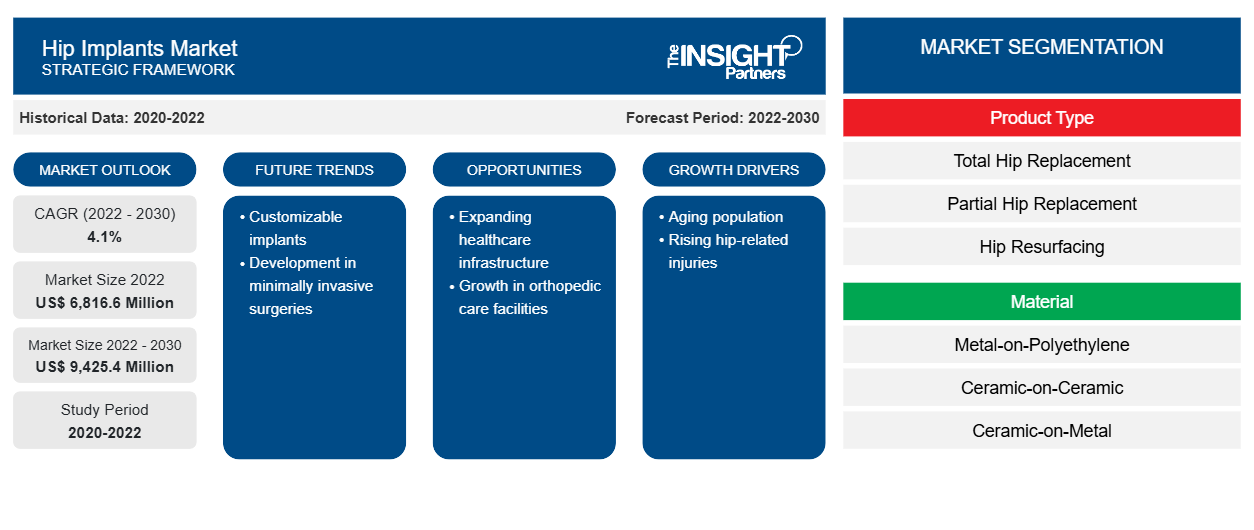

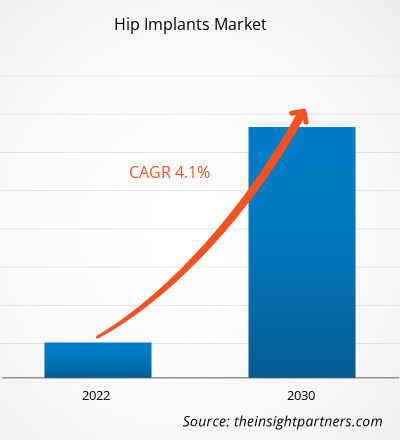

[Research Report] The hip implants market is expected to grow from US$ 6,816.6 million in 2022 to US$ 9,425.4 million by 2030; it is anticipated to record a CAGR of 4.1% from 2022 to 2030.

Market Insights and Analyst View:

The hip implants market size is growing rapidly due to the increase in hip surgeries, hip injuries, osteoarthritis, and rheumatoid arthritis. In addition, strategic initiatives by companies to stay competitive are fueling growth of the market. For instance, Smith & Nephew launched OR3O Dual Mobility System in India in August 2023 for primary and revision hip arthroplasty. OR3O includes Smith & Nephew’s advanced bearing surface, OXINIUM DH, due to its liner and proprietary OXINIUM on XLPE. This eliminates both the modular CoCr liner and/or CoCr head ball from the construct, reducing wear and corrosion risks associated with the alloy. Thus, a significant rise in revolutionary technologies to address customer needs is likely to bring new trends in the hip implants market forecast.

Growth Drivers and Challenges:

According to the Osteoarthritis Action Alliance, osteoarthritis is one of the most common forms of arthritis in the US, affecting nearly 32.5 million people, of whom 43% of the population was over 65 years in 2020. As per the Centers for Disease Control and Prevention, around 23% of the US population had arthritis in 2020. As per Arthritis Research Canada, it is estimated that over 6 million Canadians have osteoarthritis, which is projected to be 10.5 million by 2040. Osteoarthritis may lead to hip injuries and hip fractures as the bone density in arthritis patients is lower than in those who do not have arthritis.

