, with ~66,000 new cases annually in the US. Mild to moderate SNHL can be treated with hearing aids, and profound hearing can be treated with cochlear implants. Therefore, the rising prevalence of SNHL is expected to drive the hearing aids market growth in the near future.

Based on patient type, the hearing aids market is bifurcated into adults and pediatrics. The adults segment held a larger market share in 2022 and is anticipated to register a higher CAGR of 5.5% during the forecast period.

Based on the distribution channel, the hearing aids market is segmented into pharmacies, retail stores, and online. The pharmacies segment held the largest market share in 2022. However, the retail stores segment is projected to register the highest CAGR of 6.5% during the forecast period.

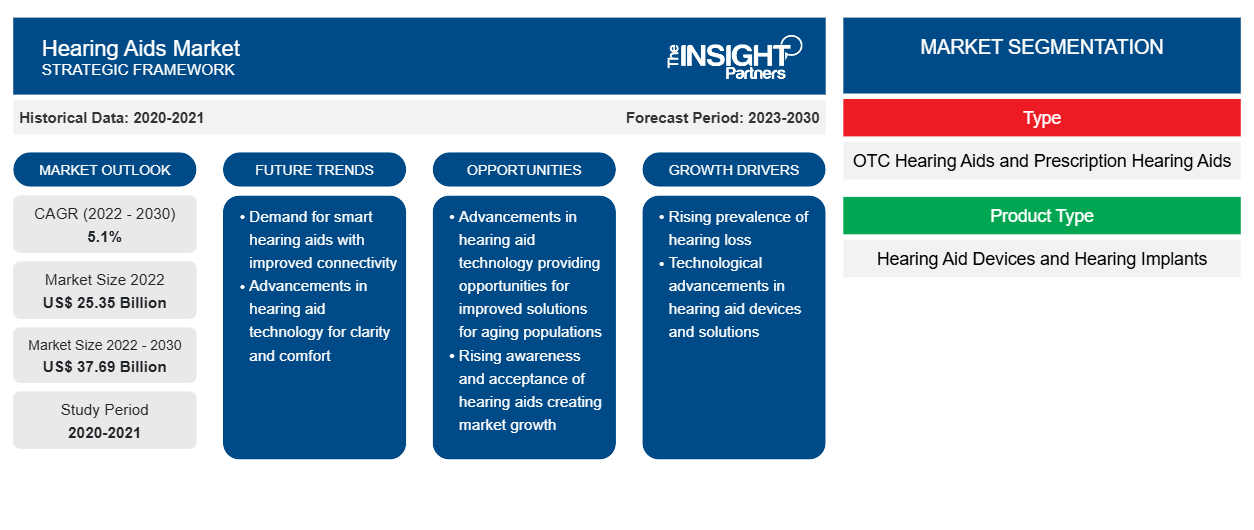

Regional Analysis:

The global hearing aids market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. North America is expected to hold the major market share owing to the increasing prevalence of hearing loss among a large population, along with new product launches in the region. The North America Hearing aids market is segmented into the US, Canada, and Mexico. The US, being one of the major countries, accounts for a major market share. As per the National Institute on Deafness and Other Communication Disorders, ~30 million people, or 13% of the US population aged 12 years and above, were experiencing hearing loss in one or both ears in 2021. As per the same source, ~28.8 million people in the US could benefit from hearing aids. The country has the presence of the leading global market players, which are focused on product development and launches.

FDA approval for OTC hearing aids is expected to create ample opportunities in the market. In October 2023, Audien Hearing launched the world's first FDA-compliant hearing aid sold over-the-counter (OTC)—ATOM ONE—for less than US$ 100. The ATOM ONE would allow millions of people suffering from hearing loss to walk in and purchase an economical device suiting their or their loved ones' needs. In October 2023, ELEHEAR, a provider of AI-powered hearing aids and audio solutions, introduced its first OTC hearing aid devices—the ELEHEAR Alpha and ELEHEAR Alpha Pro. Therefore, the increasing prevalence of hearing impairment among large populations, new product launches, and availability of OTC hearing aids at economical pricing favor the hearing aids market in the US.

Asia Pacific is expected to register a significant growth rate in the hearing aids market owing to the increasing cases of hearing loss associated with aging and other factors, along with the rising number of product launches in the region. Moreover, collaborations among market players and technological advancements would further drive the market growth in Asia Pacific. China has one of the largest geriatric populations. According to the Population Reference Bureau 2023, the Chinese geriatric population is expected to reach 366 million by 2050, i.e., substantially larger than the US. Moreover, increasing product launches and strategic collaborations are expected to promote the hearing aids market growth in the country. In September 2022, Tencent Holdings launched an advanced new hearing aid device powered by artificial intelligence (AI) technology. Additionally, in June 2022, ShengWang, the Chinese hearing aid chain of nearly 500 stores, was fully acquired by Demant, increasing the market share of Oticon and Philips devices by 5%, in retail market. Therefore, the increasing geriatric population and the number of product launches, along with strategic collaborations, drive the growth of the hearing aids market.

