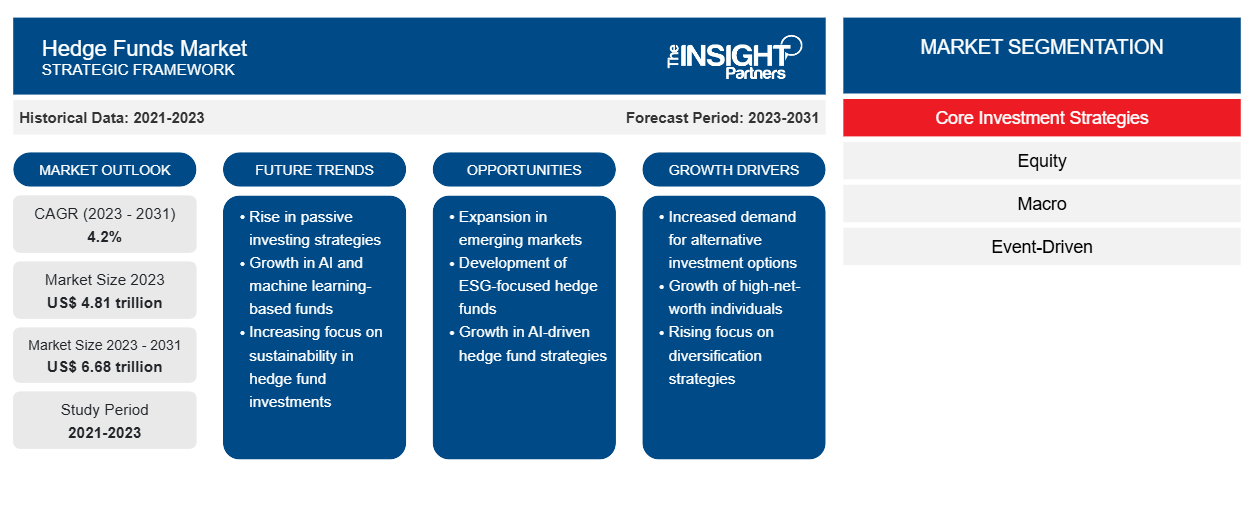

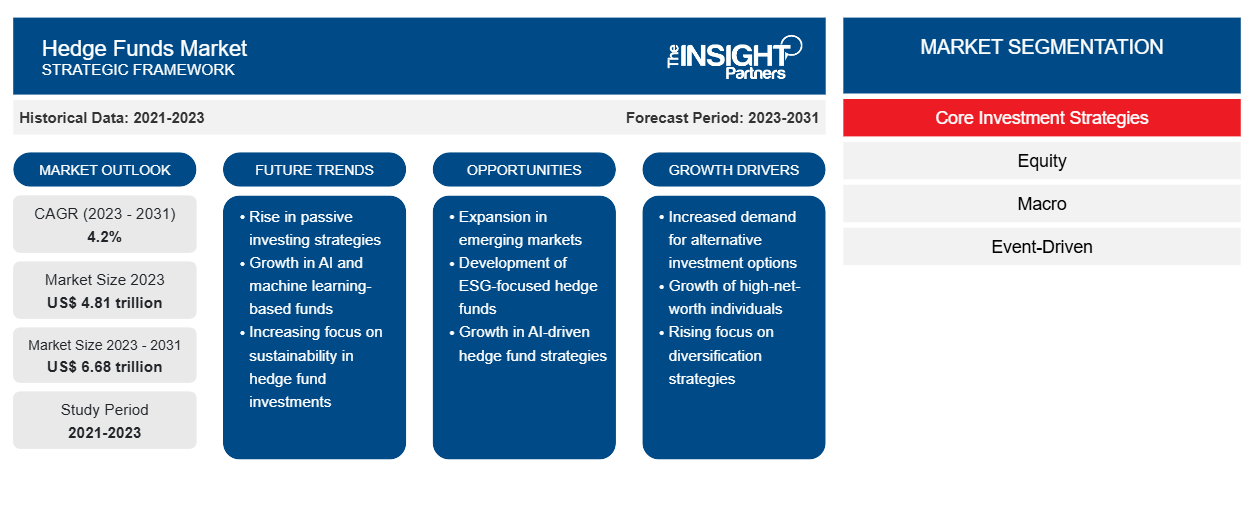

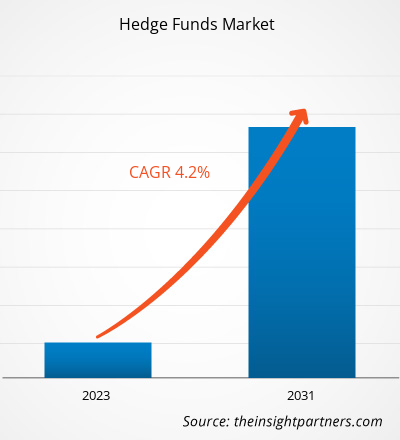

The Hedge Funds market size is expected to grow from US$ 4.81 trillion in 2023 to US$ 6.68 trillion by 2031; it is anticipated to expand at a CAGR of 4.2% from 2023 to 2031. A hedge fund is a limited partnership of private investors whose money is managed by professional fund managers who employ a variety of tactics, such as leveraging or trading non-traditional assets, to generate above-average investment returns. Hedge fund investment is sometimes regarded as a dangerous alternative investment option that demands a large minimum investment or net worth, mostly targeting rich clientele.

Hedge Funds Market Analysis

The Hedge Funds market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. The last few years have been turbulent for hedge fund managers. This can be attributed to various global situations, such as the COVID-19 pandemic, geopolitical issues, all all-time high inflation, among others. These conditions prompted many fund managers to revisit their strategies for investments and attracting new clientele.

Hedge Funds

Industry Overview

- Every year, competition in the hedge fund sector grows, and there are already an estimated 15,000 hedge funds in the market. A limited number of larger hedge fund firms with the strongest brands are projected to capture the majority of net flows in the industry. Firms with the strongest brands include the industry's largest managers as well as a select group of small to mid-sized managers who excel by providing a high-quality investment product, clearly articulating their differential advantage, and implementing a best-in-class distribution strategy that penetrates the market.

- Hedge funds have typically been centered in locations such as New York, London, and Hong Kong. However, in recent years, Dubai and Singapore have attracted more hedge funds as the sector shifts its attention away from conventional financial centers in its future plans. Dubai has attracted several huge funds as London-based managers seek alternative locations in the post-Brexit scenario.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hedge Funds Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hedge Funds Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Hedge Funds Market Driver

