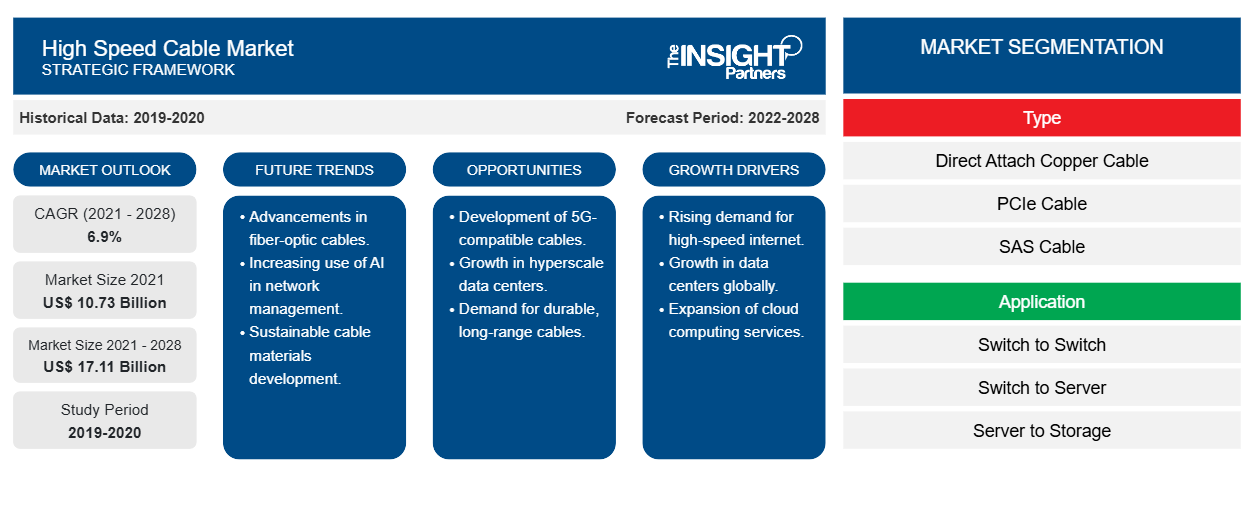

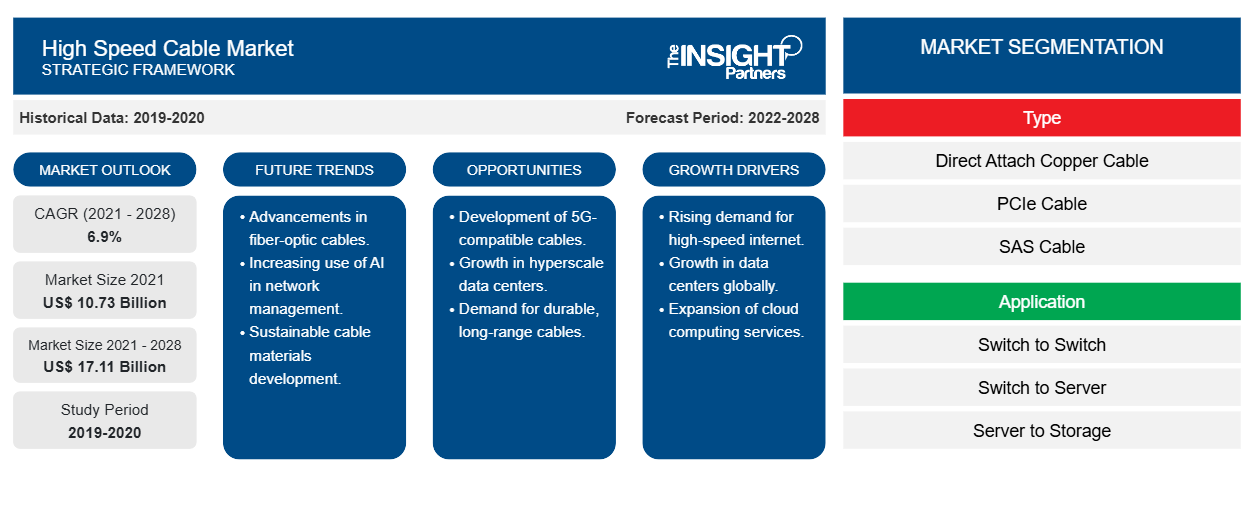

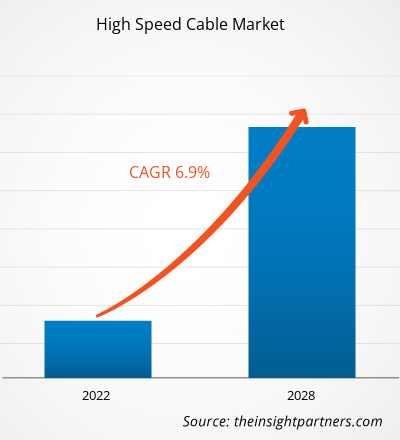

The high speed cable market is expected to grow from US$ 10,731.30 million in 2021 to US$ 17,110.52 million by 2028; it is estimated to grow at a CAGR of 6.9% from 2021 to 2028.

