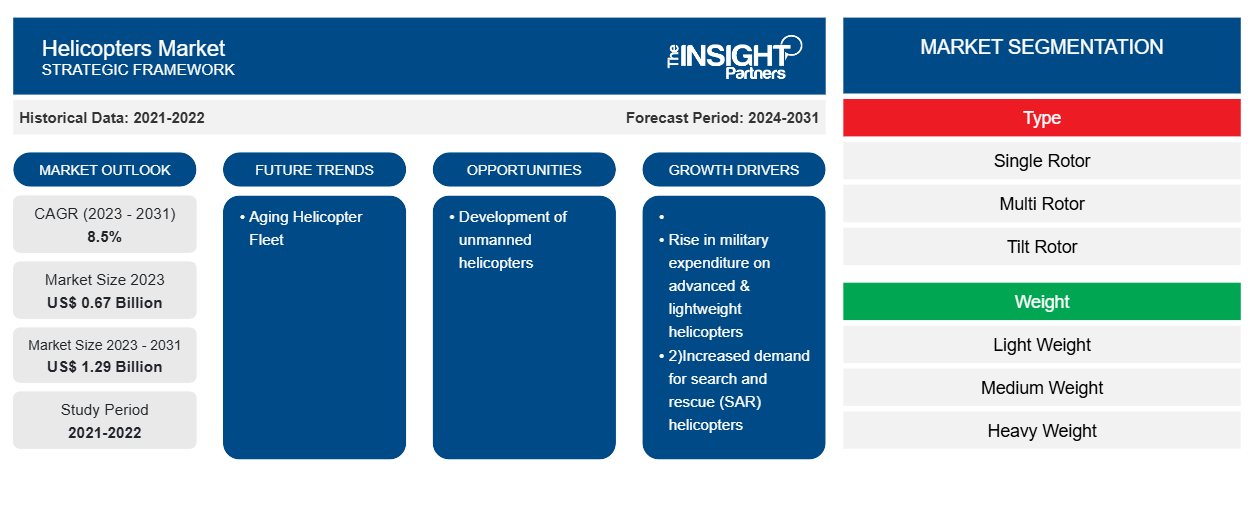

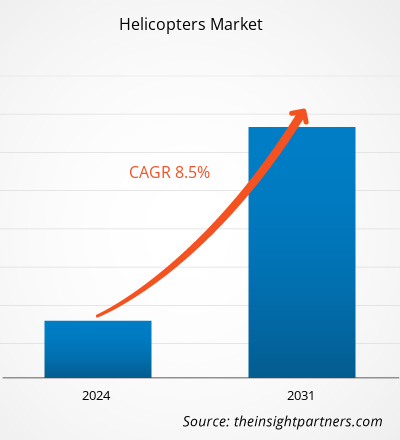

The helicopters market size is projected to reach US$ 1.29 billion by 2031 from US$ 0.67 billion in 2023. The market is expected to register a CAGR of 8.5% during 2023–2031. Development of unmanned helicopters is likely to remain a key trend in the market.

Helicopters Market Analysis

There are two types of component manufacturers operating in the market. The first ones offer highly specialized components that are developed after huge investment in research and development. These components can be engines, camera systems, and software, among others. These component manufacturers have certain level of moderate bargaining power in the market. Such manufacturers are very few in numbers. Since they offer specialized components, it helps the OEMs to develop advance helicopter systems. However, there are component manufacturers that offer standardized components, and these suppliers are comparatively huge in numbers. As there are too many suppliers in the industry, their bargaining power is diluted as they can easily be replaced by other players.

