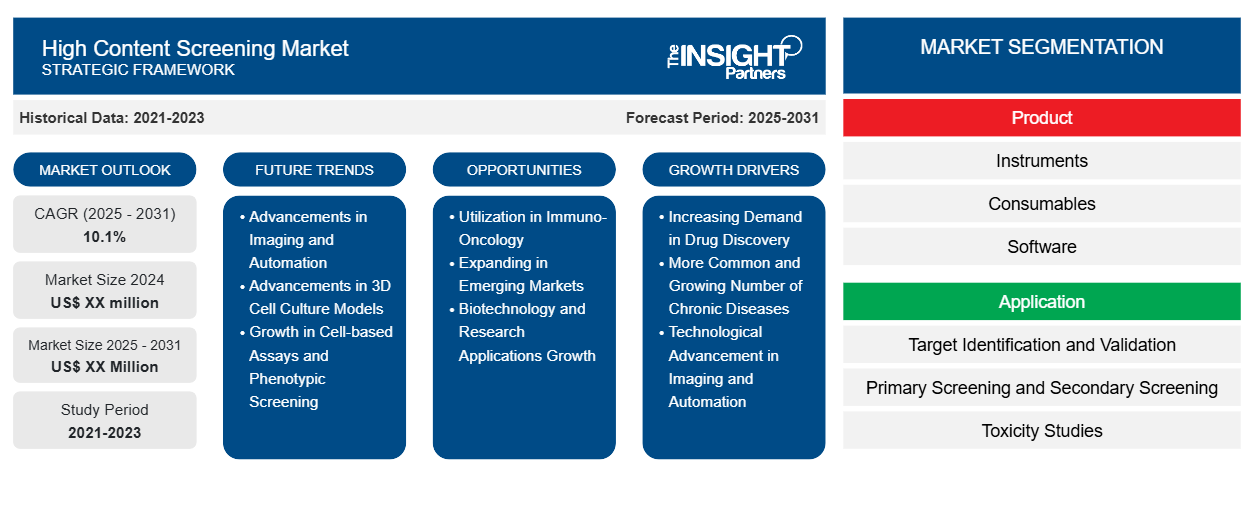

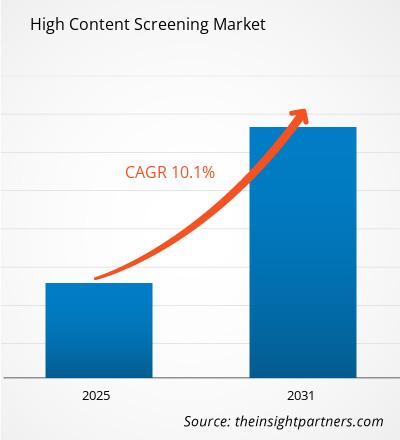

The High Content Screening Market is expected to register a CAGR of 10.1% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The High Content Screening Market is categorized by product into Instruments, Consumables, Software, Services, and Accessories. It further breaks down by application, i.e., Target Identification and Validation, Primary and Secondary Screening, Toxicity Studies, Compounds, and Others, and end users, including Pharmaceuticals and Biotechnology Companies, Academic and Government Institutes, and Contract Research Organizations (CROs). Forecasts up to 2031 offer valuable insights into how high content screening market growth impacts productivity and customer satisfaction. The global analysis is broken down at the regional level and major countries. The market evaluation is presented in US$ for the above segmental analysis.

Purpose of the Report

The report High Content Screening Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

High Content Screening Market Segmentation

Product

- Instruments

- Consumables

- Software

- Services

- Accessories

Application

- Target Identification and Validation

- Primary Screening and Secondary Screening

- Toxicity Studies

- Compounds

End User

- Pharmaceuticals and Biotechnology Companies

- Academic and Government Institutes

- Contract Research Organizations

Geography

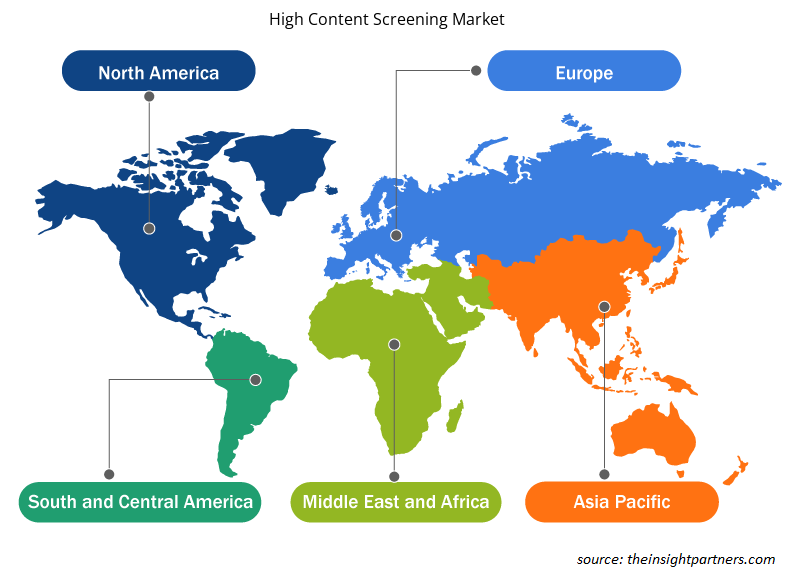

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

High Content Screening Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

High Content Screening Market Growth Drivers

- Increasing Demand in Drug Discovery: High-content screening (HCS) is a must-have technology for pharmaceutical research and development of drugs. In an increasingly globalized pharmaceutical sector looking for more efficient ways to screen for new drug candidates, HCS systems are increasingly used to screen many thousands of compounds and ascertain their effects on the cells.

