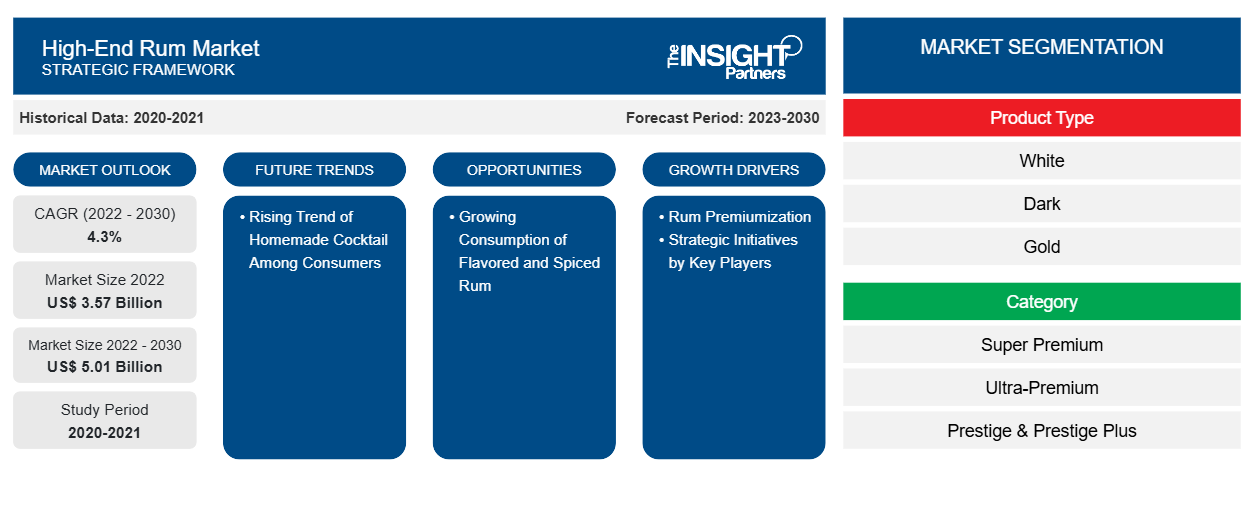

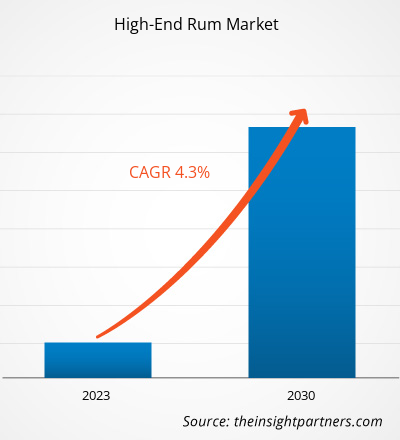

[Research Report] The high-end rum market size was valued at US$ 3,569.80 million in 2022 and is expected to reach US$ 5,006.08 million by 2030; it is estimated to register a CAGR of 4.3% from 2022 to 2030.

MARKET ANALYSIS

Based on category, the high-end rum market is segmented into super-premium, ultra-premium, and prestige & prestige plus. The super-premium rum segment held the largest market share in 2020, whereas the ultra-premium segment is projected to register the fastest CAGR from 2022 to 2030. All the rums under the high-end rums category are priced at US$ 30 and above. High-end rums are witnessing huge demand among consumers as consumers seek premium drinking experiences. Moreover, consumers are also inclined toward aged rums as these rums have a distinct aroma, flavor, and feel. High-end rums are categorized into white, gold, and dark based on their color and appearance. The age of the rum is determined by its color.

GROWTH DRIVERS AND CHALLENGES

Major factors contributing to the growing high-end rum market size are rum premiumization and strategic initiatives by key players. Traditionally, rum has been popular among a broad demographic. Initially, rum was known for its mass production, simple flavor profile, and ideal for blending into cocktails. However, over time, rum manufacturers began to explore advanced aging techniques and more sophisticated distillation methods. This resulted in the development of rums with more complex and nuanced flavor profiles comparable to other premium spirits such as whiskey and cognac. The impact of digital marketing and social media has also played an important role. Premium rum brands that effectively use social platforms have showcased the versatility and luxury associated with products, attracting consumers. Several brands, such as Diplomático, Rum Zacapa, and Richard Seale, have emerged as key players in premium rum for the quality of their products and their innovative marketing strategies. Globally, premium rum is gaining traction in several key international markets. In the US, Europe, and Asia Pacific, there is an increase in demand for premium and ultra-premium rums. Premium, matured, and high-quality rums are becoming more popular as consumers seek distinctive flavors and novel experiences in rum consumption.