Technology Integration to Drive the Hedge Funds Market

- If hedge funds are to remain competitive and acquire more wallet shares, they must digitize their operating models. Many managers have taken notice and are progressively implementing next-generation technologies to improve investment processes, enhance customer experiences, and optimize business operations.

- To remain relevant in this quickly changing industry, hedge funds are digitizing their business structures and embracing innovation. For instance, according to a 2023 survey by Broadridge, 58% of hedge funds regard digital transformation as their most essential strategic priority. Failure to invest in new technology or maintain outdated systems may put managers at a disadvantage in a difficult capital-raising environment.

- Some CIOs are utilizing AI to supplement their investment decision-making process by analyzing massive data sets and identifying prospective market moves and trends. Other hedge fund managers are using AI in their operations to improve middle- and back-office processes like fund accounting, regulatory compliance, and client reporting. These developments are expected to stimulate the hedge funds market growth.

Hedge Funds

Market Report Segmentation Analysis

- Based on the source, the Hedge Funds market report is segmented into equity, macro, event-driven, credit, relative value, niche, multi-strategy, managed futures/CTA strategies, and others.

- The equity segment is expected to hold a significant Hedge Funds market share in 2023. An equity fund would invest mostly in equities. The goal is usually to beat stock market benchmarks.

- Global macro hedge funds are actively managed funds that speculate on wide market changes resulting from economic or political events. Fund managers can invest in stocks, bonds, currencies, commodities, derivatives (like futures or options contracts), and other things.