The World Health Organization (WHO) estimated that the population aged above 60 years was 1 billion in 2019, which is anticipated to reach 1.4 billion by 2030 and 2.1 billion by 2050. Geriatric population share is predicted to surge from ~15% to ~24% during this period. According to another report by Eurostat, Europe had the world's highest percentage (20.8%) of people aged over 60 years in 2021. In addition, by 2050, in all regions except Africa, more than 25% of their populations will have crossed 60 years. Thus, the surge in the geriatric population has boosted the prevalence of various orthopedic conditions, such as hip injury, osteoarthritis, and hip dislocation due to falls and other unfortunate incidents, resulting in a hip implants market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hip Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hip Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The hip implants market is divided based on product type, material, end user, and geography. By product type, the market is segmented into total replacement, partial replacement, hip resurfacing, and revision hip implants. By material, the market is segmented into metal-on-polyethylene, ceramic-on-ceramic, ceramic-on-metal, ceramic-on-polyethylene, and others. By end user, the market is segmented into hospitals, orthopedic clinics, ambulatory surgical centers, and others. Based on geography, the is divided into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and the South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The hip implants market analysis, by product type, is segmented into femoral reconstruction, acetabular reconstruction, hip resurfacing, revision hip implants, bearing and porous metal technologies, and total replacement implants. In 2022, the total replacement implants segment held the largest hip implants market share and is expected to record the highest CAGR during 2022–2030.

By material, the market is segmented into metal-on-polyethylene, ceramic-on-ceramic, ceramic-on-metal, and ceramic-on-polyethylene. In 2022, the metal-on-plastic segment held the largest hip implants market share and is expected to record the highest CAGR in the hip implants market forecast from 2022 to 2030. The segment growth is driven by benefits such as precise outcome, durability, and cost-effectiveness. Furthermore, other benefits, such as fewer complications, technological advancements, and lesser wear particles, fuel the demand for metal-on-plastic-based hip implants.

By end user, the market is segmented into hospitals, orthopedic clinics, ambulatory surgical centers, and others. In 2022, the hospital segment held the largest hip implants market share and is expected to record the highest CAGR during 2022–2030. The growing number of surgeries for hip implants in hospitals is driving the segment of hip implant growth worldwide. Also, the hospital staff are well educated and aware of the complications that may occur during or after surgery type. The hospital staff are trained to tackle emergencies and provide balanced patient care. Reimbursement procedures for surgeries are also easily available and can be managed by hospital management. Moreover, the growing number of hospitals worldwide will likely retain the segment's dominance and leverage the hip implants market growth during the forecast period. Moreover, the growing number of hospitals worldwide will likely retain the segment's dominance.

Regional Analysis:

Geographically, the hip implants market report is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is the biggest contributor to the growth of the global hip implants market. Asia Pacific is predicted to show the highest CAGR in the hip implants market forecast from 2022 to 2030. The increasing incidence of hip implants, product launches, and sports hip injuries mainly drive the growth of the market in the US. According to the article “Hip Fracture Care and National Systems,” published by Wolters Kluwer Health, Inc., about 250,000–300,000 people in the US are hospitalized for hip fractures annually. It is also estimated that about 500,000 people will be attended by medical professionals due to hip fractures by 2040. As per the American Academy of Orthopaedic Surgeons, people aged 65 years and above are prone to hip fractures due to household or community falls in the US. As per the article “Hip Overview’ published in National Library Medicine, about US$ 40,000 is spent by patients in the first year after a hip fracture and the total cost of hip fracture care in the US amounts to nearly US$ 17 billion annually. Thus, the growing prevalence of hip fractures and hip injuries in the US and increasing spending on treatment of these injuries are current hip implants market trend in the US.

Hip Implants Market Regional Insights

Hip Implants Market Regional Insights

The regional trends and factors influencing the Hip Implants Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Hip Implants Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Hip Implants Market

Hip Implants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6,816.6 Million |

| Market Size by 2030 | US$ 9,425.4 Million |

| Global CAGR (2022 - 2030) | 4.1% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

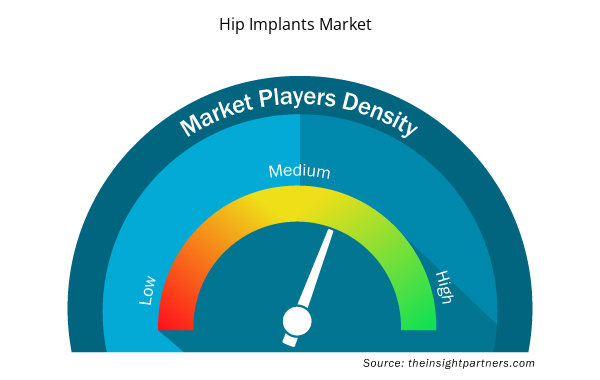

Hip Implants Market Players Density: Understanding Its Impact on Business Dynamics