The rise in internet consumption and the development of advanced software solution has steered the volume of data generation worldwide. The need for processing and storing such huge data volumes has propelled organizations to adopt advanced processing and storage solutions, which is driving the deployment data centers. With the growing trend of digitalization, data centers have become a paramount aspect of the modern industry and economy. Data centers play vital in cloud computing, and as industry is moving toward adoption of cloud technology owing to its cost and operational advantage, the SMEs are among forefront for adoption of this technology. Further, complex cloud computing operations are done by large tech companies and research institutions which also require data center. Active optical cables, direct attach copper cables, and fiber optic cables are among the widely used high speed cables at data centers Further, several industries are exploring the use of cloud services to optimize and streamline their organizational operations. Moreover, with the emergence of Internet of Things (IoT), augmented reality (AR), and virtual reality (VR), the deployment for data centers has been growing continuously, which subsequently boosts the adoption of high speed cables.

Impact of COVID-19 Pandemic on High Speed Cable Market

According to Electronic Components Industry Association, the COVID-19 pandemic has resulted in disruption in supply chain, cancellations of events, and delay in product releases and other industry activities. Several manufacturers had to temporarily halt their manufacturing units owing to containment measures and raw material shortage. Further, the manufacturers of various electronic and semiconductor products including high speed cables experienced delay in lead times, which has negatively affected the supply chain of the high speed cable market. This have had a negative impact on the high speed cables market growth in 2020. However, the supply chain of high speed cable started to stabilize from late Q4 of 2020 as economics reopened and the high speed cable market gain positive traction from 2021

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

High Speed Cable Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

High Speed Cable Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

High Speed Cable Market Insights

Elevating Number of Internet Connections Fuels Growth of High Speed Cable Market

With the emergence of met averse, internet is set become a paramount component of human society. The number of internet users is rising with the growing affordability of internet and connected devices. According to the Statist data, as of January 2021, there were 4.66 billion internet users in the world, constituting 59% of the global population. Denmark, the UAE, and Sweden have the highest internet penetration rate. Further, till 2020, APAC had the largest number of ~2.5 billion of online users, while Europe ranked second with ~728 million internet users. In 2020, China had the highest number of internet users in the world, followed by India and the US. Moreover, digitalization and internet services are in an initial phase in the MEA and SAM countries, among others. High-speed cables are among the most crucial components used for the establishment of a communication infrastructure as these cables are used for setting up cell towers and providing broadband connections to routers. The rising number of internet users is further encouraging various industries to transform their businesses by deploying digital platforms. The COVID-19 outbreak has propelled the telecommunications industry with the surge in remote working and learning practices. According to Cisco, the world is expected to have more than 500 billion internet-enabled devices, including 50 billion IoT devices by 2030. Thus, the rising number of internet users will propel the deployment of communication infrastructure, subsequently flourishing the high speed cable market growth.

Type-Based Market Insights

Based on type, the high speed cable market is segmented into direct attach copper (DAC) cable, PCIe cable, SAS cable, active electrical cable (AEC), active copper cable (ACC), active optical cable (AOC), and others. The direct attach copper (DAC) cable segment led the market in 2020. Direct attach copper (DAC) cable is made of twinax copper and assembled with swappable and fixed transceiver modules, such as QSFP, QSFP28, and SFP+. Unlike other cables, the direct attach copper cable is offered in a fixed length (i.e. less than 15m) and used for directly connecting ports between active equipment servers, storage, switches, and routers. The speed of data rate can vary from 10G to 100G, and 100G of data rate can only transmit up to 5m using direct attach copper cable. Owing to a shorter length, the direct attach copper cable is used for connecting equipment located with close proximity and are considered extremely reliable, and thus are widely used for data center application. The growing use of cloud solution owing to cost and convenience factor propels the deployment of data centers across the world, which drives the growth of the high speed cables market.

The players operating in the high speed cable market focus on strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- In 2021, Credo announced the first offering of 800G HiWire active electrical cables for next generation decentralized data centers and AI servers.

- In 2020, Broadcom and Microsoft joined the HiWire Consortium, which is developing active cable standards for data centre copper connectivity with speeds of 400 and 800 gigabits per second.

