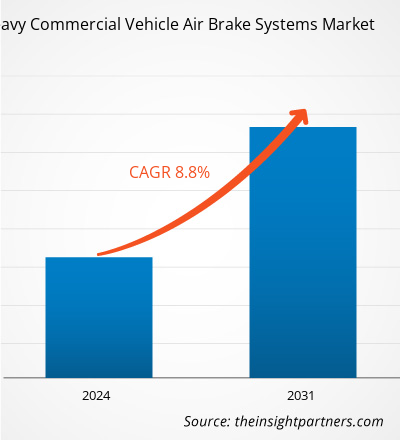

The heavy commercial vehicle air brake systems market size is projected to reach US$ 42.48 billion by 2031 from US$ 21.69 billion in 2023. The market is expected to register a CAGR of 8.8% during 2023–2031. The increase in sales and production of commercial vehicles across the globe is a major factor driving the heavy commercial vehicle air brake systems market growth.

Heavy Commercial Vehicle Air Brake Systems Market Analysis

The sales and production of commercial vehicles are witnessing an upsurge trend owing to growing development in the industrial sectors. In the past few years, the increase in commercial vehicle production, particularly in regions such as North America, Europe, and Asia Pacific, has driven the growth of the heavy commercial vehicle air brakes market. The sales of commercial vehicles were 24,226,493 in 2022, which increased to 27,452,301 in 2023. The constantly evolving industrial and manufacturing sectors are driving the demand for heavy commercial vehicles worldwide. The production of commercial vehicles in China was 4,674,258 units in 2021, which declined to 3,184,532 units in 2022. However, the production of commercial vehicles further increased to 4,037,209 units in 2023. The growing industrialization and rising e-commerce sector are fueling the demand for commercial vehicles in China, which is having a positive impact on the production of commercial vehicles in the country. Proper application of the air brake system can help prevent accidents. Many countries, such as India and the US, mandate strict regulations on using air braking systems in all heavy commercial vehicles to boost the safety measures of commercial vehicles. In addition, Federal regulations mandate all commercial truck drivers to be qualified and certified to operate vehicles equipped with air brakes. Failure to comply with these guidelines can result in legal hazards for the driver and their employer. Thus, manufacturers of heavy commercial vehicles need to follow certain guidelines and norms and integrate advanced braking systems to clear the government regulations on heavy commercial vehicles.

Heavy Commercial Vehicle Air Brake Systems Market Overview

The rising focus on boosting the safety features of commercial vehicles is one of the major drivers for the market. Rapid industrialization and growing demand for heavy-duty commercial vehicles in the oil & gas, mining, construction, and manufacturing facilities are offering ample growth opportunities to the market across the world. Additionally, the increasing number of commercial vehicle manufacturers and automotive component and part suppliers are fueling the integration of advanced brake systems.

Increasing substantial investments in the automotive sector to boost the overall infrastructure of automotive manufacturing, along with the rising emphasis of the government on road vehicle safety policies and measures, are having a positive impact on the heavy commercial vehicle air brake systems market. The growing proliferation of air brake systems in heavy-duty trailers, buses and tractors also bolsters the growth of the heavy commercial vehicle air brake systems market globally.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Heavy Commercial Vehicle Air Brake Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Heavy Commercial Vehicle Air Brake Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Heavy Commercial Vehicle Air Brake Systems Market Drivers and Opportunities

Increase in Sales and Production of Commercial Vehicles

Proper application of the air brake system can help prevent accidents. Many countries, such as India and the US, have strict regulations on using air braking systems in all heavy commercial vehicles to boost the safety measures of commercial vehicles. Air brake systems are designed to deliver reliable and steady braking power for large commercial trucks. Buses, trailers, and trains also utilize air brake systems. Vehicles carrying a large payload are usually equipped with an air brake system. Federal regulations have mandated that all commercial truck drivers must be qualified and certified to operate vehicles equipped with air brakes. Thus, with the growing sales and production of commercial vehicles, the heavy commercial vehicle air brake systems market grows in tandem across the world.

