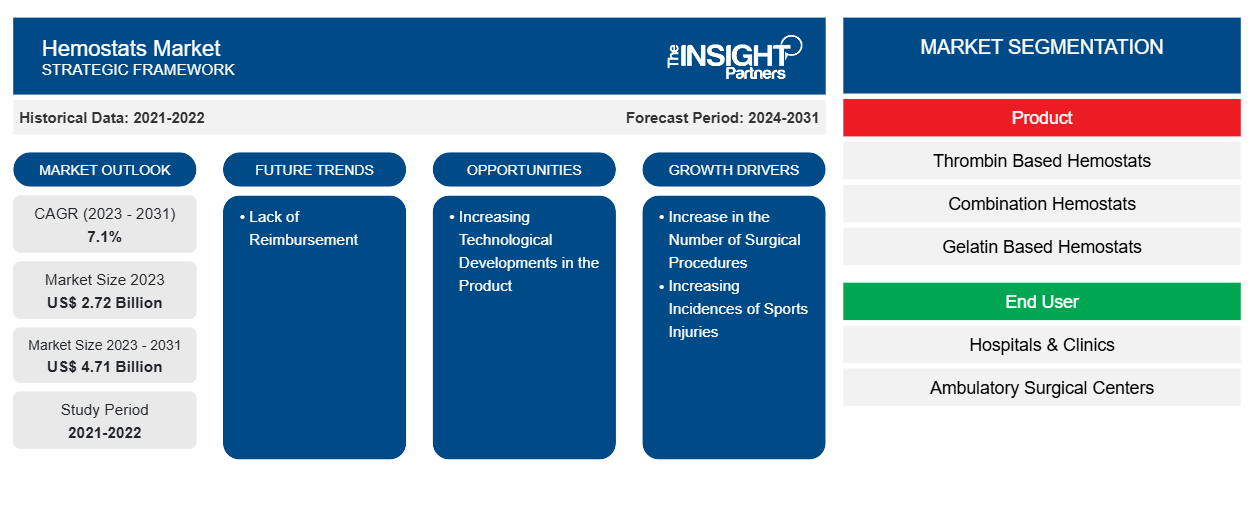

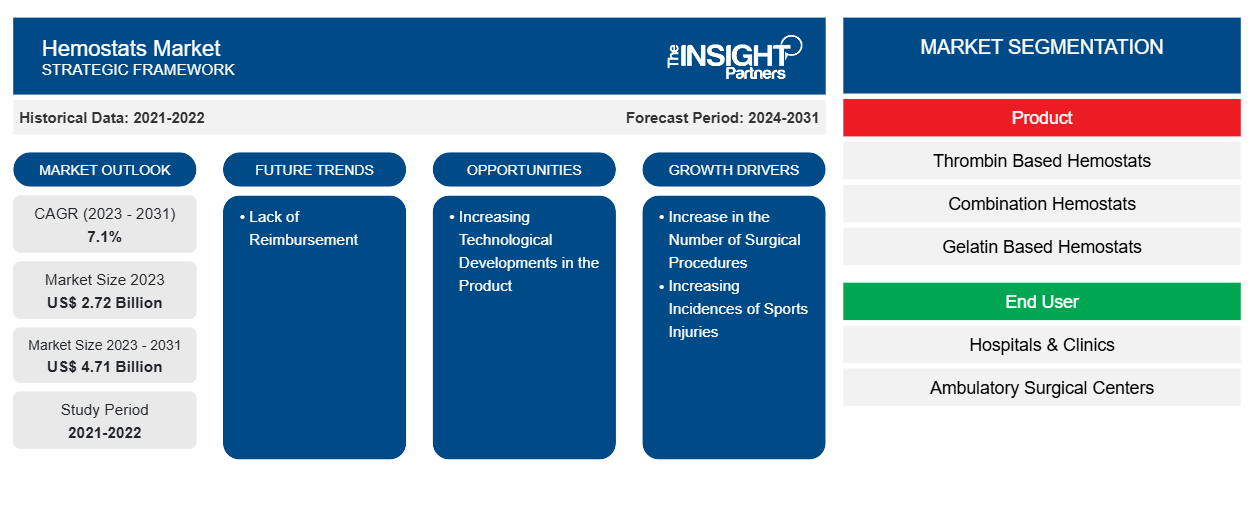

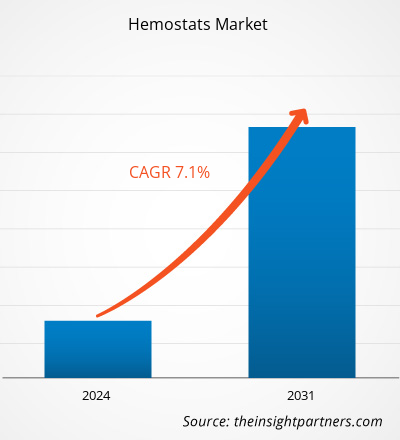

The hemostats market size is projected to reach US$ 4.71 billion by 2031 from US$ 2.72 billion in 2023. The market is expected to register a CAGR of 7.1% during 2023–2031. Growing research activities, as well as product innovations in hemostats are likely to remain key trends in the market.