Helicopters Market Overview

The major stakeholders in the global market ecosystem include component manufacturers, helicopter manufacturers and suppliers and end-users. With the rising need for advanced and efficient helicopter for various application across the globe, the component providers of helicopters are also experiencing a rise in demand. The components of helicopter include airframe, landing gear, tail rotor system, main rotor system, sensors, camera system among others. The component manufacturer work in tandem with the OEMS to offer reliable components that complies with the technical specification. Some of the key component manufacturers of helicopters are LISI AEROSPACE- that works with companies like Airbus S.A.S and Boeing Corporation, Safran- that offered main harnesses for the UH-60M and HH-60M aircraft models, RA Lalli among others

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Helicopters Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Helicopters Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Helicopters Market Drivers and Opportunities

Rise in Military Expenditure on Advanced and Lightweight Helicopters

The swift change in modern-day warfare has been urging the governments to allocate higher amounts toward respective military forces. The budget allocated to military helps the military forces to engage themselves in the development of robust indigenous technologies and procurement of advanced weapons, armaments, vehicles, and other equipment from international manufacturers. There is a rise in modernization of soldiers and military vehicles among most of the military forces in order to keep the personnel and vehicles mission ready. With an objective to modernize soldiers and vehicles, the defense ministries across the globe are investing substantial amounts in newer technologies, including advanced helicopters. This factor is boosting the growth of the global helicopter market. According to the Stockholm International Peace Research Institute (SIPRI), the global military expenditure rose to US$ 2,443 billion in 2023 compared to US$ 2158.12 billions in 2022. The key countries in 2023, which accounted for ~60% of global expenditure, include the US, China, India, Russia, and Saudi Arabia. Such investments have been boosting the procurement and orders for military helicopters from across different countries worldwide which is further driving the market growth.

Aging Helicopter Fleet

Many countries are now witnessing an increase in aging helicopter fleet size, which is creating immense demand for new and advanced helicopters. OEMs can effectively use this opportunity to strengthen their market position. For instance, in 2020, in India, The Hindustan Aeronautics Limited received the initial operational clearance for production of the light utility helicopter, which is set to replace the aging fleet of Cheetah and Chetak helicopters of the Indian armed forces. Further, according to a report published in 2018–2019, approximately 25% of the total helicopter fleet size in India is over 20 years old and falls under “fleet renewal pending “category, which is expected to create opportunity for OEMs in the market. In 2021, the UK ministry announced that the country will retire the Airbus Helicopters Puma HC2 rotorcraft by the middle of this decade, as the Ministry of Defence (MoD) is targeting a range of capability updates. South Korea, yet another prominent country in the market, is also planning to upgrade its helicopter fleet. In April 2021, the country announced (under Defense Acquisition Program Administration (DAPA)) that it is looking for more new attack helicopters for the Republic of Korea Army (RoKA) under the second phase of its ongoing helicopter recapitalization programme. All these ongoing upgrade programs taking place in various major countries are expected to create growth opportunity for OEMs.

Helicopters Market Report Segmentation Analysis

Key segments that contributed to the derivation of the helicopters market analysis are type, weight, and application.

- Based on type, the helicopters market is segmented into single rotor, multi rotor, and tilt rotor. The single rotor segment held a larger market share in 2023.

- Based on weight, the helicopters market is segmented into light weight, medium weight, and heavy weight. The medium weight segment held a larger market share in 2023.

- Based on technology, the helicopters market is segmented into commercial & civil and military. The military segment held a larger market share in 2023. Further, the military segment is sub-segmented into attack & reconnaissance, maritime, transport/search & rescue, and training.