Implementation of Regenerative Braking Systems

The manufacturers of air braking systems are focusing on fabricating hybrid braking systems that optimize both braking efficacy and energy recovery by associating regenerative braking systems with air brakes. The regenerative system starts its operation to slow down the vehicle and gain energy when the driver applies the brakes. The vehicle is consequently brought to a complete stop by the air brake system, which offers the required stopping power. This dual-system method not only improves the overall braking competence but also reduces the wear and tear on the air brake parts, resulting in reduced maintenance costs and a longer system life. From the perspective of the swiftly developing adoption of electric commercial vehicles, the air brake system market is likely to witness a significant growth prospect as a result of the incorporation of regenerative braking with already existing air brakes. For instance, Robert Bosch GmbH offers regenerative braking. The portfolio offers both vacuum-independent and vacuum-based regenerative braking systems. The company also offers regenerative braking systems that comply with strict safety requirements for standard and electrical braking systems. Vehicle electrification and emission control strategies are fueling technological innovation in the braking system sector, and regenerative brakes are considered an integral part of the future as the world is shifting toward electric heavy commercial vehicles.

Heavy Commercial Vehicle Air Brake Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the heavy commercial vehicle air brake systems market analysis are component, type, technology, distribution channel, and application.

- Based on component, the heavy commercial vehicle air brake systems market is segmented into the compressor, reservoir, foot valve, brake linings and drums/rotors, and brake chambers and slack adjusters. The growing usage of air braking systems in heavy commercial vehicles, such as buses, trucks, trailers, and industrial vehicles, is boosting the demand for major components such as air compressors, reservoirs, and brake linings.

- Based on type, the heavy commercial vehicle air brake systems market is bifurcated into air disc brakes and air drum brakes. The rising long-haul transportation and growing safety regulations for heavy commercial vehicles are boosting the demand for air disc and air drum brakes in developing and developed nations of North America and Europe.

- Based on technology, the heavy commercial vehicle air brake systems market is segmented into conventional air brake systems, electronically controlled air brake systems (ECAS), and anti-lock braking systems (ABS). The growing safety regulations for heavy commercial vehicles and increasing demand for advanced braking systems are factors boosting the demand for air braking systems across the world.

- Based on distribution channel, the heavy commercial vehicle air brake systems market is segmented into OEM and aftermarket. The growing sales of air braking systems are propelling the need for services at regular intervals, owing to which OEMs and aftermarket services across different nations, such as the US, China, and India, are witnessing significant customer traction.

- Based on vehicle type, the heavy commercial vehicle air brake systems market is segmented into buses, trucks, trailers and construction equipment, tractors, and others. The rising industrialization and growing development in the oil and gas and mining sectors are acting as a major driver for heavy duty commercial vehicles. In addition, the rising adoption of heavy-duty tractors is fueling the application of air brake systems in the heavy commercial vehicles sector.

Heavy Commercial Vehicle Air Brake Systems Market Share Analysis by Region

The geographic scope of the heavy commercial vehicle air brake systems market report offers a detailed regional and country analysis. North America, Europe, and Asia Pacific are major regions witnessing significant growth in the heavy commercial vehicle air brake systems market.

Asia Pacific held the largest share in 2023, owing to the increasing investment in plant expansion of heavy commercial vehicles by major players in the market. Robust industrialization is a key factor influencing the growing demand for commercial vehicles across Asia Pacific. The growing implementation of high-end, heavy-duty commercial vehicles for good transportation and logistics is boosting the demand for air brake systems in trucks, buses, trailers, and tractors. Furthermore, numerous initiatives by local and state governments are promoting on-road vehicle safety programs and policies, which are boosting the application of air brake systems in heavy-duty commercial vehicles to enhance vehicle safety and secure operations. The growing government emphasis on vehicle safety standards and policies is fueling the integration of high-end air brake systems in commercial vehicles, which is acting as a major driver for the heavy commercial vehicle air brake system market across Europe.