Hemostats Market Analysis

The rise in bleeding complications led to the growth of the hemostats market worldwide. The growing surgical procedures performed worldwide is an important market driver. The growing adoption of hemostat products in the healthcare sector has added to growth in the market. The increasing number of regulatory approvals, spinal problems, and an increase in sports injuries are other factors contributing to the acceleration of the market. Certain clinical limitations, like uncontrolled bleeding, limit product acceptance and restrain market growth. Although the product achieves good results, factors such as the treatment of bleeding complications during surgery and a significantly lower risk of infection lead to limited acceptance of the product, such as the high cost of the product. In addition, raising awareness of key opinion leaders, such as medical professionals, opens up opportunities for future market growth for hemostats.

Hemostats Market Overview

The hemostats market witnessed an upswing due to rapidly improving healthcare infrastructure, increased purchasing power, and increased awareness about the health practices in the hemostatics market. Low research and development costs enable developed and technologically advanced products with improved functions. Tissue sealants, adhesion prevention, and tissue adhesives replaced traditional wound and incision sutures. Its advantages include improved visualization, minimally invasive application, prevention of non-blood fluid leakage, shortened operation time, prevention of non-blood fluid leakage, and shorter postoperative time.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hemostats Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hemostats Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Hemostats Market Drivers and Opportunities

Increasing Incidences of Sports Injuries to Favor Market

The rising incidences of sports injuries are influenced by weekend sports players, youngsters, children, professional athletes, and sometimes adults. Most sports injuries are orthopedic injuries that include sprain, swelling, strain, pain, fractures, ligament tears, and others. ~5 million children 18 years old or younger in the US consult their primary care physician or a sports medicine clinic for yearly injuries. ~3 million children go to hospital emergency rooms yearly because of sports injuries. Repetitive strain injuries are also common in other high-speed sports. Sports injuries and spinal problems contribute to the increased use of hemostasis and tissue sealants. Focusing on effective blood loss management during surgeries drives the market growth.

Increasing Technological Developments in the Product

Biotechnology and materials science innovations have produced more effective and safer hemostatic products, improving surgical outcomes and patient recovery times. New hemostat technologies have filled a critical gap in healthcare, emergency response, and defense, providing sustainable, accessible, and affordable biomedical devices for emergency medical response. In March 2023, Axio Biosolutions received clearance for its Ax-Surgi surgical hemostat from the US FDA 510(k). This innovative hemostatic product utilizes chitosan and is specifically designed to treat and control severe bleeding effectively during surgical procedures. In September 2022, Medtronic received FDA approval for its Nexpowder endoscopic hemostasis device. This technology intends to improve patient outcomes and, thus, the overall quality of care.

Hemostats Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Hemostats market analysis are type, cause, disorder type, category, and end user.

- Based on product, the hemostats market is segmented into thrombin-based hemostats, combination hemostats, gelatin based hemostats, collagen based hemostats, and oxidized regenerated cellulose based hemostats. The thrombin-based hemostats segment held the largest market share in 2023. However, combination hemostats are expected to register highest CAGR during the forecast period.

- By end user, the market is segmented into hospitals & clinics, ambulatory surgical center, and others. The hospitals & clinics segment held the largest share of the market in 2023 and is anticipated to register highest CAGR during 2021–2031.

