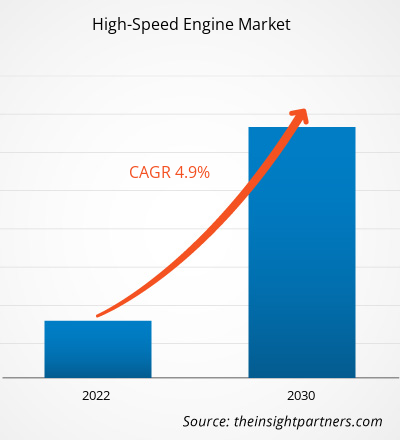

The High-Speed Engine Market size is projected to reach US$ 36.28 billion by 2030 from US$ 24.71 billion in 2022. The market is expected to register a CAGR of 4.9% in 2022–2030.

Increasing preferences for alternate fuel-powered engines is likely to remain key High-Speed Engine Market trends.

High-Speed Engine Market Analysis

The report includes growth prospects in light of current high-speed engine market trends and factors influencing the market growth. High-speed engine finds applications across the oil & gas, power generation, and industrial sectors for their pivotal role in energy recovery and optimization. The global inclination toward sustainability and energy efficiency are among the key factors contributing to the high-speed engine market growth. Governments of various countries and industries worldwide are increasingly focusing on reducing carbon footprints and achieving energy-efficiency goals. By harnessing energy from various processes such as the expansion of natural gas expansion, high-speed engines play a vital role in enabling the recovery of valuable energy that is otherwise wasted.

The high-speed engine market is witnessing substantial growth in regions such as Asia Pacific (APAC), wherein rapid industrialization, ambitious energy targets, and a focus on marine transport are driving the demand for high-speed engines. Similarly, the high demand for high-speed engines in oil & gas sectors across various countries in the Middle East & Africa contributes significantly to the growing high-speed engine market size. The power generation sector is another prominent domain driving the high-speed engine market.

High-Speed Engine Market Overview

High-speed engines are used in power utilities, marine, oil & gas, and railway, among other industry facilities. The global demand for energy is rising; according to the data published by the International Energy Agency, the global electricity demand increased in 2023 by 2.2%. As per the data given by Exxon Mobile in 2024, the demand for energy is expected to increase by 15% by 2050 from 2021. Industries and electricity generation are projected to become the largest energy consumption sectors in the coming years.

On the other hand, owing to increased awareness of carbon emissions, the demand for dual-fuel engines has grown. Thus, many high-speed engine manufacturers are focusing on developing high-speed engines that can be operated on renewable fuels such as methanol, hydrogen, and natural gas, which, in turn, is expected to fuel the high-speed engine market growth during the forecast period. For instance, in January 2024, Yanmar Power Technology (YPT) initiated the development of a hydrogen-fueled, 4-stroke, high-speed engine for power generation on coastal vessels in Japan. Such trends are projected to create massive demand for high-speed engines in the power generation industry. Further, the growing investments in machinery, automation, and industrial production are likely to support the growth of the market in the coming years. The elevating demand for natural gas in power generation, energy recovery, and gas processing facilities favors the high-speed engine market expansion worldwide. The high-speed engine market is projected to experience significant developments over the forecast period owing to the burgeoning demand for these systems in the power generation and marine industries, among others.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

High-Speed Engine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

High-Speed Engine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

High-Speed Engine Market Drivers and Opportunities

Upsurge in Demand for Energy

The rising population and growing urbanization are a few factors boosting the consumption of energy worldwide. India is the third-largest energy-consuming country worldwide, after China and the US, owing to growing incomes and improved living standards. India's energy consumption has doubled since 2000. According to the data published by ExxonMobil in 2024, the global demand for energy reached approximately 580 quadrillion British thermal units (Btu) in 2021. The US, Europe, China, and India are a few of the major consumers of energy. Further, the demand for energy is also growing in the industrial sector. For instance, as per the data published by the US Energy Information Administration in 2023, the industrial sector accounted for 30% of the total energy demand of the country; however, in 2022, the share reached approximately 34% of the total energy. Due to the high demand from the industrial and commercial sectors, the adoption of high-speed engines increased. Also, manufacturers are focused on supplying a strong product portfolio. For instance, in January 2024, Yanmar developed 4 stroke engines for the power generation application. Thus, the upsurge in demand for energy fuels the market for high-speed engines.

