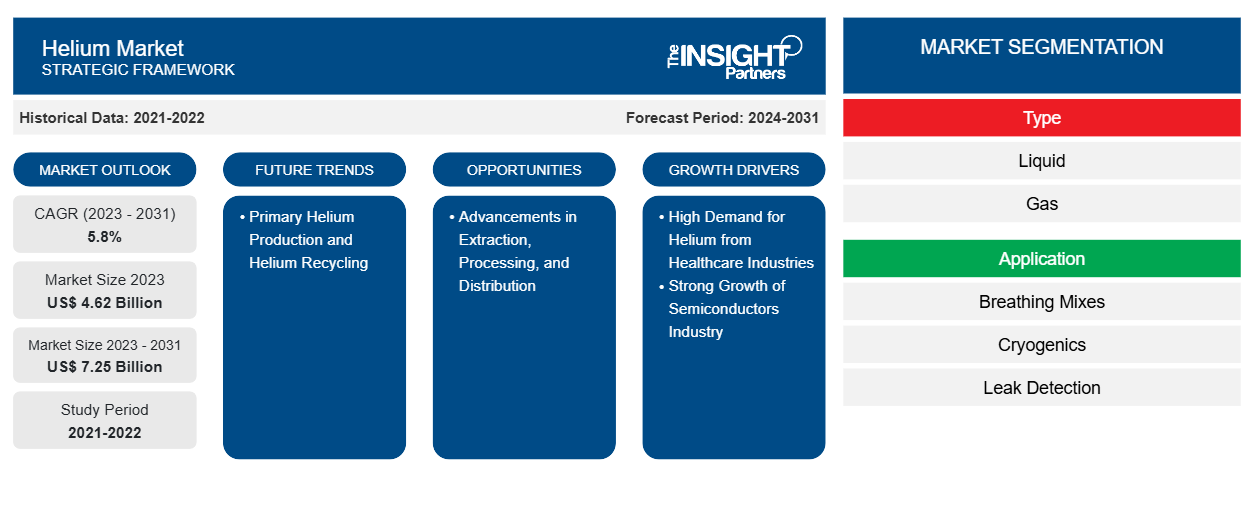

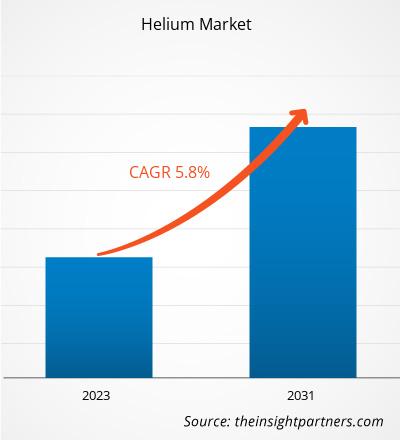

The helium market size is projected to reach US$ 7.25 billion by 2031 from US$ 4.62 billion in 2023. The market is expected to register a CAGR of 5.8% during 2023–2031. Primary helium production and helium recycling are likely to emerge as new market trends during the forecast period.

Helium Market Analysis

The expanding healthcare infrastructure and the increasing number of MRI installations in medical facilities in rural areas are anticipated to create a constant need for helium in the coming years. Helium is utilized in the cooling of high-performance electronics and sensors that are essential for electric powertrains and autonomous systems. These components often require highly controlled environments to function efficiently, and helium's inert, nonreactive properties make it ideal for maintaining optimal operating conditions. Further, the need for helium in the automotive sector is expected to rise in the coming years with its shift toward the manufacturing of more sustainable and technologically advanced vehicles.