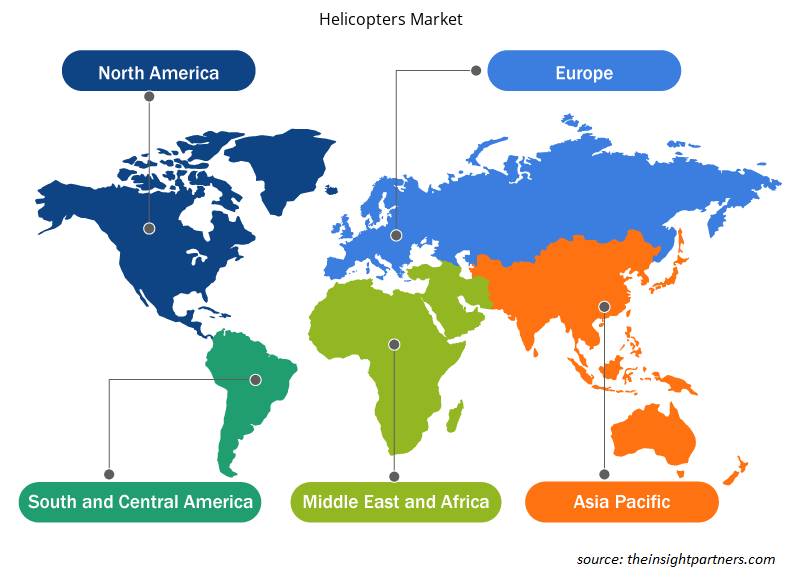

Helicopters Market Share Analysis by Geography

The geographic scope of the helicopters market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the market in 2023 followed by Europe and Asia Pacific regions. Further, Asia Pacific is also likely to witness highest CAGR in the coming years. The US dominated the North America helicopters market in 2023. The US is the dominant and a mature market for helicopters. The helicopter market in the US is driven by growing procurement of such helicopter for military and commercial use. For commercial use, the US is in the ongoing process of procuring helicopters of search and rescue operation. The country is upgrading and procuring SAR helicopters. In 2021, the country completed the testing of a next generation combat rescue helicopter- the Sikorsky HH-60 W. Developed by Sikorsky Aircraft Corporation, the HH-60W is a highly modified variant of the battle-proven UH-60M Black Hawk. The helicopter is highly capable and reliable over the HH-60G. It better support the full range of combat rescue and other special missions.

Helicopters Market Regional Insights

The regional trends and factors influencing the Helicopters Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Helicopters Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Helicopters Market

Helicopters Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 0.67 Billion |

| Market Size by 2031 | US$ 1.29 Billion |

| Global CAGR (2023 - 2031) | 8.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

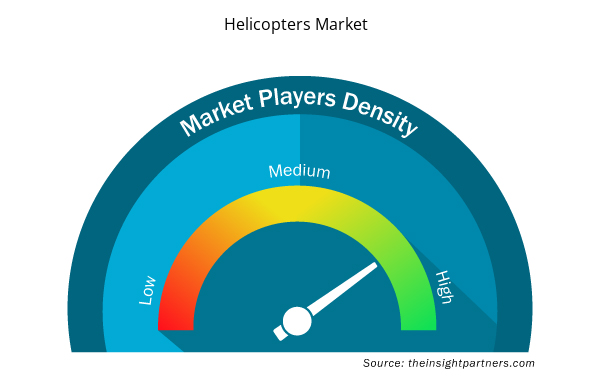

Helicopters Market Players Density: Understanding Its Impact on Business Dynamics

The Helicopters Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Helicopters Market are:

- Airbus S.A.S.

- Leonardo S.p.A.

- Bell Textron Inc.

- Russian Helicopters

- Lockheed Martin Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Helicopters Market top key players overview

Helicopters Market News and Recent Developments

The helicopters market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the helicopters market are listed below:

- Bell Textron, a Textron Inc. (NYSE:TXT) company, announced today during HAI Heli-Expo that it has appointed Chinook Helicopters as an authorized Bell 505 dealership serving western Canada. (Source: Bell Textron, Press Release, Feb 2024)

- Columbia Helicopters, a leading manufacturer and operator of heavy-lift helicopters, has announced a new partnership with Coulson Aviation, a world leader in aerial firefighting technology, to offer Coulson’s RADS-L Delivery System for operators of Columbia’s Model 234 helicopters. (Source: Columbia Helicopters, Press Release, Mar 2023)

Helicopters Market Report Coverage and Deliverables

The “Helicopters Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Helicopters market market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Helicopters market market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Helicopters market market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the helicopters market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type , Weight , and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The helicopters market is likely to register of 6.7% during 2023-2031.

The estimated value of the helicopters market by 2031 would be around US$ 68.87 billion.

Development of unmanned helicopters is one of the major trends of the market.

Airbus SAS, Leonardo SpA, Bell Textron Inc, Russian Helicopters, Lockheed Martin Corporation, The Boeing Co, Enstrom Helicopter Corp, Kaman Corporation, MD Helicopters Inc, and Robinson Helicopter Company are some of the key players profiled under the report.

Rise in military expenditure on advanced & lightweight helicopters and increased demand for search and rescue (SAR) helicopters are some of the factors driving the growth for helicopters market.

North America region dominated the helicopters market in 2023.

Get Free Sample For

Get Free Sample For