Industry Developments and Future Opportunities:

Hearing Aids Market Regional Insights

Hearing Aids Market Regional Insights

The regional trends and factors influencing the Hearing Aids Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Hearing Aids Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Hearing Aids Market

Hearing Aids Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 25.35 Billion |

| Market Size by 2030 | US$ 37.69 Billion |

| Global CAGR (2022 - 2030) | 5.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

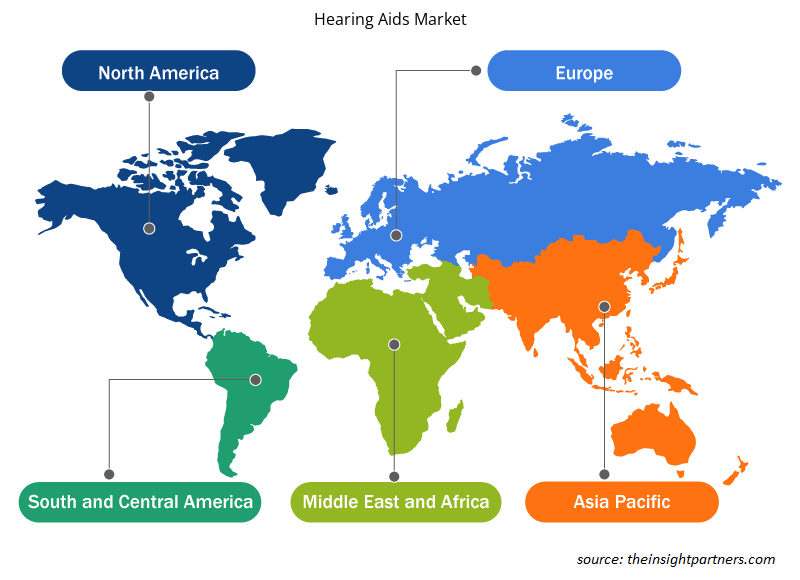

Hearing Aids Market Players Density: Understanding Its Impact on Business Dynamics

The Hearing Aids Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Hearing Aids Market are:

- Starkey Laboratories Inc.

- Audina Hearing Instruments Inc

- Sebotek Hearing Systems LLC

- Earlens Corp

- GN Store Nord AS

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Hearing Aids Market top key players overview

Various initiatives taken by key players operating in the hearing aids market are listed below:

- In February 2023, Starkey launched its new hearing aid device, Genesis AI. Genesis AI has a new processor, industrial design, and Neuro Sound Technology. Genesis AI comes with Pro8 hydra shield technology, making it sweat, dirt, and dunk resistant.

- In November 2022, Cochlear Limited received US Food and Drug Administration (FDA) approval for the Cochlear Nucleus 8 Sound Processor. The Nucleus 8 Sound Processor features Cochlear's latest and most innovative hearing technology to sense changes in a person's environment and automatically adjust their listening settings.

Competitive Landscape and Key Companies:

Starkey Laboratories Inc., Audina Hearing Instruments Inc., SeboTek Hearing Systems LLC, Earlens Corp, GN Store Nord AS, Cochlear Ltd, Amplifon Hearing Health Care Corp, WS Audiology AS, Sonova Holding AG, and Sonic Innovations Inc are the largest hearing aids companies. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Product Type, Technology, Type of Hearing Loss, Patient Type, Distribution channel and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The hearing aids market is segmented into North America, Europe, Asia Pacific, Middle east & Africa, and South & Central America. North America is expected to hold the major market share however, Asia Pacific is expected to register the significant growth over the forecast period.

The hearing aids market is analyzed on the basis of type, product type, technology, type of hearing loss, patient type, and distribution channel. Based on type, the market is bifurcated into prescription hearing aids and OTC hearing aids. Based on product type, the market is bifurcated into hearing aid devices and hearing implants. In 2022, Hearing aids segment held the major market share and register the significant growth rate.

The hearing aids market majorly consists of the players such as Starkey Laboratories Inc., Audina Hearing Instruments Inc, Sebotek Hearing Systems LLC, Earlens Corp, GN Store Nord AS, Cochlear Ltd, WS Audiology AS, Sonova Holding AG, Sonic Innovations Inc, Amplifon Hearing Health Care Corp

The growth of the hearing aids market is attributed to a few key factors, such as increasing incidence of hearing loss and surge in strategic initiatives by the market players.

hearing aid is a small electronic device that makes sounds louder and clear so that a person with hearing loss can listen, communicate, and participate in daily activities. The hearing aid helps in the restoration of hearing among deaf, hard to hear or geriatric population. A hearing aid can be prescribed by a physician after a health examination, or it can be bought over-the-counter for mild to moderate hearing loss.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of companies - Hearing Aids Market:

- Starkey Laboratories Inc.

- Audina Hearing Instruments Inc

- Sebotek Hearing Systems LLC

- Earlens Corp

- GN Store Nord AS

- Cochlear Ltd

- WS Audiology AS

- Sonova Holding AG

- Sonic Innovations Inc

- Amplifon Hearing Health Care Corp.

Get Free Sample For

Get Free Sample For