Helium Market Overview

Helium is an odorless and colorless nonrenewable natural resource, usually recovered from the deposits of natural gas. In the aerospace industry, helium is used to purge hydrogen systems as a cryogenic cooling agent and pressurizing agent in flight and ground fluid systems. The helium market is analyzed on the basis of type, application, and end-use industry. Based on application, the market is further segmented into breathing mixes, cryogenics, leak detection, pressurizing and purging, welding, controlled atmosphere, semiconductor, MRI, and others. Helium, widely used in electronics, healthcare, MRI, NMR technology, aerospace, and defense, is expected to boost market growth due to its growing adoption in various sectors.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Helium Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Helium Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Helium Market Drivers and Opportunities

Strong Growth of Semiconductors Industry Bolsters Market

As the semiconductor industry experiences rapid growth, the demand for helium in various stages of semiconductor manufacturing is rising. It is highly used in semiconductor manufacturing because of its high thermal conductivity and inert characteristics. Helium's ability to rapidly cool down chips during the production process makes it irreplaceable as semiconductor nodes become smaller and more efficient. The need for enhanced thermal management becomes critical as the semiconductor industry harnesses the potential of advancements in AI and quantum computing. The role of helium is crucial in ensuring optimal conditions in chip manufacturing without the risk of overheating. Thus, the robust growth of the semiconductors industry is driving the market growth.

Advancements in Extraction, Processing, and Distribution to Generate Significant Growth Opportunities

Recent innovations in technologies employed in helium gas production revolve around improvements in extraction methods, purification processes, and distribution infrastructure and processes. These advancements aim to address the challenges posed by the scarcity and environmental impact of helium. There is a rising focus on innovative methods used in helium extraction. The extraction has seen significant strides with the use of membrane technology. Membranes made of polybenzimidazole exhibit high selectivity and permeability rates, enabling efficient separation of helium from natural gas reserves. This method helps reduce energy consumption as compared to traditional cryogenic processes. Moreover, novel poly(p-phenylene benzobisimidazole) membranes offer even better performance, ensuring maximum recovery from natural gas. These materials withstand harsh operational conditions, ensuring durability and efficiency. Advancements in purification techniques are essential for maintaining high-quality standards. Polymer-based membranes such as polybenzimidazole provide superior permeability and selectivity, ensuring effective removal of impurities. Quality management processes incorporate real-time monitoring systems to detect impurities and maintain purity levels. These systems have sophisticated sensors and analytical tools that determine and manage helium quality during its processing. Ensuring consistent purity is highly important to obtain desired outcomes in scientific research and therapeutics. Technologically advanced data analytics, cloud computing, artificial intelligence, and automation capabilities are essential to make helium production and delivery more efficient. Cloud computing is anticipated to enable better communications between distributors and producers to ensure quick order fulfillment. Automation systems can also lower costs associated with human labor by improving operational efficiency from refining processes through packaging operations. Thus, advancements in helium extraction, processing technologies, and distribution are expected to offer lucrative opportunities for the global helium market growth during the forecast period.

Helium Market Report Segmentation Analysis

Key segments that contributed to the derivation of the helium market analysis are type, application, and end-use industry.

- Based on type, the helium market is bifurcated into liquid and gas. The gas segment held a larger market share in 2023.

- In terms of application, the market is segmented into breathing mixes, cryogenics, leak detection, pressurizing and purging, welding, controlled atmosphere, semiconductors, MRI, and others. The MRI segment held a significant share of the market in 2023.

- Based on end-use industry, the helium market is segmented into aerospace, automotive, electronics and semiconductors, power, healthcare, welding and metal fabrication, recreation or events, and others. The electronics and semiconductors segment held the largest market share in 2023.

Helium Market Share Analysis by Geography

The geographic scope of the helium market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is one of the prominent markets utilizing helium owing to the noticeably growing industries such as healthcare, electronics, semiconductors, and space exploration in several countries. The region is one of the largest manufacturers of semiconductors and electronics, with countries such as Taiwan, South Korea, and China leading the global market. An increasing number of on-fleet vehicles in countries such as China, India, and South Korea propels the demand for printed circuit boards (PCBs) and semiconductors. With China's evolution into a high-skilled manufacturing hub, developing countries such as South Korea, India, Taiwan, and Vietnam are attracting several businesses that plan to relocate their low- to medium-skilled manufacturing facilities to neighboring countries to benefit from the low labor costs in these countries. As per the study by the Semiconductor Industry Association, ~75% of global semiconductor capacity is based in China and East Asia. Semiconductor companies are expected to benefit from a possible cost advantage of 25–50% by commencing manufacturing activities in the region. Helium plays a critical role in semiconductor manufacturing, wherein it is used as a coolant and protective gas in processes that require high precision, such as chip production. With the increasing demand for consumer electronics, 5G networks, and EVs, the need for semiconductors will continue to grow in the coming years in Asia Pacific, resulting in higher helium consumption.

