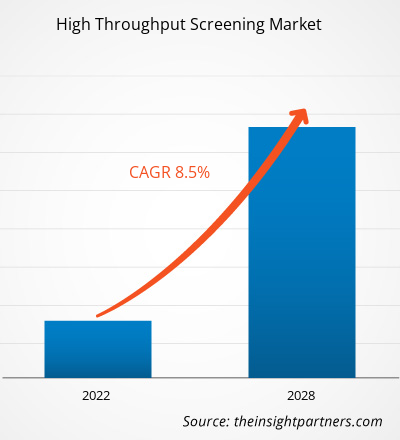

The high throughput screening market is projected to reach US$ 28,255.71 million by 2028 from US$ 15,997.47 million in 2021. The market is estimated to grow with a CAGR of 8.5% from 2021 to 2028.

High-throughput screening (HTS) is a drug discovery method that enables automated testing of various chemical or biological compounds for a specific biological target. High-throughput screening methods are widely used in the pharmaceutical industry, leveraging robotics and automation to quickly test the biological or biochemical activity of a significant number of molecules, usually drugs. They accelerate target analysis, as large-scale compound libraries can soon be screened cost-effectively. HTS is a valuable tool for assessing pharmacological targets, pharmacologically profiling agonists, and antagonists for receptors (such as GPCRs) and enzymes. Factors such as an increase in investment in research & development by the pharmaceutical and biotechnology industry and the introduction of technologically advanced products in the high throughput screening market are expected to boost the market growth over the years. However, the high cost of high-throughput screening, lack of trained professionals, and complexity in assay development are likely to hamper the market's growth in the coming years.

Market Insights

Increase in Investment in Research and Development by Pharmaceutical and Biotechnology Industry

An increase in R&D expenditures by pharmaceutical and biotechnology companies and significant drug pipelines to treat various chronic diseases such as cardiovascular disorders, cancer, immunological disorders, metabolic disorders, and neurological disorders are notable drivers for the high throughput screening market. Several big and small pharmaceutical companies are involved in developing and manufacturing new molecules for several life-threatening diseases. This has led to the choice of automated high-throughput screening (HTS) methods to screen huge chemical libraries to engageengage the needs of ever-increasing drug target molecules. For instance, an automated high throughput screening system can screen around 10,000 to 100,000 target compounds in a single day. Pharma and biotech companies have substantially invested in high throughput screening techniques in the past decade. For instance, the famous alliance of Millennium Pharmaceuticals, Inc. and Bayer AG has successfully discovered 18 novel drug targets and brought four of them into high throughput screening in just less than eight months. The alliance adopts a novel production approach based on genomics research to get molecules into clinical trials as quickly as possible. High-throughput screening has been regarded as a vital technology in the drug discovery process. For instance, above 60% of Boehringer Ingelheim’s fully developed lead structure optimization programs are due to the successful implementation of HTS. More than 2.5 billion US dollars are annually spent on HTS products and HTS services in the US alone. Large pharmaceutical companies invest up to US$ 35 million annually in screening technologies. A significant proportion of these investments goes into the development of new assays.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

High Throughput Screening Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

High Throughput Screening Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

A rising number of drug targets for screening, which is used for drug discovery and development, and growing investments by government and research institutes will further boost the adoption of HTS techniques. For instance, in December 2020, a UK-based independent integrated drug discovery and pre-clinical contract research organization, Sygnature Discovery has invested around US$ 4.12 million for strengthening its high-throughput screening (HTS) and translational oncology service. Moreover, programs like “Toxicology in the 21st Century”- a joint venture of the US FDA, Environment Protection Agency, and the US National Institute of Health-use automated HTS for testing chemicals, formulation, and environmental drugs, for an extensive toxicological examination and to develop specific pathways associated to the disease to predict the toxicological levels. Such ventures will support the proliferation of the high throughput screening market.

Product and Service-Based Insights

Based on product and service, the high throughput screening market is categorized into consumables, instruments, accessories, software, and services. In 2021, the consumables segment held the largest share of the market and is expected to witness the fastest CAGR during the forecast period.

Report Coverage

Technology-Based Insights

Based on technology, the high throughput screening market is segmented into cell-based assays, lab-on-a-chip, ultra-high-throughput screening, bioinformatics, and label-free technology. In 2021, the cell-based assays segment held the largest share of the market, whereas the lab-on-a-chip segment is expected to grow at the fastest CAGR during the forecast period.

Application-Based Insights

Based on application, the high throughput screening market is segmented into drug discovery, biochemical screening, life sciences research, and other applications. In 2021, the drug discovery segment held the largest share of the market and is expected to grow at the fastest CAGR during the forecast period.

End-User -Based Insights

Based on end-user, the high throughput screening market is segmented into pharmaceutical and biotechnology companies, academic and government institutes, contract research organizations (CRO), and others. In 2021, the pharmaceutical and biotechnology companies segment held the largest share of the market, whereas the contract research organizations (CRO) segment is expected to grow at the fastest CAGR during the forecast period.

Various companies operating in the high throughput screening market are adopting strategies such as product launches, mergers and acquisitions, collaborations, product innovations, and product portfolio expansions to expand their footprint worldwide, maintain brand name, and meet the growing demand from end users.