- More Common and Growing Number of Chronic Diseases: The number of chronic diseases (cancer, diabetes, neurodegenerative diseases, etc) is increasing, which further necessitates the use of screening technologies for drug development and precision medicine. This fuels high-content screening in biomedical studies and clinical practice.

- Technological Advancement in Imaging and Automation: There have been significant advancements in imaging technologies, including automated microscopy, 3D imaging, and AI-driven image analysis. These are making a difference in the HCS process, enabling higher throughput, better accuracy, and greater resolution of cellular responses. Such improvements are driving the usage of HCS in all sorts of research and clinical applications due to the ability of screening large compound libraries at higher rates with greater precision.

High Content Screening Market Future Trends

- Advancements in Imaging and Automation: Automation in automated imaging, microplate readers, and data analytics has improved the precision and throughput of high-content screening solutions. HCS systems that are automated give consistency and efficiency to detect active compounds which drives the market.

- Advancements in 3D Cell Culture Models: There is a trend now toward using 3D cell culture systems in HCS. These systems allow for drug testing in an environment more physiologically relevant than traditional 2D cultures. These cultures are better representations of the complex human tissue, and that is reflected in the results for drug screening. This increasing demand is creating a huge market for advanced HCS platforms to support 3D cell culture systems and is a driver for market growth.

- Growth in Cell-based Assays and Phenotypic Screening: There is a growing preference for cell-based assays over traditional biochemical assays, as they provide more relevant biological information. Phenotypic screening, in particular, is gaining popularity due to its ability to identify the effects of compounds on cellular phenotypes without preconceived notions about the molecular targets. This trend is enhancing the utility of HCS in identifying novel drug candidates and improving disease models.

High Content Screening Market Opportunities

- Utilization in Immuno-Oncology: High-content screening is gaining adoption in immuno-oncology to find new cancer immunotherapies. This new research field could offer a major platform for HCS technologies to screen for immune-modulating drugs that would boost the cure of cancer.

- Expanding in Emerging Markets: With the global need for precision medicine rising, emerging markets offer enormous growth opportunities for the expansion of high-content screening technologies. As healthcare infrastructure and research facilities in these regions grow, adoption will likely accelerate.

- Biotechnology and Research Applications Growth: HCS is rapidly increasing in academic research and biotechnology fields, especially for cancer research, stem cell research, and genetic studies. HCS systems' ability to analyze complex biological phenomena and provide high-dimensional data helps in understanding cellular responses, gene expression, and disease mechanisms, thereby creating a space for HCS in research institutions, biotech firms, and contract research organizations that deal with advanced research and innovation.

High Content Screening Market Regional Insights

The regional trends and factors influencing the High Content Screening Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses High Content Screening Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for High Content Screening Market

High Content Screening Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 10.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

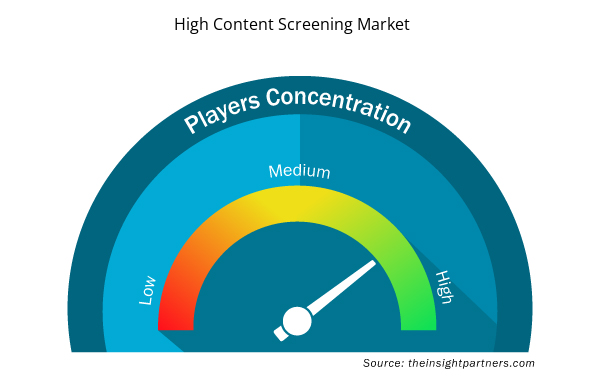

High Content Screening Market Players Density: Understanding Its Impact on Business Dynamics

The High Content Screening Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the High Content Screening Market are:

- GENERAL ELECTRIC

- Danaher

- Perkinelmer, Inc.

- Thermo Fisher Scientific Inc.

- BD

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the High Content Screening Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the High Content Screening Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the High Content Screening Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Hydrolyzed Collagen Market

- Data Center Cooling Market

- Explosion-Proof Equipment Market

- Rare Neurological Disease Treatment Market

- Battery Testing Equipment Market

- Ceramic Injection Molding Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Ketogenic Diet Market

- Aircraft Landing Gear Market

- Artificial Intelligence in Defense Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on request are additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Key companies in this market are- GENERAL ELECTRIC, Danaher, Perkinelmer, Inc., Thermo Fisher Scientific Inc., BD, BioTek Instruments, Inc., Bio-Rad Laboratories, Inc., Tecan Trading AG, Merck KGaA,

The market is expected to register a CAGR of 5.7% during 2023-2031.

The driving factors of the High Content Screening Market include technological advancements in imaging and automation, the rise of personalized medicine, and increased investment in drug discovery.

Future trends include integration with artificial intelligence, personalized medicine focus, and growth in cell-based assays

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. GENERAL ELECTRIC

2. Danaher

3. Perkinelmer, Inc.

4. Thermo Fisher Scientific Inc.

5. BD

6. BioTek Instruments, Inc.

7. Bio-Rad Laboratories, Inc.

8. Tecan Trading AG

9. Merck KGaA

10. Yokogawa Electric Corporation

Get Free Sample For

Get Free Sample For