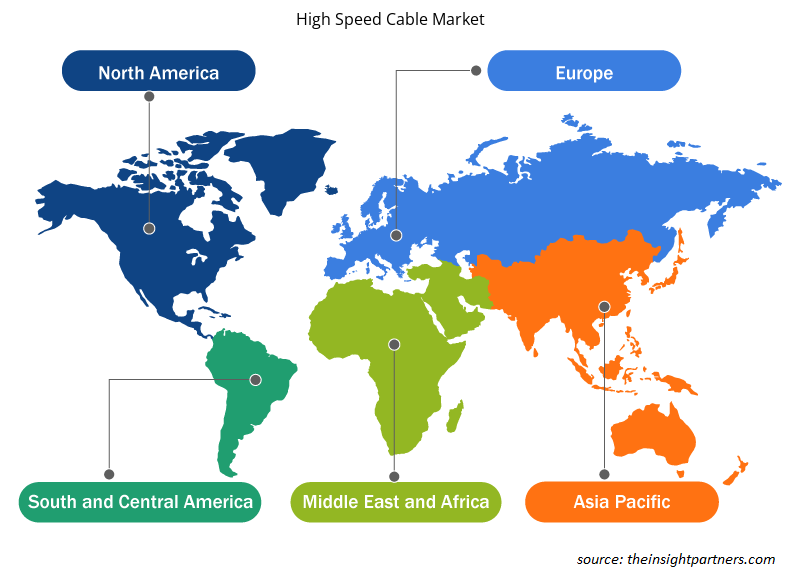

High Speed Cable Market Regional Insights

The regional trends and factors influencing the High Speed Cable Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses High Speed Cable Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for High Speed Cable Market

High Speed Cable Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 10.73 Billion |

| Market Size by 2028 | US$ 17.11 Billion |

| Global CAGR (2021 - 2028) | 6.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

High Speed Cable Market Players Density: Understanding Its Impact on Business Dynamics

The High Speed Cable Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the High Speed Cable Market are:

- Amphenol ICC

- Axon' Cable

- Carlisle Interconnect Technologies.

- HPL

- LEONI AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the High Speed Cable Market top key players overview

The global high speed cable market has been segmented as follows:

High Speed Cable Market – by Type

- Direct Attach Copper (DAC) Cable

- PCIe Cable

- SAS Cable

- Active Electrical Cable (AEC)

- Active Copper Cable (ACC)

- Active Optical Cable (AOC)

High Speed Cable Market – by Application

- Switch to Switch

- Switch to Server

- Server to Storage

High Speed Cable Market – by Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Russia

- UK

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- Japan

- Australia

- South Korea

- Rest of APAC

- Middle East & Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- South & Central America (SAM)

- Brazil

- Argentina

- Rest of SAM

Company Profiles

- Amphenol ICC

- Axon' Cable

- Carlisle Interconnect Technologies.

- HPL

- LEONI AG

- NVIDIA CORPORATION

- Samtec

- Shenzhen Sopto Technology Co., Ltd.

- TE Connectivity Corporation

- JPC Connectivity

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

In 2020, North America led the market with a substantial revenue share, followed by APAC and Europe. Asia Pacific is a prospective market for high speed cable market players.

The major companies in high speed cable includes TE Connectivity, LEONI, Broadcom, Sumitomo Corporation, and Amphenol Corporation.

The major application of high speed cable includes switch to switch, switch to server, and server to storage. The switch to switch segment dominates the market in 2020 with a market share of 64.3%.

The direct attach copper (DAC) cable segment led the high speed cable market with a share of 32.4% in 2020. Direct attach copper (DAC) cable is made up of twinax copper and assembled with swappable and fixed transceiver modules such as QSFP, QSFP28, and SFP+. Unlike other cables, the direct attach copper is offered in fixed length by the manufactures i.e. less than 15m and used for directly connecting ports between active equipment servers, storage, switches, and routers. The speed of data rate can vary between 10G to 100G, and 100G of data rate can only transmit up to 5m using direct attach copper cable. Owing to shorter length, the direct attach copper cable is used for connecting equipment located with close proximity and are considered extremely reliable, and thus are widely used for data center application. The growing use of cloud solution owing to cost and convenience factor which resulting increasing deployment of data centers across the globe, thus subsequently driving the market of high speed cables.

The implementation of 5G is expected to address the growing need for robust communication to streamline and optimize various digital operations. The greater amplitude of 5G wavelength supports high speed data transmission; however, with the 5G connectivity, signals cannot be transmitted over a long distance, as that with 3G and 4G. An efficient 5G infrastructure network requires a large number of cell towers. Thus, with the growing penetration of 5G, the high speed cables market players are expected to witness substantial growth in the coming years.

The adoption of internet services has increased in North America, Asia, and Europe as a majority of the population is working from home during the COVID-19 pandemic. A consequent surge in demand for home networking devices, fiber optic connections, and computers, among others, is creating lucrative opportunities for the growth of the high speed cable market players. Further, with the emerging need for data storage, the number of data centers is escalating. The transfer of data on cloud servers requires connectivity solutions of higher speed, which fuels the adoption of high speed cables.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - High Speed Cable Market

- Amphenol ICC

- Axon' Cable

- Carlisle Interconnect Technologies.

- HPL

- LEONI AG

- NVIDIA CORPORATION

- Samtec

- Shenzhen Sopto Technology Co., Ltd.

- TE Connectivity Corporation

- JPC Connectivity

Get Free Sample For

Get Free Sample For