Heavy Commercial Vehicle Air Brake Systems Market Regional Insights

The regional trends and factors influencing the Heavy Commercial Vehicle Air Brake Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Heavy Commercial Vehicle Air Brake Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Heavy Commercial Vehicle Air Brake Systems Market

Heavy Commercial Vehicle Air Brake Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023. | US$ 21.69 Billion |

| Market Size by 2031 | US$ 42.48 Billion |

| Global CAGR (2023 - 2031) | 8.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

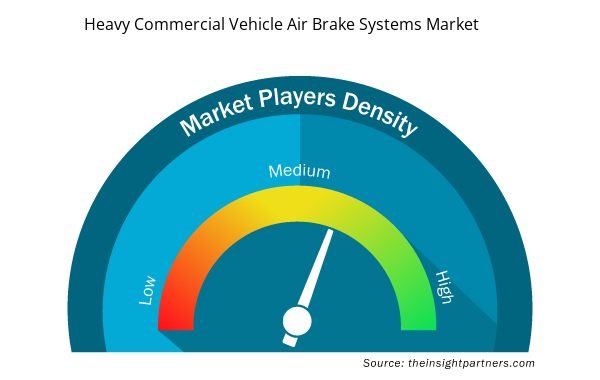

Heavy Commercial Vehicle Air Brake Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Heavy Commercial Vehicle Air Brake Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Heavy Commercial Vehicle Air Brake Systems Market are:

- Knorr-Bremse Commercial Vehicle Systems GmbH.

- Doctor Air Brake

- Cojali S.L

- Bremse AG

- Meritor, Inc.

- Haldex AB

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Heavy Commercial Vehicle Air Brake Systems Market top key players overview

Heavy Commercial Vehicle Air Brake Systems Market News and Recent Developments

The heavy commercial vehicle air brake systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the heavy commercial vehicle air brake systems market are listed below:

- Haldex has entered an agreement with Schmitz Cargobull, a leading trailer manufacturer in Europe, to supply ModulT disc brakes. The Haldex ModulT program is an innovative air disc brake platform developed specifically to meet increased customer demands on performance, robustness, service up-time, weight and total cost of ownership. The agreement includes the supply of both 22” and 19” ModulT versions. The deal is an important milestone to continue to grow in this segment and further strengthens Haldex's already strong market position for air disc brakes for trailers in Europe. This is an important and strategic deal for Haldex, but based on estimated order value, it is not significant in relation to total sales for the Haldex Group. (Haldex, Company Website, May 2022)

Heavy Commercial Vehicle Air Brake Systems Market Report Coverage and Deliverables

The "Heavy Commercial Vehicle Air Brake Systems Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Heavy commercial vehicle air brake systems market size and forecast at country levels for all the key market segments covered under the scope

- Heavy commercial vehicle air brake systems market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Heavy commercial vehicle air brake systems market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the heavy commercial vehicle air brake systems market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The heavy commercial vehicle air brake systems market was estimated to be valued at US$ 21.69 billion in 2023 and is anticipated to grow at a CAGR of 8.8% over the forecast period.

The rising sales and production of commercial vehicles are witnessing an upsurge trend owing to growing development in the industrial sector drives the market growth.

Implementation of Air Braking Systems in Autonomous Commercial Vehicles to drive the growth of the Heavy Commercial Vehicle Air Brake Systems market in the coming years.

The key players operating in the heavy commercial vehicle air brake systems market include Knorr-Bremse Commercial Vehicle Systems GmbH.; Doctor Air Brake; Cojali S.L; Bremse AG; Meritor, Inc.; Haldex AB; ZF Friedrichshafen AG; Wabtec Corporation; Nabtesco Corporation; TSE Brakes Inc.; Federal-Mogul; and SORL Auto Parts.

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period.

The heavy commercial vehicle air brake systems market is expected to reach US$ 42.48 billion by 2031.

The brake lining and drum or rotors segment led the Heavy Commercial Vehicle Air Brake Systems market with a significant share in 2023.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - Heavy Commercial Vehicle Air Brake Systems Market

- Autodesk, Inc.

- Topcon Positioning Systems, Inc.

- Caliper Corporation

- SuperMap Software Co., Ltd.

- Hexagon AB

- Hi-Target

- Pitney Bowes Inc.

- Maxar Technologies

- AmigoCloud, Inc.

- Trimble Inc.

- Bentley Systems, Incorporated

- Cadcorp Limited

- Spatialworks Sdn Bhd.

- Environmental Systems Research Institute, Inc.

- Blue Marble Geographics

- Abaco SpA

- TomTom International BV

- FARO Technologies, Inc.

- L3Harris Technologies, Inc.;

- Ba?arsoft Information Technologies Inc.

Get Free Sample For

Get Free Sample For