Aging Commercial Fleet

In almost all countries, the majority of the commercial ship fleet is aged. As per the data published by the United Nations in 2023, the average age of the ships globally was 22.2 years, and more than half of the ships are older than 15 years. In addition, as per the data provided by the US Bureau of Transportation in 2021, there were approximately 27,000 vessels in the US that are more than 15 years old. Further, as per the data provided by the Braemer in 2023, approximately 1.8% and 1.5% of the total ships globally are projected to retire by 2024 and 2025, respectively. As the fleet is aging rapidly, the demand for new ships is projected to increase to replace the aged and retired ships, which is expected to increase the demand for high-speed engines. According to the data published by The Baltic and International Maritime Council (BIMCO) in January 2024, 478 container ships are already scheduled for delivery in 2024 with a combined capacity of 3.0 million TEU. Thus, with the aging of the commercial fleet, the need for replacing the commercial fleet will increase, which is anticipated to create lucrative opportunities for the high-speed engine market growth during the forecast period.

High-Speed Engine Market Report Segmentation Analysis

Key segments that contributed to the derivation of the High-Speed Engine Market analysis are speed, power output, and end user.

- Based on speed, the global high-speed engine market is segmented into 1,000–1,500 rpm; 1,500–1,800 rpm; and Above 1,800 rpm. The 1500–1800 rpm segment held the largest market share in the global high-speed engine market.

- On the basis of power output, the global high-speed engine market is categorized into less than 2MW, 2–4 MW, and above 4 MW. The less than 2MW segment is anticipated to account for the majority of the market share in the high-speed engine market during the forecast period.

- In terms of end user, the market is bifurcated into marine, power generation, railway, oil and gas, and others. The marine segment dominated the market in 2023.

High-Speed Engine Market Share Analysis by Geography

The geographic scope of the High-Speed Engine Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In terms of revenue, Asia Pacific dominated the high-speed engine market share. The Asia Pacific high-speed engine market is segmented into Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific. The region is expected to record a notable CAGR during the forecast period owing to continuously growing marine, railway, and oil & gas sectors in countries such as China and India. Europe registered the third-largest market share in 2022 and is expected to maintain its dominance during the forecast period. Various countries such as Italy, the UK, Spain, and Germany held the majority share in the Europe high-speed engine market owing to the increasing investments in the marine and oil & gas sectors. In February 2023, the UK government announced two new investments for infrastructure development and zero-emission vessels. The government has invested US$ 80 million in infrastructure development and zero-emission vessels. Further, the marine sector in Spain has invested approximately US$ 250 million in R&D to provide cutting-edge technologies in an increasingly competitive market. New technologies such as autonomous shipping, artificial intelligence, and efficient fuel systems will play a critical role in the future expansion of the marine sector across Spain.

High-Speed Engine Market Regional Insights

The regional trends and factors influencing the High-Speed Engine Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses High-Speed Engine Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for High-Speed Engine Market

High-Speed Engine Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 24.71 Billion |

| Market Size by 2030 | US$ 36.28 Billion |

| Global CAGR (2022 - 2030) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Speed

