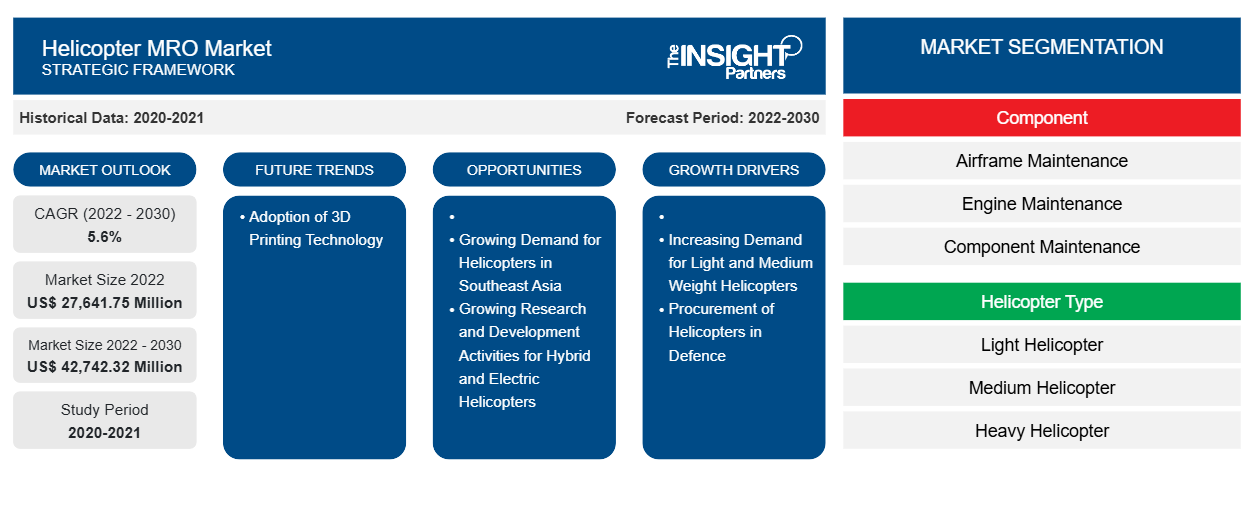

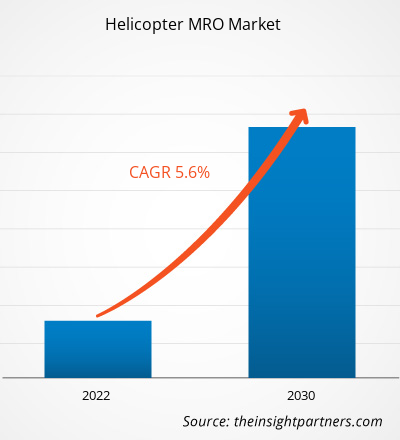

The Helicopter MRO Market size is projected to reach US$ 42,742.32 million by 2030 from US$ 27,641.75 million in 2022. The market is expected to register a CAGR of 5.6% in 2022–2030. Increasing commercial applications of helicopters and helicopter fleet expansion strategy in the defense sector are driving the demand for airframe maintenance, engine maintenance, component maintenance, and line maintenance. In July 2023, the Indian army issued a tender to replace its Cheetah and Chetak helicopters with 20 modern light helicopters. In 2022, AdventHealth expanded its helicopter fleet in its ambulance fleet to cater to increasing demand from the growing population. Moreover, as per the data published by the General Aviation Manufacturers Association in 2022, the demand for commercial helicopters increased by ~7.4% from 2021, which totaled 876 deliveries in 2022. Thus, owing to the growing demand for helicopters in the commercial and defense sectors, the demand for helicopter MRO is projected to increase during the forecast period.

Helicopter MRO Market Analysis

Helicopter component manufacturers and MRO service providers offer services to civil and military aviation players. MRO services are essential for civil and military helicopters to ensure that they are maintained in predetermined conditions. The demand for MRO services is increasing as most of the military helicopters are grounded, and rescheduling a flight requires a prior check-up to ensure the aircraft is ready to take off. In order to provide robust maintenance services to various aircraft components, companies such as Lufthansa Technik AG, AAR Corp., and Rolls-Royce PLC are focusing on developing innovative services integrated with advanced technologies such as blockchain to fulfill the demand of commercial and military end users. RotorPlace, Hindustan Aeronautics Limited., Patria Group, Technovision Engineers Private Limited, KADEX Aero Supply, Jones Metal Products, Helicopter Spares, Blueberry Aviation, Indo Copters, and Sterling Helicopter are among the key helicopter spare parts providers. These suppliers offer helicopter parts to MRO service providers and helicopter manufacturers around the globe.