Global high-end rum manufacturers are investing significantly in strategic development initiatives such as product innovation, merger & acquisition, and expansion of their businesses to attract many consumers and enhance their market position. Moreover, consumers' demand for high-end rum is increasing due to the growing popularity of luxury and premium spirits and product availability in distinct flavors. Thus, manufacturers such as Pernod Ricard SA, Diageo plc, and Brown-Forman Corp are launching various high-end rums to cater to the increasing demand. For instance, in August 2023, BACARDÍ Rum launched a new limited-edition premium variant, BACARDÍ Reserva Ocho Sevillian Orange Cask Finish. This third installment in the popular Cask Series, Sevillian Orange, continues the brand legacy of producing premium rums that match consumer taste preferences. However, in the past few years, awareness regarding health and nutrition has increased significantly due to a rise in the incidence of diseases such as diabetes, cardiovascular diseases, obesity, and cancer. High-end rum and other premium spirits contain psychoactive compounds with dependence-producing properties; therefore, excessive consumption of such products leads to adverse health conditions. Spirit consumption is linked to more than 200 health conditions, such as cancer, liver and cardiovascular diseases, and adverse mental health, along with suicides and road injuries. According to the report published by the World Health Organization (WHO), in 2022, three million deaths were caused due to high consumption of alcohol, and 5.1% of global diseases and injuries were recorded due to alcohol consumption.

The WHO aims to reduce the harmful effects and social consequences of alcohol, aligned with its Sustainable Development Goals 2030 agenda. Consumers are significantly preferring low-alcoholic drinks such as beer, hard seltzers, and alcopops. Social media campaigns and celebrity influence are also the key factors boosting the demand for nonalcoholic beverages. Further, contributions and market initiatives of the Cayman Spirits Co, Sovereign Brands LLC, and Cognac Ferrand SASU are positively influencing the high-end rum market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

High-End Rum Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

High-End Rum Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global High-End Rum Market Analysis" has been carried out by considering the following segments: product type, category, nature, distribution channel, and geography. The report provides key statistics on the use of high-end rum across the world, along with their demand in major regions and countries. In addition, the report provides a qualitative assessment of factors affecting the high-end rum market performance in major regions and countries. It also includes a comprehensive analysis of the leading players in the high-end rum market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, high-end rum market trends, and lucrative opportunities that would, in turn, aid in generating higher revenues.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global high-end rum market, which helps understand the entire supply chain and various factors influencing the high-end rum market growth.

SEGMENTAL ANALYSIS

The global high-end rum market is segmented on the basis of product type, category, nature, and distribution channel. Based on Product type, the high-end rum market is segmented into white, dark, and gold. The gold segment holds the largest high-end rum market share. Gold rum, also known as "amber" rum, is medium-bodied rum that is generally aged. Gold rum gains a dark color from aging in wooden barrels. Gold rums have more flavor and are stronger in taste than light rum or white rum and it is considered as midway between light rum and the darker varieties. Gold rum is used in the dark cocktail. Examples of gold rums include 1 Barrel, Abuelo, Appleton Special, Barcelo Dorado, Brugal Añejo, and Bermudez Ron Dorado.

Based on category, the high-end rum market is segmented into super-premium, ultra-premium, and prestige & prestige plus. The super-premium segment holds the largest market share. Rum that falls under the price range of US$ 30–44.99 is known as super-premium rum. The brands such as Grey Goose or Amaro Montenegro provide super-premium rum. The sales of super premium rums are increasing significantly with several initiatives taken by key market players. Based on nature, the high-end rum market is segmented into plain, and flavored. The plain segment holds the largest market share. Generally, white rum is considered plain rum. Plain rum is only made up of sugarcane molasses through fermentation and distillation. Consumers opt for plain rum as they prefer the traditional taste of rum without adding any external flavor. The plain rum contains minimum ingredients. These factors are expected to drive the market for the segment during the forecast period.

The rum is available in various flavors, including vanilla, fruity flavors (pineapple, citrus, and raspberry), and spice flavors (cinnamon and clove). The shifting trend toward flavored and spiced rums drives manufacturers to focus on expanding their product offerings in the flavored category. Flavored rum has various flavors and spices mixed into rum to create an exceptionally unique taste. Spiced rum, developed initially to meet medical needs, is gaining popularity. Based on distribution channels, the high-end rum market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The specialty stores segment holds the largest market share. The specialty stores segment includes liquor stores. Liquor stores are widely preferred distribution channels for the sale of high-end rum due to their ability to ensure the availability of an extensive range of products, offer attractive deals and discounts, and provide high-end customer service. These stores usually have trained staff that helps customers find the right product. Owing to the availability of a variety of products in one place, customers can enjoy a one-stop shopping experience.

REGIONAL ANALYSIS

The report provides a detailed overview of the global high-end rum market with respect to five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Europe accounted for the largest high-end rum market share and was valued at over US$ 1,400 million in 2022. Europe marks the presence of major rum manufacturing businesses operating in the region. The market in North America is expected to reach over US$ 1,500 million by 2030. The market in Asia Pacific (APAC) is expected to record a CAGR of ~5% from 2022 to 2030. The Europe high-end rum market is thriving because of increasing urbanization and changing consumer preferences. The market in Europe is significantly growing owing to its drinking culture and favorable climatic conditions. Several nations across the region are popular for the production and consumption of high-end rum. In recent years, the country has witnessed a growing number of rum enthusiasts among the younger demographic. Thus, rum premiumization is contributing to the growing high-end rum market globally.