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

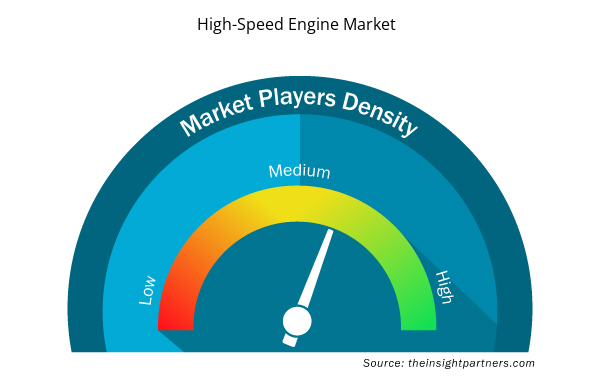

High-Speed Engine Market Players Density: Understanding Its Impact on Business Dynamics

The High-Speed Engine Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the High-Speed Engine Market are:

- AB Volvo

- Caterpillar Inc.

- Cummins Inc.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries Ltd

- Rolls-Royce Holdings Plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the High-Speed Engine Market top key players overview

High-Speed Engine Market News and Recent Developments

The High-Speed Engine Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for high-speed engine and strategies:

- In January 2024, MAN Energy Solutions and Karpowership have signed a contract for the delivery of a total of 48 dual-fuel engines for Karpowership’s fleet of power plant ships (Powerships). The engine order consists of MAN 18V51/60DF dual-fuel engines with a mechanical output of 20.7 MW each. (Source: https://www.man-es.com/company/press-releases/press-details/2024/01/12/man-energy-solutions-and-karpowership-signed-a-contract-for-48-dual-fuel-engines)

- In September 2022, Rolls-Royce has received an order from Armon, the Spanish shipyard, to supply nine mtu Hybrid PropulsionPacks for nine new ships of the leading Italian high-speed maritime passenger transport company—Liberty Lines. The contract was officially signed during the SMM international shipping exhibition in Hamburg. The vessels are scheduled to enter service between 2023 and 2026. The construction of an optional nine additional ships is planned for delivery between 2027 and 2030. (Source: https://www.rolls-royce.com/media/press-releases/2022/08-09-2022-rr-receives-order-for-9-mtu-hybrid-propulsionpacks-for-9-new-liberty-lines-fast-crafts.aspx)

High-Speed Engine Market Report Coverage and Deliverables

The “High-Speed Engine Market Size and Forecast (2022–2030)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Increasing preferences for alternate fuel-powered engines is expected to be the key trend for the high-speed engine market.

AB Volvo, Caterpillar Inc., MAN Energy Solutions SE, Mitsubishi Heavy Industries Ltd, Rolls-Royce Holdings Plc, Weichai Heavy Machinery Co., Ltd., Yanmar Holdings Co., Ltd., Doosan Infracore Co., Ltd., Wartsila Corp., and Cummins Inc. are the key market players operating in the global high-speed engine market.

Rise in marine transportation owing to increase in logistics services across the globe and upsurge in demand for energy from developing and developed economies owing to rapid urbanization and industrialization are anticipated to be the key drivers behind the high-speed engine market growth during the forecast period.

Aging commercial fleet and rise in demand for high-speed engine from marine, industrial, and power generations applications are expected to be the key opportunities in high-speed engine market.

Asia Pacific holds the largest share of the global high-speed engine market owing to increased marine transportation activities in China and India. As per data published by the United Nations in 2023, China has become the second-largest ship-owning country in the world, owing to its emergence as a global manufacturing hub. China is one of the top countries in the world for electric vehicle manufacturing; as per the data published by Harvard Business in January 2024, more than half of the electric vehicles that are on the road worldwide are manufactured in China.

Trends and growth analysis reports related to Energy and Power : READ MORE..

The List of Companies - High Speed Engine Market

- AB Volvo

- Caterpillar Inc.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries Ltd

- Rolls-Royce Holdings Plc

- Weichai Heavy Machinery Co., Ltd.

- Yanmar Holdings Co., Ltd.

- Doosan Infracore Co., Ltd.

- Wartsila Corp.

- Cummins Inc.

Get Free Sample For

Get Free Sample For