Helium Market Regional Insights

The regional trends and factors influencing the Helium Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Helium Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Helium Market

Helium Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.62 Billion |

| Market Size by 2031 | US$ 7.25 Billion |

| Global CAGR (2023 - 2031) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

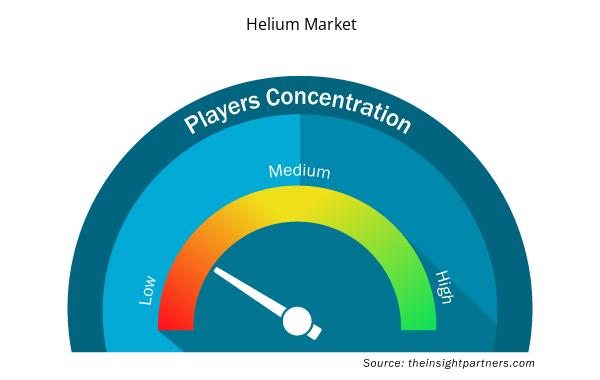

Helium Market Players Density: Understanding Its Impact on Business Dynamics

The Helium Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Helium Market are:

- LAir Liquide SA

- Linde Plc

- Weil Group Resources LLC

- Air Products and Chemicals Inc

- Messer SE & Co KGaA

- Avanti Helium Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Helium Market top key players overview

Helium Market News and Recent Developments

The helium market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the noteworthy recent developments in the helium market are mentioned below:

- Air Liquide partnered with Laurentis Energy Partners, a clean-energy leader, to produce and distribute helium-3 (He3), a rare isotope used in quantum computing, quantum science, astrophysics, neutron detection, medical imaging, and fusion. (Source: Air Liquide, Press Release, June 2021)

- Avanti Helium Corp signed a midstream agreement with IACX Resources Montana LLC to build, finance, and operate a helium recovery plant by processing raw gas from Avanti's Sweetgrass Helium pool. (Source: Avanti Helium Corp, Newsletter, May 2023)

Helium Market Report Coverage and Deliverables

The "Helium Market Share and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Helium market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Helium market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Helium market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the helium market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Animal Genetics Market

- Intraoperative Neuromonitoring Market

- Radiopharmaceuticals Market

- Machine Condition Monitoring Market

- Frozen Potato Market

- Smart Mining Market

- Hydrogen Storage Alloys Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Parking Management Market

- Digital Language Learning Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The helium market size is projected to reach US$ 7.25 billion by 2031.

L’Air Liquide SA, Linde Plc, Weil Group Resources LLC, Air Products and Chemicals Inc, Messer SE & Co KGaA, Avanti Helium Corp, nexAir LLC, Renergen Ltd, American Gas Products Inc, Praxair Technology Inc, Nippon Sanso Holdings Corp, Exxon Mobil Corp, PGNiG SA, Gulf Cryo LLC, and Advanced Specialty Gases are a few of the key players operating in the helium market.

High demand from healthcare industries and strong growth of the semiconductors industry are major factors contributing to the growth of the market.

Primary helium production and helium recycling are likely to emerge as key trends in the market in the future.

Asia Pacific dominated the market with the largest share in 2023.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Helium Market

- L’Air Liquide SA

- Linde Plc

- Weil Group Resources LLC

- Air Products and Chemicals Inc

- Messer SE & Co KGaA

- Avanti Helium Corp

- nexAir LLC

- Renergen Ltd

- American Gas Products Inc

- Praxair Technology Inc

- Nippon Sanso Holdings Corp

- Exxon Mobil Corp

- PGNiG SA

- Gulf Cryo LLC

- Advanced Specialty Gases

Get Free Sample For

Get Free Sample For