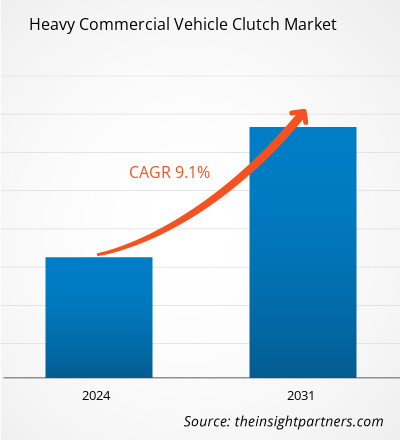

The heavy commercial vehicle clutch market size is projected to reach US$ 41,029.45 million by 2031 from US$ 20,445.80 million in 2023. The market is expected to register a CAGR of 9.1% during 2023–2031. Growing research and development efforts to develop clutch for heavy duty hybrid electric vehicles are likely to bring new key trends in the market in the coming years.

Heavy Commercial Vehicle Clutch Market Analysis

The rise in construction activities, infrastructure development, trade activities, and the shipping and logistics industry is fueling the demand for commercial vehicles such as heavy-duty vehicles across the globe. Heavy commercial vehicles are essential for long-haul transport, handling large loads, and making heavy commercial vehicles crucial for industries with significant hauling capacity. Different types of heavy commercial vehicles include large commercial buses, delivery trucks, dump trucks, large motor homes, tow trucks, tractor-trailers, tanker trucks, and transit buses, among others. As per the OICA, the global demand and sales for commercial vehicles, including light commercial vehicles, heavy commercial vehicles, and buses and coaches, increased from 24.22 million units in 2022 to 27.45 million units in 2023. Commercial vehicle sales across the globe increased by 13.3% from 2022 to 2023. In addition, the highest commercial vehicle sales growth was registered in Europe, with a growth rate of 18.7% from 2022 to 2023. Moreover, the production of buses and coaches increased from 0.25 million units in 2022 to 0.31 million units in 2023, while heavy truck production grew from 3.31 million units in 2022 to 3.77 million units in 2023. Thus, a surge in the production and sales of commercial vehicles drives the heavy commercial vehicle clutch market Furtherm growing investments in infrastructure development by governments of different countries across the globe are projected to create lucrative opportunities for heavy commercial vehicle clutch manufacturers during the forecast period.

Heavy Commercial Vehicle Clutch Market Overview

Heavy commercial vehicles are increasingly used in the efficient transportation of heavy machinery, equipment, materials, construction equipment, and other material handling equipment. Heavy commercial vehicles have several applications, including towing, moving, hauling, shipping, logistics, and garbage collection. Rise in investments in residential, commercial, and industrial construction owing to urbanization are driving the demand for heavy commercial vehicles. According to the insights from the International Organization of Motor Vehicle Manufacturers (OICA), commercial vehicle sales worldwide increased from 24.23 million units in 2022 to 27.45 million units in 2023. North America accounted for more than 58% of commercial vehicle sales (light commercial vehicles, heavy commercial vehicles, and buses and coaches) in 2023.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Heavy Commercial Vehicle Clutch Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Heavy Commercial Vehicle Clutch Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Heavy Commercial Vehicle Clutch Market Drivers and Opportunities

Rapid Growth of Construction Industry

High demand for residential and commercial complexes, industrial expansion, a rise in government initiatives towards infrastructure development, and increased high-rise constructions are a few factors contributing to the growth of the construction industry. The rise in construction activities is mainly driven by urbanization, increasing population, and growth in the economy. According to the data published by the Word Bank in 2023, approximately 56% of the total population in 2022, which is 4.4 billion persons, has been living in urban areas, while in 2010—3.5 billion people were registered to be living in urban areas. Governments of different countries are taking various initiatives to improve and develop infrastructure. These initiatives lead to an increase in demand for heavy commercial vehicles in the transportation of heavy machinery, construction equipment, huge structures, and other raw materials at construction sites. For instance, the Government of India introduced a scheme to provide affordable housing to all in 2015; through this scheme, approximately 10 million housing units were built between 2019 to 2024.

Growing Investments in Infrastructure Development

Governments of various countries and construction companies across the globe are investing heavily in the development of infrastructure to support economic growth and overall development. In October 2024, the US government announced the Hudson River Tunnel Project worth US$ 16 billion. Under this project, the government plans to construct a tunnel to build a railway track connecting the Hudson River to New Jersey. This project is expected to launch by 2025. In October 2024, the US Department of Transportation announced US$ 635 million in funding for 22 small and medium-sized bridge projects in rural and urban parts of the US.

According to the data published by the European Construction Industry Federation in June 2024, the European Federal Government announced to build 400 bridge construction projects in 2026 to renovate mature bridges across Europe. In November 2024, the UAE government announced the Dubai Exhibition Center expansion project plan worth US$ 2.7 billion. The project will be completed in three different phases; the first phase includes the expansion of its current 58,000 square meters to 140,000 square meters, which will be completed by 2026.

Heavy Commercial Vehicle Clutch Market Report Segmentation Analysis

Key segments that contributed to the derivation of the heavy commercial vehicle clutch market analysis are distribution channel, product, and vehicle type.

- Based on distribution channel, the heavy commercial vehicle clutch market is divided into OEM and aftermarket. The aftermarket segment held a larger share of the market in 2023.

- Based on product, the market is categorized into single plate clutches, multi-plate clutches, diaphragm spring clutches, centrifugal clutches, and hydraulic clutches. The single plate clutch segment dominated the market in 2023.