High-End Rum Market Regional Insights

High-End Rum Market Regional Insights

The regional trends and factors influencing the High-End Rum Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses High-End Rum Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for High-End Rum Market

High-End Rum Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.57 Billion |

| Market Size by 2030 | US$ 5.01 Billion |

| Global CAGR (2022 - 2030) | 4.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

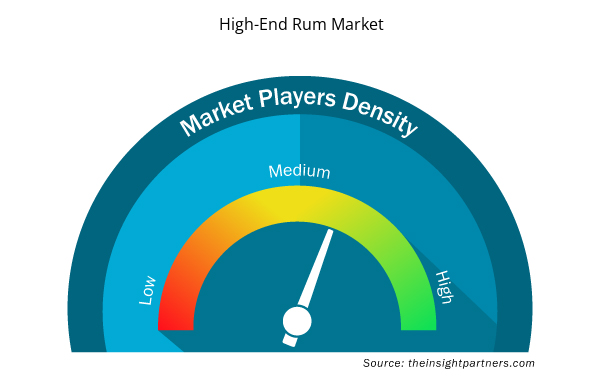

High-End Rum Market Players Density: Understanding Its Impact on Business Dynamics

The High-End Rum Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the High-End Rum Market are:

- Cayman Spirits Co

- Sovereign Brands LLC

- Cognac Ferrand SASU

- Pernod Ricard SA

- Distilleries Arehucas SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the High-End Rum Market top key players overview

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Cayman Spirits Co, Sovereign Brands LLC, Cognac Ferrand SASU, Pernod Ricard SA, Distilleries Arehucas SA, Mount Gay Distilleries Ltd, Davide Campari Milano NV, Brown-Forman Corp, Westerhall Estate Ltd, and Diageo Plc are among the prominent players profiled in the high-end rum market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The high-end rum market report also includes company positioning and concentration to evaluate the performance of competitors/players in the market.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Initiatives taken by the key players operating in the high-end rum market are listed below:

- In November 2023, Mount Gay, a rum distillery in Barbados, reintroduced its Single Estate Series, focusing on every step of the rum-making process, from sugarcane cultivation to bottling, on the estate.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Category, Nature, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on category, the high-end rum market is segmented into super premium, ultra-premium, and prestige & prestige plus. The ultra-premium segment was the fastest growing segment in 2022. Rum that comes under the price range of $45.00 to $99.99 are defined as ultra-premium rum. Brugal Rum is a popular brand of ultra-premium rum. The demand for ultra-premium rum is increasing globally with the rising disposable income of consumers.

Europe accounted for the largest share of the global high-end rum market. The Europe high-end rum market is thriving because of increasing urbanization and changing consumer preferences. The market in Europe is significantly growing owing to its drinking culture and favorable climatic conditions. Several nations across the region are popular for the production and consumption of high-end rum.

Based on Product type, the high-end rum market is segmented into white, dark, and gold. The gold segment holds the largest high-end rum market share. Gold rum, also known as "amber" rum, is medium-bodied rum that is generally aged. Gold rum gains a dark color from aging in wooden barrels. Gold rums have more flavor and are stronger in taste than light rum or white rum and it is considered as midway between light rum and the darker varieties.

Traditionally, rum has been popular among a broad demographic. Initially, rum was known for its mass production, simple flavor profile, and ideal for blending into cocktails. However, over time, rum manufacturers began to explore advanced aging techniques and more sophisticated distillation methods. This resulted in the development of rums with more complex and nuanced flavor profiles comparable to other premium spirits such as whiskey and cognac.

The population worldwide is more inclined toward consuming crafted flavored spirits and blends than traditional mass-produced spirits. Nowadays, consumers are looking for high-quality products with distinct flavors. Above all, the popularity of spiced rum and flavored spirits is increasing among young adults. Flavored rum offers a unique flavor to cocktails and rum cakes.

The major players operating in the global high-end rum market are Cayman Spirits Co, Sovereign Brands LLC, Cognac Ferrand SASU, Pernod Ricard SA, Distilleries Arehucas SA, Mount Gay Distilleries Ltd, Davide Campari Milano NV, Brown-Forman Corp, Westerhall Estate Ltd, and Diageo Plc.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - High-End Rum Market

- Cayman Spirits Co

- Sovereign Brands LLC

- Cognac Ferrand SASU

- Pernod Ricard SA

- Distilleries Arehucas SA

- Mount Gay Distilleries Ltd

- Davide Campari Milano NV

- Brown-Forman Corp

- Westerhall Estate Ltd

- Diageo Plc

Get Free Sample For

Get Free Sample For