Hedge Funds

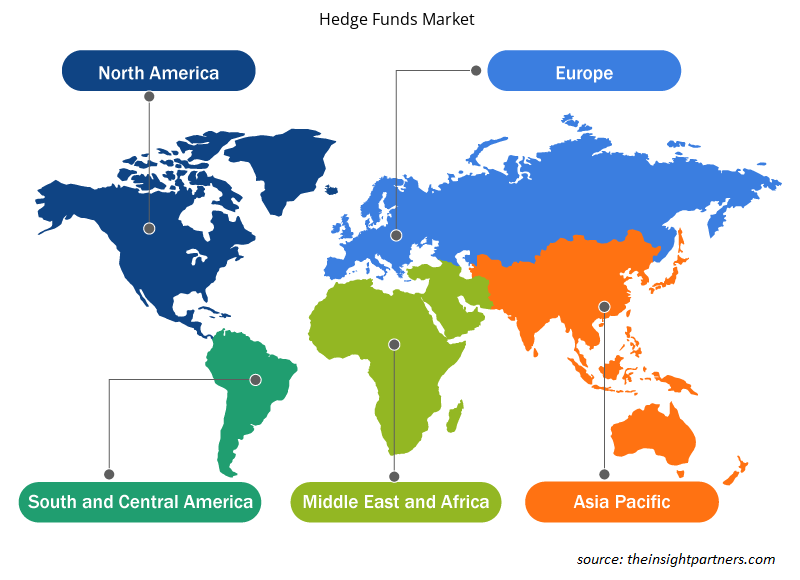

Market Analysis by Geography

The scope of the Hedge Funds market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant Hedge Funds market share. Overall, North America is home to 70% of hedge funds, with the United States hosting many of the world's largest. Contributions and market initiatives of the key players Bridgewater Associates and Man Group in North America are influencing the hedge funds market growth.

Hedge Funds

Hedge Funds Market Regional Insights

The regional trends and factors influencing the Hedge Funds Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Hedge Funds Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Hedge Funds Market

Hedge Funds Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.81 trillion |

| Market Size by 2031 | US$ 6.68 trillion |

| Global CAGR (2023 - 2031) | 4.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Core Investment Strategies

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Hedge Funds Market Players Density: Understanding Its Impact on Business Dynamics

The Hedge Funds Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Hedge Funds Market are:

- Bridgewater Associates

- Man Group

- Renaissance Technologies

- Millennium Management

- Citadel

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Hedge Funds Market top key players overview

The "Hedge Funds Market Analysis" was carried out based on core investment strategies and geography. In terms of core investment strategies, the market is segmented into Equity, Macro, Event-Driven, Credit, Relative Value, Niche, Multi-Strategy, Managed Futures/CTA Strategies, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Hedge Funds

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Hedge Funds market. A few recent key market developments are listed below:

- In December 2014, Man Group plc Announces Acquisition of Merrill Lynch Alternative Investments LLC’s Fund of Hedge Fund Portfolio. The assets that were acquired are spread across 17 multi-manager hedge funds and managed futures fund of funds. One fund was registered as an investment company with the US Securities and Exchange Commission, while the others are private. All of the funds complement Man Group’s and FRM’s existing product offering, with 3 multi-strategy funds and 14 strategy-focused funds. This includes emerging markets, equity long/short, global macro, relative value, managed futures and other credit-focused products.

[Source: Man, Company Website]

- In Feb 2022, Wellington Management announced the strategic expansion of its Alternative Investments platform through the hiring of the investment team of Shelter Haven Capital Management, a market-neutral, long/short equity manager that primarily focuses on small and mid-cap companies in the technology, media, telecom, and consumer sectors.

[Source: Wellington Management, Company Website]

Hedge Funds

Market Report Coverage & Deliverables

The market report "Hedge Funds Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Core Investment Strategies, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Innovative fund manager strategies and emerging regional economies are the major factors that propel the global hedge funds market growth.

The global Hedge Funds market is expected to reach US$ 6.68 trillion by 2031.

The global Hedge Funds market was estimated to be US$ 4.81 trillion in 2023 and is expected to grow at a CAGR of 4.2% during the forecast period 2023 - 2031.

The adoption of AI and ML technologies to enhance user experience is impacting Hedge Funds, which is anticipated to bring new Hedge Funds market trends in the coming years.

The key players holding majority shares in the global Hedge Funds market are Bridgewater Associates; Man Group; Renaissance Technologies; Millennium Management; and Citadel

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Bridgewater Associates

- Man Group

- Renaissance Technologies

- Millennium Management

- Citadel

- TCI Fund Management

- D.E. Shaw Group

- Davidson Kempner Capital Management

- Farallon Capital Management

- Point72 Asset Management

Get Free Sample For

Get Free Sample For