- The vehicle type segment of the heavy commercial vehicle clutch market is categorized into bus, truck, trailer and construction equipment, and tractor. The truck segment held the largest share of the market in 2023.

Heavy Commercial Vehicle Clutch Market Share Analysis

The geographic scope of the heavy commercial vehicle clutch market report offers a detailed global analysis. North America, Europe, and Asia Pacific are major regions witnessing significant growth in the heavy commercial vehicle clutch market.

Asia Pacific holds a key position in the heavy commercial vehicle clutch market owing to its strong industrial base and increasing production of heavy commercial vehicles in the region. China dominated the heavy commercial vehicle clutch market in the region in 2023. The expansion of industries such as construction, aerospace, defense, waste management, agriculture, and logistics require advanced heavy commercial vehicles for the transportation of heavy machinery, materials, large equipment, and others, which will fuel the demand for heavy commercial vehicle clutch in Asia Pacific. The construction sector in China and India plays a significant key role in driving the heavy commercial vehicle clutch market owing to the rise in demand for heavy commercial vehicles used in the transportation of various construction machinery, materials, and heavy vehicles. North America accounted for a major share of the heavy commercial vehicle clutch market in 2023, owing to the presence of key economies, including the US, Canada, and Mexico. For instance, as per the insights from the Associated General Contractors (AGC), the construction sector in the US is one of the key contributing sectors to the US economy and generates ~US$ 2.1 trillion worth of structures every year, which, in turn, is expected to fuel the demand for heavy commercial vehicles in the coming years. In addition, Canada and Mexico are contributing to the growth of the heavy commercial vehicle clutch market in North America, with the rise in investment in the establishment of logistics and transportation bases and public infrastructure in these countries. For example, as per the OICA, commercial vehicle sales in North America increased by 14.2% from 1.33 million units in 2022 to 1.52 million units in 2023. Such a rise in commercial vehicle sales is expected to boost the market growth in the coming years.

Heavy Commercial Vehicle Clutch Market Regional Insights

The regional trends and factors influencing the Heavy Commercial Vehicle Clutch Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Heavy Commercial Vehicle Clutch Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Heavy Commercial Vehicle Clutch Market

Heavy Commercial Vehicle Clutch Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 20,445.80 Million |

| Market Size by 2031 | US$ 41,029.45 Million |

| Global CAGR (2023 - 2031) | 9.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Distribution Channel

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Heavy Commercial Vehicle Clutch Market Players Density: Understanding Its Impact on Business Dynamics

The Heavy Commercial Vehicle Clutch Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Heavy Commercial Vehicle Clutch Market are:

- AISIN Group

- Magneti Marelli

- Schaeffler Group

- ZF Friedrichshafen

- BorgWarner, Inc.

- Valeo SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Heavy Commercial Vehicle Clutch Market top key players overview

Heavy Commercial Vehicle Clutch Market News and Recent Developments

The heavy commercial vehicle clutch market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the heavy commercial vehicle clutch market are listed below:

- BorgWarner provides its wet clutch and hydraulic control module for the 2-speed hybrid transmission of Buick’s brand-new GL8 PHEV van; production began in June 2024. As the first large and medium-sized plug-in hybrid transmission produced by General Motors in China for the Chinese market, BorgWarner's efficiency-enhancing wet clutch and hydraulic control module will contribute to setting a new benchmark for plug-in hybrids. (Source: BorgWarner, Press Release, July 2024)

- Eaton announced the launch of Advantage automated series clutch and Cummins flywheel kits for the Eaton-Cummins Endurant automated manual transmission (AMT). For the first time, the two will be sold in the same kit. (Source: Eaton, Press Release, October 2024)

Heavy Commercial Vehicle Clutch Market Report Coverage and Deliverables

The "Heavy Commercial Vehicle Clutch Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Heavy commercial vehicle clutch market size and forecast at country levels for all the key market segments covered under the scope

- Heavy commercial vehicle clutch market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Heavy commercial vehicle clutch market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the heavy commercial vehicle clutch market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Mail Order Pharmacy Market

- Neurovascular Devices Market

- Vessel Monitoring System Market

- Batter and Breader Premixes Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Biopharmaceutical Contract Manufacturing Market

- Hydrolyzed Collagen Market

- Ceramic Injection Molding Market

- Small Molecule Drug Discovery Market

- Hydrocephalus Shunts Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Asia Pacific dominated the global heavy commercial vehicle clutch market in 2023.

Surge in commercial vehicle production and sales and rapid growth of construction industry and infrastructure development projects are the driving factors in the market.

Increasing research & development efforts in the development of clutches for heavy-duty hybrid electric vehicles is the key future trend of the Global heavy commercial vehicle clutch market.

AISIN Group; Magneti Marelli; Schaeffler Group; ZF Friedrichshafen; BorgWarner, Inc.; Valeo SA; Eaton Corporation; EXEDY Corporation; and F.C.C. Co., Ltd. are the leading players operating in the global heavy commercial vehicle clutch market.

The estimated value of the global heavy commercial vehicle clutch market by 2031 is US$ 41.03 billion.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - Heavy Commercial Vehicle Clutch Market

- AISIN Group

- Magneti Marelli

- Schaeffler Group

- ZF Friedrichshafen

- BorgWarner, Inc.

- Valeo SA

- Eaton Corporation

- EXEDY Corporation

- F.C.C. Co., Ltd.

- Setco Automotive Limited

Get Free Sample For

Get Free Sample For