The Hip Implants Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Hip Implants Market are:

- Smith & Nephew

- Exactech

- Zimmer Biomet

- Stryker Corporation

- DJO Surgical (Enovis)

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Hip Implants Market top key players overview

Industry Developments and Future Opportunities:

Various plans by key players operating in the Hip Implants Market are listed below:

- In August 2022, Exatech commercially launched a novel total hip arthroplasty system consisting of Spartan Stem and Logical Cup. The Spartan Hip Stem reflects contemporary patient needs and the newest advancements in surgical approach. The Logical Cup is an advanced, modular acetabular system designed to meet the demands of highly active patients while also enabling an efficient surgical process in hospitals and ambulatory surgical centers.

- Smith & Nephew launched OR3O Dual Mobility System in September 2022 for primary and revision hip arthroplasty in Japan. This advanced bearing surface, OXINIUM DH, is utilized for its linear and proprietary OXINIUM on XLPE for its polyethylene inserts and femoral head.

Competitive Landscape and Key Companies:

A few of the prominent players covered in the hip implants market report are Smith & Nephew, Exactech, Zimmer Biomet, Stryker Corporation, DJO Surgical (Enovis), Medacta, Conformis, DePuy Orthopaedics, MicroPort Orthopedics, and Symbios. These companies focus on geographic expansions and new product launches to meet the growing demand from consumers worldwide and increase their product range in specialty portfolios. Their global presence allows them to serve a large customer base, facilitating market expansion.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Redistribution Layer Material Market

- Lyophilization Services for Biopharmaceuticals Market

- Cosmetic Bioactive Ingredients Market

- Small Internal Combustion Engine Market

- Smart Mining Market

- Point of Care Diagnostics Market

- Green Hydrogen Market

- Intraoperative Neuromonitoring Market

- Medical Devices Market

- Emergency Department Information System (EDIS) Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Material, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The hip implants market, by product type, is segmented into total replacement implants, partial total replacement implants, hip resurfacing, and revision hip implants. In 2022, the total replacement implants segment held the largest market share and is expected to record the highest CAGR during 2022–2030.

The hip implants market, by material, is segmented into metal-on-polyethylene, ceramic-on-ceramic, ceramic-on-metal, and ceramic-on-polyethylene and others. 2022 the metal-on-plastic segment held the largest market share and is expected to record the highest CAGR from 2022 to 2030.

The hip implants market, by end-user, is segmented into hospitals, orthopedic clinics, ambulatory surgical centers, and others. In 2022, the hospital segment held the largest market share and is expected to record the highest CAGR during 2022–2030.

The hip implants market majorly consists of players such Smith & Nephew, Exactech, Zimmer Biomet, Stryker Corporation, DJO Surgical (Enovis), Medacta, Conformis, DePuy Orthopaedics, MicroPort Orthopedics, and Symbios.

The hip implants market size is largely driven by the increasing number of hip injuries and related diseases, and strategic initiatives in hip implants. However, the high cost of hip implants hinders the growth of the hip implant market.

Based on geography, the hip implants market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). North America is the largest contributor to the growth of the global hip implants market. Asia Pacific is expected to register the highest CAGR in the hip implants market from 2022 to 2030.

Hip implants are medical devices designed to restore mobility and alleviate pain, usually associated with arthritis and other hip diseases or injuries. Every hip implant has its benefits and risks. Every hip implant system has unique device design features such as size, shape, material, and dimensions. In addition, the same hip implant system may have different outcomes in different patients. In addition, strategic initiatives by companies to stay competitive in the market are fueling market growth. For instance, Smith & Nephew launched the OR3O Dual Mobility System in August 2023 for use in primary and revision hip arthroplasty in India. OR3O includes Smith & Nephew’s advanced bearing surface, OXINIUM DH, due to its liner and proprietary OXINIUM on XLPE. This eliminates both the modular CoCr liner and/or CoCr head ball from the construct, which reduces wear and corrosion risks associated with the alloy. Thus, a significant rise in revolutionary technologies to address customer needs is likely to bring new trends in the market during the forecast period.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Hip Implants Market

- Smith & Nephew

- Exactech

- Zimmer Biomet

- Stryker Corporation

- DJO Surgical (Enovis)

- Medacta

- Conformis

- DePuy Orthopaedics

- MicroPort Orthopedics

- Symbios

Get Free Sample For

Get Free Sample For