Helicopter MRO Market Overview

Commercial applications such as air ambulance, helicopter tourism, and offshore wind turbines are growing continuously. For instance, In October 2023, Wales Air Ambulance Charity announced the addition of its new helicopter. In 2022, Wales Air Ambulance announced that Gama Aviation Plc had won a seven-year aviation contract covering the operation and maintenance of a primary fleet of four Airbus H145 helicopters. The service now operates three H145 helicopters and one smaller H135 helicopter. The H135 aircraft will be modified to an H145 as part of the new contract.

On the other hand, helicopter fleet expansion activities by many developed nations are driving the helicopter MRO demand in the defense industry. For instance, in December 2022, the Defense Acquisition and Program Administration (DAPA) of South Korea and Korea Aerospace Industries (KAI) signed a US$ 234 million contract for the first stages of mass production for their Light Armed Helicopter (LAH). Thus, the factors mentioned above are projected to fuel the demand for helicopter MRO in the commercial and defense sectors.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Helicopter MRO Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Helicopter MRO Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Helicopter MRO Market Drivers and Opportunities

Increasing Demand for Helicopters

The demand for heavy helicopters is mainly driven by increasing adoption by the defense sector. In contrast, the demand for light helicopters is mainly driven by growing commercial applications such as air ambulance and tourism. Medium-sized helicopters are widely used in commercial as well as defense sectors. For instance, in May 2023, Corewell Health added a new Sikorsky S-76 C++ helicopter to its air ambulance fleet. In January 2023, Sikorsky, a Lockheed Martin subsidiary, delivered the 5,000th "Hawk" variant helicopter, a US Army UH-60M Black Hawk. In the coming years, this aircraft will continue to fulfill medium-lift requirements for the US military and international operators. Thus, such activities are projected to create lucrative demand for light, medium, and heavy helicopters in the coming years.

Growing Research and Development Activities for Hybrid and Electric Helicopters

In January 2023, Arc Aerosystem announced the development of a hybrid slowed-rotor aircraft with an 800-mile range. Further, in October 2023, the US Air Force received an all-electric helicopter for experimental purposes. The Air Force and Joby Aviation, an aircraft manufacturer, will conduct joint testing to investigate the military possibilities. The Joby aircraft, with a range of up to 100 miles, plus energy reserves and a top speed of 200 mph, can transport a pilot and four passengers fast and quietly while emitting zero operating emissions. Development activities are expected to generate demand and increase the adoption of hybrid and electric helicopters in the coming years. Thus, the need for helicopter MRO services is expected to rise in the coming years owing to the complexity and delicacy of hybrid and electric helicopters.

Helicopter MRO Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Helicopter MRO Market analysis are component, helicopter type, end user, and geography.

- Based on component, the Helicopter MRO Market has been segmented into airframe maintenance, engine maintenance, component maintenance, line maintenance. The engine MRO segment held a larger market share in 2022.

- By helicopter type, the Helicopter MRO Market has been segmented into light helicopter, medium helicopter, and heavy helicopter. The medium helicopter segment held the largest share of the market in 2022.

- In terms of end users, the Helicopter MRO Market has been segmented into commercial and military. The commercial segment dominated the market in 2022.