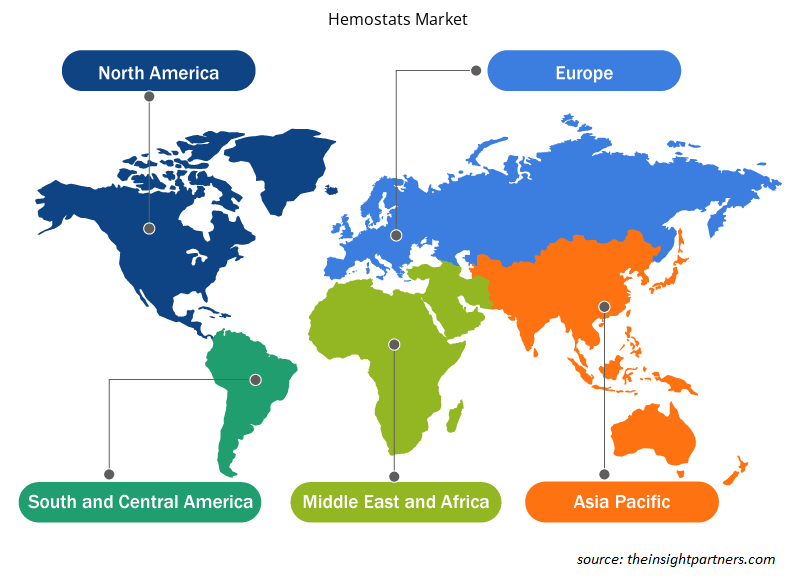

Hemostats Market Share Analysis by Geography

The geographic scope of the Hemostats market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the hemostats market. Factors leading to the growth of the hemostats market in North America are a rise in the number of surgical procedures, improvement in the region's healthcare infrastructure, and the availability of technological advancements. The cumulative use of technologically advanced products and the volume of surgical procedures have resulted in a higher demand for hemostats in North America. Furthermore, the increasing product approvals by the US FDA also support the region's dominance in the global market. For instance, in January 2023, breakthrough device designation was granted to Medcura, Inc.'s LifeGel absorbable surgical hemostat by the US Food and Drug Administration (FDA). In North America, the US held a significant market share in 2023. The significant growth in the US during the forecast period is due to factors such as the increasing number of surgical procedures, innovative product developments by the key market players, and provision of advanced healthcare facilities in the country.

Hemostats Market Regional Insights

The regional trends and factors influencing the Hemostats Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Hemostats Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Hemostats Market

Hemostats Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.72 Billion |

| Market Size by 2031 | US$ 4.71 Billion |

| Global CAGR (2023 - 2031) | 7.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Hemostats Market Players Density: Understanding Its Impact on Business Dynamics

The Hemostats Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Hemostats Market are:

- Johnson & Johnson Services, Inc. (Ethicon LLC),

- BD,

- Baxter,

- B. Braun Melsungen Ag,

- Pfizer, Inc.,

- GELITA MEDICAL,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Hemostats Market top key players overview

Hemostats Market News and Recent Developments

The Hemostats market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Hemostats market are listed below:

- Ethicon, a Johnson & Johnson MedTech company, announced the approval of ETHIZIATM, an adjunctive hemostat solution which has been clinically proven to achieve sustained hemostasis in difficult to control bleeding situations. Comprised of unique synthetic polymer technology, ETHIZIA Hemostatic Sealing Patch is the first and only hemostatic matrix designed to be equally active and efficacious on both sides. Designed for maximum adaptability, it can be stuffed, rolled, pulled apart, trimmed, and tailored, making it easy to handle in both open and minimally invasive surgeries. (Source: Johnson & Johnson Services, Inc, Press Release, November 2023)

- Baxter International Inc., a global leader in advancing surgical innovation, announced the launch of PERCLOT Absorbable Hemostatic Powder in the US PERCLOT is a passive, absorbable hemostatic powder that is ready to use and designed for patients with intact coagulation to address mild bleeding. (Baxter, Press Release, July 2023)

- Olympus announced the launch of EndoClot Adhesive (ECA), EndoClot Polysaccharide Hemostatic Spray (PHS) and EndoClot Submucosal Injection Solution (SIS) in the Europe, Middle East and Africa (EMEA) region. This innovative portfolio is developed by EndoClot Plus, Inc. (EPI), which expanded its distribution agreement with Olympus from the US to EMEA in December 2022. (Olympus, Press Release, April 2023)

- Medcura, Inc., a commercial-stage life science and medical device company, announced that Walmart.com, one of the world’s largest online retailers, will now be selling the Company’s antibacterial wound gel Rapid-Seal through Walmart.com. Rapid-Seal was cleared by the Food and Drug Administration (FDA) to provide rapid bleeding management and an antibacterial barrier helping to reduce infections. (Medcura, Press Release, December 2022)

- Omni-stat Medical Inc’s parent company, Medtrade Products Ltd is pleased to announce CE certification for its CELOX PPH Uterine Hemostatic Tamponade, a significant and state-of-the-art innovation that provides rapid and effective control of postpartum bleeding, a prevalent and severe complication of childbirth. Gaining accreditation for this game-changing device is a significant medical milestone in the field of obstetrics. (Source: Omni-stat Medical Inc, News, November 2022)

Hemostats Market Report Coverage and Deliverables

The “Hemostats Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Hemostats market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Hemostats market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Hemostats market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Hemostats market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Legal Case Management Software Market

- Flexible Garden Hoses Market

- Cut Flowers Market

- Data Annotation Tools Market

- Adaptive Traffic Control System Market

- Pressure Vessel Composite Materials Market

- Semiconductor Metrology and Inspection Market

- Ketogenic Diet Market

- Trade Promotion Management Software Market

- Aerosol Paints Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product ; End User ; and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The North America region dominated the hemostats market in 2023.

An increase in the number of surgical procedures and growing cases of sports injuries are the driving factors impacting the hemostats market.

Growing research activities and product innovations are likely to act as future trends for the hemostats market.

BD and B. Braun Melsungen Ag are the leading players operating in the hemostats market.

US$ 4.71 billion would be the estimated value of the hemostats market by 2031.

7.1% is the CAGR of the hemostats market.

Get Free Sample For

Get Free Sample For