High Throughput Screening Market Regional Insights

The regional trends and factors influencing the High Throughput Screening Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses High Throughput Screening Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for High Throughput Screening Market

High Throughput Screening Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 16 Billion |

| Market Size by 2028 | US$ 28.26 Billion |

| Global CAGR (2021 - 2028) | 8.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product and Service

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

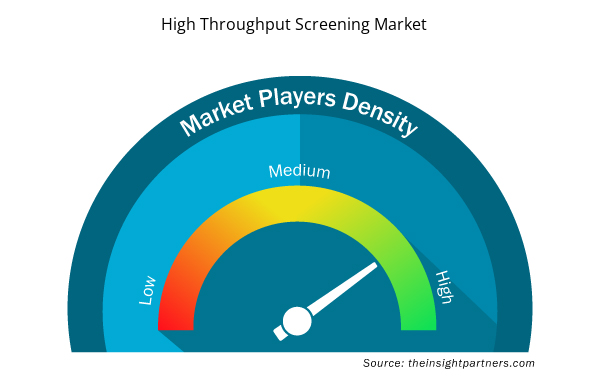

High Throughput Screening Market Players Density: Understanding Its Impact on Business Dynamics

The High Throughput Screening Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the High Throughput Screening Market are:

- Agilent Technologies, Inc.

- Axxam S.P.A.

- Eurofins Scientific

- Corning Incorporated

- Molecular Devices, LLC.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the High Throughput Screening Market top key players overview

High Throughput Screening Market – by Product and Service

- Consumables

- Reagents and Assay Kits

- Laboratory Equipment

- Instruments

- Liquid Handling Systems

- Detection Systems

- Accessories

- Software

- Services

High Throughput Screening Market – by Technology

- Cell-Based Assays

- Lab-On-A-Chip

- Ultra-High-Throughput Screening

- Bioinformatics

- Label-Free Technology

- Surface Plasmon Resonance

- Reflective Interferometry

- Isothermal Titration Calorimetry

- Differential Scanning Calorimetry

- Microcantilevers

- Carbon Nanotubes

- Photonic Crystals

- Others

High Throughput Screening Market – by Application

- Drug Discovery

- Biochemical Screening

- Life Sciences Research

- Other Applications

High Throughput Screening Market – by End User

- Pharmaceutical and Biotechnology Companies

- Academic and Government Institutes

- Contract Research Organizations (CRO)

- Others

High Throughput Screening Market – by Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Spain

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of Asia Pacific

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

South America (SAM)

- Brazil

- Argentina

- Rest of South and Central America

Company Profiles

- Agilent Technologies, Inc.

- Axxam S.P.A.

- Eurofins Scientific

- Corning Incorporated

- Molecular Devices, LLC.

- Hamilton Company

- Merck Group

- Perkinelmer, Inc.

- Tecan Group

- Thermo Fisher Scientific Inc.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product and Service, Technology, Application, End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Key factors that are driving the growth of this market increase in investment in research and development by the pharmaceutical and biotechnology industry and the introduction of technologically advanced products in the high throughput screening.

The pharmaceutical and biotechnology companies segment dominated the global high-throughput screening market and accounted for the largest revenue share of 45.27% in 2021.

High-throughput screening (HTS) is a drug discovery process that allows automated testing of large numbers of chemical and/or biological compounds for a specific biological target. High-throughput screening methods are extensively used in the pharmaceutical industry, leveraging robotics and automation to quickly test the biological or biochemical activity of a large number of molecules, usually drugs. They accelerate target analysis, as large-scale compound libraries can quickly be screened in a cost-effective way. HTS is a useful tool for assessing for instance pharmacological targets, pharmacologically profiling agonists and antagonists for receptors (such as GPCRs) and enzymes.

The consumables segment dominated the global high-throughput screening market and held the largest revenue share of 44.85% in 2021.

Global high-throughput screening market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. In North America, the U.S. is the largest market for high-throughput screening. The US is estimated to hold the largest share in the high-throughput screening market during the forecast period. The growth of the market can be because of prevalence of various diseases, government support for biotechnology and increasing efforts in R&D activities as well as other activities undertaken by the market players operating in the market. In addition, technologically advanced products are likely to stimulate the growth of high-throughput screening market in North America. On the other hand, large pool of population suffering with chronic diseases, rapidly developing healthcare infrastructure, and intellectual capabilities of scientists and researchers in the Asia Pacific is expected to account for the fastest growth of the region during the coming years.

The high-throughput screening market majorly consists of the players such Agilent Technologies, Inc., Axxam S.P.A., Eurofins Scientific, Corning Incorporated, Molecular Devices, LLC., Hamilton Company, Merck Group, Perkinelmer, Inc., Tecan Group and Thermo Fisher Scientific Inc. among others.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - High Throughput Screening Market

- Agilent Technologies, Inc.

- Axxam S.P.A.

- Eurofins Scientific

- Corning Incorporated

- Molecular Devices, LLC.

- Hamilton Company

- Merck Group

- Perkinelmer, Inc.

- Tecan Group

- Thermo Fisher Scientific Inc.

Get Free Sample For

Get Free Sample For