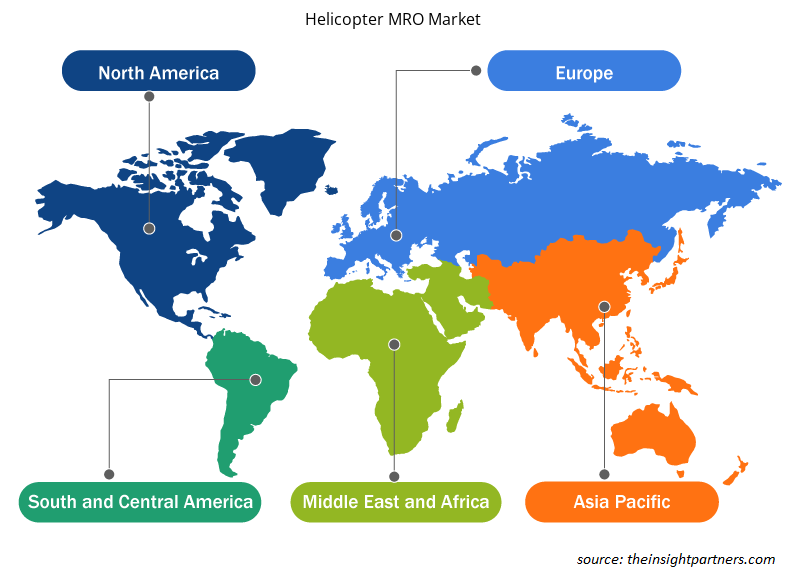

Helicopter MRO Market Share Analysis by Geography

The geographic scope of the Helicopter MRO Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific has dominated the Helicopter MRO Market in 2022, and it is expected to experience highest CAGR during the forecast period as well. In 2022, India had more than 800 helicopters, with ~72% of the fleet from Non-Scheduled Operators (NSOP), while others belonged to government officials, public sector units (PSU), and private parties. According to the India Brand Equity Foundation Organization, Indian helicopter owners, including private and government, spend more than US$ 1.2 billion annually on their maintenance, repair, and overhaul (MRO) services and are mostly outsourced to overseas companies. Helicopters are complex machines that require careful inspection before flying. It is mandatory to perform routine helicopter maintenance with the help of renowned MRO aviation companies that guarantee aircraft are safe while flying in the air. According to the Stockholm Peace International Research Institute, global military spending reached nearly US$ 2.2 trillion in 2022, increased by 3.7% compared to 2021. Such an increase in military expenditure around the globe with rising helicopter production drives the helicopter MRO market growth. The US military army invested significant resources in the modernization of the helicopters and has increased its budget by 20% to US$ 1.1 billion for 2021 compared to 2020. The US government launched the Future Vertical Lift program for the modernization of helicopters and aircraft. Such rising military expenditure and growth in the military helicopters drive the helicopter MRO services market.

Helicopter MRO Market Regional Insights

The regional trends and factors influencing the Helicopter MRO Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Helicopter MRO Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Helicopter MRO Market

Helicopter MRO Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 27,641.75 Million |

| Market Size by 2030 | US$ 42,742.32 Million |

| Global CAGR (2022 - 2030) | 5.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Helicopter MRO Market Players Density: Understanding Its Impact on Business Dynamics

The Helicopter MRO Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Helicopter MRO Market are:

- AAL Group Ltd

- Abu Dhabi Aviation

- Airbus

- Elbit Systems Ltd

- GAL (EDGE Group PJSC)

- Gulf Helicopters

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Helicopter MRO Market top key players overview

Helicopter MRO Market News and Recent Developments

The Helicopter MRO Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for helicopter MRO market and strategies:

- In October 2023, Abu Dhabi Investment Office (ADIO) has partnered with Abu Dhabi Aviation (ADA), the biggest commercial helicopter operator in the Middle East, to promote electric vertical take-off and landing (eVTOL) aircraft.ADA will set up an eVTOL MRO facility in Abu Dhabi as part of the partnership, further complementing the city’s extensive portfolio of MRO businesses and promoting smart and autonomous vehicle solutions and applications. (Source: Abu Dhabi Aviation, Press Release/Company Website/Newsletter)

- In January 2023, the acquisition of ZF Luftfahrttechnik by Airbus Helicopters has now been finalized, as all the necessary regulatory approvals have been obtained. With over 100 years of experience in the aviation industry, the company will now operate under the name Airbus Helicopters Technik GmbH as a wholly-owned subsidiary located in Kassel-Calden. The world-leading manufacturer of dynamic components for light and medium helicopters including related services with a global customer base is also a national leader with regards to the MRO for dynamic components of military helicopters. (Source: Airbus, Press Release/Company Website/Newsletter)

Helicopter MRO Market Report Coverage and Deliverables

The “Helicopter MRO Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Integrated Platform Management System Market

- Fishing Equipment Market

- Virtual Event Software Market

- Wind Turbine Composites Market

- Airline Ancillary Services Market

- Thermal Energy Storage Market

- Small Internal Combustion Engine Market

- Mesotherapy Market

- Ceramic Injection Molding Market

- Clear Aligners Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Helicopter Type, End Users, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For